The current popular view is that in response to the Covid-19 problem, the central bank will stimulate, and this will support the local, and therefore global economy. One reason why markets are sanguine.

There is just one problem with this. China’s Global Times (one external voice of the Government) headed a piece “China should get ready for belt-tightening following virus outbreak”. Maybe China will not stimulate the economy by rolling out another massive monetary stimulus. This is potentially a game changer.

With the Chinese economy taking a major hit from the outbreak of the novel coronavirus pneumonia (COVID-19), the central government appears to pursue fiscal austerity as part of the efforts to pull through the difficult times.

While it is generally expected that fiscal stimulus and monetary easing will undoubtedly be the two main tools of central authorities for alleviating downward pressure on the economy and for maintaining macroeconomic stability, given the past experience and the financial risks currently facing China, a flood of spending programs seems no longer on the financial regulators’ list of choices for stimulating the economy.

“China will face decreased fiscal revenues and increased expenditures for some time to come, and the fiscal operation will maintain a state of ‘tight balance.’, Chinese Finance Minister Liu Kun wrote in an article published on Qiushi, a magazine affiliated with the Communist Party of China Central Committee. In this situation, it won’t be feasible to adopt a proactive fiscal policy by expanding the fiscal expenditure scale. I, and instead, policies and capital must be used in a more effective, precise and targeted way,” Liu said. Chinese Finance Minister Liu Kun wrote in an article published on Qiushi, a magazine affiliated with the Communist Party of China Central Committee.

Liu’s article sent a clear signal that China would not stimulate the economy by rolling out another massive monetary stimulus.

Due to the major impact of the coronavirus outbreak on businesses across the country, the Ministry of Finance has already made it clear that it would continue to reduce the tax burden on enterprises, which will undoubtedly weigh down the already slowing fiscal income. And a potential decrease in fiscal revenues directly points to the limited room for splashing out on unnecessary programs. China’s fiscal revenues grew 3.8 percent in 2019, the slowest growth since 1987, while fiscal expenditures during the same year gained 8.1 percent compared with the previous year, outpacing economic growth.

Therefore, to maintain a “tight balance,” the Chinese economy will have to tighten its belt by curbing non-essential expenditures while expanding investment in a precise and targeted manner.

There has been a consensus call among economists and economic observers for the fiscal deficit ratio to break the 3 percent GDP mark temporarily so that more space could be given to fiscal expenditures to stabilize the economy amid the epidemic.

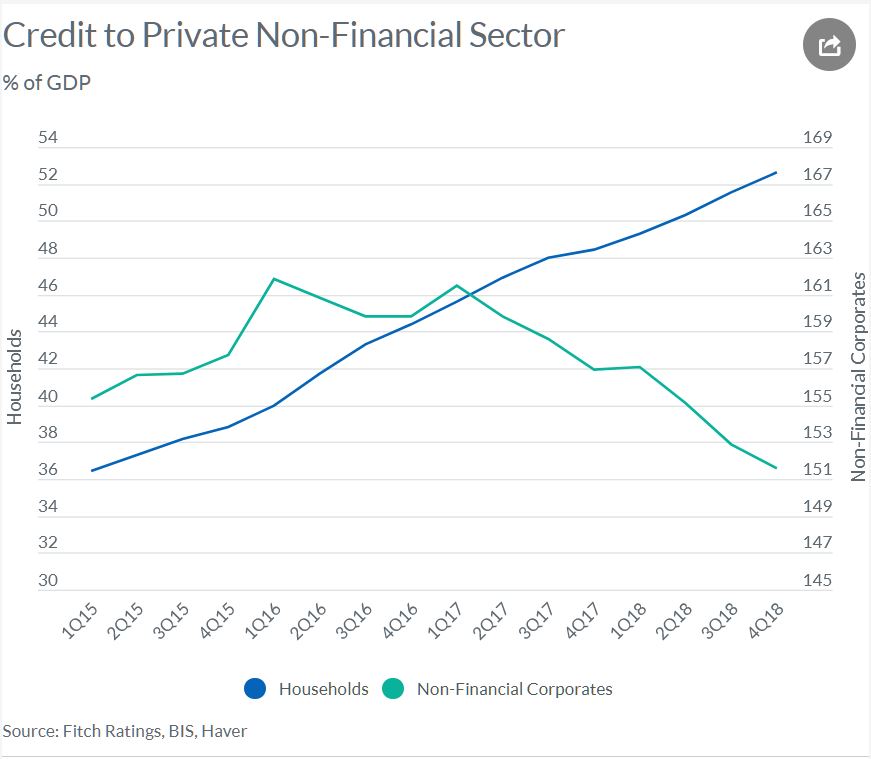

However, it should be noted that fiscal space constraint is not the key reason for belt-tightening. Past experience with massive stimulus already showed that a flood of investments could lead to many consequences like high levels of local government debts, and to the detriment of high-quality economic growth.

In 2019, China’s fiscal expenditures reached 23.9 trillion yuan ($3.4 trillion), of which only 3.5 trillion yuan was spent by the central government, and the rest by local governments.

In this sense, governments at all levels should be prepared for belt-tightening in the future to come.

This could have significant consequences for us all!