Westpac is considering the separation on its New Zealand business. With 85% of banking in NZ Aussie owned, what are the wider implications?

Go to the Walk The World Universe at https://walktheworld.com.au/

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

Westpac is considering the separation on its New Zealand business. With 85% of banking in NZ Aussie owned, what are the wider implications?

Go to the Walk The World Universe at https://walktheworld.com.au/

The latest on the Aussie Post issue, after the Senate initiated a wide-ranging inquiry into the issues surrounding the watches, the wide banking sector issues, and the corporate and political behaviour revealed in the past few months.

This is a significant win for people power.

I discuss developments with Robbie Barwick from the Citizens Party.

Go to the Walk The World Universe at https://walktheworld.com.au/

Elisa Barwick from The Citizens Party joins me to discuss the disturbing developments which are in train, as Central Banks gain more control of the financial system and our futures.

Essentially exercising power outside democratic responsibility, and with the blessing of politicians and the media, a group of technocrats are driving our economy into the ground, to the benefit of the few, on the grounds of “financial stability”. In practice, while it may support big corporations and super-national financial sector players, in practice it is hollowing out the real economy and reducing our civil liberties.

In this show we outline the evidence for this, and propose an alternative. Time is short.

Go to the Walk The World Universe at https://walktheworld.com.au/

We look at the latest report from ASIC on School Banking, in the context of the regulators current trimming of power and responsibility.

Go to the Walk The World Universe at https://walktheworld.com.au/

Steve Mickenbecker is the Group Executive, Financial Services at Canstar. I discuss the recent rates changes across the markets in Australia, consider the implications for savers, and touch on negative rates down the track.

We discuss the question of inflation targeting and the role of Central Bankers.

The Australian Labor Party has announced that it will introduce a new levy on ASX100-listed banks to hire more financial rights lawyers and financial counsellors to help victims of financial misconduct, via The Adviser.

Earlier this week, a joint release from opposition leader Bill Shorten, shadow minister for financial service Clare O’Neil and shadow assistant minister for families and communities, senator Jenny McAllister, announced that Labor would look to establish a $640-million Banking Fairness Fund “to revolutionise the services available to Australians in financial difficulty”.

A levy would be placed on the four major banks (ANZ, CBA, NAB, and Westpac) as well as ASX100-listed lenders AMP, Bank of Queensland, Bendigo and Adelaide Bank, Macquarie Bank, and Suncorp Bank to raise $160 million per year for the fund.

On Monday (25 February), the party said it would look to utilise $320 million of the Banking Fairness Fund over the next four years to expand the number of financial counsellors from 500 to 1,000, according to the party.

These new financial counsellors would provide “advocacy, support and advice” to an additional 125,000 Australians each year and help victims of banking and financial service provider misconduct pursue “fair compensation” through AFCA.

Meanwhile, on Tuesday (26 February), Ms O’Neil released a joint announcement with shadow attorney general and shadow minister for national security Mark Dreyfus outlining that the fund would also provide $30 million a year (totalling $120 million over four years) to “expand the financial rights legal assistance sector from 40 lawyers to 240 lawyers across Australia”.

The release reads: “The 200 extra financial rights lawyers will assist victims of bank and financial service provider misconduct by providing legal advice and running complex cases in court and through the Australian Financial Complaints Authority (AFCA).

“When Australians face a fight with their banks, Labor will make sure they are not fighting alone.”

According to the Labor Party, the extra lawyers would be able to service an additional 150,000 Australians per year. Currently, the ALP estimates that around 240,000 Australians are in need of financial rights legal advice every year, but suggested that the sector is currently “only able to service about 30,000 people”.

Labor added that the 200 new lawyers could help more Australians bring claims through AFCA. This builds on Labor’s previously announced plans to quadruple the compensation cap for consumers from $500,000 to $2 million for consumers and remove the $5,000 sub-cap for non-financial loss, should they be brought into power following the upcoming general election.

The Banking Fairness Fund has been proposed by Labor as a means of supporting victims of misconduct and meeting one of the suggestions put forward by Commissioner Hayne in his final report for the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry that there be “careful consideration” of how “predictable and stable funding for the legal assistance sector and financial counselling services” could be best delivered, given the “clear” need for it.

Commissioner Hayne wrote in his report: “The legal assistance sector and financial counselling services perform very valuable work. Their services, like financial services, are a necessity to the community. They add strength to customers who are otherwise disadvantaged in disputes with financial services entities.”

He continued: “[T]here will likely always be a clear need for disadvantaged consumers to be able to access financial and legal assistance in order to be able to deal with disputes with financial services entities with some chance of equality of arms.”

The Labor Party said: “The banking royal commission is a once-in-a-generation opportunity to give Australians the ability to stand up for their rights against the big banks and their well-funded legal teams.

“Labor will make sure that Australians don’t miss out on that opportunity. Labor is proud to support the hardworking financial rights legal assistance sector.”

A look at what’s changed since then (and what’s the same).

https://www.investordaily.com.au/markets/43614-lehman-10-years-after

Please consider supporting our work via Patreon ;

Please share this post to help to spread the word about the state of things….

Alongside the property exposures data that we discussed recently, see our post, “The Mortgage Industry in Three Sides“, APRA also related their quarterly data relating to banks in Australia to March 2018.

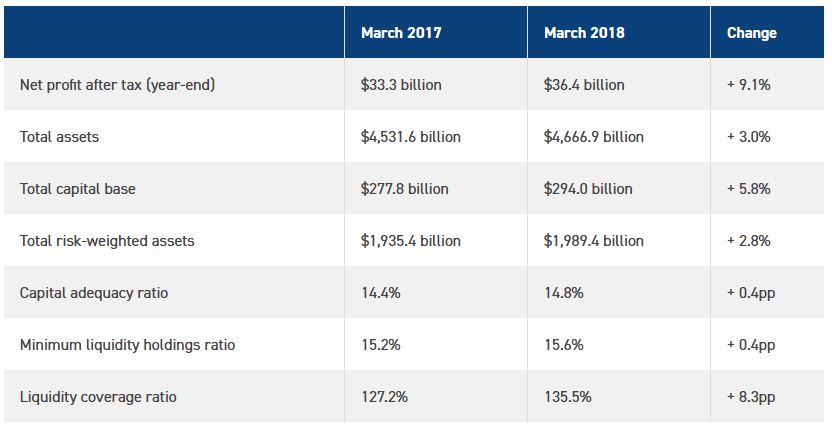

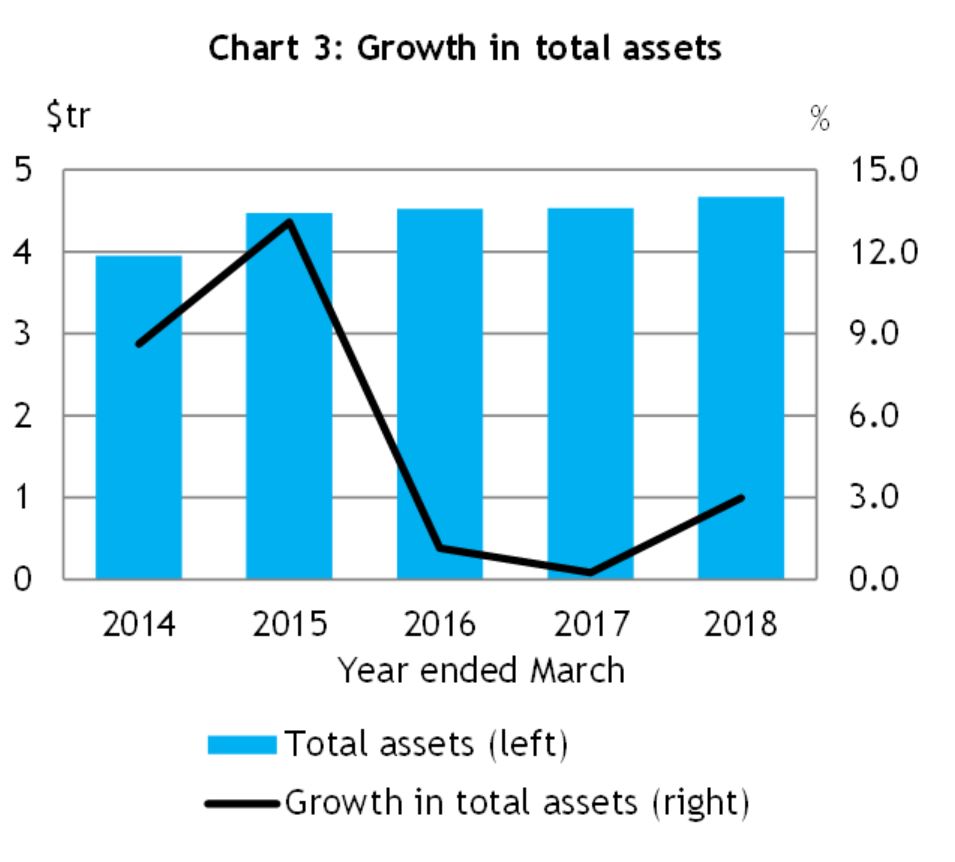

In summary the total profits were up 9.1% compared with a year ago, total assets grew 3% over the same period, the capital base grew 5.8%, the capital adequacy rose 0.4 percentage points and the liquidity coverage ratio rose 8.3 percentage points.

In summary the total profits were up 9.1% compared with a year ago, total assets grew 3% over the same period, the capital base grew 5.8%, the capital adequacy rose 0.4 percentage points and the liquidity coverage ratio rose 8.3 percentage points.

So superficially, all the ratios suggest a tightly run ship. But it is worth looking in more detail at these statistics, because as we will see below the waterline, things look less pristine.

So superficially, all the ratios suggest a tightly run ship. But it is worth looking in more detail at these statistics, because as we will see below the waterline, things look less pristine.

First, there were 148 Authorised Depository Institutions (ADI’s) a.k.a banks at the end of March.

So the net number rose by 1 from December 2017.

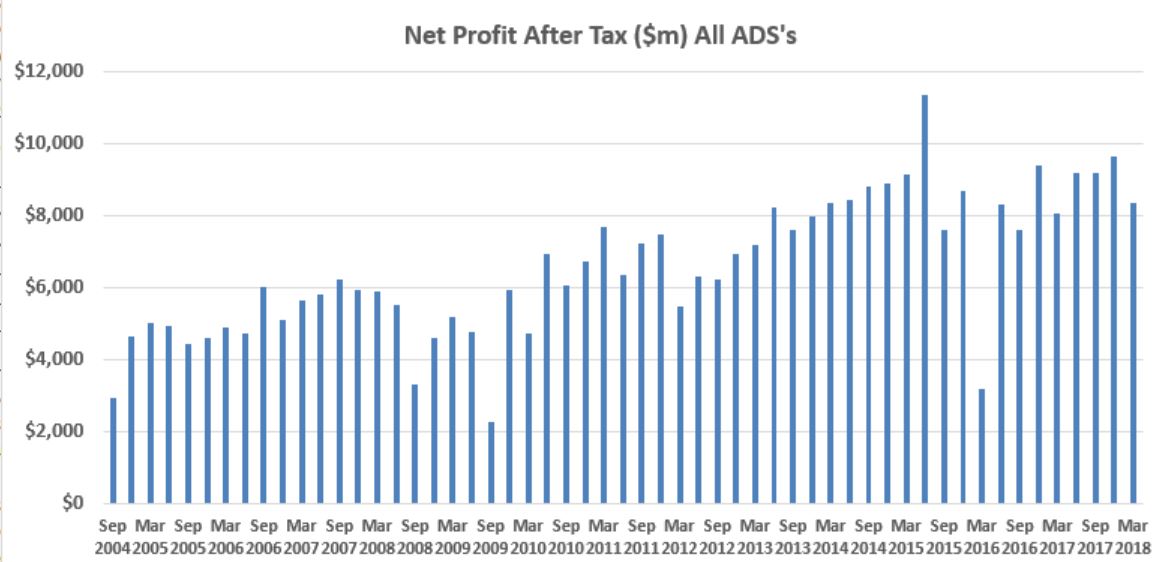

In terms of overall performance, APRA says that the net profit after tax for all ADIs was $36.4 billion for the year ending 31 March 2018. This is an increase of $3.0 billion or 9.1 per cent on the year ending 31 March 2017.

This was because of a nice hike in mortgage margins, in reaction to the regulator’s intervention in the investor mortgage sector, and a significant drop in overall provisions. But top line revenue growth slowed and margins have started to tighten. As a result, profits were lower this quarter compared with the prior three quarters.

This was because of a nice hike in mortgage margins, in reaction to the regulator’s intervention in the investor mortgage sector, and a significant drop in overall provisions. But top line revenue growth slowed and margins have started to tighten. As a result, profits were lower this quarter compared with the prior three quarters.

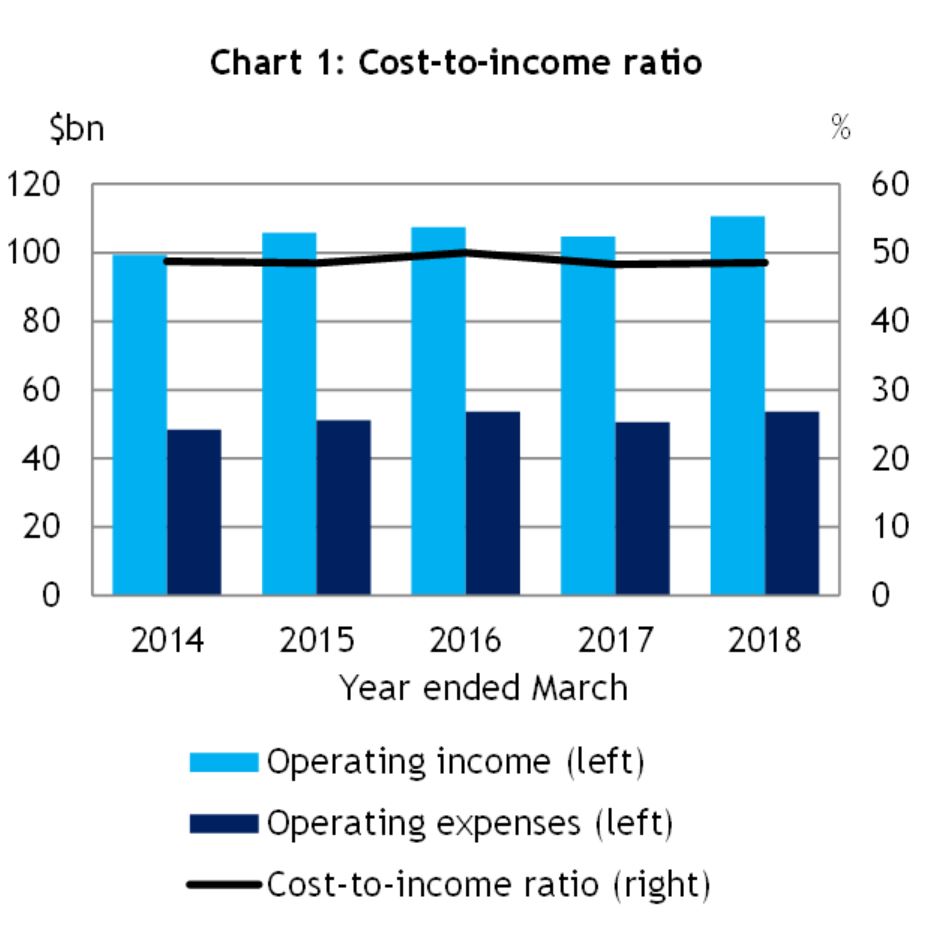

The cost-to-income ratio for all ADIs was 48.5 per cent for the year ending 31 March 2018, compared to 48.2 per cent for the year ending 31 March 2017. In other words, the costs of the business grew faster than income.

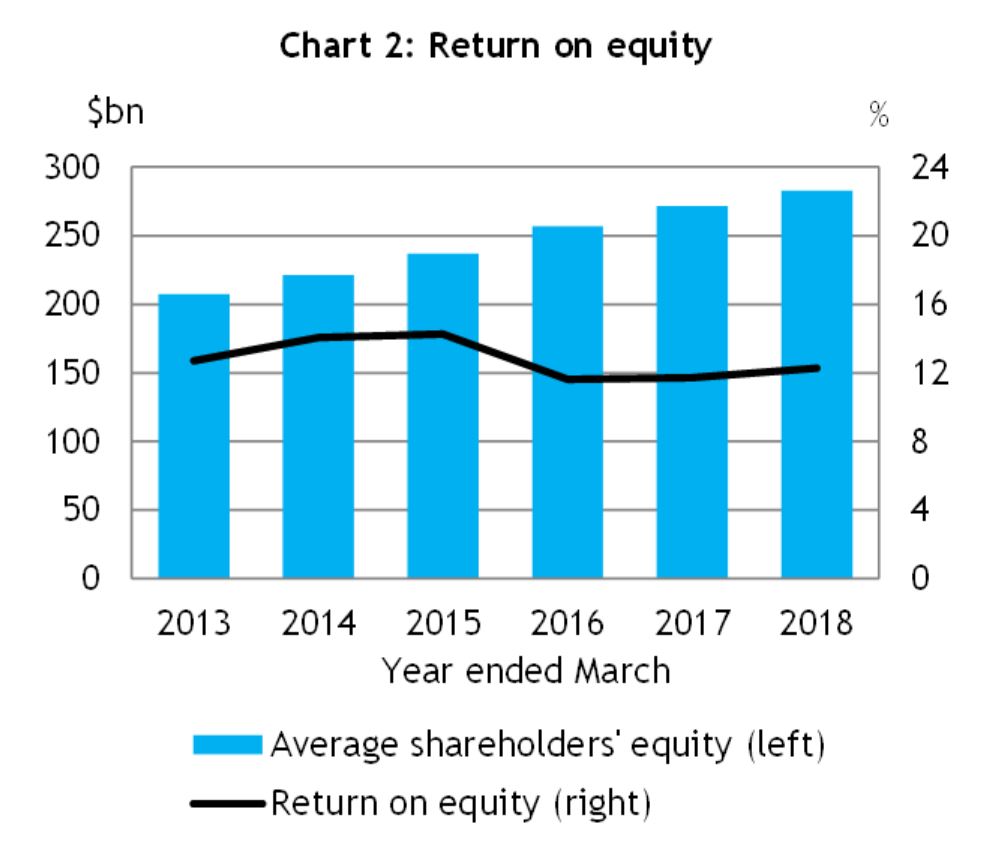

The return on equity for all ADIs increased to 12.3 per cent for the year ending 31 March 2018, compared to 11.7 per cent for the year ending 31 March 2017. We suspect this increase will not be repeated in the coming year.

The return on equity for all ADIs increased to 12.3 per cent for the year ending 31 March 2018, compared to 11.7 per cent for the year ending 31 March 2017. We suspect this increase will not be repeated in the coming year.

That said an ROE of 12.3 per cent would still put the banking sector near the top of both Australian companies and global banks, reflecting a lack of true competition and some poor practices as laid bare by the Royal Commission. The quest for profit growth from some players has proved to be at the cost of customers. If banks do become more customer focussed, it is possible ROE’s will fall, and one-off penalties and fees (for example CBA, ANZ) will also hit returns.

The total assets for all ADIs was $4.67 trillion at 31 March 2018. This is an increase of $135.9 billion (3.0 per cent) on 31 March 2017 and was largely driven by mortgages which grew strongly over the period.

The total assets for all ADIs was $4.67 trillion at 31 March 2018. This is an increase of $135.9 billion (3.0 per cent) on 31 March 2017 and was largely driven by mortgages which grew strongly over the period.

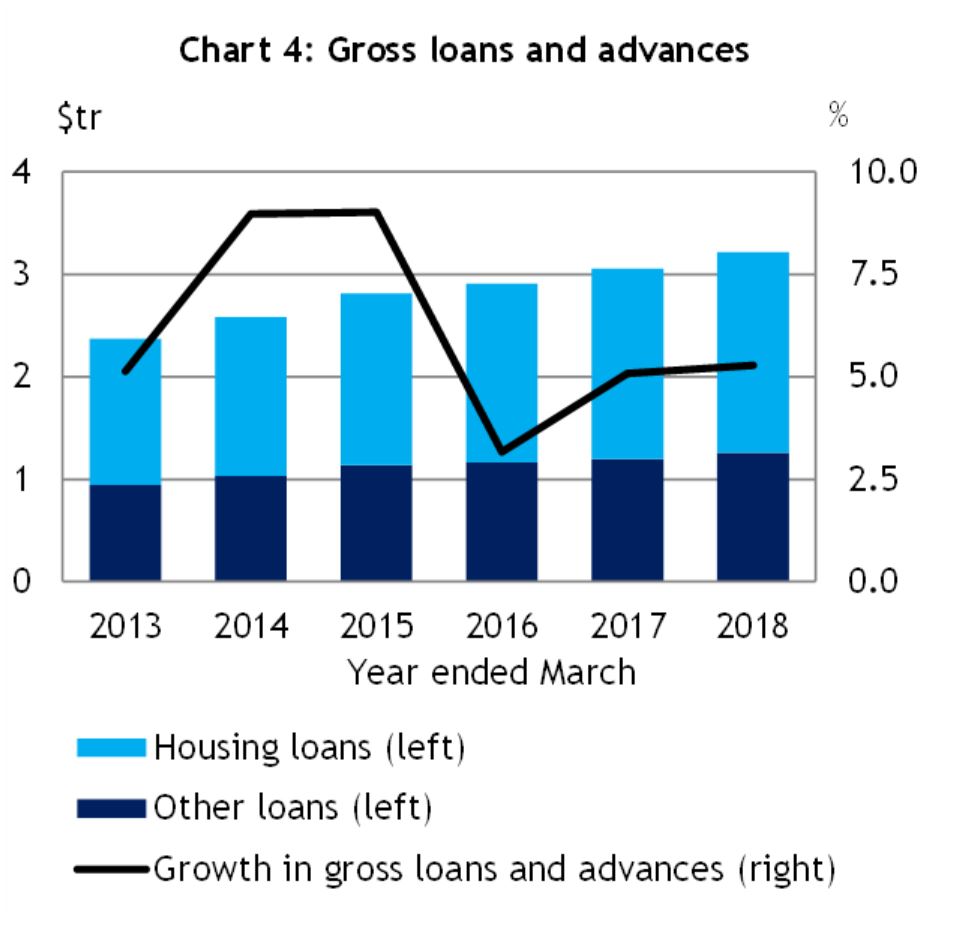

The total gross loans and advances for all ADIs was $3.22 trillion as at 31 March 2018. This is an increase of $161.4 billion (5.3 per cent) on 31 March 2017.

The total gross loans and advances for all ADIs was $3.22 trillion as at 31 March 2018. This is an increase of $161.4 billion (5.3 per cent) on 31 March 2017.

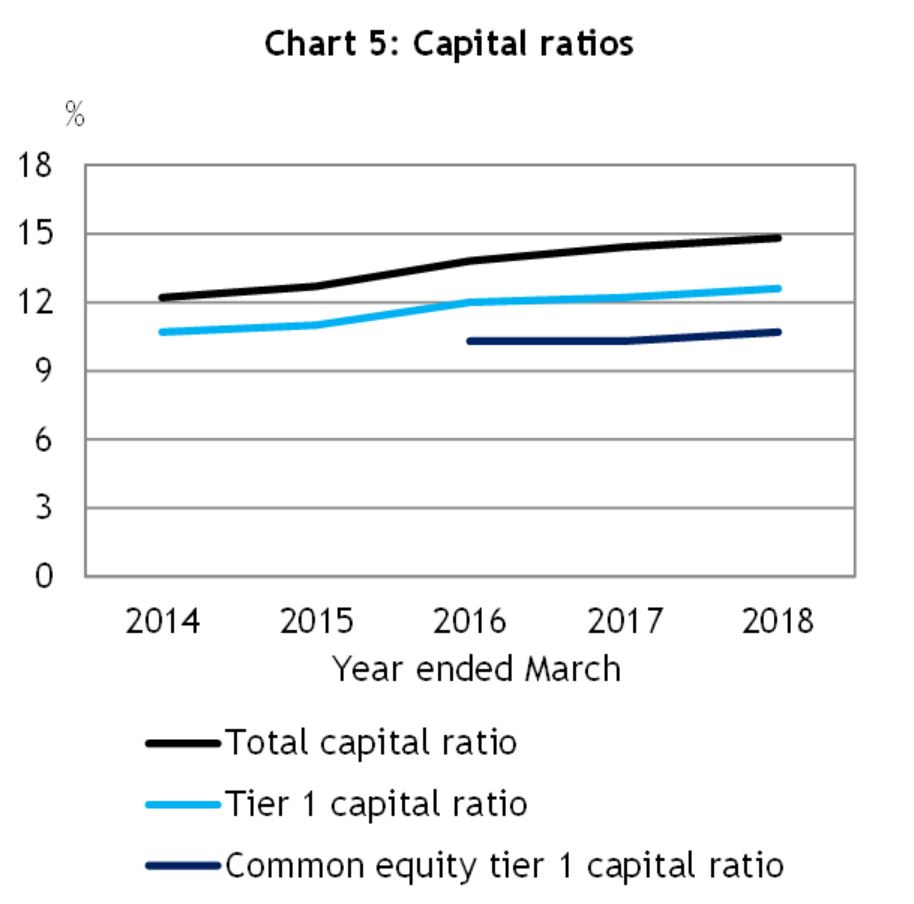

The total capital ratio for all ADIs was 14.8 per cent at 31 March 2018 , an increase from 14.4 per cent on 31 March 2017. This is a reflection of higher APRA targets. The common equity tier 1 ratio for all ADIs was 10.7 per cent at 31 March 2018, an increase from 10.3 per cent on 31 March 2017.

The total capital ratio for all ADIs was 14.8 per cent at 31 March 2018 , an increase from 14.4 per cent on 31 March 2017. This is a reflection of higher APRA targets. The common equity tier 1 ratio for all ADIs was 10.7 per cent at 31 March 2018, an increase from 10.3 per cent on 31 March 2017.

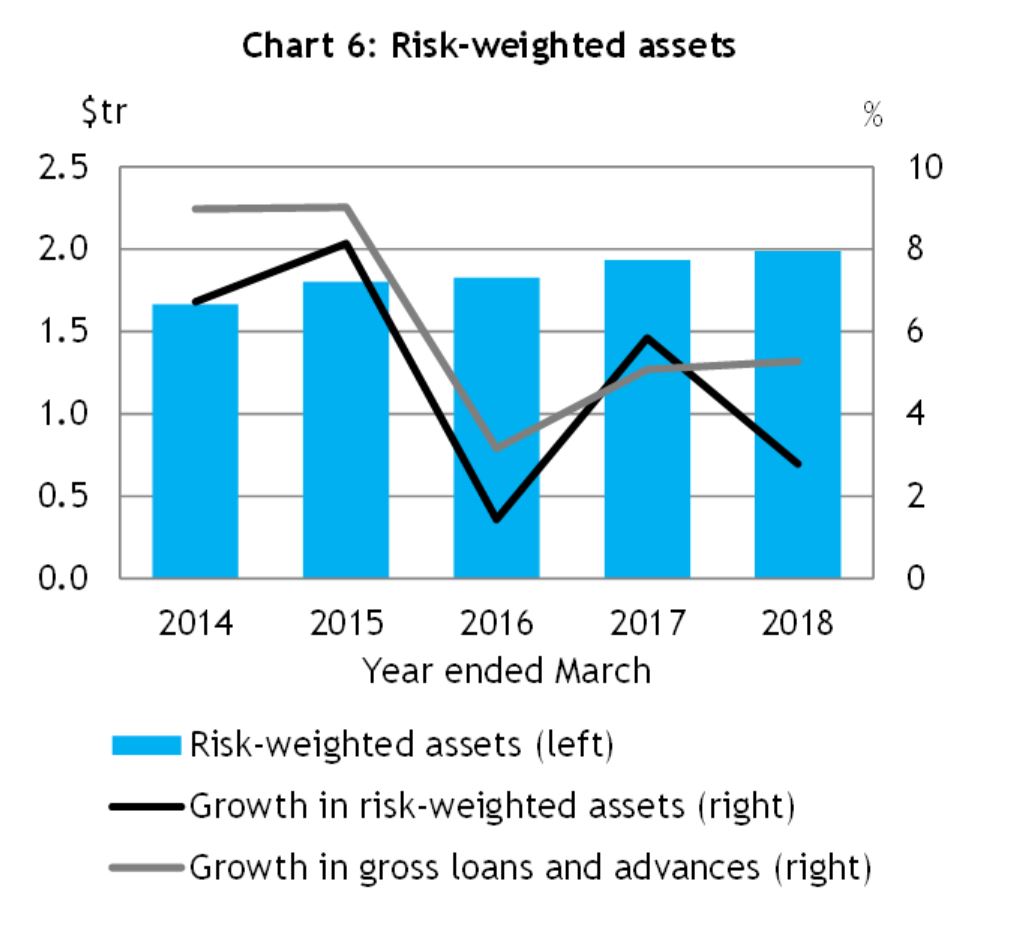

The risk-weighted assets (RWA) for all ADIs was $1.99 trillion at 31 March 2018, an increase of $53.9 billion (2.8 per cent) on 31 March 2017.

The risk-weighted assets (RWA) for all ADIs was $1.99 trillion at 31 March 2018, an increase of $53.9 billion (2.8 per cent) on 31 March 2017.

So if you compare the $3.22 trillion assets with the $1.99 trillion weighted assets for capital purposes, you can see the impact of lower risk weights for some asset types.

So if you compare the $3.22 trillion assets with the $1.99 trillion weighted assets for capital purposes, you can see the impact of lower risk weights for some asset types.

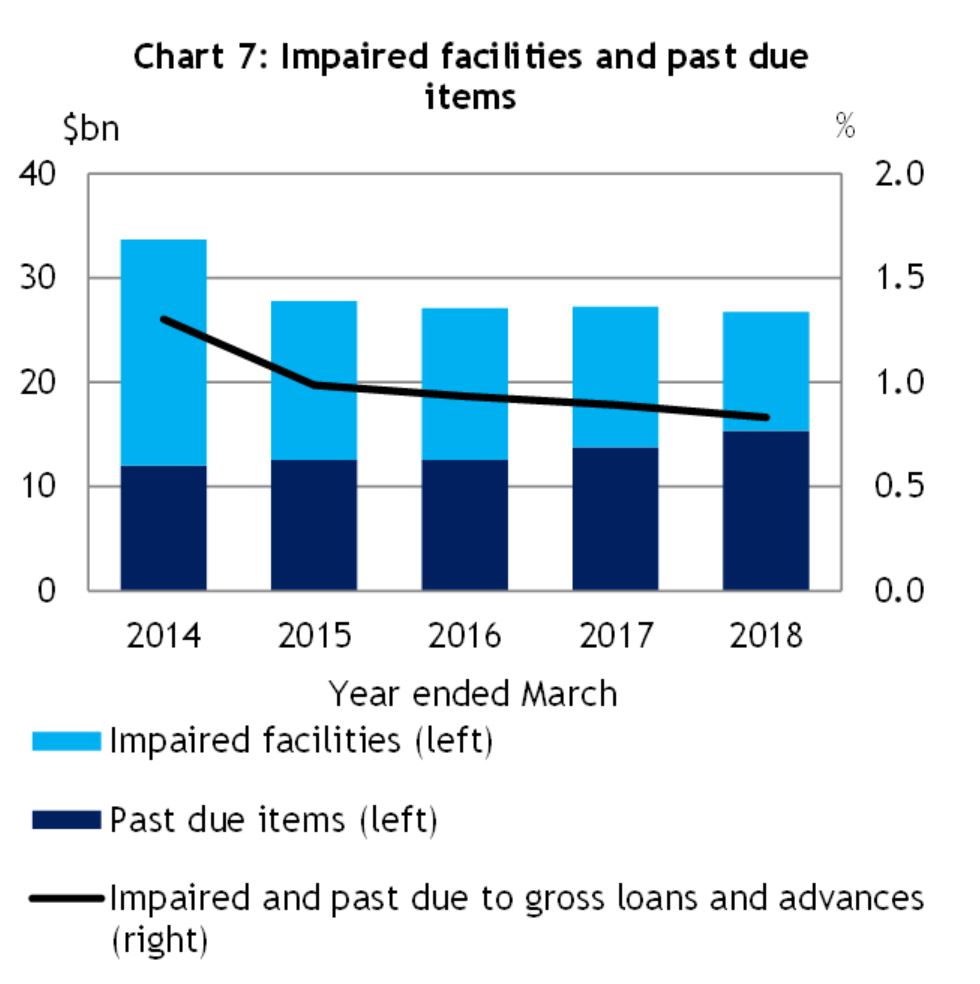

Looking at impairments for all ADIs we see that impaired facilities were $11.4 billion as at 31 March 2018. This is a decrease of $2.1 billion (15.7 per cent) on 31 March 2017.

Past due items were $15.4 billion as at 31 March 2018. This is an increase of $1.6 billion (11.5 per cent) on 31 March 2017. Rising 90 day delinquencies for mortgage loans was the main reason for the uplift, despite commercial loans performing a little better. Expect more delinquencies ahead, as indicated by our mortgage stress analysis. See our post “Mortgage Stress On the Rise”

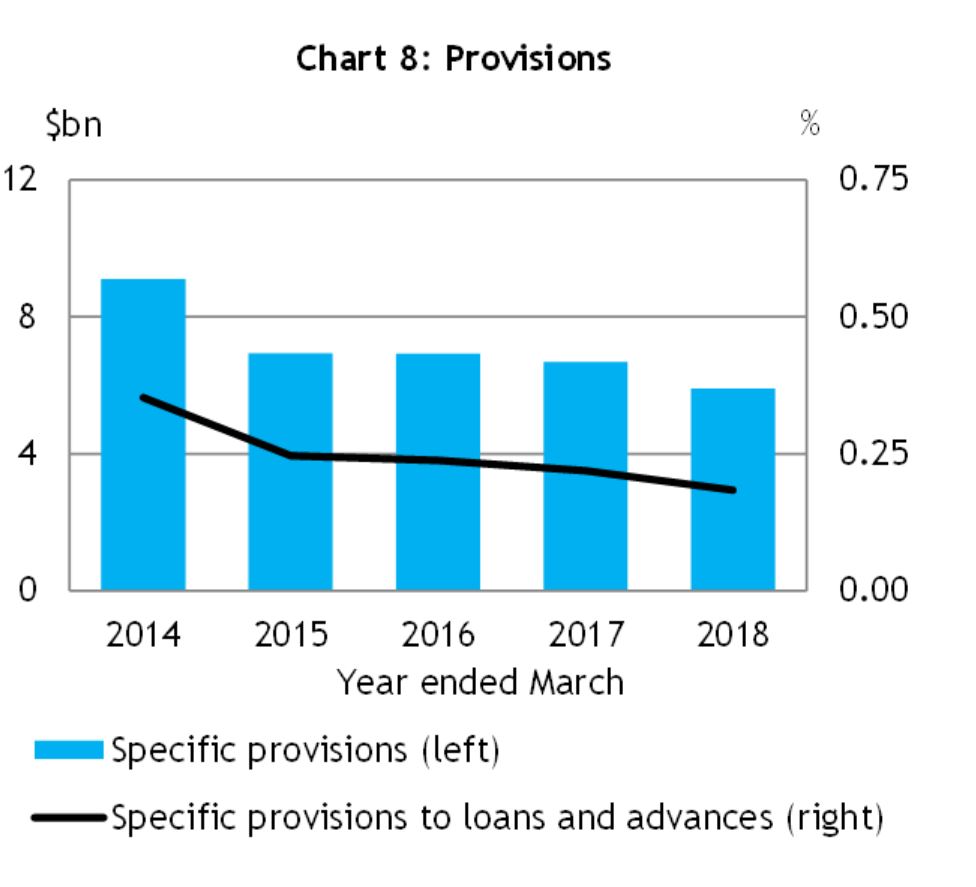

That said, impaired facilities and past due items as a proportion of gross loans and advances was 0.83 per cent at 31 March 2018, a decrease from 0.89 per cent at 31 March 2017 and specific provisions were $5.9 billion at 31 March 2018. This is a decrease of $0.8 billion (11.7 per cent) on 31 March 2017. In addition, specific provisions as a proportion of gross loans and advances was 0.18 per cent at 31 March 2018, a decrease from 0.22 per cent at 31 March 2017.

That said, impaired facilities and past due items as a proportion of gross loans and advances was 0.83 per cent at 31 March 2018, a decrease from 0.89 per cent at 31 March 2017 and specific provisions were $5.9 billion at 31 March 2018. This is a decrease of $0.8 billion (11.7 per cent) on 31 March 2017. In addition, specific provisions as a proportion of gross loans and advances was 0.18 per cent at 31 March 2018, a decrease from 0.22 per cent at 31 March 2017.

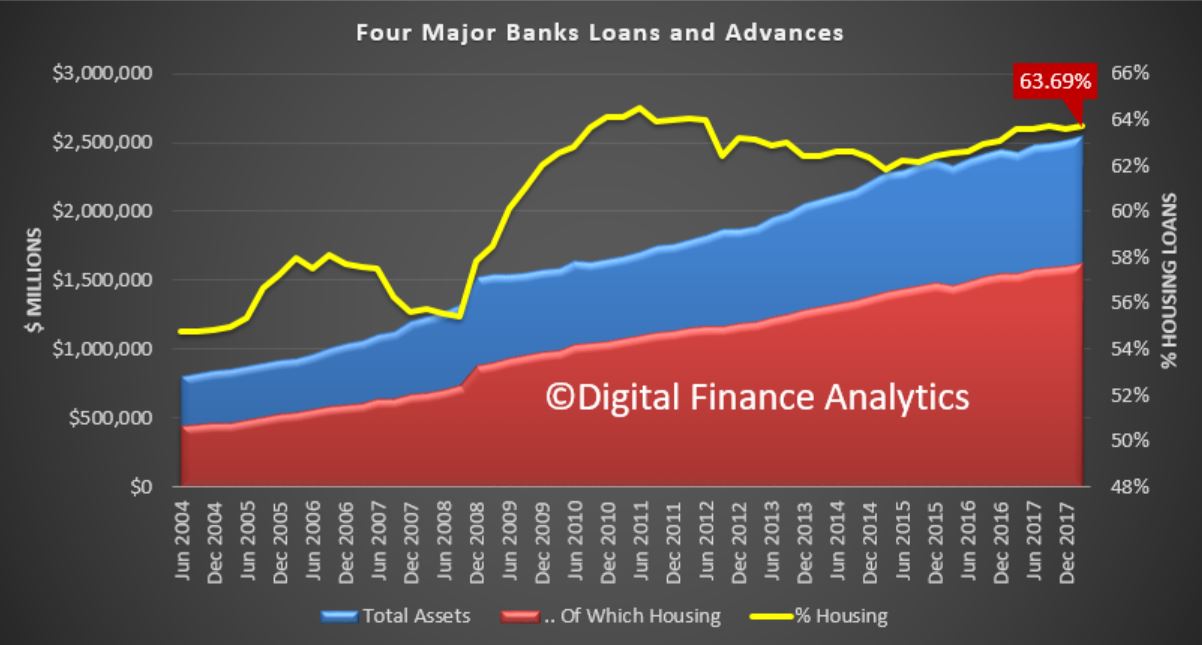

But there were two really important observations in the data, when we look at just the big four. The first is that total loans and advances by the four majors reached $2.55 trillion dollars, a record, and 63.69% of all loans were for housing lending. Not since 2012 has this been such a high proportion, its previous peak was 64.48% in the Jun 2011 quarter. The proportion of investor loans fell slightly, thanks to the recent tightening, but owner occupied lending by the big four remained strong. Think about it, nearly 64% of all loans are property related, so consider what a significant fall in prices would mean for them.

But there were two really important observations in the data, when we look at just the big four. The first is that total loans and advances by the four majors reached $2.55 trillion dollars, a record, and 63.69% of all loans were for housing lending. Not since 2012 has this been such a high proportion, its previous peak was 64.48% in the Jun 2011 quarter. The proportion of investor loans fell slightly, thanks to the recent tightening, but owner occupied lending by the big four remained strong. Think about it, nearly 64% of all loans are property related, so consider what a significant fall in prices would mean for them.

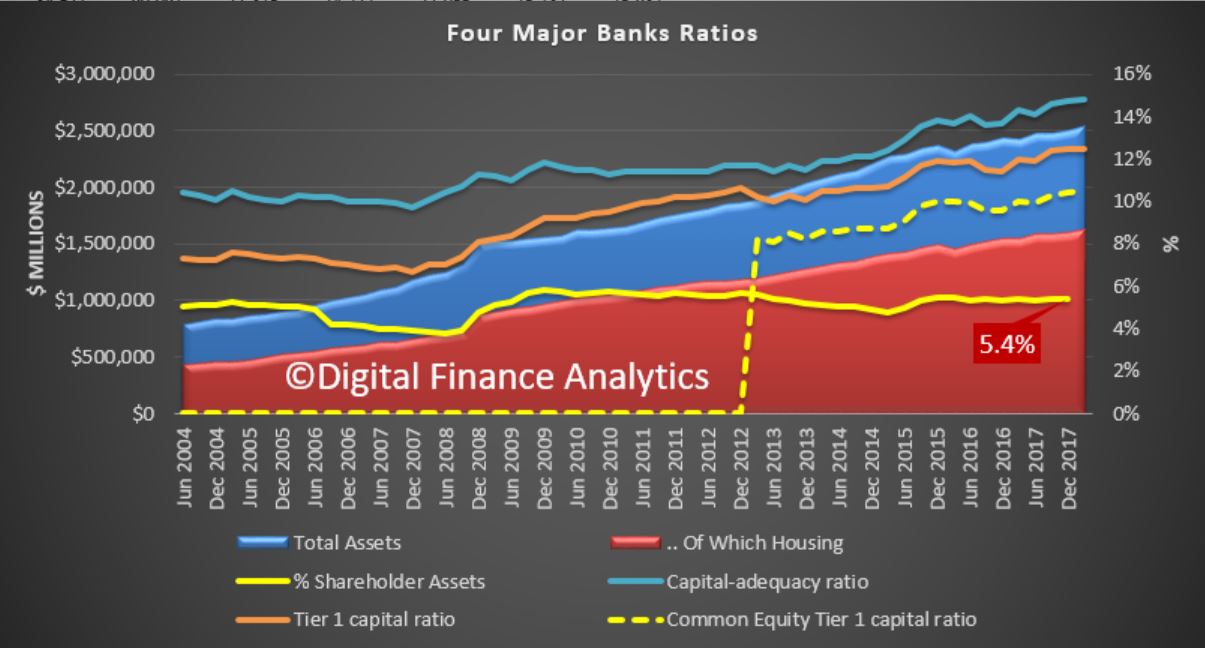

The second observation relates to the critical banking ratios. We all know that APRA has been pushing the capital rations and the newer CET1 (from January 2013) higher, and these are all rising, with the CET1 sitting, on an APRA basis at 10.5%, the highest its been.

The second observation relates to the critical banking ratios. We all know that APRA has been pushing the capital rations and the newer CET1 (from January 2013) higher, and these are all rising, with the CET1 sitting, on an APRA basis at 10.5%, the highest its been.

However, if you look at the ratio of shareholder capital, it is sitting at a miserly 5.4% of all loans. In other words for every $100 invested in the loans made by an investor, they only have $5.40 at risk. This is, in extremis, the heart of the banking business, and this explains why shareholder returns are so high from the banking sector. These are highly leveraged businesses and if their risk and loan underwriting standards are not correctly calibrated it can go wrong very quickly. By the way the smaller banks and mutual have much lower leverage ratios, so they are simply less risky.

However, if you look at the ratio of shareholder capital, it is sitting at a miserly 5.4% of all loans. In other words for every $100 invested in the loans made by an investor, they only have $5.40 at risk. This is, in extremis, the heart of the banking business, and this explains why shareholder returns are so high from the banking sector. These are highly leveraged businesses and if their risk and loan underwriting standards are not correctly calibrated it can go wrong very quickly. By the way the smaller banks and mutual have much lower leverage ratios, so they are simply less risky.

Banking is a risk business, but we see here laid bare, who is really taking the risks while the shareholders are doing very nicely thank-you!

Last Wednesday, the US House of Representatives’ Financial Services Committee held a hearing on the Financial CHOICE Act of 2017, which was introduced on 19 April and aims to provide banks relief from various provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act enacted in 2010.

The proposed legislation envisions a broad reduction in regulatory and supervisory requirements that would be negative for banks’ creditworthiness, increasing the potential asset risk in the banking system and the likelihood of a disorderly unwinding of a failed systemically important bank.

Increased likelihood of a disorderly bank resolution.

Among the CHOICE Act’s most notable provisions is the repeal of Title II of Dodd-Frank, including the orderly liquidation authority (OLA) to resolve highly interconnected, systemically important banks. Although the bill calls for a new section of the bankruptcy code to accommodate the failure of large, complex financial institutions, we believe that dismantling the OLA increases the likelihood of a disorderly wind-down of a failed systemically important bank with greater losses to creditors. Additionally, although the aim of repealing Title II is to end “too big to fail,” without the enactment of a credible replacement bank resolution framework, the actual effect could be the opposite.

A credible operational resolution regime (ORR) to replace OLA would require provisions specifically intended to facilitate the orderly resolution of failed banks and would provide clarity around the effect of a bank failure on its depositors and other creditors, its branches and affiliates.

The intent of OLA is to resolve failed banks as going concerns, preserving bank franchise value so as to limit losses to bank creditors and counterparties. If, under the new legislation, failed banks are liquidated instead of being resolved as going concerns, loss rates suffered by creditors would increase.

A disorderly resolution would also have greater repercussions for the broader financial markets and the economy. This suggests that although the intent of eliminating OLA may be to reduce the likelihood of future bank bailouts, absent an ORR we believe that the likelihood of a US government bailout of a systemically important US bank could actually increase.

A return to greater risk-taking, only partly offset by improved profitability prospects. The CHOICE Act would also ease restrictions on risk-taking by eliminating the Volcker Rule and rolling back the supervisory function of the US Consumer Financial Protection Bureau (CFPB), limiting it instead to the enforcement of specific consumer protection laws. Eliminating the Volcker Rule restrictions on proprietary trading could reverse the decline in banks’ trading inventories and private equity and hedge fund investments since the financial crisis. That decline in trading inventories has contributed to a decline in risk measures such as value at risk. How far inventories rebound and proprietary trading pick up will take time to become evident, but increased risk seems likely. Changes to the CFPB could also add risk by lifting the regulatory scrutiny that has caused banks to scale back or eliminate some riskier consumer lending products (such as payday advances).

The CHOICE Act also imposes a variety of restrictions and requirements on US banking regulators that could erode the robustness of US banking regulation. More generally, weakened supervision and oversight create the potential for increased asset risk in the banking system. From a credit risk standpoint, the resulting uptick in credit costs and tail risks from increased risk-taking would outweigh the potential boost to bank profitability from reduced compliance expenses and new revenue opportunities.

Less robust capital supervision and stress-testing.

The CHOICE Act calls for a reduction in the frequency of regulatory stress testing, and an exemption from enhanced US Federal Reserve supervision, including stress-testing, for banks with a Basel III supplementary leverage ratio of at least 10%. These measures would undermine the post-crisis Dodd-Frank Act Stress Test (DFAST) and Comprehensive Capital Analysis and Review (CCAR) regimes, which have driven both an increase in capital ratios and a more conservative approach to capital management.

We believe that DFAST and CCAR have been successful tools in reducing the risk of bank failures, not only improving capital and placing beneficial restrictions on shareholder distributions but, more importantly, stimulating vast improvements in banks’ internal risk management and capital planning processes. The DFAST and CCAR results are a useful, independent and public tool to analyze banks’ stress capital resilience over time. The public disclosures from these exercises are an important data point for creditors, the market and our own stress-testing analysis, and provide a strong incentive for bank management teams to closely manage and fully resource their stress-testing and capital-planning processes.