The Australian Securities and Investments Commission (ASIC) is urging Australians to do a quick and free search on ASIC’s MoneySmart website to see if a share of $1.1 billion of unclaimed money is theirs.

‘There are more than a million records of unclaimed money from dormant bank accounts, life insurance, shares and other investments waiting to be claimed and we’re keen to reunite people with their money’, said Peter Kell, ASIC’s Deputy Chairman.

‘Unclaimed money is transferred to the Commonwealth after it’s been unclaimed usually for seven years. The unclaimed money managed by ASIC is always claimable by the rightful owner with no time limit on claims. In 2016, over $87m was paid out to more than 16,000 people’, Mr Kell said.

‘It’s free, quick and easy to use ASIC’s MoneySmart website to search for your name or family and friends, just visit moneysmart.gov.au‘, said Mr Kell.

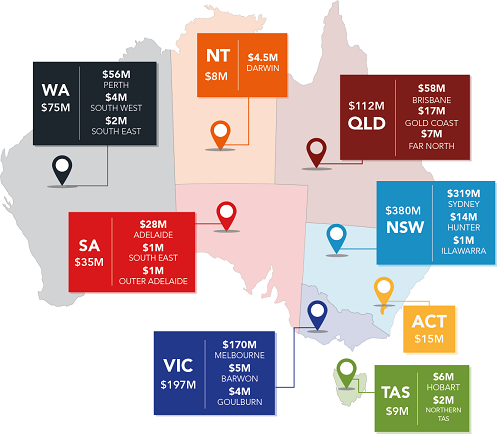

There are vastly different amounts of forgotten money waiting to be claimed ranging from a few dollars to over a million. The approximate amounts of unclaimed money available broken down by State and Territory are:

Figure 1: Unclaimed money held by ASIC by State and Territory, approximate amounts (rounded), April 2017

People may find they have unclaimed money if they:

- have moved house without letting the bank or the institution know;

- have not made a transaction on their cheque or savings account for seven years;

- stopped making payments on a life insurance policy;

- have noticed that regular dividend or interest cheques have stopped coming; or

- were an executor of a deceased estate.

Once a person has found unclaimed money using ASIC’s MoneySmart online search, they need to contact the relevant bank or other financial institution where the money is held if the money is listed as ‘banking’ or ‘life insurance’. The institution will assess and lodge a claim with ASIC. ASIC aims to process claims within 28 days of receiving all necessary claim documentation and release the funds back to the institution.

‘If you find you have unclaimed money, ASIC’s MoneySmart website offers free and impartial financial guidance and online tools to help you use it wisely and make the most of your money’, said Mr Kell.

ASIC’s unclaimed money infographic shows how much is there to be claimed around Australia.

Click to view

Background

ASIC’s MoneySmart website provides trusted and impartial financial guidance and tools to help Australians of all ages manage their money and make informed financial decisions. It also offers a free and easy search for unclaimed money.

Why is ‘unclaimed money’ held by ASIC?

‘Unclaimed money’ is money from dormant bank accounts, unclaimed life insurance policy payouts and money from shares and other investments that people have not been collected from companies.

‘Unclaimed money’ is transferred to ASIC after a certain period of time to be held by the Commonwealth. The unclaimed money held by ASIC is always claimable by the rightful owner and there is no time limit on claims.

Interest on unclaimed money is payable from 1 July 2013. No tax is paid on the interest you earn.

Banks, building societies and credit unions

ASIC holds money from bank, credit union and building society accounts that have not been used in 7 years and contain a balance of $500 or more. On 31 December 2015 this changed from 3 years. Bank accounts created for children and those held in a foreign currency are exempt.

Life insurance policies

ASIC holds money from life insurance policies from insurance companies or friendly societies that have been unclaimed for 7 years after the policy matures. On 31 December 2015 this changed from 3 years.

Shares and investments

ASIC holds most of the unclaimed money from shares and other investments that people have not collected from companies. This type of unclaimed money is usually the result of a takeover and may include cash and/or shares, depending on the takeover offer.

The approximate amounts of money available in unclaimed bank accounts, life insurance policies and shares broken down by State and Territory are:

| State/Territory |

Bank accounts |

Life insurance policies |

Shares & other investments |

| New South Wales |

$200m |

$25m |

$154m |

| Victoria |

$120m |

$16m |

$61m |

| Queensland |

$62m |

$10m |

$40m |

| Western Australia |

$43m |

$5m |

$27m |

| South Australia |

$17m |

$4m |

$14m |

| ACT |

$7m |

$1m |

$7m |

| Northern Territory |

$4.5m |

$0.5m |

$3m |

| Tasmania |

$5m |

$1m |

$3m |