Not according to the ABA’s press release.

Deputy Australian Bankers’ Association Chairman and Bendigo and Adelaide Bank Chief Executive Mike Hirst has today described rumours of a split in the ABA as “complete rubbish”.

“From time to time there are occasions where banks have different views and different commercial interests. However, 99 per cent of the time we agree,” Mr Hirst said.

“As individual members we each have the strength and respect for each other that allows us to have robust discussions on a variety of issues.

“Together we are a strong industry with a strong industry association working to provide better banking for Australia’s customers,” he said.

ABA Chief Executive Anna Bligh has been in regular contact with non-major bank CEOs, including a teleconference with all regional bank CEOs as recently as yesterday afternoon, and has several scheduled meetings with non-major bank executives in the coming days.

AFG has today asked the regulator to keep a watchful eye on the big banks to ensure they do not use the Government’s recently announced major bank levy and their own Australian Bankers’ Association (ABA) Retail Banking Remuneration Review as a justification to implement changes designed to reduce the financial viability of providing broking services and marginalise large portions of the lending sector, leaving them without a distribution network.

“The ‘big bank levy’ announced by the Treasurer on budget night recognises the artificial taxpayer subsidy the four major banks and Macquarie have received through their lower borrowing costs since the GFC,” said AFG CEO (Interim) David Bailey. “The government is finally seeking to level the playing field.

“History suggests the big banks will undoubtedly pass this new cost on. The extent to which they are able to pass this levy on will depend on how strong our regulators are with the new supervisory powers also announced on budget night.

“Supervision of mortgage pricing has been tasked to the ACCC and the Productivity Commission will be conducting an Inquiry into competition in the sector. AFG welcomes this news.

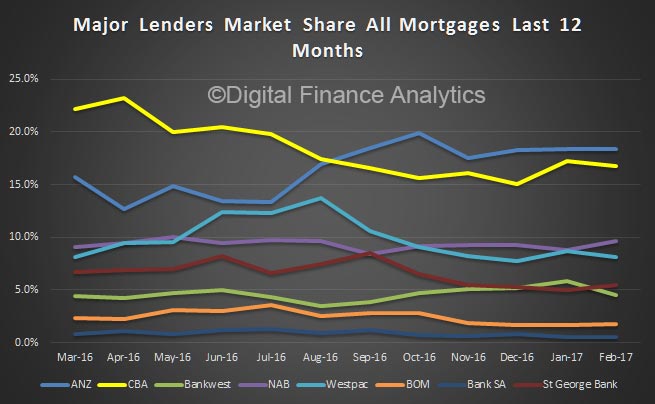

“We will be telling the Productivity Commission that the four major banks dominate the Australian lending market and a viable mortgage broking market is crucial for retaining competitive pressure,” he said.

The Australian Securities and Investments Commission (ASIC) has recently completed an exhaustive review of the remuneration of mortgage brokers and the overriding conclusion was that brokers are good for competition and as such have delivered good consumer outcomes.

“ASIC identified some areas where the industry could be strengthened but it did not recommend wholesale changes to the current remuneration structure as incorrectly reported in some quarters,” said Mr Bailey.

“It is incumbent upon the industry as a whole to respond to the regulatory process and our industry is doing so. AFG will continue to play a leading role in this response representing our 2,800 mortgage brokers.

“One very vocal industry participant, the Australian Bankers’ Association (ABA), conducted their own review into remuneration structures, principally about their own sales channel, which is entirely appropriate. However, at the time the scoping document was released AFG questioned why, given the width and breadth of the ASIC review the ABA would choose to incorporate the broker channel in their scope.

“For the ABA Review to be regarded as a significant analysis of the broking industry is quite frankly outrageous. We continue to assert that it is nothing more than the opinion of a single interest group, the banking lobby group.

“All major lenders came out within hours of the ABA review being released and committed to implementing all of the changes recommend.

“For anyone to suggest that the ABA should be the one driving remuneration change when there is already a consultative process underway with ASIC and Treasury is ridiculous.

“Tweaks are needed, not wholesale change; we would urge the regulators and government to ensure the ASIC Review is not used as a lever to drive an even better outcome for the big banks.”

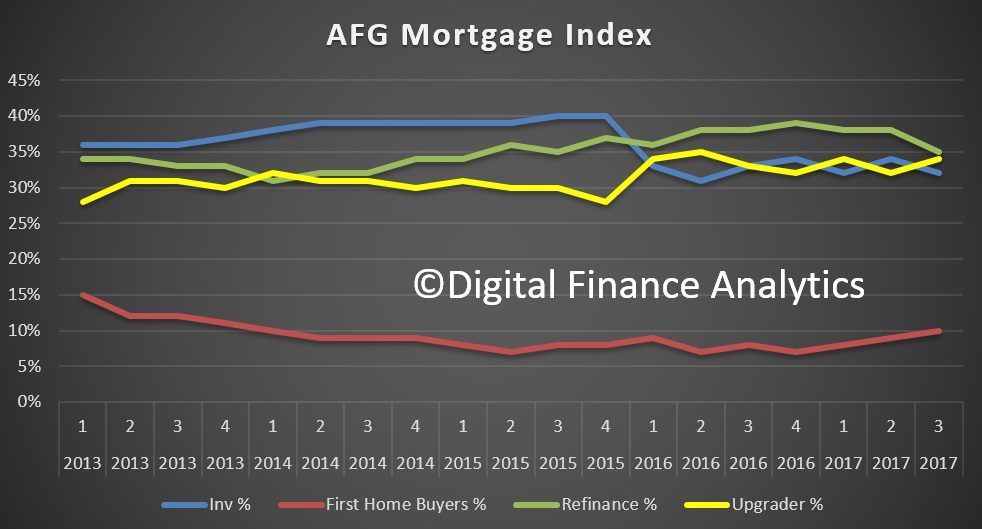

“We all need to come back to the central conclusions of the ASIC Review – brokers are good for competition and for consumers. If consumers were not satisfied with the broker channel they would have abandoned it. In fact, recent statistics show that that broker market share is growing.

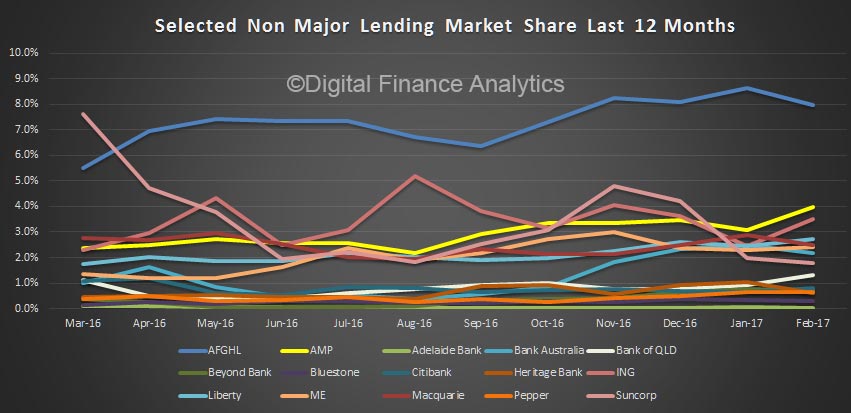

“A significant change to the broker remuneration model impacts the ability of the broking industry to survive which mean the non major lenders, who rely on the broker channel to distribute their products across the Australian market becomes compromised,” said Mr Bailey.

“This means less choice for consumers and higher home loan rates. This is not a good consumer outcome but does provide more strength to the Big Four banks.

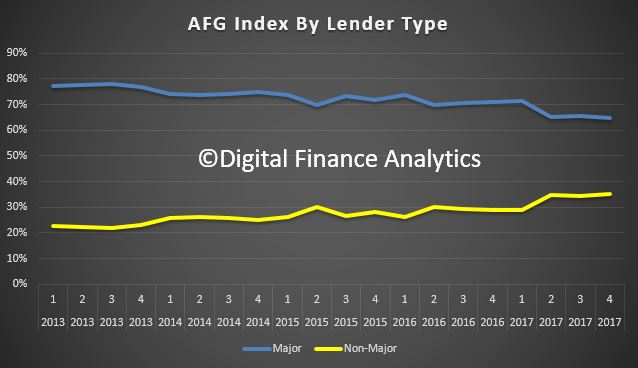

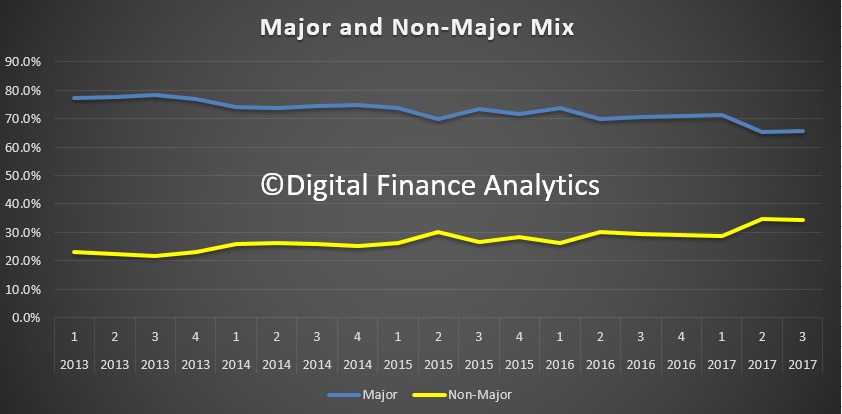

“AFG has worked hard at providing choice for our brokers’ customers and with 45 lenders on our panel more than 30% of our flow now goes to non-major lenders. This is a great consumer outcome. We would like to think the non-majors are supportive of the current remuneration structure,” he concluded.

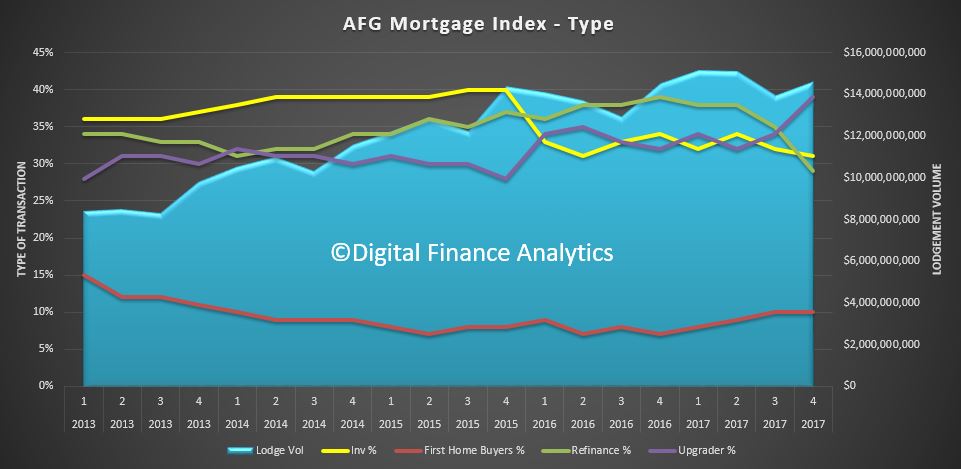

AFG is a diversified lending services company and one of the country’s largest mortgage broking groups. Through a network of 2,875 contracted mortgage brokers, AFG processes around $4.5 billion of finance every month and has a combined residential and commercial loan book of $133 billion.