The Senate Inquiry report of Credit Cards was published today. They have made 11 recommendations, which could have some impact on the sector, but they have rejected regulation of card rates. They suggest a focus on easier switching, better disclosure, affordability assessments and tweaks to minimum payments. They also flag the potential for an alternative longer-term credit product.

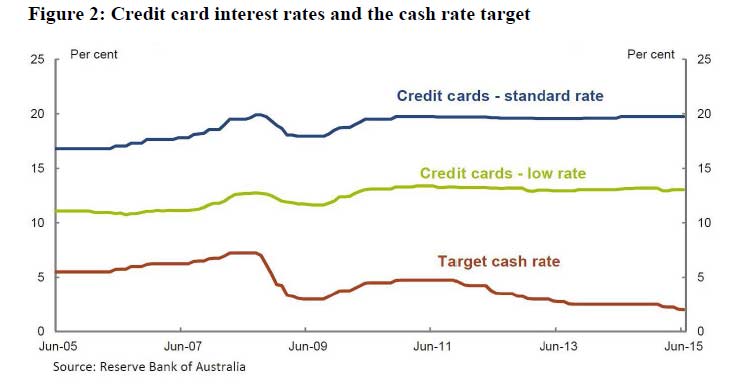

Two important points come though. First, card rates have not followed cash rates down.

Second, less affluent households, who revolve consistently and maintain high debt balances cross-subside more affluent households who do not. You can read about our analysis of card economics here.

Second, less affluent households, who revolve consistently and maintain high debt balances cross-subside more affluent households who do not. You can read about our analysis of card economics here.

In addition, many who do borrow on a card do not understand the true rates of interest they are paying.

Here are the recommendations:

- Credit card advertising and marketing material should disclose clearly the cost of a credit card for a consumer, including the card’s headline interest rate and ongoing annual fee.

- Credit card monthly statements should include prominent reminders about a credit card’s headline interest rate and ongoing annual fee.

- The government to work with key stakeholders to develop a system that informs consumers about their own credit card usage and associated costs. Initially, historic usage and cost data could be provided in monthly statements. Over time, it would be desirable to provide customer-specific, online, machine readable records that would allow credit card users to compare credit cards using online comparison engines.

- The government should undertake a review into technical and systems innovations that might help facilitate switching in the credit card market, and as part of this review consider the feasibility of account number portability for credit card accounts.

- Card providers should be required to provide consumers with the ability to close a credit card through an online process (‘click-and-close’).

- The responsible lending obligations, as they apply to credit card lending, be amended so that serviceability is assessed on the basis of the borrower’s ability to pay off their debt over a reasonable period. The government should consult with industry, consumer groups and other interested stakeholders to determine what constitutes a ‘reasonable period’ in this regard.

- The government consider introducing a credit card minimum repayment requirement and alternative means of reducing the use of credit cards as long-term debt facilities.

- Credit card providers should be required to make reasonable attempts to contact a cardholder when a balance transfer period is about to expire and the outstanding balance has not been repaid. In doing so, the provider should be required to initiate a discussion about the suitability of the customer’s current credit card and, where appropriate, provide advice on alternative products.

- The government should consider expanding financial literacy programs such as the Australian Securities and Investments Commission’s MoneySmart Schools Program.

- Credit card providers should be required to make reasonable attempts to contact a cardholder in cases where a cardholder has only made the minimum payment for 12 consecutive months on interest bearing balances, and thereby initiate a discussion about product suitability and alternative lending products.

- The government consider a Productivity Commission inquiry into the value and competitive neutrality of payments regulations, with a particular focus on interchange fees.

There are some separate comments and recommendations from Nick Xenophon, who suggests consideration should be given, in conjunction with consumer groups and experts, to providing appropriate warnings on credit card statements and credit card advertisements.

Finally, Coalition Senators expressed some concerns about the potential impact of some of the recommendations, as being overbearing.