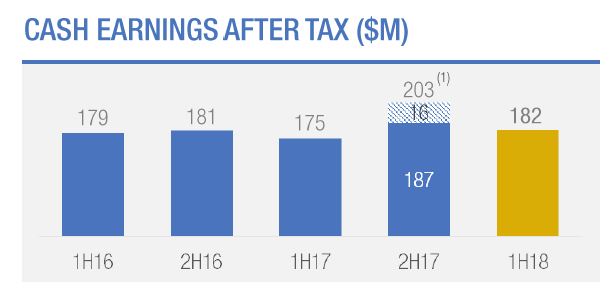

Bank of Queensland (BOQ) has announced cash earnings after tax of $182 million for 1H18, up 4 per cent on 1H17. This is weaker than expected. They continue to bat on a sticky wicket. Being a regional bank is a tough gig! The BOQ Board has maintained a fully franked interim dividend of 38 cents per ordinary share.

Statutory net profit after tax increased by 8 per cent to $174 million.

Statutory net profit after tax increased by 8 per cent to $174 million.

Net Interest Margin was up 1 basis point on the prior half to 1.97%, helped by loan book growth and deposit repricing, but under pressure thanks to intense new mortgage loan discounting. Growth in overall NIM was lower than expected. Ahead we think the higher BSBW rates will impact NIM adversely alongside discounted attractor rates..

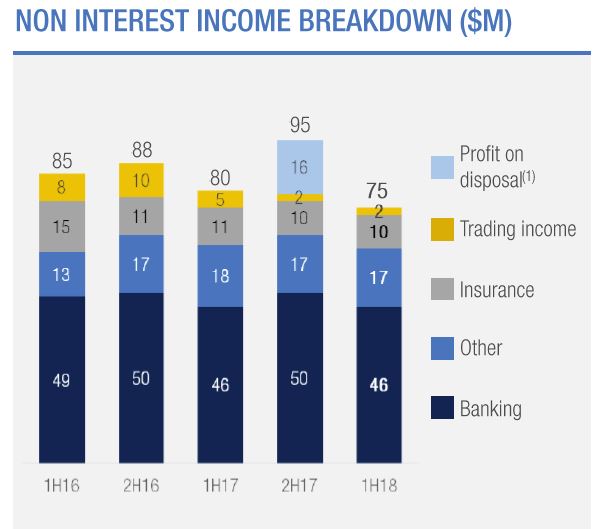

In addition, lower than expected non-interest income hit the result, thanks to an ATM fee impact of $0.6m, banking fees under pressure and a fall in trading income opportunities.

In addition, lower than expected non-interest income hit the result, thanks to an ATM fee impact of $0.6m, banking fees under pressure and a fall in trading income opportunities.

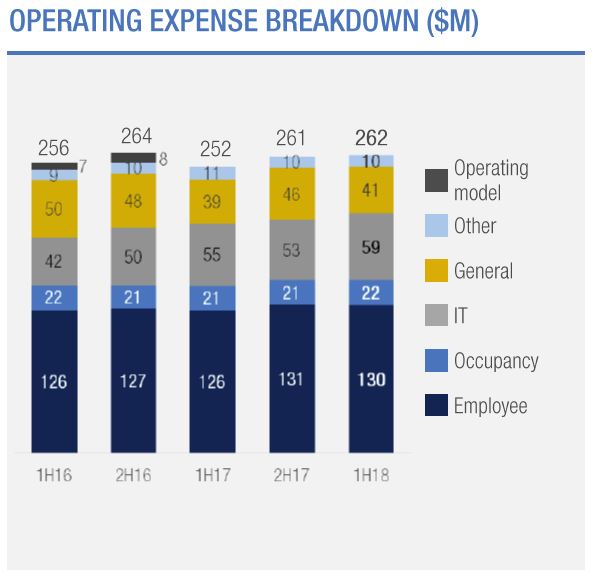

Also higher than expected costs impacted the result. Their Cost to Income ratio was up 20 bps to 47.6%

Also higher than expected costs impacted the result. Their Cost to Income ratio was up 20 bps to 47.6%

BOQ also today announced the sale of St Andrew’s Insurance to Freedom Insurance Group. More detail on this transaction is provided in a separate announcement. The CET1 uplift was estimated at 20 basis points after completion, with completion expected in second half of the year.

BOQ also today announced the sale of St Andrew’s Insurance to Freedom Insurance Group. More detail on this transaction is provided in a separate announcement. The CET1 uplift was estimated at 20 basis points after completion, with completion expected in second half of the year.

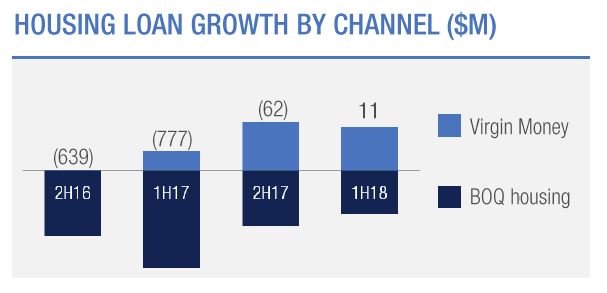

The Banks says there has been a notable improvement in lending growth, continuing the positive business momentum that returned in the previous half. This was supported by the commercial niche segments, as well as home loan growth through the Virgin Money, BOQ Specialist and BOQ Broker channels. Total lending growth of $671 million in 1H18 represents an uplift of more than $800 million compared to the contraction of $157 million in 1H17.

This has been delivered through 3 per cent annualised housing loan growth (+$382 million) at 0.5x system, together with strong commercial loan growth of 6 per cent annualised (+$292 million), which was 1.6x system.

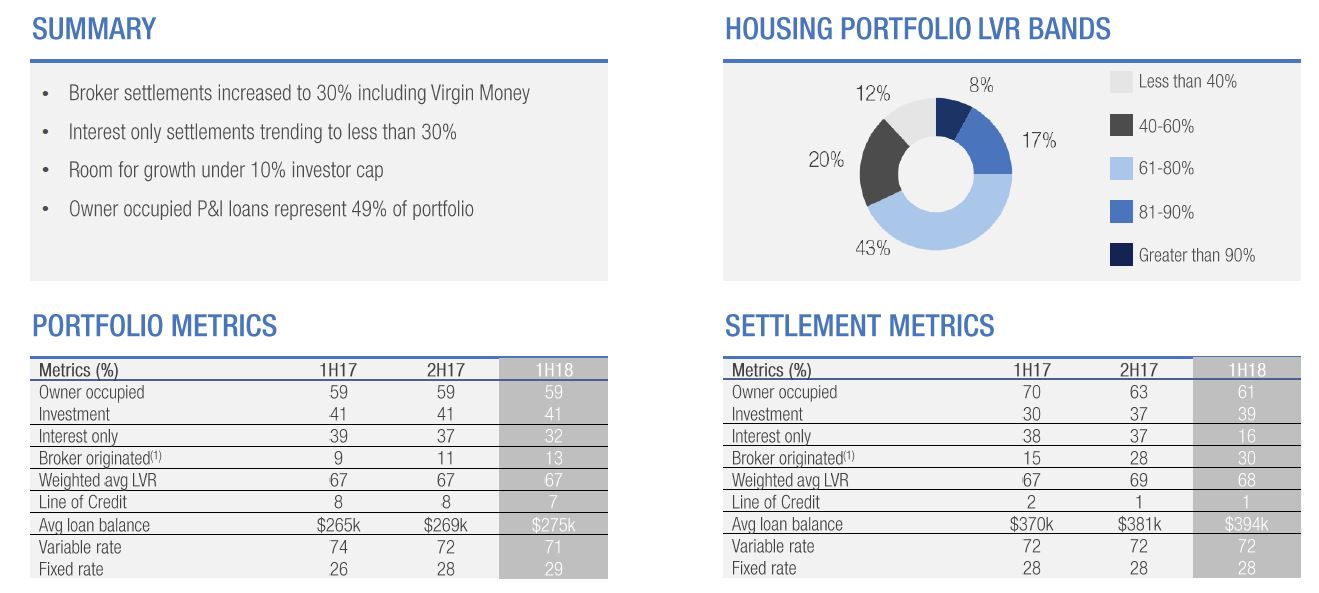

They show that broker settlements increased to 30%, including via Virgin Money, whilst the proportion of investment loans rose to 39%, compared with 30% a year ago. Interest only loans were 16% of flows, compared with 38% a year ago, and represents 32% of their portfolio. The average loan balance has risen to $394k and the weighted average LVR on new loans was 68%.

They show that broker settlements increased to 30%, including via Virgin Money, whilst the proportion of investment loans rose to 39%, compared with 30% a year ago. Interest only loans were 16% of flows, compared with 38% a year ago, and represents 32% of their portfolio. The average loan balance has risen to $394k and the weighted average LVR on new loans was 68%.

“We moved to adopt enhanced servicing, validation and responsible lending practices much earlier than many of our peers” the bank said.

“We moved to adopt enhanced servicing, validation and responsible lending practices much earlier than many of our peers” the bank said.

“Although this has hampered our growth in prior periods, we think it was the most prudent approach to take for the long term,” he said.

Impaired assets as a percentage of gross loans were down to 39 basis points, while loan impairment expense was just 10 basis points of gross loans during the half.

Arrears levels remained benign across all portfolios and there were signs of improvement in the Queensland and Western Australian economies. But they noted an uptick in the most recent quarter in housing …

They also showed potential construction exposure to apartments – at $90m, at 16 developments across 3 states completing 2018 to 2019. They observed this was a well diversified cross-state portfolio. But $53m is in Victoria.

They also showed potential construction exposure to apartments – at $90m, at 16 developments across 3 states completing 2018 to 2019. They observed this was a well diversified cross-state portfolio. But $53m is in Victoria.

They also have $100m exposure to the mining sector.

They also have $100m exposure to the mining sector.

Loan impairment rose, but remained at 10 basis points of GLA. Impaired assets fell a further 10% from 2H17 and new impaired asset volumes also reduced to the lowest level since pre-2012.

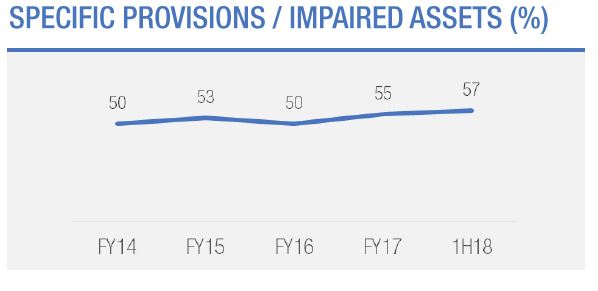

Specific provisions were increased to 57%.

Specific provisions were increased to 57%.

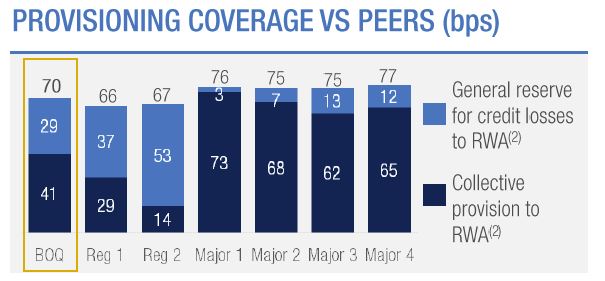

They say total provisions remain strong and provisional coverage compares favorably with peers.

They say total provisions remain strong and provisional coverage compares favorably with peers.

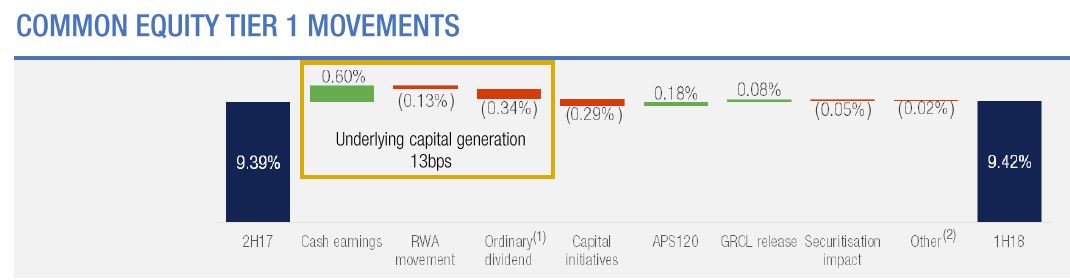

BOQ’s capital position has been maintained. The CET1 ratio was up 3 basis points over the half to 9.42 per cent.

BOQ’s capital position has been maintained. The CET1 ratio was up 3 basis points over the half to 9.42 per cent.

The bank said that the recent Basel and APRA papers suggest BOQ’s current CET1 ratio positions it well for the changes that are coming.

The bank said that the recent Basel and APRA papers suggest BOQ’s current CET1 ratio positions it well for the changes that are coming.

Ahead, they said that the industry was facing a number of headwinds, but BOQ remains well placed.

“The industry faces challenges of low credit growth, low interest rates, regulatory uncertainty, increasing consumer expectations and increased scrutiny of conduct and culture.

“In this environment, our long term strategy remains the right one; we are building out our business bank in higher growth sectors of the economy and opening up new retail channels.

“We also remain focused on our customers, investing in a number of initiatives across the group that will improve our digital offering, bring us closer to our customers and enable us to provide them with a differentiated service offering.

“Our very strong capital position provides us with flexibility to consider options that will deliver the best value to our shareholders,”