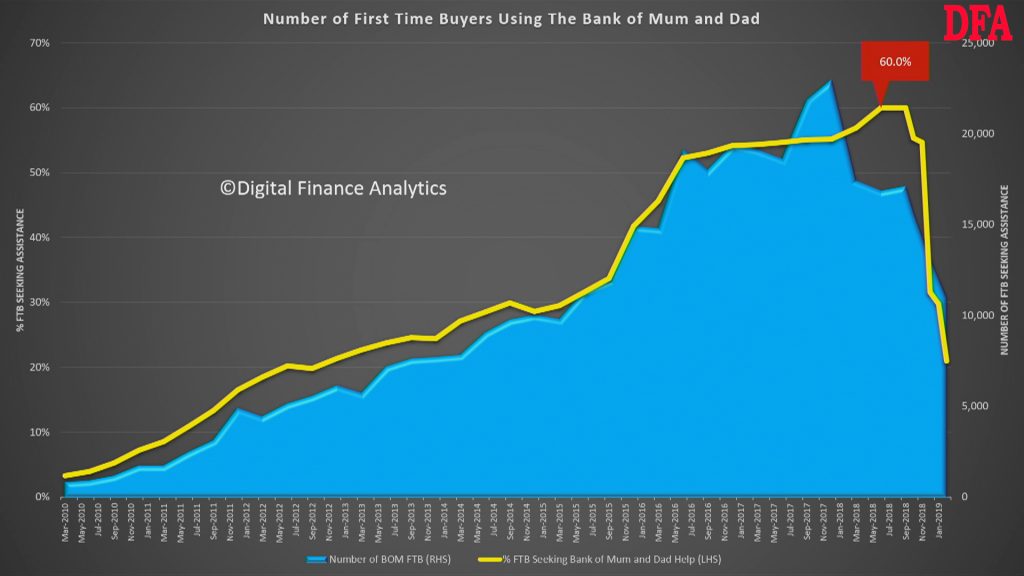

Latest data released today from the DFA household surveys shows that a smaller number of potential first time buyers are now getting help from their parents to buy property.

This video explains what is going on.

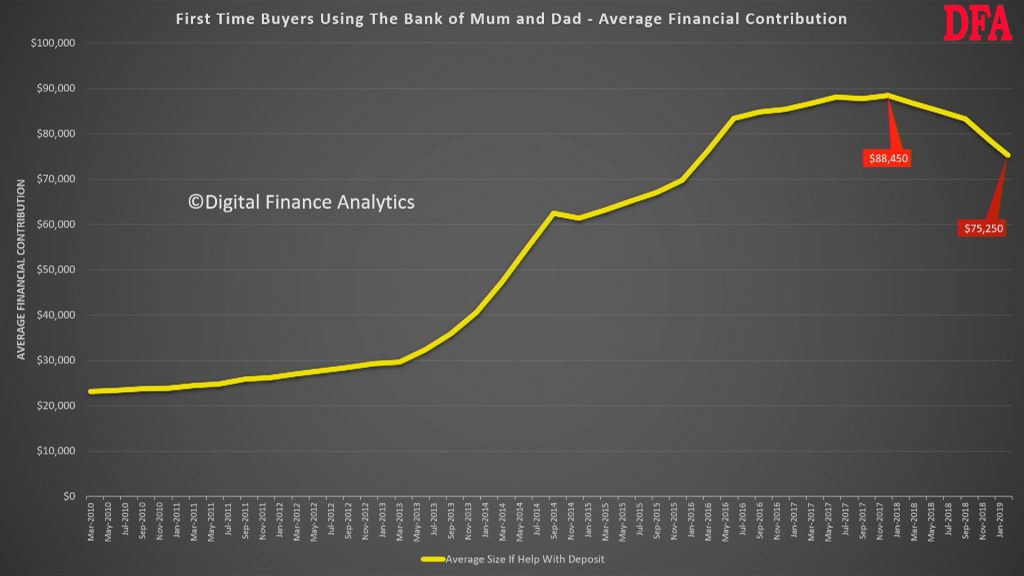

At its height 60% of first time buyers were getting help from their parents, but this has now dropped to 20%. In addition the value of that help has fallen from around $88,000 to around $75,000, on average.

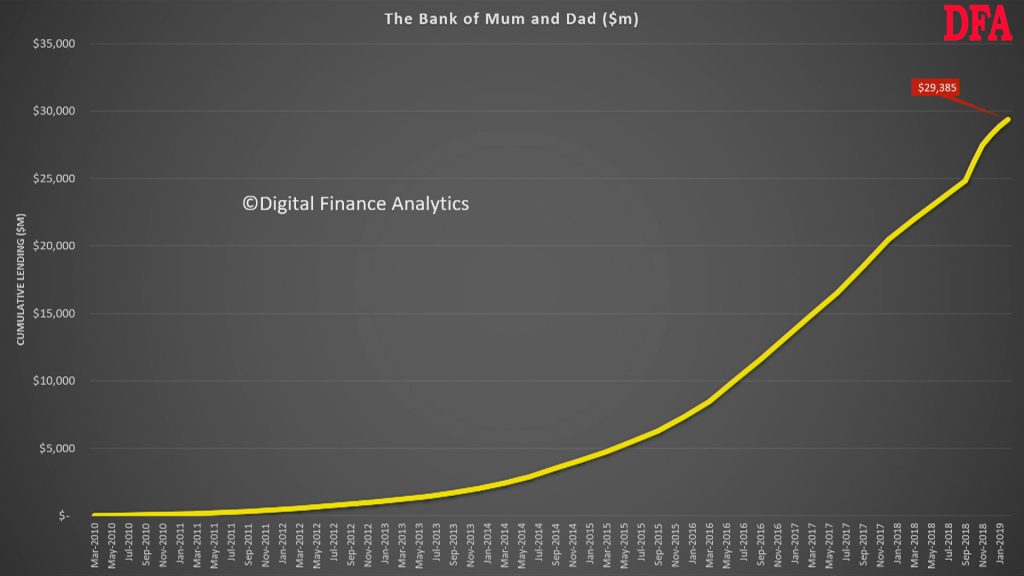

That said the total amount lent by the Bank of Mum and Dad is approaching $30 billion.

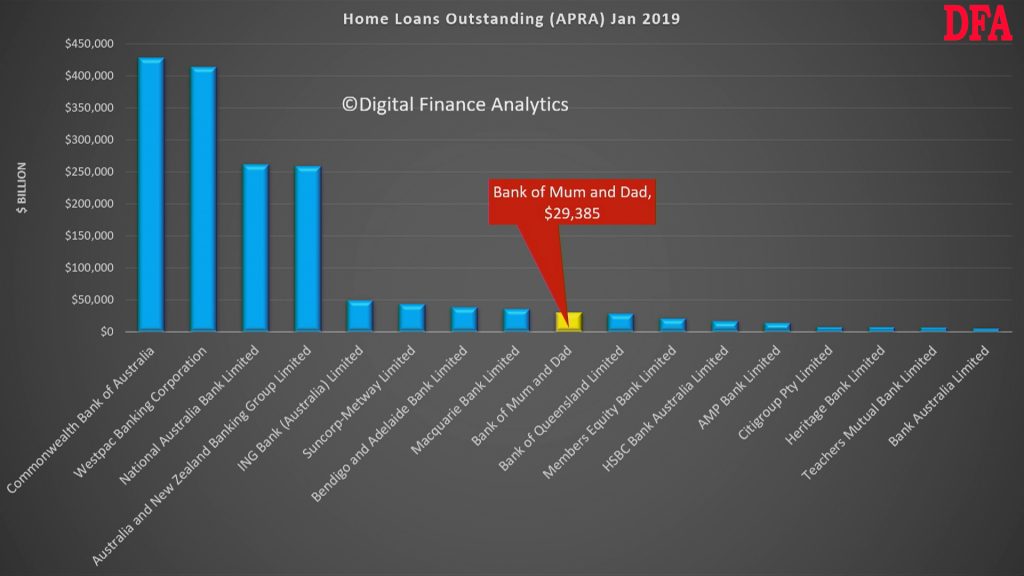

This puts the Bank of Mum and Dad among the top-10 lenders in Australia, based on the latest APRA data, in terms of loan stock.

Three drivers explain these changes. First parents are more concerned in a falling market about the equity in their property, when facing into retirement. The “ATM” has run dry. They cannot afford to pass money down the generation now.

Second despite some incentives, such as those in the Northern Territories, announced recently, many first time buyers are preferring to wait, rather than buy into a falling market and risk loosing their deposits. Plus we know that those who get help from parents are twice a likely to default in the subsequent 5 years compared with those who saved.

Third, banks are reluctant to lend, and a seagull payment is not regarded well, compared with a record of regular savings. Some lenders have stopped lending to borrowers with a Bank of Mum and Dad deposit.

Thus we think the momentum we saw last year is slowing and the Bank of Mum and Dad may be a less important factor ahead.

Some parents may decided to help pay monthly mortgage payments instead as this is a more flexible alternative and does not risk capital.