The review of Prospa’s contract is part of a broader surveillance by ASIC to examine lenders’ small business loan contracts to reduce the risk of unfair contract terms.

As a result of ASIC’s review, Prospa has made a number of changes resulting in improved terms for borrowers and guarantors. The changes include addressing problematic terms outlined in ASIC Report 565: Unfair contract terms and small business loans, and changes to other terms which could have operated unfairly for borrowers and guarantors.

Prospa has agreed that all customers who entered into or renewed contracts from 12 November 2016 will have the benefit of the changes agreed with ASIC. Prospa will be communicating these changes to its small business customers with the amended contract coming into effect in early October.

ASIC’s surveillance of small business loan contracts is ongoing, and will consider regulatory action where appropriate.

Changes to Prospa’s loan contract

Prospa has agreed to make the following changes to its standard form small business loan contract:

- amended the early repayment clause so that borrowers can now prepay their loan early without requiring Prospa’s consent, and removed Prospa’s absolute discretion whether to provide a discount for prepayment – Prospa will now apply a published Early Prepayment Policy so borrowers can determine the discounts they they can expect to receive if they do pay back their loan early;

- amended the ‘unilateral variation’ clause to significantly limit Prospa’s ability to unilaterally vary contracts to specific instances. Prospa has also extended the notice period to 60 days where Prospa intends to vary fees;

- amended clauses defining events of default to add remediation periods and materiality thresholds and to permit changes to control of the Borrower with the lender’s consent (not to be unreasonably withheld);

- removed a broad ‘cross-default’ clause which allowed Prospa to call a default under the loan contract due to any default under another finance document related to the loan (for example, guarantee or security document);

- restricted the borrower’s indemnity to ensure that:

– the borrower is required to indemnify only Prospa, its employees and agents (and not third parties that are not parties to the contract such as receivers or contractors); and

– the borrower is not required to indemnify Prospa for losses or costs incurred due to the fraud, negligence or wilful misconduct of Prospa, its employees, officers, agents, contractors or receivers appointed by Prospa;

- removed an ‘entire agreement’ clause which absolved Prospa from contractual responsibility for conduct, statements or representations made to borrowers about the loan contract;

- limited the class of people who can provide guarantees under the loan contract to:

– people who are actively involved in the management of a borrower’s business;

– if the borrower is a company, people who are directors or shareholders of the borrower; and

– if a shareholder of the borrower company is a company, directors or shareholders of that company.

- inserted a 5-business-days’ notice provision to guarantors about:

– borrowers who are 30 calendar days behind their agreed repayment schedule; and

– the commencement of legal proceedings against a borrower or the appointment of a receiver.

- limited the guarantor’s liability so that the guarantor is not liable for any increase in the amount of the loan principal and interest agreed at the start of the loan(but the guarantor is liable for fees and reasonable enforcement costs).

- inserted a provision to obtain consent of the guarantor:

– where there is a discharge or release of any security held by Prospa given by the borrower or a guarantor; and

– where there are multiple guarantors, before releasing a guarantor.

- limited the actions of lender-appointed attorneys where there is an event of default under the loan contract so that an appointed attorney cannot act in a way that prefers the interests of the attorney over the interests of the borrower or guarantor.

Prospa’s Interest Charges and Late Fees

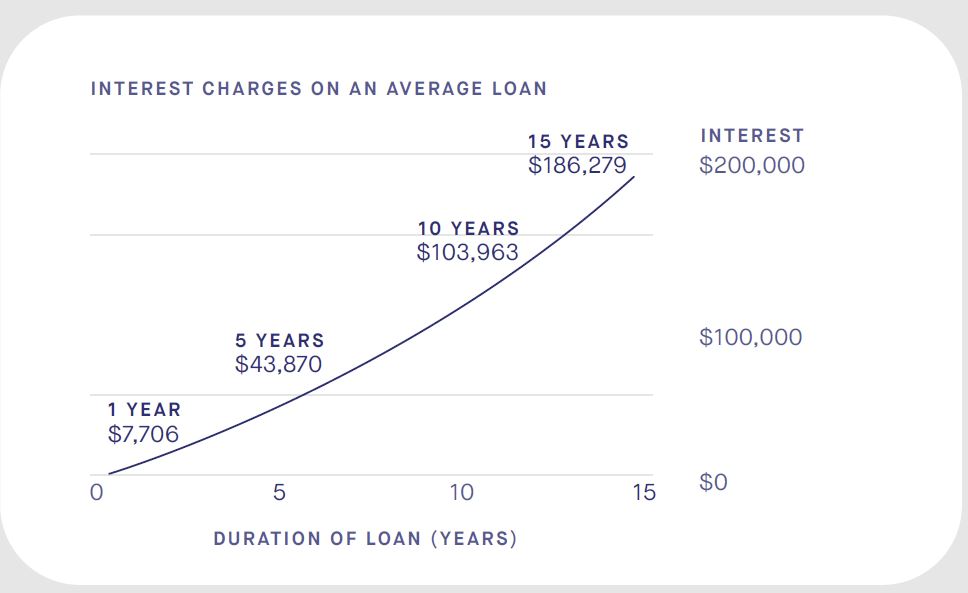

Prospa charges a factor rate for interest on its fixed term loans. The amount of interest, which can be considerably higher than bank loans, is fixed and disclosed at the outset and does not vary even if the loan term is extended. The amount of interest is therefore part of the “upfront price” of the loan and is excluded from review under the unfair contract term provisions.

Late payment fees for missed payments are, however, subject to review under the unfair contract term provisions. ASIC will be undertaking further monitoring of Prospa’s charging of late payment fees to assess whether the manner in which the fees are being charged is unfair in practice.

Background

In March 2018, ASIC published REP 565, which outlines changes to small business loan contracts made by the big four banks to comply with the UCT law. This report also provides guidance to the broader small business lending industry.

At the same time ASIC announced that it will also examine other lenders’ small business loan contracts to ensure that their contracts do not contain terms that raise concerns under the UCT law. ASIC is reviewing the contracts of bank and non-bank small business lenders, including Prospa, to check their compliance with UCT law.

Since publishing REP 565, ASIC is also monitoring the big four banks’ compliance with the UCT law. In March 2017, ASIC and the ASBFEO completed a review of small business standard form contracts and called on lenders across Australia to take immediate steps to ensure their standard form loan agreements comply with the law (refer: 17-056MR).

In August 2017, ASIC and the ASBFEO welcomed the changes ASIC required to small business loan contracts by the big four banks (refer: 17-278MR) that have: