We discuss the latest attempts to keep the debt balloon in the air. Tarric is on Twitter as @AvidCommentator

Tag: APRA

Look The Other Way – The DFA Daily 10th September 2020

The latest edition of our finance and property news digest with a distinctively Australian flavour.

Shifting The Regulatory Goal Posts

APRA and ASIC have some out with more relief for the banks as they wrestle with mortgage payment suspensions. Can firmly being kicked, but what are the implications?

Housing Credit Stirs In June, But Forget Growth Ahead

The RBA and APRA released their monthly stats to end June on Friday.

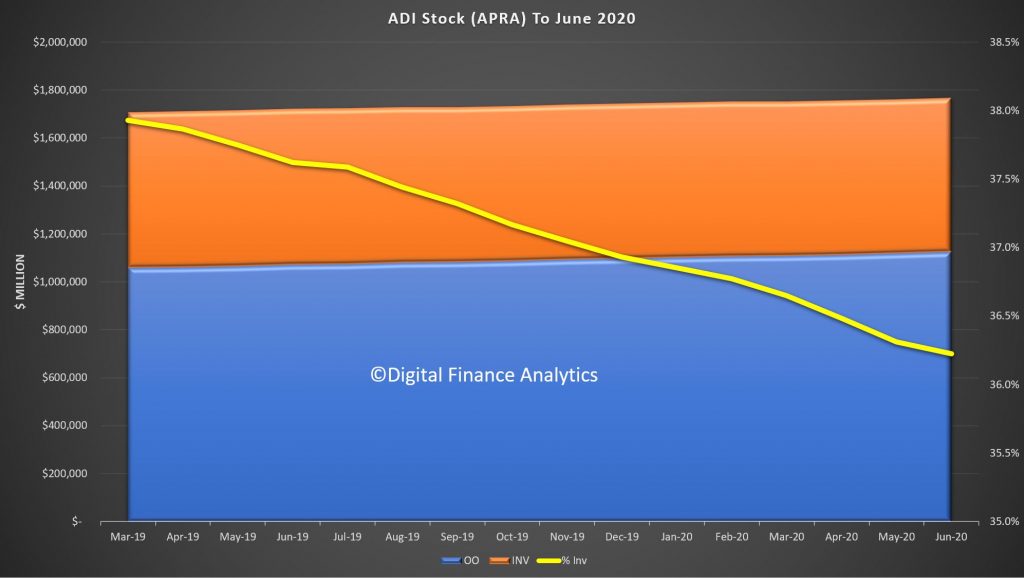

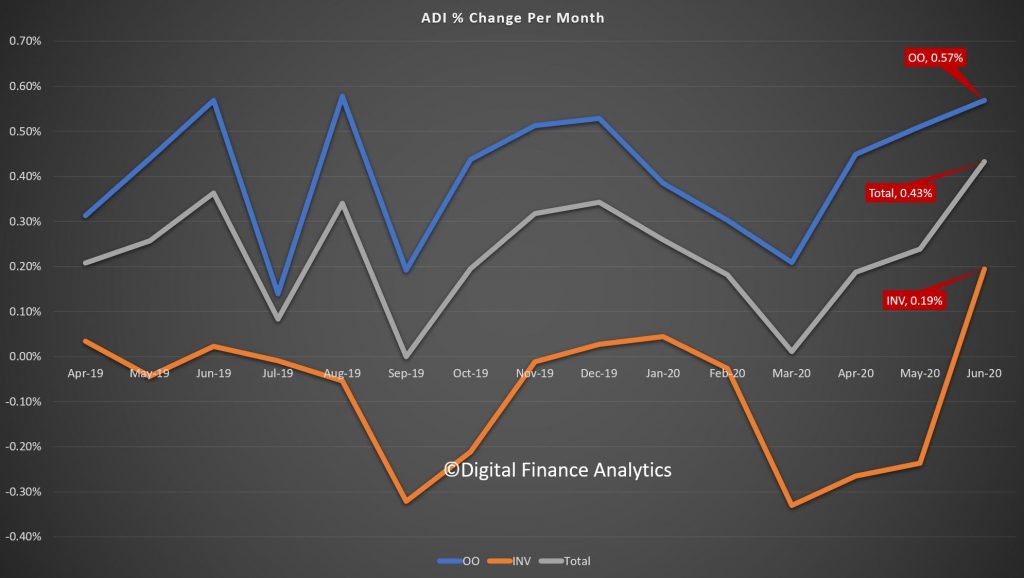

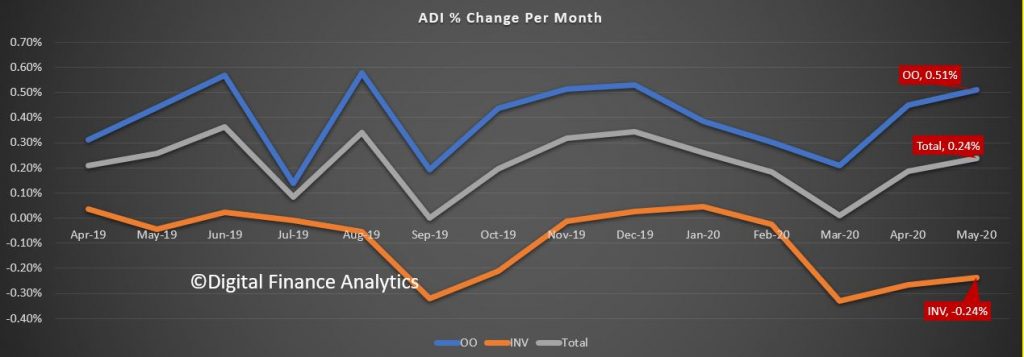

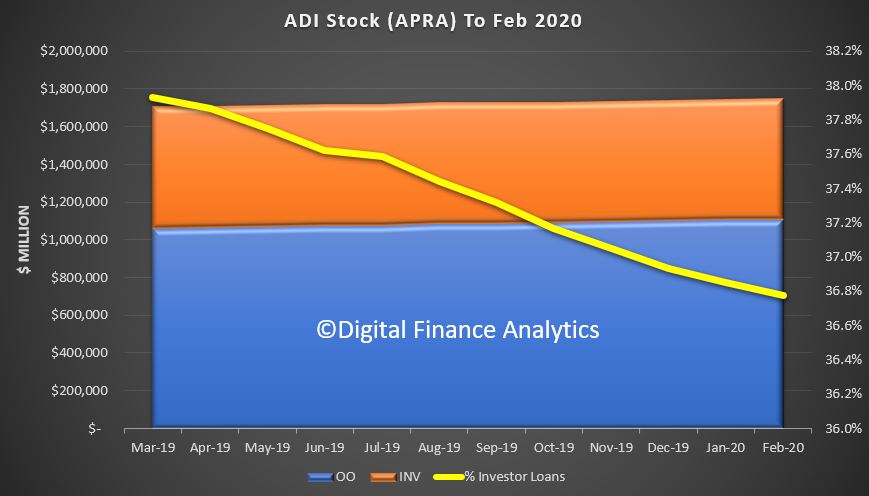

The stock data from APRA, relating to the ADI’s (banks etc.) revealed that total owner occupied housing lending rose 0.57% to $1.12 trillion, while investment lending rose 0.19% to $0.64 trillion. As a result total lending for housing from ADI’s was up 0.43% to $1.76 trillion. A record. Investment lending was 36.2%, dropping again. And remember, around 11% (~$200 billion) of borrowing households are on repayment holidays, so balances are automatically rising as a result. Something which I note few are commenting on.

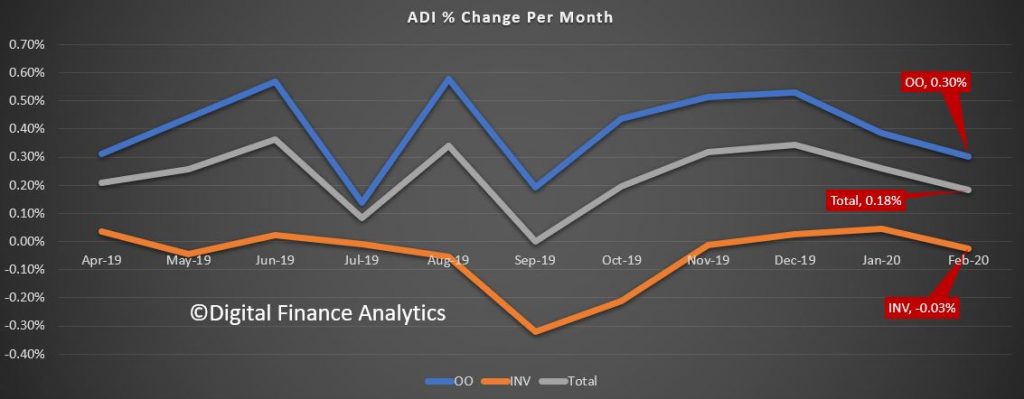

The change over time shows that as the lock downs were eased in June, demand for credit was higher, something which we suspect will be temporary. And of course refinancing is 40% higher, and we know that many drew down additional equity through the transaction. More on that in a later post.

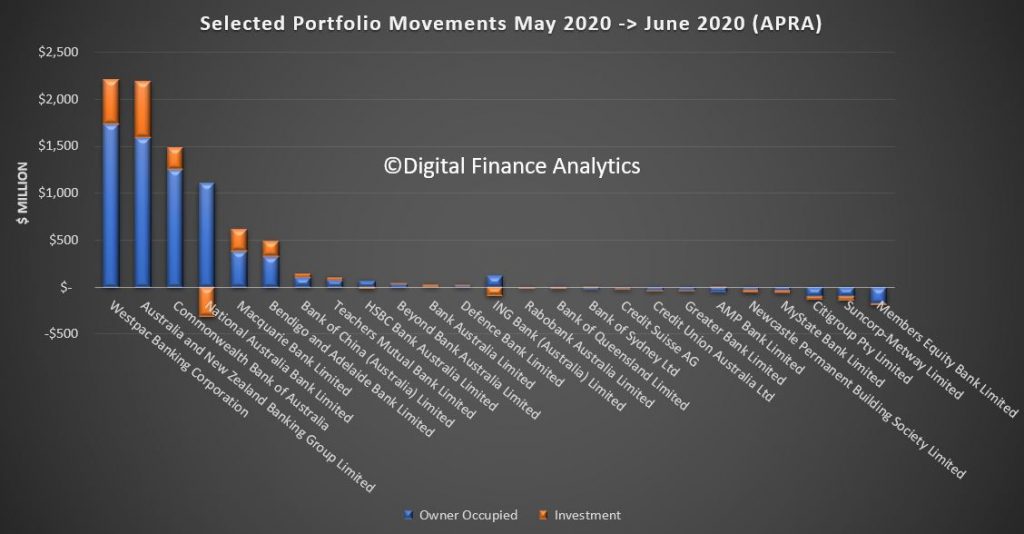

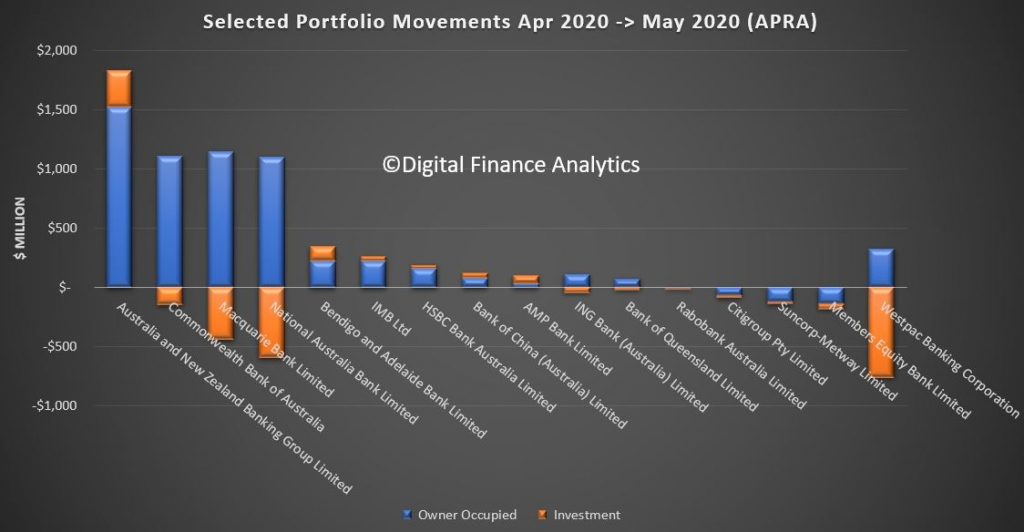

Westpac led the pack according to the bank level data, with growth that matched CBA, although CBA wrote more investor loans. NAB dropped investor loan balances according to the APRA report, while Members Equity and Suncorp dropped both investor and owner occupied balances. The cheap loans offered by the big four makes it hard for smaller players to compete as they fight for market share scraps in a difficult market. The 60 basis point drop in funding, thanks to the RBA, is of course helping to drive rates lower.

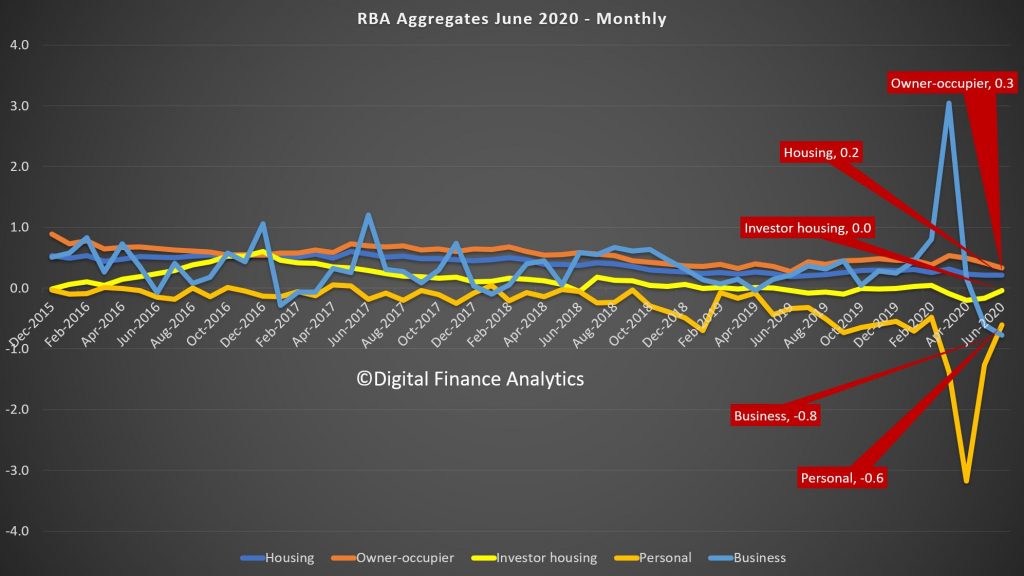

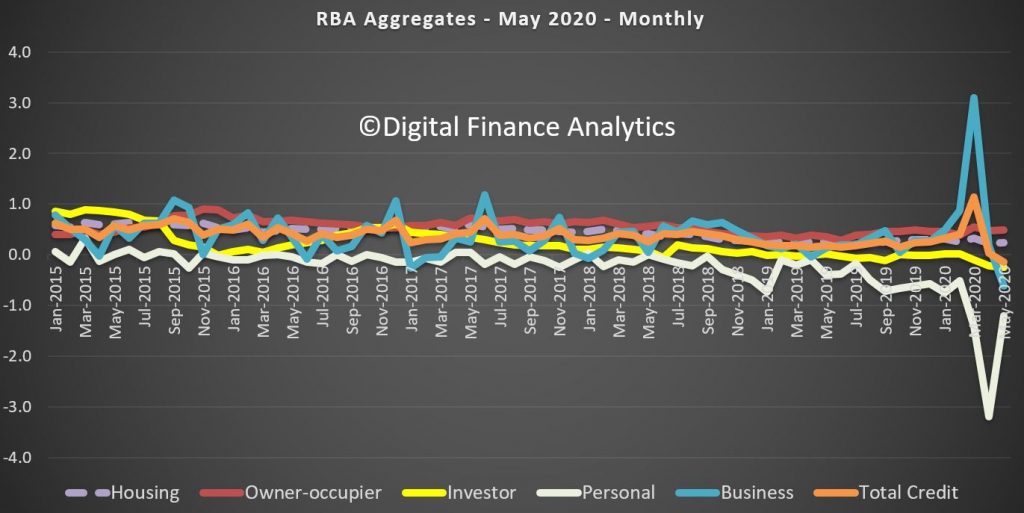

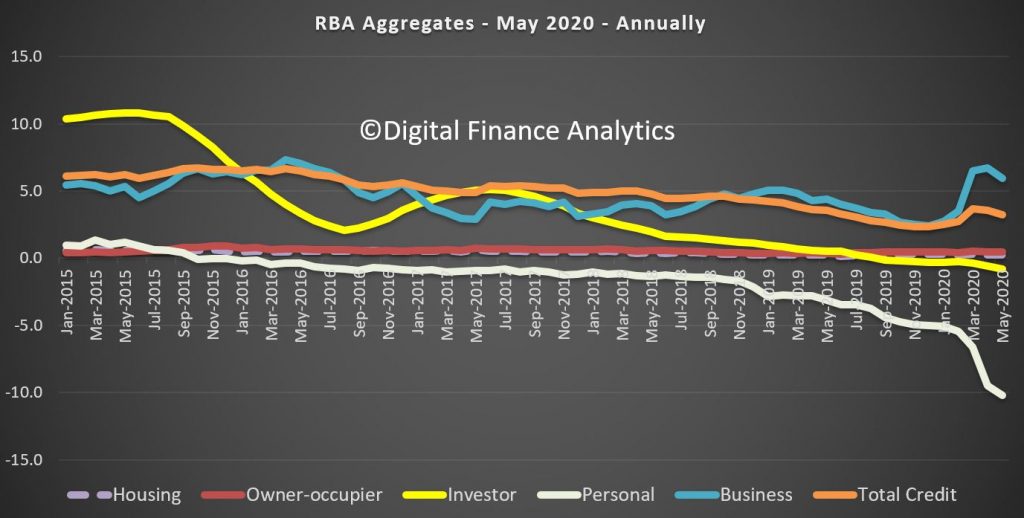

The RBA series, which includes the non-banks shows a somewhat similar story with the monthly housing for owner occupied higher, at 0.3% up, investment lending flat, and total housing up 0.2%. Business lending and personal credit were both lower.

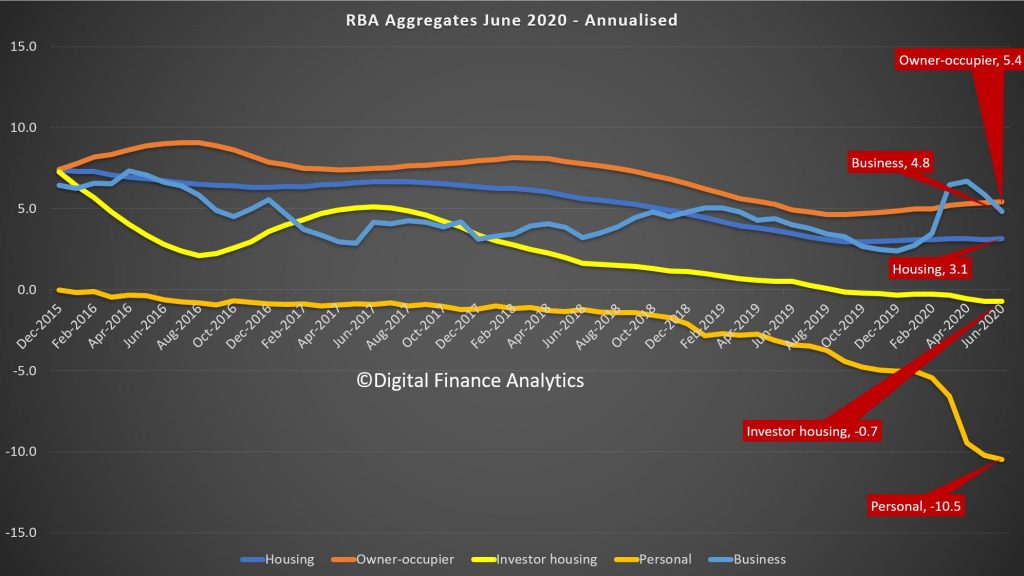

The less noisy annual trends revealed that annualised growth of owner occupied loans is still an amazing 5,4%, while investor lending is down 0.7%, leading to average housing lending at 3.1%. Business credit is 4.8% but that was upped by drawn downs at the start of the virus phase, and is now lower, and personal lending is down 10.5%.

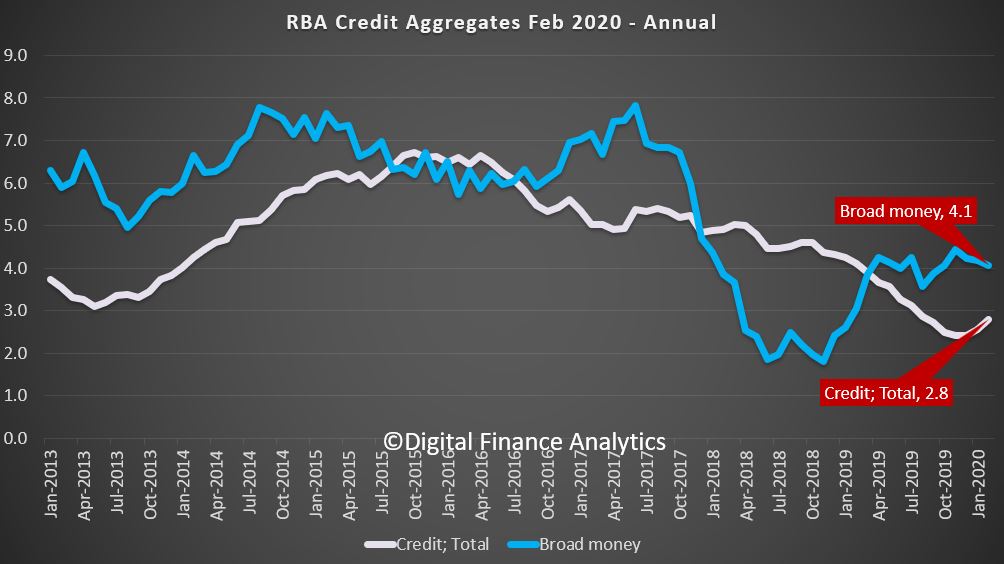

The total credit number was down to 2.9% and we suspect will continue to head south, while the broad money measure was up to 10.2% – thanks to the RBA interventions, JobSeeker, JobKeeper, Super withdrawals, and other stimulus measures. The question now becomes where will the money flow – to drive prices higher as people buy more, or into the financial system to drive stocks and other financial assets higher? One leads to inflation, the other to deflation – I suspect we will follow the Japan route but we will see.

Credit Crunch Bites In May

APRA and the RBA released their May loan numbers yesterday. These are stock numbers, taking account of repayments, refinances and new loans. APRA said that banks increased their overall residential property lending by 0.24%, with owner occupied loans up 0.51% and investor loans down again, this time 0.24%.

As result the proportion of loans for investment purposes dropped back to 36.3%. Total loans were 1.758 trillion dollars.

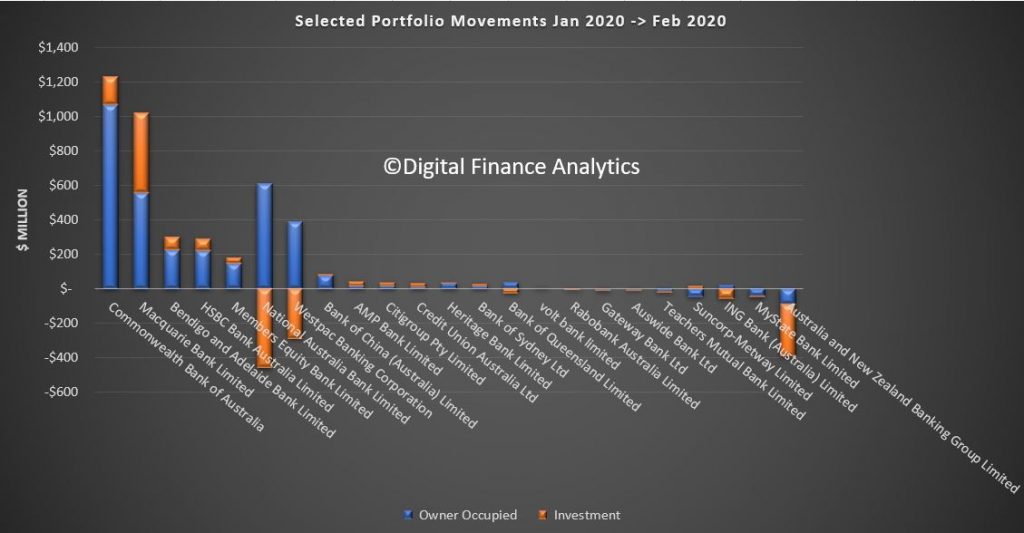

Within the individual lenders, Westpac dropped their investment portfolios, more than NAB, Macquarie and CBA, while ANZ expanded both investment and owner-occupied loans, as did Bendigo and Adelaide Bank and Bank of Queensland. Suncorp, Citigroup, and Members Equity Bank all reported lower balances to APRA this month.

Turning to the RBA series, which includes the non-bank sector, Credit to the private sector contracted in the month of May, the first decline in credit since June 2011.Demand for credit has weakened across across businesses and households.

The RBA reported that the May decline in total credit of 0.1% included: a 1.2% contraction in personal; a 0.6% fall in business; and a weak 0.24% rise in housing (with the investor segment in decline).

Businesses are in survival mode now, having initially pulled down available credit lines, which led to a March spike of 3.1%, the largest monthly increase in business credit since the start of 1988.

Now they are moving into cut mode with expenditure and investment both slowing. We expect this to continue, along with more structural job cuts.

Personal household credit which makes up around 8% of total household credit fell, as confidence ebbs away. The temporary “lock-down” also impacted. In fact in the past 12 months personal credit is down more than 10%.

Overall housing credit was up 0.22% in April and by 0.24% in May, which translates into an annulaised 2.8%. It continues to weaken. Of course this is a function of confidence, off the back of COVID, plus rising underemployment, Investor Housing credit dropped -0.25% over the month, and down -0.8% across the year for May. Our research suggests many property investors are coming unglued as home prices fall and rents get crushed. Owner Occupied credit grew, up 0.49% over the month, or 5.4% annualised.

So to me the question will be the ongoing impact of underemployment, and the impact of the cliff, depending of what the banks do (will they continue to postpone repayments) and the shape of future government support, to say nothing of the passage of the virus.

Deeper In The Mire – DFA Daily 31 March 2020

The latest finance update with a distinctively Australian flavour.

Mortgage Lending Was Slowing Before The Crisis

APRA released their banking statistics to end February 2020 today, as it is the last day of the month. They are of course using the new Economic and Financial Statistics (EFS) data collection, which modernised the collection of data submitted by ADIs and Registered Financial Corporations (RFCs).

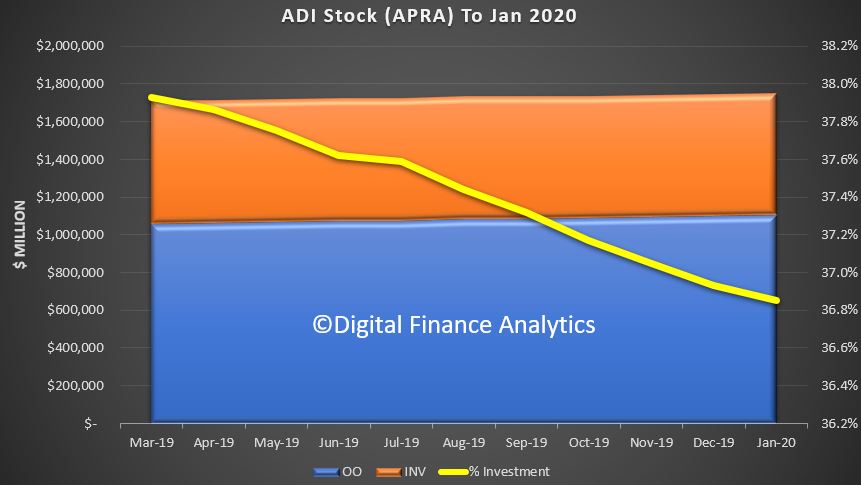

In the halcyon days of February (remember when the stock markets hit all time highs), total mortgage lending growth from the banks was already weak, with investment lending balances falling slightly, and owner occupied lending growing, on a net basis. Some of this was driven by households choosing to pay down loans thanks to their own financial uncertainty. This could have proved to be very smart. The share of investment mortgages in the portfolio dropped to 36.8%, with the total exposures up to $1.75 trillion dollars, with owner occupied loans at $1.10 trillion and investment loans $0.64 trillion.

In percentage terms, investment balances fell by 0.03% or $170 million and owner occupied loans rose 0.3% or $3.3 billion, giving total loan growth of 0.18% or $3.17 billion. Ahead of course, interest will be rolled up into balances for the duration, but the number of new mortgages may slow. Hard to predict, as some seek to switch loans, or even sell quickly.

Portfolio movements within the banks, as reported by APRA, is subject to a range of potential input errors. but with that caveat it seems that CBA, Macquarie, Bendigo and HSBC were lending more freely, while NAB and Westpac saw their investor balances fall, whereas ANZ dropped both sets of balances. ING and Bank of Queensland dropped investor loans, while Suncorp dropped owner occupied balances while growing investor loan balances once again.

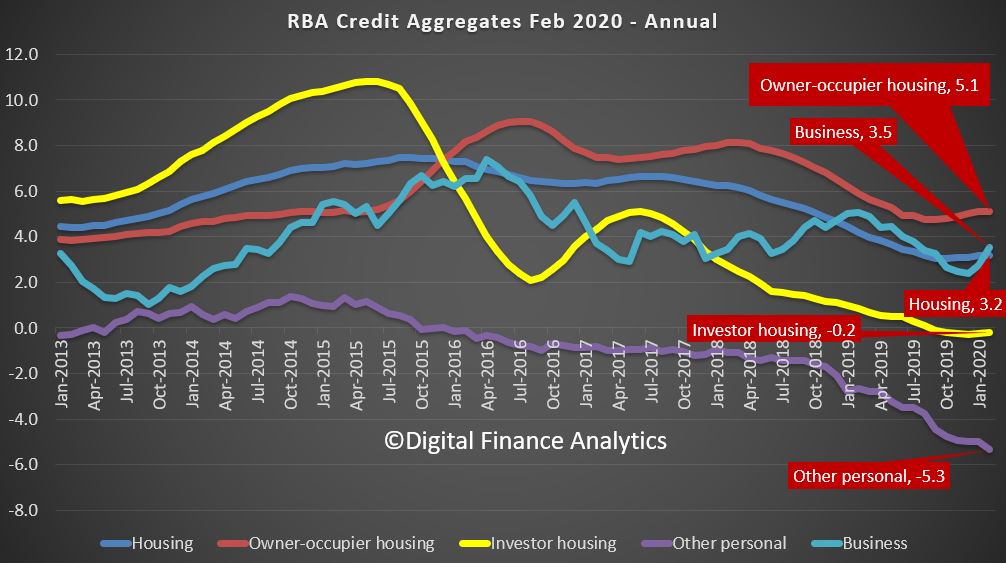

Meantime, the RBA aggregate figures are also out today. They reported total credit grew 0.4% in February, and 2.8% over the year, compared to 4.1% a year before. More signs of slowing.

Within that, lending for housing rose 0.3% in February to 3.2% over the year, compared with 4.2% a year ago. Business lending rose 0.9% in February to reach 3.5% over the year, compared with 5.1% a year back. And personal credit dropped 0.5% in February, and is down 5.3% over the year, compared with down 2.6% the previous year.

More granular analysis shows that lending for owner occupation is where the growth is, at 5.1% annualised, up from a low of 4.8% back in October last year, so hardly a stellar recovery. Investment lending is still falling slightly.

Broad money is falling, down to 4.1% annualised, despite the rise in credit. All signs of weakness before the current health crisis is freezing the economy.

All pretty academic now, but there is the data for the record!

APRA Advises Regulatory Approach to COVID-19 Support

The Australian Prudential Regulation Authority (APRA) today confirmed its regulatory approach to the COVID-19 support packages being offered by banks and other lenders to their borrowers in the current environment.

Many banks have recently announced COVID-19 support packages that provide affected borrowers with an option to defer their repayments for a period of up to six months. These packages have mainly been offered to small business and home loan customers.

Where a borrower who has been meeting their repayment obligations until recently chooses to take up the offer not to make repayments as part of a COVID-19 support package, the bank need not treat the period of the repayment holiday as a period of arrears. Similarly, loans that have been granted a repayment deferral as part of a COVID-19 support package need not be regarded as restructured.

APRA will be writing to all authorised deposit-taking institutions (ADIs) to advise them of the specific reporting treatment for loans subject to these support arrangements. APRA will require ADIs to report to APRA, and publicly disclose, the nature and terms of any repayment deferrals and the volume of loans to which they are applied. ADIs must also still continue to provision for these loans under relevant accounting standards.

APRA also confirmed that the Coronavirus SME Guarantee Scheme announced by the Commonwealth Government yesterday is to be regarded as an eligible guarantee by the government for risk-weighting purposes.

In addition, we note that the Government’s package launched yesterday included a relation of bankruptcy and corporate government rules, including the protection of directors responsible for companies who, under normal rules would perhaps indicate their businesses would not be viable.

APRA Drops Capital Requirements

The Australian Prudential Regulation Authority (APRA) today announced temporary changes to its expectations regarding bank capital ratios, to ensure banks are well positioned to continue to provide credit to the economy in the current challenging environment.

Over the past decade, the Australian banking system has built up substantial capital buffers. The highest quality form of capital, Common Equity Tier 1 (CET1) capital, reached $235 billion at the end of 2019. As a result, banks are typically maintaining capital levels well above minimum regulatory requirements.

In 2017, APRA set benchmark capital targets for banks to enable them to be regarded internationally as unquestionably strong (which was a recommendation of the 2014 Financial System Inquiry). These benchmarks are well above current minimum regulatory requirements. For the four major banks, for example, this benchmark equated to having a CET1 ratio of at least 10.5 per cent of risk-weighted assets. A lower benchmark applies for smaller banks. In comparison, the actual CET1 ratio of the banking system by the end of 2019 had reached 11.3 per cent.

APRA is advising all banks today that, given the prevailing circumstances, it envisages they may need to utilise some of their current large buffers to facilitate ongoing lending to the economy. This is especially the case for banks wishing to take advantage of new facilities announced today by the Reserve Bank of Australia to promote the continued flow of credit. Provided banks are able to demonstrate they can continue to meet their various minimum capital requirements, APRA would not be concerned if they were not meeting the additional benchmarks announced in 2016 during the period of disruption caused by COVID-19.

APRA Chair Wayne Byres said: “APRA has been pursuing a program to build up the financial strength of the system for many years, when banks had the capacity to do so. As a result, the Australian banking system is well-capitalised by both historical and international standards.

“APRA’s objective in building up this capital strength has been to ensure it is available to be drawn upon if needed in times such as this. Today’s announcement reflects the underlying strength of the system: even if the banking system utilises some of its current large buffers, it will still be operating comfortably above minimum regulatory requirements,” Mr Byres said.

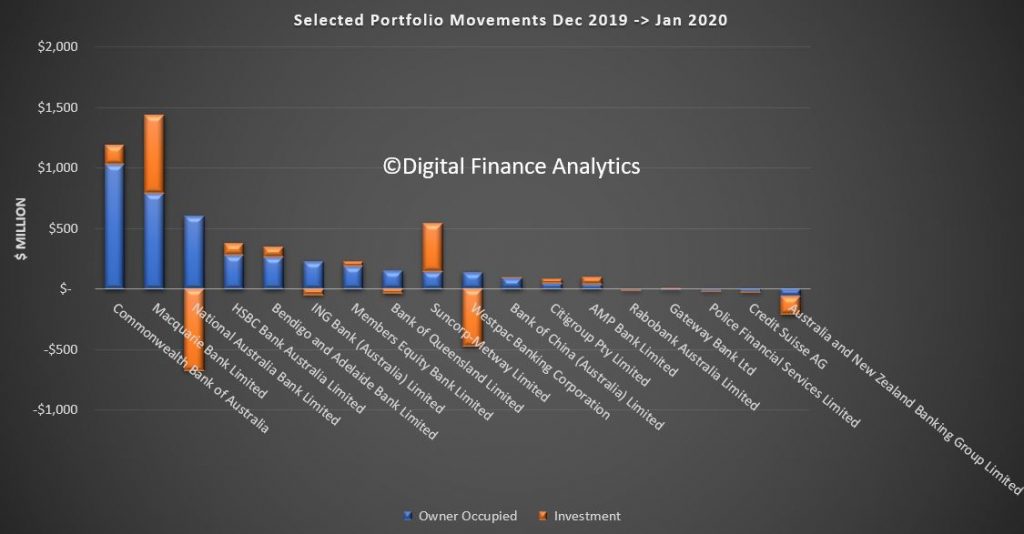

ADI Mortgage Credit Growth Slows In January 2020

APRA released their monthly stats showing total reported balances for each bank to the end of January 2020.

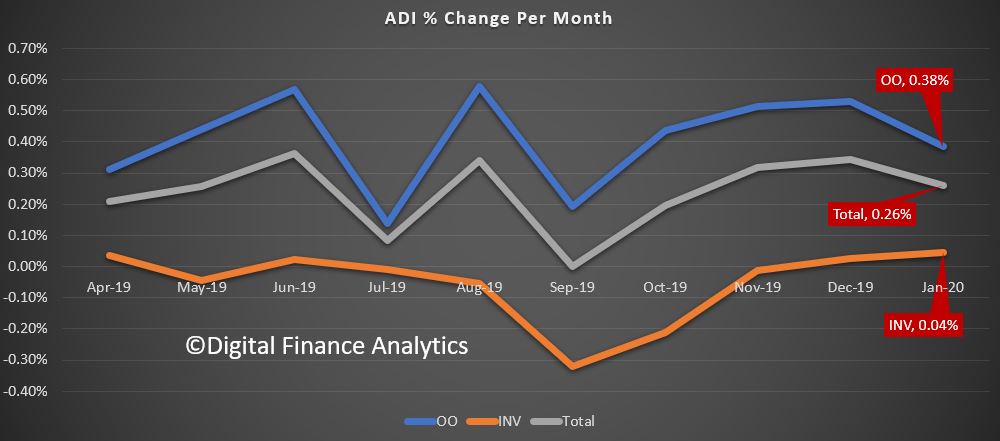

Total balances grew by 0.26%, to $1.75 trillion dollars, with loans for owner occupation up 0.38%, to $1.1 trillion dollars and investment loans up 0.04% to $0.64 trillion dollars. Investment loans made up 36.9% of the portfolio.

These are net balances, after repayments and new loans, and refinancing between banks.

The individual movements between banks shows that CBA and Macquarie Bank are leading the growth, while NAB, and Westpac dropped investment loan balances, ANZ dropped both types, while Suncorp accelerated their investment lending. Macquarie still leads in investment lending however.

This suggests ongoing weakness in credit growth – and we will examine the RBA data shortly, also out today. But clearly individual lenders are executing different strategies, and the portfolio changes highlight the net impact.