We look at the latest data from the ABS. Its a mixed bag!

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

We look at the latest data from the ABS. Its a mixed bag!

We look at the latest data from the ABS. Its a mixed bag!

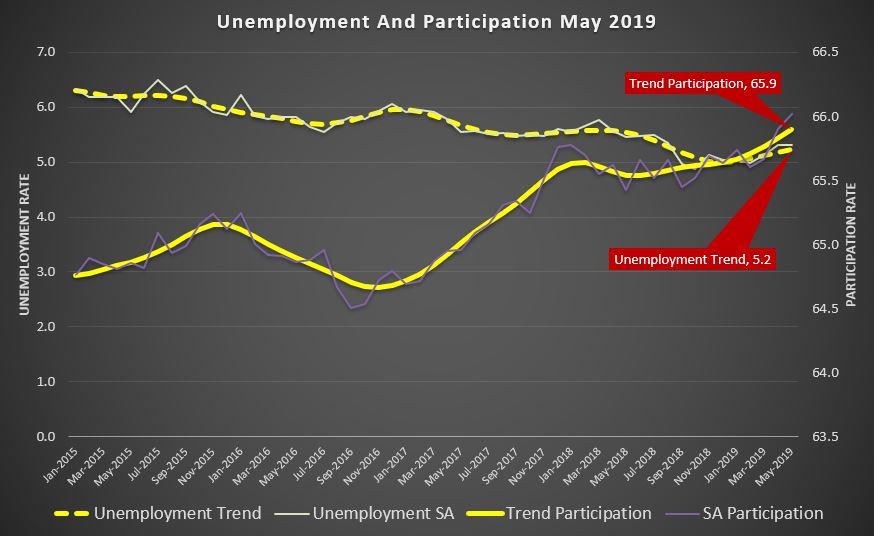

The trend unemployment rate remained steady at 5.1 per cent, for the third consecutive month. The seasonally adjusted unemployment rate remained steady at 5.2 per cent in May 2019 . But the moving parts are not so hot.

Underemployment was up, to 8.6%, while the total hours worked fell, -0.3%. There was a rise in jobs by 42,300, mainly part-time employment, which helps to explain the rising underemployment. But the results are muddied by ABS sample rotation AND temporary work associated with the election, so watch next month….

Australia’s trend participation rate increased to 65.9 per cent in May 2019, a new high, according to the latest information released by the Australian Bureau of Statistics (ABS).

ABS Chief Economist Bruce Hockman said: “Australia’s participation in the labour force continues to rise with the participation rate up 0.4 percentage points over the past year to an all-time high of 65.9 per cent.”

“The participation rate for people aged 15-64 also climbed to a record rate of 78.4 per cent, with a record 74.3 per cent of people in this age group employed,” Mr Hockman said.

The trend unemployment rate remained steady at 5.1 per cent, for the third consecutive month.

Employment and hours

In May 2019, trend monthly employment increased by around 28,000 persons. Both full-time and part-time employment increased by 14,000 persons.

Over the past year, trend employment increased by 333,000 persons (2.7 per cent) which was above the average annual growth over the past 20 years (2.0 per cent).

The trend monthly hours worked increased by 0.2 per cent in May 2019 and by 2.5 per cent over the past year. This was above the 20 year average year-on-year growth of 1.7 per cent.

Underemployment and underutilisation

The trend monthly underemployment rate rose slightly to 8.5 per cent in May, returning to the same level as May 2018. The trend underutilisation rate decreased by 0.3 percentage points over the year.

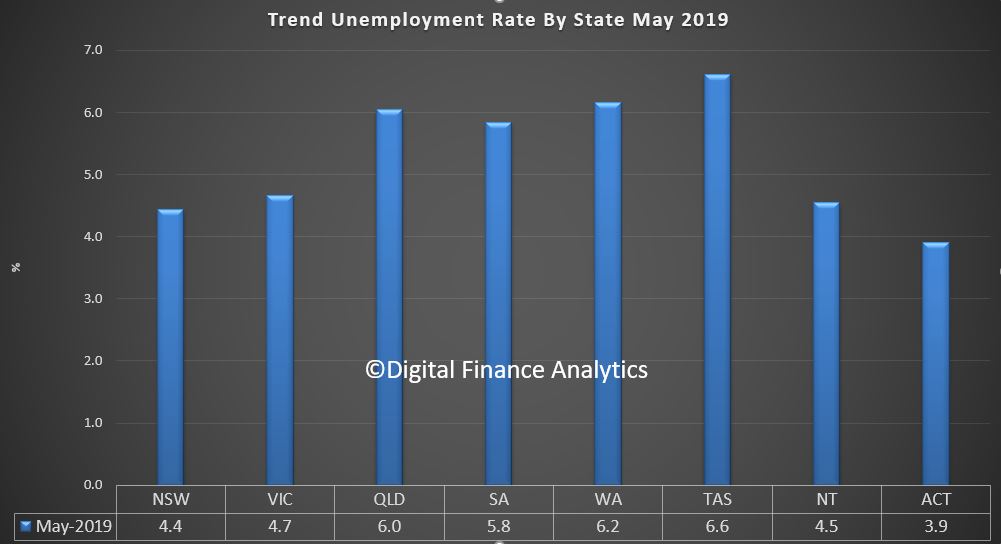

States and territories trend unemployment rate

The trend unemployment rate increased by 0.1 percentage points in the Australian Capital Territory, and remained steady in all other states and territories.

“Over the year, unemployment rates fell in New South Wales, Victoria, Queensland and Western Australia, and increased in South Australia, Tasmania, the Northern Territory and the Australian Capital Territory,” Mr Hockman said.

Seasonally adjusted data

The seasonally adjusted unemployment rate remained steady at 5.2 per cent in May 2019, while the underemployment rate increased by less than 0.1 percentage points to 8.6 per cent. The seasonally adjusted participation rate increased by 0.1 percentage points to 66.0 per cent, and the number of persons employed increased by around 42,000.

The net movement of employed persons in both trend and seasonally adjusted terms is underpinned by around 300,000 people entering and leaving employment in the month.

We look at the latest ABS lending flow data for April 2019.

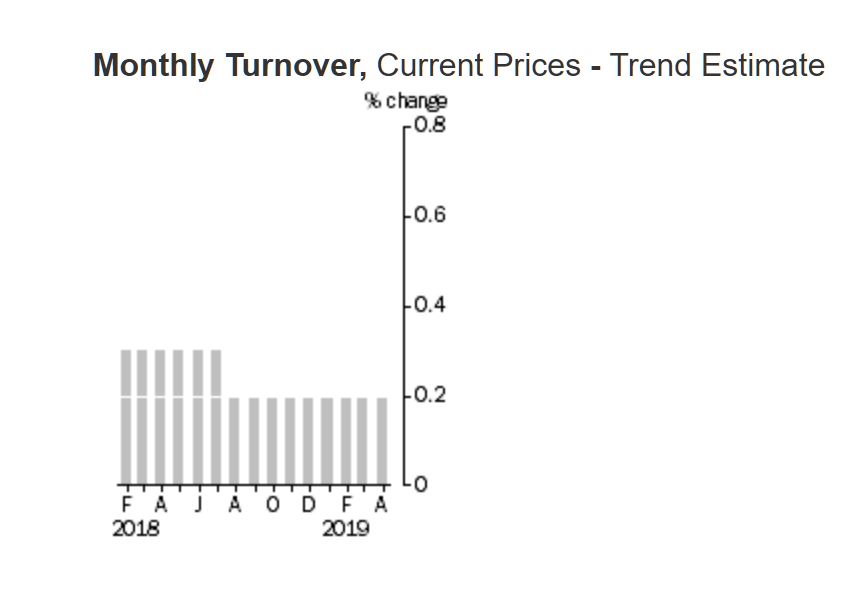

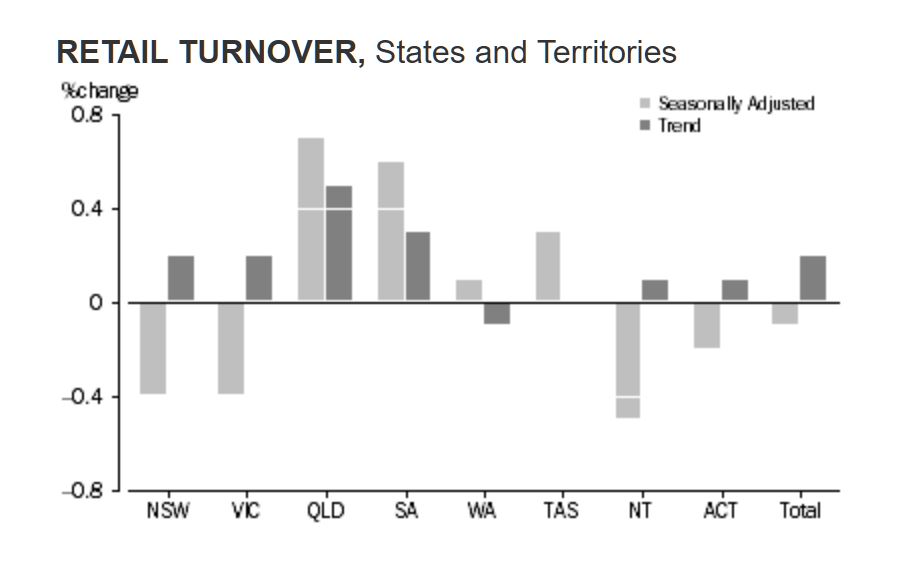

Australian retail turnover fell 0.1 per cent in April 2019, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures. This follows a rise of 0.3 per cent in March 2019.

The trend estimate for Australian retail turnover rose 0.2 per cent in April 2019, following a 0.2 per cent rise in March 2019. Compared to April 2018, the trend estimate rose 2.9 per cent.

We look at the latest data from the ABS and auction results. Maybe no rebound yet?

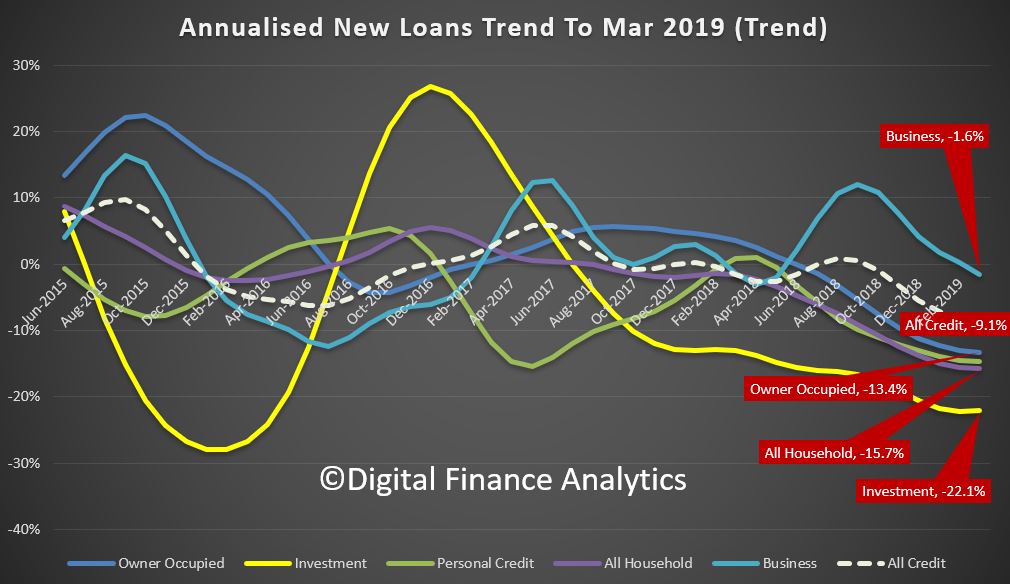

We review the latest ABS lending flow data to March 2019.

The value of lending commitments to households fell 3.7% in seasonally adjusted terms. This follows a 2.2% rise in February 2019.

Lending to households fell across all components in seasonally adjusted terms, with the largest falls in personal finance (down 11.2%) and owner occupier dwellings (down 3.4%).

In trend terms, lending commitments for owner occupier dwellings fell 0.9% and investment dwellings fell 2.1% in March 2019.

The number of lending commitments made to owner occupier first home buyers recorded a relatively small fall (down 0.5%) compared to the fall in the number of lending commitments made to non-first home buyers (down 3.3%) in March, seasonally adjusted.

Personal finance excluding refinancing fell 11.2% in seasonally adjusted terms during March 2019 and is down 23.8% from March 2018. Lending to households for refinancing was down 0.4% in seasonally adjusted terms, following a 2.3% rise in February 2019. In trend terms, the value of lending commitments to businesses fell 2.0% in March, and is down 1.8% from March 2018.

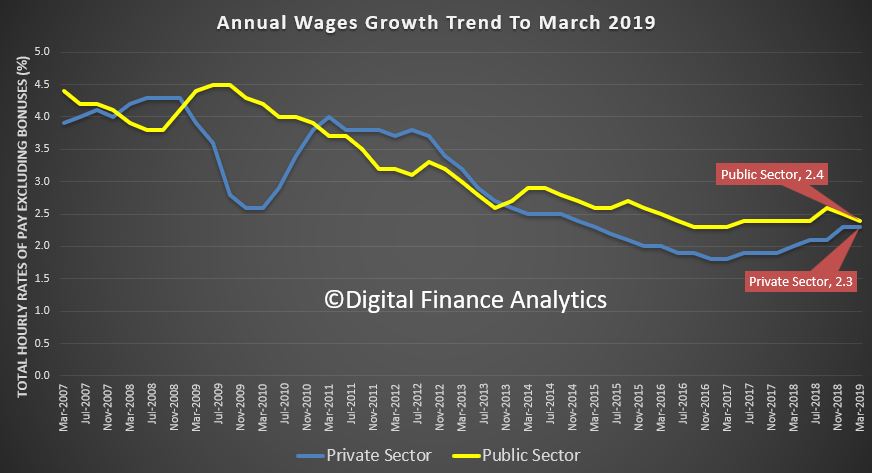

The trend Wage Price Index (WPI) rose 0.6 per cent in the March quarter 2019 and 2.3 per cent through the year, according to figures released today by the Australian Bureau of Statistics (ABS).

Trend growth in the public sector was 2.4% over the past year, compared with 2.3% in the private sector.

ABS Chief Economist Bruce Hockman said: ” The main contributors to growth over the quarter were regularly scheduled wage rises in the Health care and social assistance and Education and training industries, as was the case in the previous March quarter.”

In original terms, annual wages growth to the March quarter 2019 by industry ranged from 1.8 per cent for Construction and the Information, media and telecommunication services industries to 3.0 per cent for Health care and social assistance.

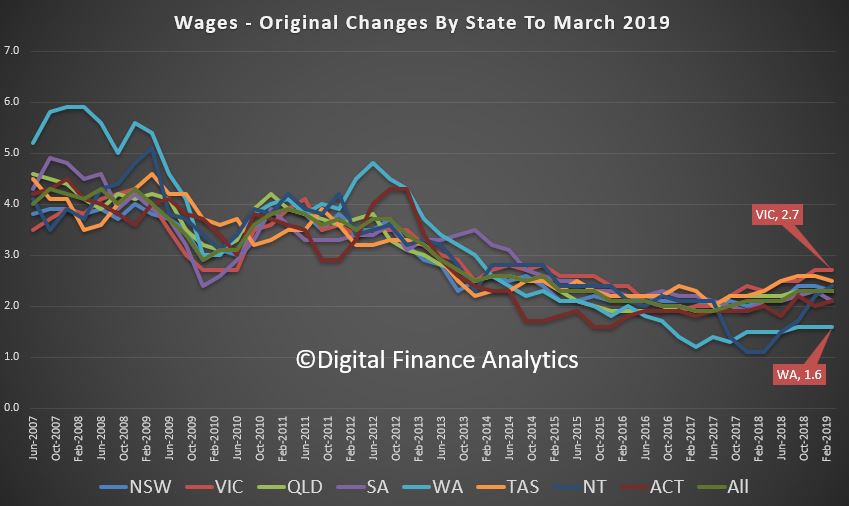

Western Australia recorded the lowest through the year wage growth of 1.6 per cent while Victoria recorded the highest of 2.7 per cent.

The value of new lending commitments to households fell 3.7 per cent in March 2019, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) figures on new lending to households and businesses.

The fall in lending to households in March follows a 2.2 per cent rise in February 2019.

ABS Chief Economist, Bruce Hockman said: “All components of new lending to households were weaker in March, more than offsetting a bounce in lending activity seen in February.”

“There were large falls in the value of lending for owner occupier dwellings in seasonally adjusted terms in both New South Wales (-5.7 per cent) and Queensland (-5.3 per cent) in March, after rises in both states the previous month” he said.Nationally, lending for investment dwellings also contracted further in March, with the series down 25.9 per cent (seasonally adjusted) compared to March 2018. The level of new lending for investment dwellings is at its lowest level since March 2011.

While nationally there was a fall in the number of loans to owner occupier first home buyers (-0.5 per cent) in March, in a similar pattern to recent months this fall was again much less than the drop in the number of loans to owner occupier non-first home buyers (-3.3 per cent).

After rises in January and February, lending to households for personal finance excluding refinancing fell 11.2 per cent in March, seasonally adjusted.

In trend terms, the value of new lending commitments to businesses fell 2.0 per cent in March. All components of business lending remained subdued.

More detailed analysis to follow. Home prices will fall further.

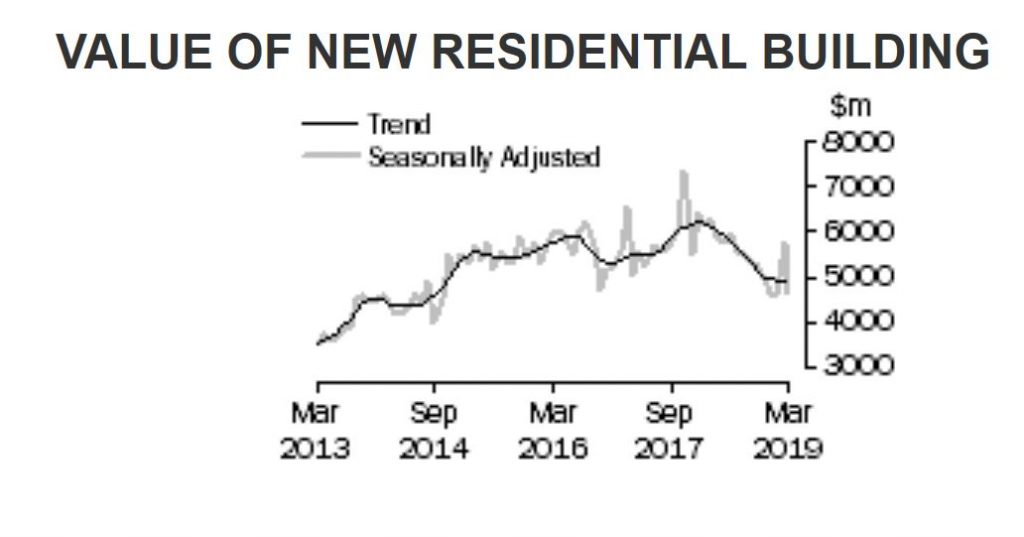

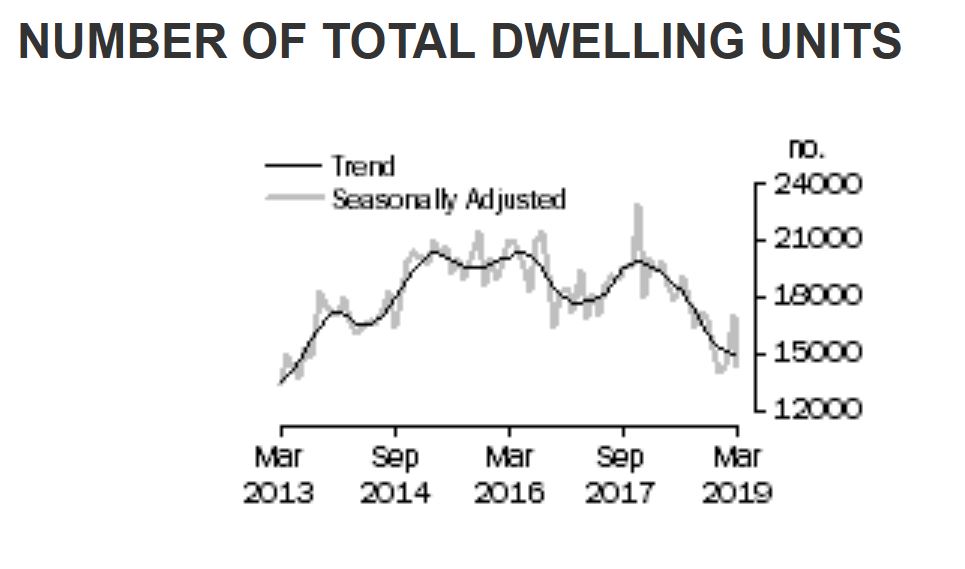

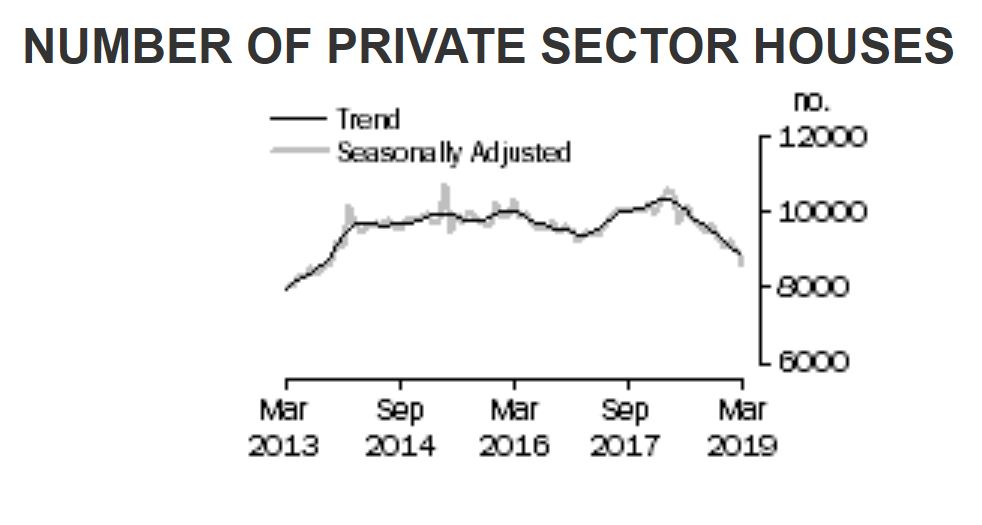

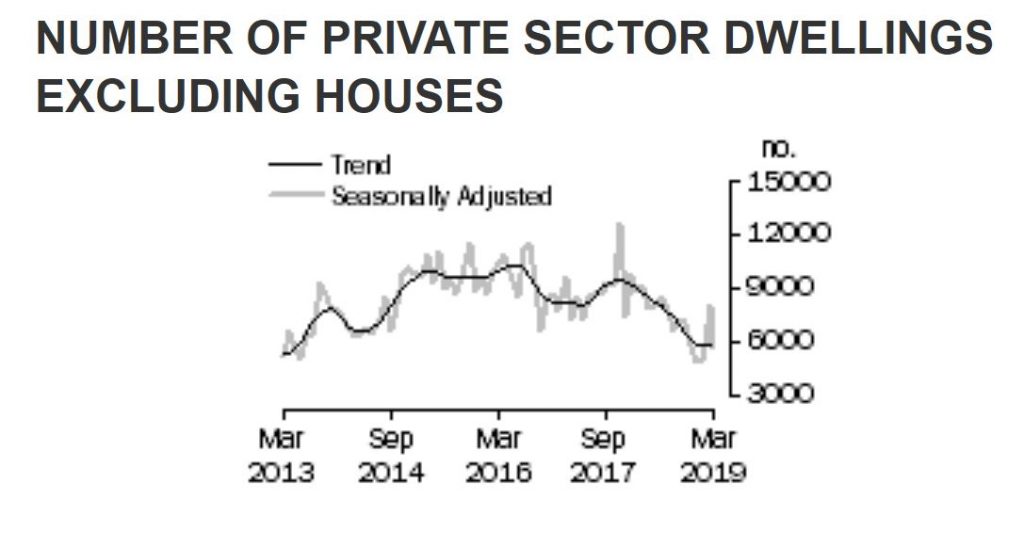

The number of dwellings approved in Australia fell by 0.6 per cent in March 2019, in trend terms, according to data released by the Australian Bureau of Statistics (ABS) today. This won’t help the GDP or construction employment.

“The overall decrease was driven by private sector houses, which declined 1.4 per cent in trend terms,” said Justin Lokhorst, Director of Construction Statistics at the ABS. “

However, private dwellings excluding houses rose by 0.8 per cent”.

Among the states and territories, total dwelling approvals fell in Victoria (3.5 per cent) and Queensland (1.4 per cent) in trend terms. Increases were recorded in the Australian Capital Territory (4.8 per cent), the Northern Territory (3.9 per cent), Western Australia (3.8 per cent), New South Wales (0.8 per cent) and South Australia (0.4 per cent). Tasmania was flat.

Approvals for private sector houses fell 1.4 per cent nationally in trend terms. Declines were recorded in the three largest states: New South Wales (3.4 per cent), Victoria (1.8 per cent) and Queensland (0.9 per cent), while increases were recorded in Western Australia (1.0 per cent) and South Australia (0.9 per cent).

In seasonally adjusted terms, total dwellings declined by 15.5 per cent in March, largely driven by falls in New South Wales (27.4 per cent) and Victoria (27.0 per cent). The decline was led by private dwellings excluding houses which fell 30.6 per cent, while private house approvals decreased 3.2 per cent.

The value of total building approved was flat in March, in trend terms. The value of residential building rose 0.4 per cent, while non-residential building fell 0.6 per cent.