AFG, a major Mortgage Broker Aggregator says that introducing fees for service would cause a “major disruption” in the finance industry, be a “clear disincentive” for borrowers to use brokers and “further entrench the oligopoly powers of the major banks”, in a response to the Productivity Commission, as reported by The Adviser.

In its response to the Productivity Commission’s (PC) draft report into competition in the Australian financial system, the Australian Finance Group (AFG) responded to the call for more information on the effect of replacing broker commissions with a fee-for-service model.

The group pulled no punches in warning that the introduction of such a model would “provide a clear disincentive for consumers to use brokers and would inevitably cause a major disruption in the finance industry”.

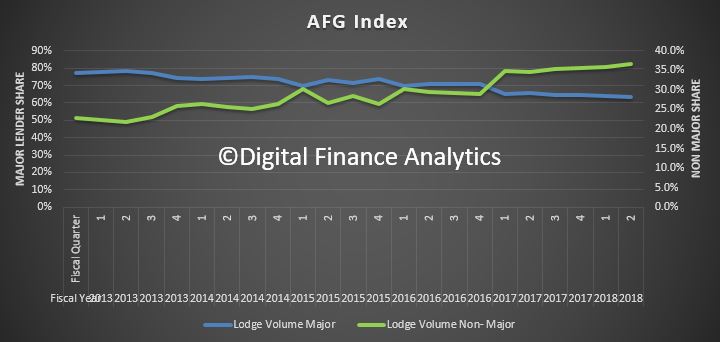

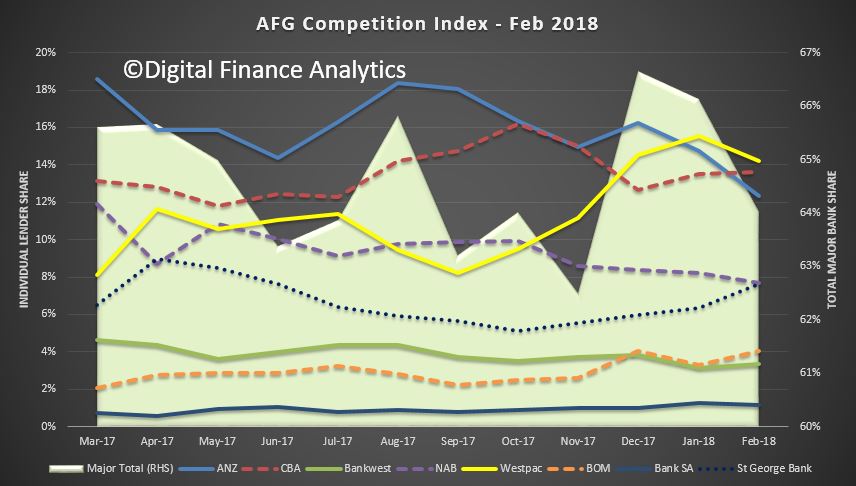

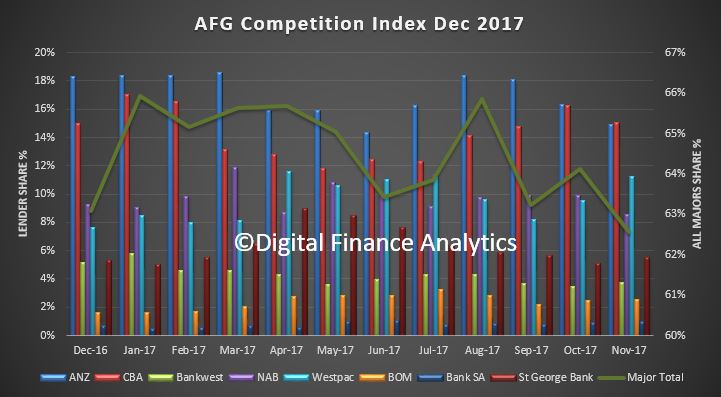

“The four major banks would be the only beneficiaries of a change of this kind as they would gain an additional competitive advantage over competing lenders that do not have extensive direct distribution channels,” the broking group said.

“This would further entrench the oligopoly powers of the major banks, which, coupled with the commission’s observations concerning the regulatory advantage of D-SIBs, ha[s] a negative impact on competition in the finance sector and [will] lead to a loss of the pricing benefits that resulted from the development of the mortgage broking industry.”

AFG also predicted that should such a change occur, it would not necessarily mean that any savings would be passed on (i.e. that loans would be repriced or that consumers would save money), as banks would have to distribute their products and would have additional costs (including increased staffing) “to deal with direct applications that have not been professionally compiled and pre-assessed by a broker to meet the lender’s requirements”.

“It is AFG’s contention that the presence of the mortgage broking channel is one of the few drivers of competitive tension in the Australian lending market,” the response reads.

“A consumer dealing directly with a lender has limited negotiating power or knowledge of the interest rates and lending criteria offered by competitors. A mortgage broker with access to a panel of lenders drives competition between lenders to the benefit of all consumers, not just their own clients.”

Touching on trail, AFG said that it “strongly supports” the removal of trail that increases over time, but that it does not agree that the standard trail commission operate as a disincentive to switching.

It said: “When a broker assists a consumer to refinance, trail commissions that cease with respect to the repaid loan will be replaced with the trail commissions payable on the new loan. As a result, it is AFG’s view that, in the absence of increasing trail commission rates over time, trail commissions per se are not likely to have a negative impact on broker behaviour.”

It concluded: “It is important that any changes should not result in an economic drift away from the broker to the lender, as devaluing the service provided by brokers would have significant and long-term detrimental effects for consumers by lessening the competitive tensions that currently exist in the credit industry.

“It is essential that anticompetitive conduct is not permitted to proliferate under the guise of regulatory reform.”

Best interests duty

In regard to the PC’s suggestion that a duty of care be implemented on lender-owned aggregators to act in the consumer’s best interests, AFG said that it was “very concerned” about introducing a test that would be applied to only one section of the industry “as it is likely to result in market distortions and unintended consequences”.

For example, it suggested that lender-owned aggregators could suggest that consumers are at risk if they use a broker that is not subject to the same test (and assert that the safest course for consumers is to only use brokers that are subject to the additional “best interests duty”).

Noting that the Combined Industry Forum has been working on a reform package, AFG added that “before considering additional law reform proposals, sufficient time must be allowed for those proposals to be implemented and embedded into the processes, procedures and culture of individual broker businesses”.

“Once that has occurred, it will be an appropriate time to again review the extent to which community expectations are met and good consumer outcomes are achieved,” the group said.

Lack of data on costs “disingenuous”

Noting that the commission found it difficult to ascertain from lenders the costs and benefits of using brokers rather than branches to source home loans, AFG said that the lack of information from lenders “should be considered to be disingenuous”.

“It is difficult to accept that entities that are sophisticated enough to develop and manage banking products and meet complex legal and regulatory obligations do not have information about product costs that would be needed to price those products,” the group said.

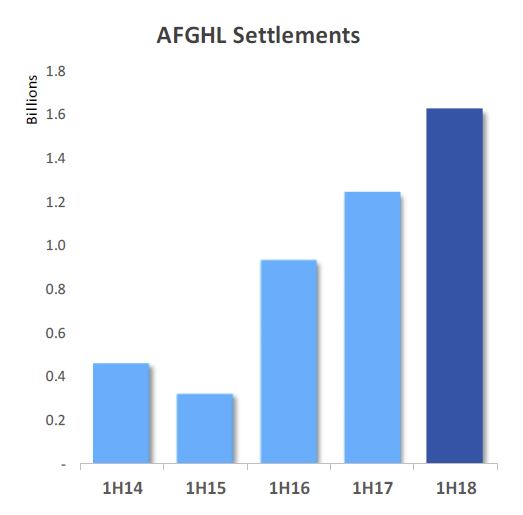

“However, absent a willingness to publicise that information, AFG submits that the willingness of lenders to embrace broker distribution should be considered reasonably reliable evidence that brokers provide an efficient and cost-effective means of distributing lending products.”

It added: “Brokers provide a variable cost base for lenders, with payment only required when a loan is settled and while it remains undischarged and not in default. This means that the risk of non-completion by a prospective borrower is substantially borne by the broker. As a result, lenders using broker distribution (as opposed to fixed-cost branch networks) can more easily price loans in a way to ensure that they are profitable.”

AFG also outlines that it believes ASIC should be responsible for advancing competition in the financial system, that consumers would receive “an inferior standard of service” should financial advisers also offer credit advice, and that ASIC could produce a best practice guide on disclosure requirements.