ASIC has released its first review of the rapidly growing buy now pay later industry. The review of this diverse and evolving market has found that buy now pay later arrangements are influencing the spending habits of consumers, especially younger consumers. One in six users had either become overdrawn, delayed bill payments or borrowed additional money because of a buy now pay later arrangement.

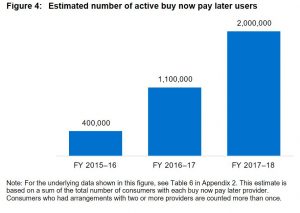

They estimate 2 million active buyers use these services.

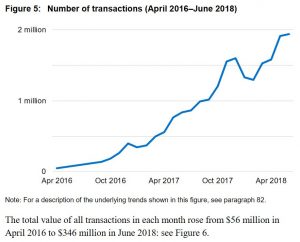

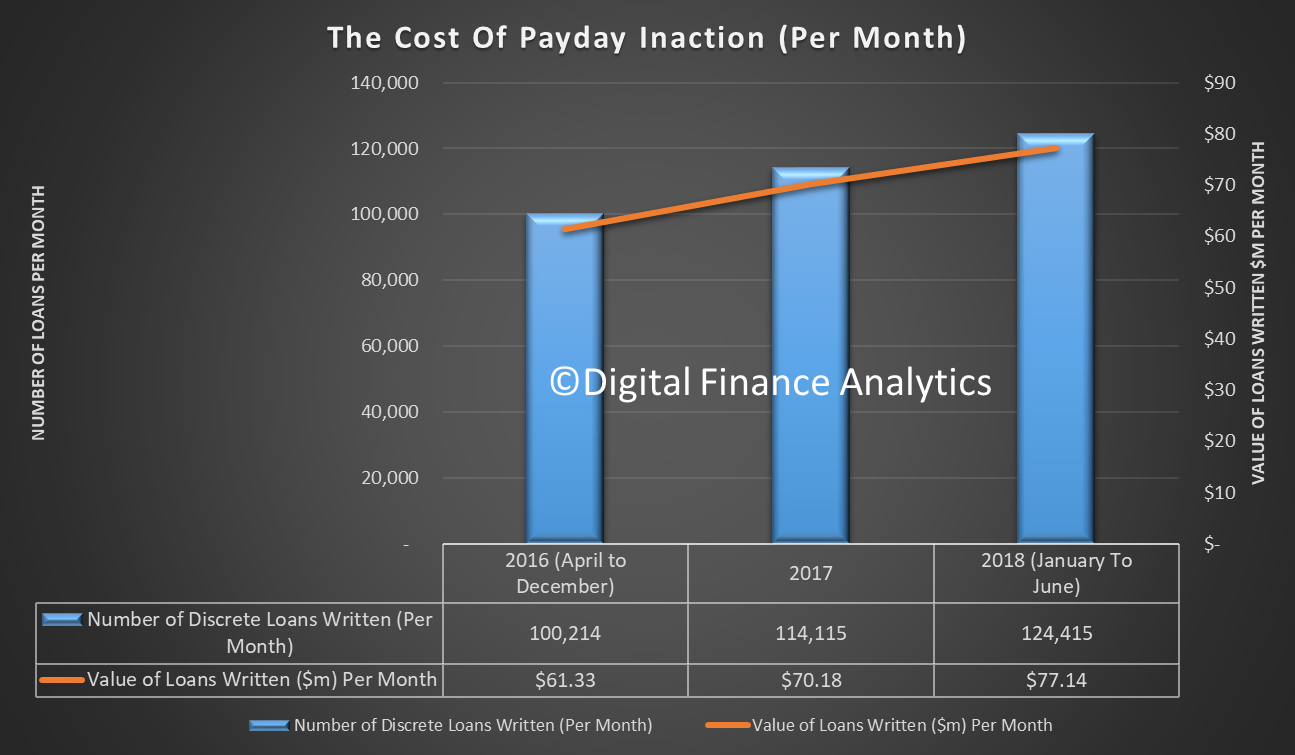

… and transactions are increasing.

… and transactions are increasing.

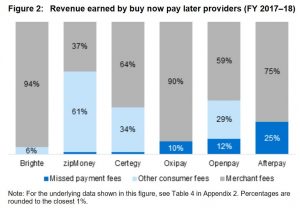

They show that much of the revenue generated comes from merchant fees, but also includes some missed payment and other consumer fees.

A buy now pay later arrangement allows consumers to purchase and obtain goods and services immediately but pay for that purchase over time. While some buy now pay later providers offer fixed term contracts up to 56 days for amounts up to $2,000, other providers offer a line of credit for amounts up to $30,000.

ASIC found that the number of consumers who have used buy now pay later has increased five-fold from 400,000 to 2 million over the financial years 2015-2016 to 2017-2018. The number of transactions has increased from about 50,000 during the month of April 2016 to 1.9 million in June 2018. At 30 June 2018, there was $903m in outstanding buy now pay later balances.

ASIC Commissioner Danielle Press said ‘Although our review found many consumers enjoy using buy now pay later arrangements and plan to continue using them, there are some potential risks for consumers in using these products.

‘The typical buy now pay later consumer is young with 60% of buy now pay later users aged between 18 to 34 years old. We found that buy now pay later arrangements can cause some consumers to become financially overcommitted and liable to paying late fees.’

One in six users had either become overdrawn, delayed bill payments or borrowed additional money because of a buy now pay later arrangement. Most consumers believe that these arrangements allow them to buy more expensive items than they would otherwise and spend more than they normally would. Providers also use behavioural techniques which can influence consumers to make a purchase without careful consideration of the costs.

‘The exponential growth in this industry, along with the risks we have identified, means this will remain an area of ongoing focus for ASIC. One area we will be targeting is where consumers are paying more than they need to for using a buy now pay later arrangement’, said Ms Press.

Given the potential risks to consumers, ASIC supports extending the proposed product intervention powers to all credit facilities regulated under the ASIC Act. Product intervention powers will provide ASIC with a flexible tool kit to address emerging products and services such as buy now pay later arrangements. This will ensure ASIC can take appropriate action where significant consumer detriment is identified.

Background

Buy now pay later arrangements allow consumers to defer payment for purchases from participating merchants and obtain the goods and services immediately.

Under the arrangement, consumers are generally not charged interest. However, some arrangements have an establishment fee and account-keeping fees. Consumers may also be charged a fee if they miss a payment.

Buy now pay later arrangements are available from a range of merchants. For example, these arrangements could be used to finance high-value purchases such as solar power products, health services, travel, and electronics. Buy now pay later arrangements are also available for everyday purchases from retailers such as Big W, Target, Harris Scarfe and Kmart.

These arrangements are not regulated under the National Credit Act and as a result providers are not required to be licensed or to comply with the responsible lending laws that prohibit a lender from providing credit that would be ‘unsuitable’ for the consumer. However, these arrangements are considered ‘credit facilities’ under the ASIC Act meaning that ASIC can take action where a buy now pay later provider engages in conduct that is misleading or unconscionable.

ASIC’s review

ASIC undertook a proactive review of these arrangements to develop a broad understanding of this growing industry and to identify potential risks for consumers. The review examined six providers, four of which are part of larger ASX-listed companies. The buy now pay later arrangements we reviewed were: Afterpay, zipPay, Certegy Ezi-Pay, Oxipay, BrightePay and Openpay.

To better understand how this industry is working in practice, we considered qualitative and quantitative data from July 2016 to June 2018. We also relied on independent consumer research which involved a survey of 600 randomly selected consumers who had recently used a buy now pay later arrangement.

ASIC also tested each of the providers performance in areas such as transparency, dispute resolution and hardship. As a result, all of the providers have made improvements that will benefit consumers. For example, all of the providers are now members of the new Australian Financial Complaints Authority, and all of the providers are reviewing their standard form contracts for potentially unfair contract terms.

ASIC will continue to collect data to monitor the adequacy of consumer protections in this sector and review changes made by buy now pay later providers.

ASIC’s MoneySmart website explains how buy now pay later services work and how consumers can avoid getting into financial trouble when using them.