The Adviser has learned that CBA could be actively targeting home loan customers that were introduced by brokers with the promise of a better rate should they refinance via a branch.

Despite the bank telling The Adviser earlier this week that it is once again accepting new refinance applications for investment home loans with P&I repayments through broker channels (following a hiatus on new investor refinance applications in February), concerns that some of the major banks are favouring their branch networks over the broker channel are rising.

Adding to the speculation, a source speaking to The Adviser said that he was actively targeted to refinance his home loan during an application for a credit card at a North Sydney branch of the Commonwealth Bank of Australia (CBA).

During the assessment process the source was surprised to hear that the branch could give him a “lower rate than his broker” if he refinanced his home loan directly with CBA.

The loan was originally written by an Aussie broker.

When asked how the branch was able to do this, the representative at the bank told the CBA-customer that he had been told by his manager to refinance broker-originated loans where possible.

The Adviser can confirm that a representative at the Walker Street branch in North Sydney said that they could give a CBA customer a ‘better deal’ than a broker on a refinance loan.

When asked by The Adviser whether CBA is looking to reduce its mortgage flows through the broker channel, a Commonwealth Bank spokesperson said: “Commonwealth Bank is committed to consistently delivering the best customer outcomes for home buyers, and mortgage brokers are an important part of how we meet the home buying needs of customers.”

Proprietary channels a ‘strategic priority’ for CBA

However, the bank has been open in its preference to boost the proprietary channel, telling The Adviser in February that it was a “strategic priority”.

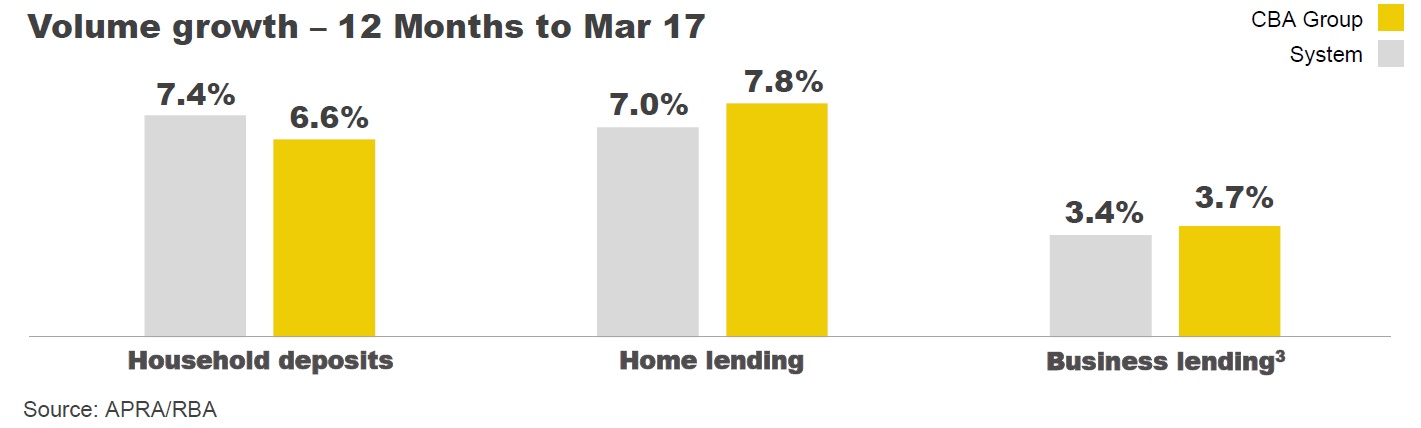

Following the 2017 half year results announcement in February (which showed a 4 per cent drop in broker market share over the six months to December 2016), The Adviser asked CEO Ian Narev whether the bank was moving away from the broker channel.

Mr Narev said that while the broker network “provides a really important proposition that customers like and want” and will be a “critical part of the group strategy”, the “preference” was for customers to go through the proprietary channel.

He said: “[O]ur preference is always going to be, as you can imagine — for all sorts of reasons — to service as many of our customers through our own channels as we possibly can. That’s a strategic priority for us.”

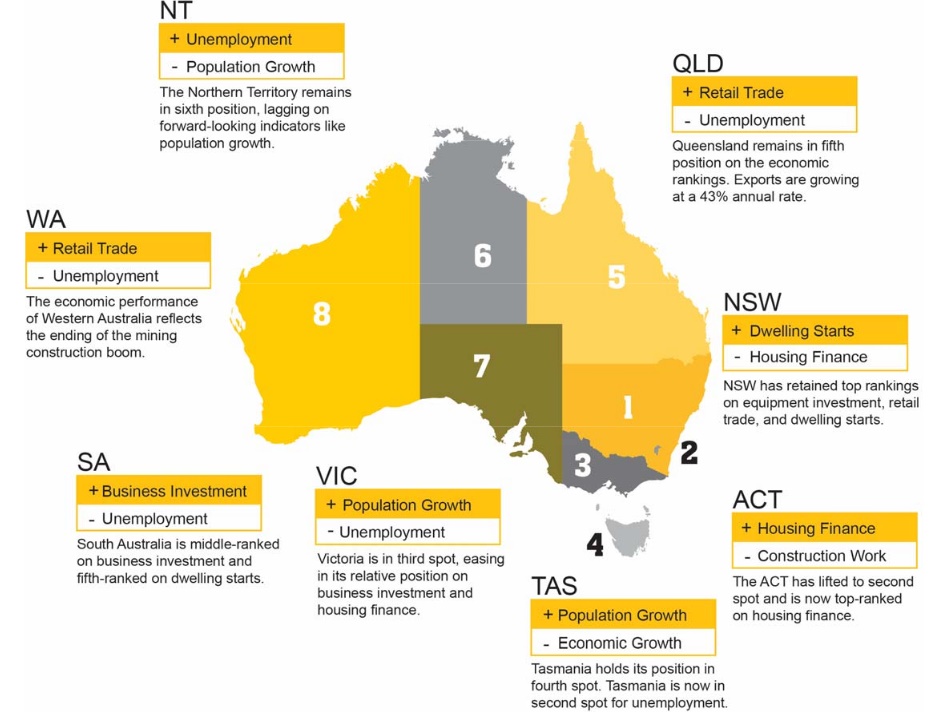

Mr Narev told The Adviser that the increase in loans being written directly through the bank was due to the fact that it had “upgraded and put more lenders in the branches — people who are able to have lending specific conversations with customers”.

He added: “We’ve been able to provide more analytics to support those lenders and others in the branch and we’ve really invested in the branch proposition and as a result of that we’ve seen our own share of the proprietary channel go up at the time when the markets have gone down — so for us that is a pretty good outcome.”