We are at a significant point in the spring auction market as the prospect of early interest rate relief for home buyers becomes more uncertain in the months ahead, even though weekly clearance rates are so far holding steady, as overall property listings rise.

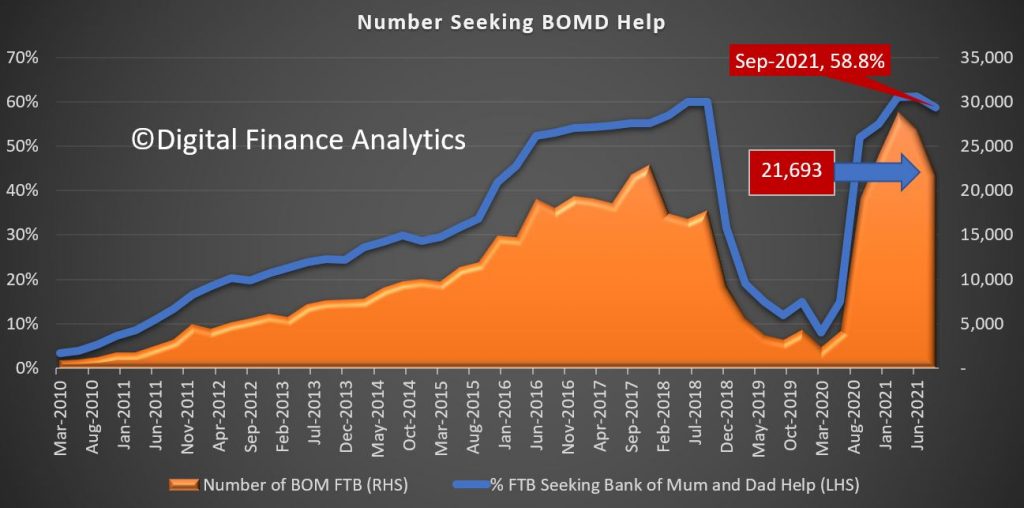

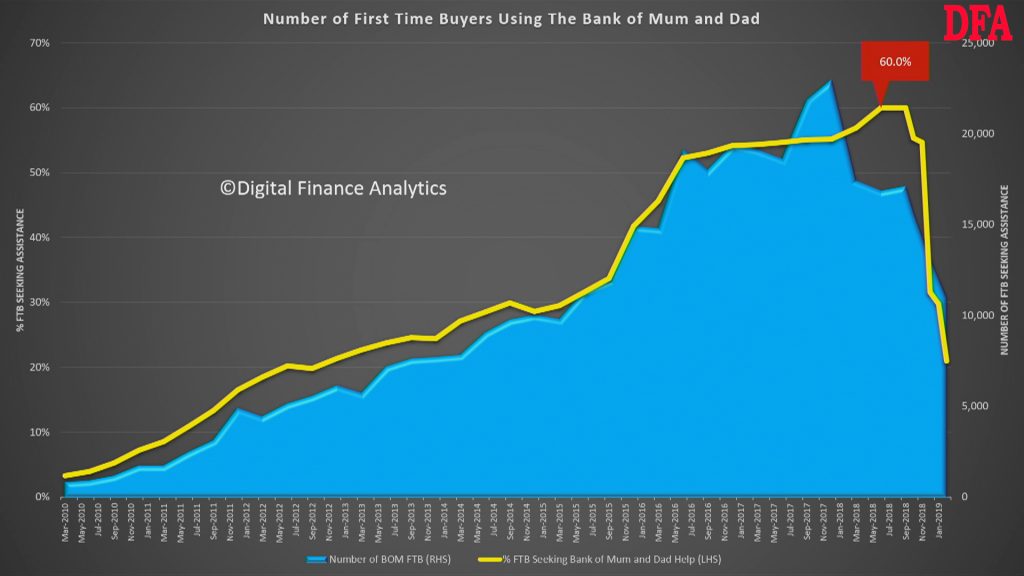

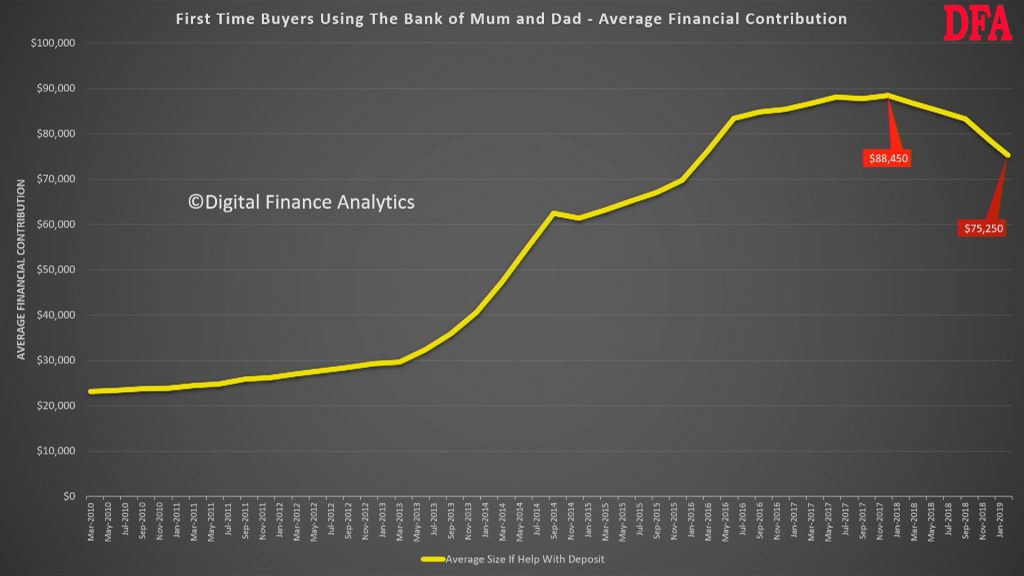

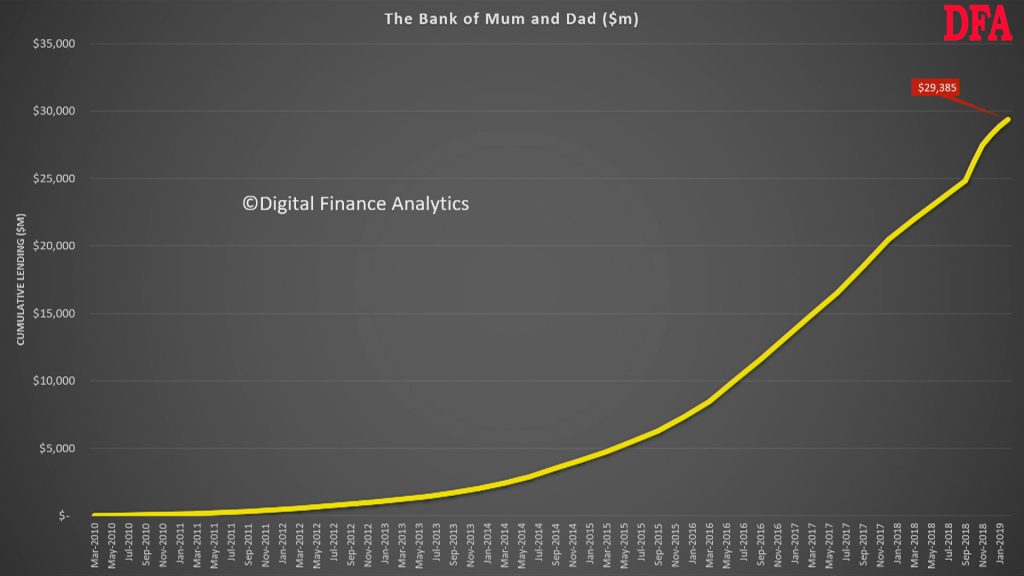

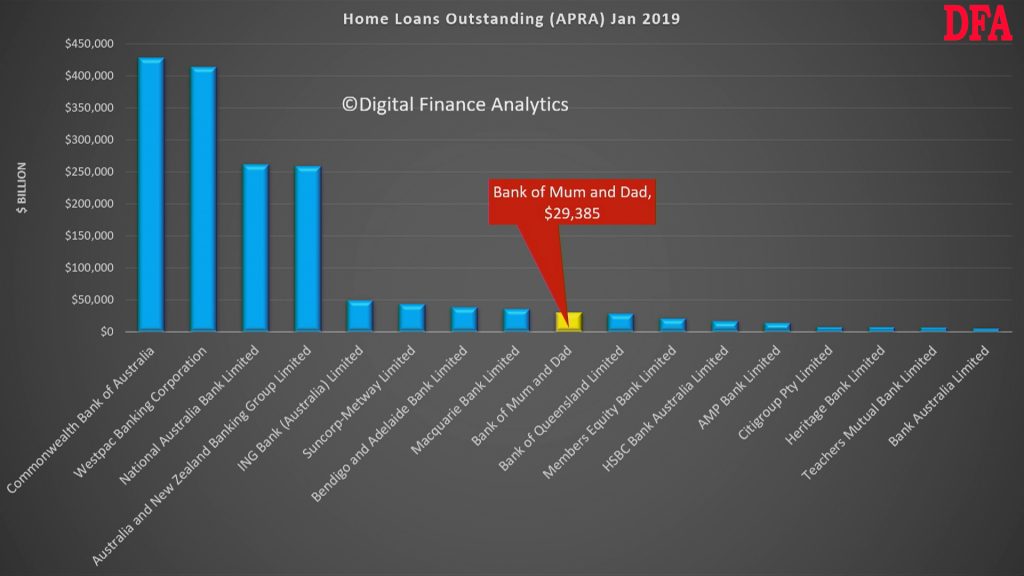

But within that less expensive property is shifting faster, driven by a further rise in those buying with the help of the family bank – with money from parents, grandparents or siblings, easing the purchase path, whilst other first time buyers are clubbing together to become joint owners of a new home, despite the potential risks.

More generally it’s another symptom of the broken housing market. If you want to learn more about this, and get the latest on our modelling, join us next Tuesday for my live stream at 8pm Sydney, where you can ask a question live. You can see the latest post code level analysis and we will also look at the broader trends.

This is a time for caution, given the rising levels of uncertainty, but that said, for many jumping from the rental sector to buying their own home could be equivalent to jumping from the frying pan into the fire in the current environment.

http://www.martinnorth.com/

Go to the Walk The World Universe at https://walktheworld.com.au/

Find more at https://digitalfinanceanalytics.com/blog/ where you can subscribe to our research alerts

Today’s post is brought to you by Ribbon Property Consultants.

If you are buying your home in Sydney’s contentious market, you do not need to stand alone. This is the time you need to have Edwin from Ribbon Property Consultants standing along side you.

Buying property, is both challenging and adversarial. The vendor has a professional on their side.

Emotions run high – price discovery and price transparency are hard to find – then there is the wasted time and financial investment you make.

Edwin understands your needs. So why not engage a licensed professional to stand alongside you. With RPC you know you have: experience, knowledge, and master negotiators, looking after your best interest.

Shoot Ribbon an email on info@ribbonproperty.com.au & use promo code: DFA-WTW/MARTIN to receive your 10% DISCOUNT OFFER.