From CoreLogic.

Abolishing stamp duty for first home buyers is likely to create some headaches for eligible buyers who have recently entered into contracts. Additionally we can expect first home buyer activity to stall before surging higher on July 1 2017. The long term outcome may be self-defeating due to higher demand pushing up prices.

The decision yesterday by the News South Wales Government Premier Gladys Berejiklian to provide first home buyers with a stamp duty exemption for properties with a price tag under $650,000 is likely to boost demand for this under represented segment of the market. Based on recent Australian Bureau of Statistics (ABS) data, first home buyers comprised only 8% of owner occupier mortgage commitments in March 2017, which is only marginally higher than the record low of 7.5% recorded in September last year and well below the long term average of 17%.

According to the latest CoreLogic ‘Perceptions of Housing Affordability’ report, it highlighted that across New South Wales the largest proportion of respondents (48%) identified that stamp duty was the most significant obstacle to housing affordability. Additionally, almost three quarters of respondents (74%) felt that removing or reducing stamp duty would be an effective way to improve housing affordability in New South Wales.

Clearly the state government is responding to one of the most significant pain points for prospective buyers.

The current policy provides a stamp duty exemption to first home buyers purchasing a new home with a price tag under $550,000. The new policy has substantially broader scope, providing an exemption for both new and established housing with a price tag under $650,000 and sliding discounts up to $800,000.

To put these limits into context, over the past twelve months, 45.4% of dwellings sold across New South Wales had a price tag of $650,000 or less and 58% of dwelling sales had a price tag $800,000 or less. The proportion of properties that meet the exemption criteria falls away sharply if the analysis is confined only to the Sydney metropolitan area where 25.8% of dwelling sales over the past twelve months were at a price of $650,000 or less.

With a substantial premium on detached housing, the proportions are also substantially different between the broad product types. The past twelve months saw 20.0% of Sydney houses sell for $650,000 or less while unit sales comprised just over one third of all sales (33.5%) at or below this price.

Additionally, with investor demand likely to be slowing due to higher mortgage rates, tighter credit policies and low yields; there is the potential that a rise in first time buyer demand could fill the ‘hole’ left by fewer investors in the market and offset the recent slowdown in the pace of capital gains.

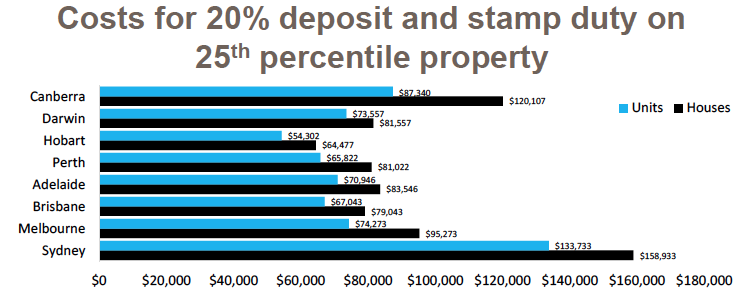

First home buyers still need to contend with the challenges of raising a deposit, which is another major barrier to market entry. Housing prices in Sydney are the highest amongst the capital cities, with the latest data from CoreLogic putting the median house price at just over $1 million and median unit price at just under $743,000. Those buyers who can’t stump up a 20% deposit have been given another leg up, with stamp duty for lenders mortgage insurance also abolished.

Stamp duty on lenders mortgage insurance is charged at 9% of the premium; so a first home buyer with a 5% deposit on a $650,000 property is likely to save themselves around $2,250 (based on a premium of $25,000).

Removing or reducing the transactional costs for first home buyers is likely to provide both positive and negative consequences across the New South Wales housing market.

From a positive sense, policies aimed at improving housing accessibility for first time home buyers are likely to be positively received. Sydney is Australia’s most unaffordable housing market by any measure, and for many buyers, the cost of entry, including stamp duty and raising a deposit, is the most significant barrier to entry. On a $650,000 dwelling purchase, a non-first home buyer would be paying stamp duty costs of around $25,000; so the exemption is a substantial cost saving for a first home buyer.

On the negative side, it’s widely accepted that policies aimed at stimulating demand tend to push prices higher; there is a possibility that the new policy could ultimately be self-defeating, increasing housing demand which could place further upwards pressure on the price of housing which will exacerbate the affordability challenges even further.

The new policy comes into effect on July 1st, so we can expect first home buyer sales to stall over the remainder of June and likely surge higher from the beginning of the new financial year. For those buyers who are potentially eligible for the new exemptions but have recently entered into contacts, there is likely to be some severe disappointment that these rules aren’t applied retrospectively.