The fall in interest rates and an easing of lending standards will “breathe life” into the property market, but not without consequences, according to Moody’s Analytics, via The Adviser.

Financial intelligence agency Moody’s Analytics has released its Second Quarter 2019 Housing Forecast Report, in which it has noted its outlook for the Australian housing market.

Drawing on CoreLogic’s Hedonic Home Value Index, the research agency noted the correction in residential property prices, which it said was “a long time coming” after a “strong run-up” in values across more densely populated markets, particularly in Sydney and Melbourne.

However, Moody’s has observed that while residential home prices have moderated from their peak in September 2017, the decline has not led to a “material” improvement in housing affordability, with values still 20 per cent higher than during the pre-boom period in 2013.

Nonetheless, Moody’s has reported that it expects the Reserve Bank of Australia’s (RBA) cut to the official cash rate and proposals to ease home loan serviceability guidelines from the Australian Prudential Regulation Authority (APRA) to rekindle demand for credit and spark activity in the housing market.

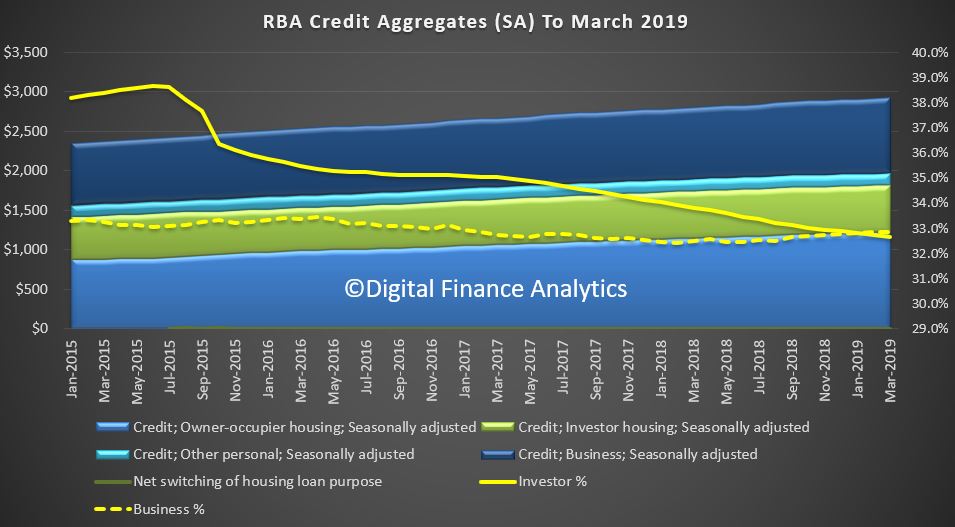

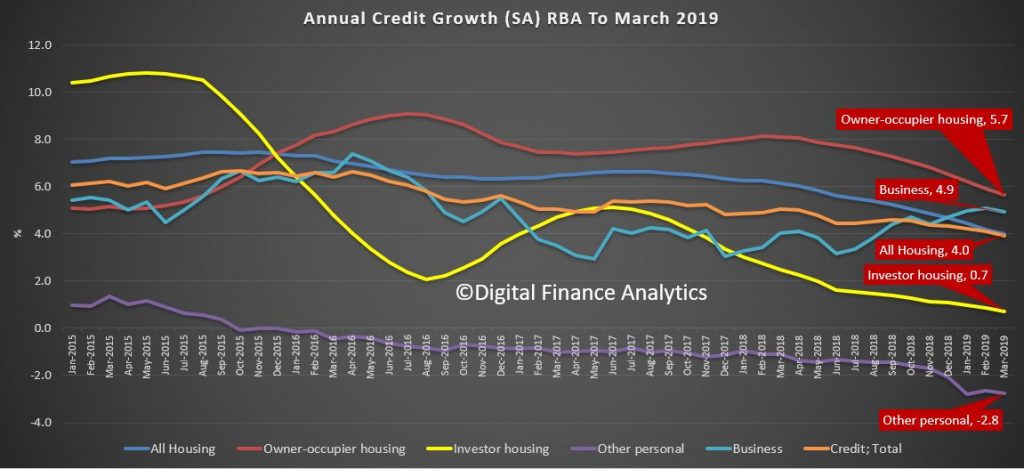

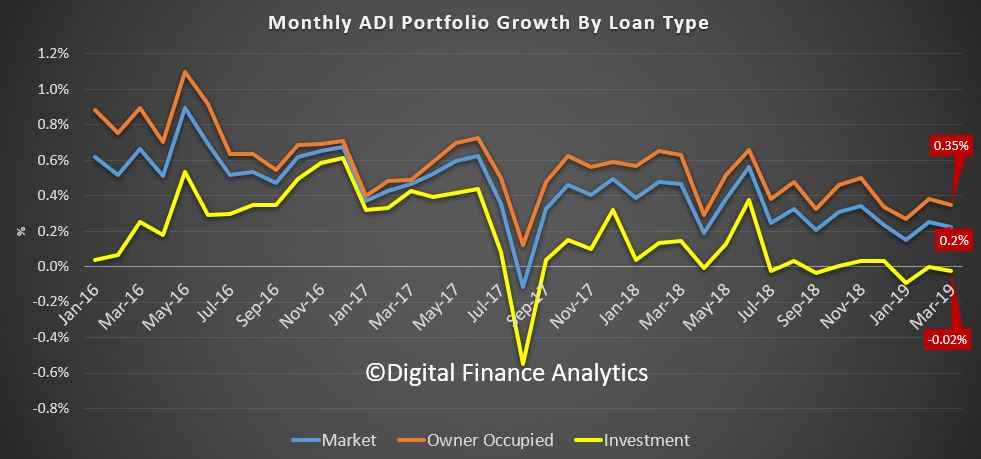

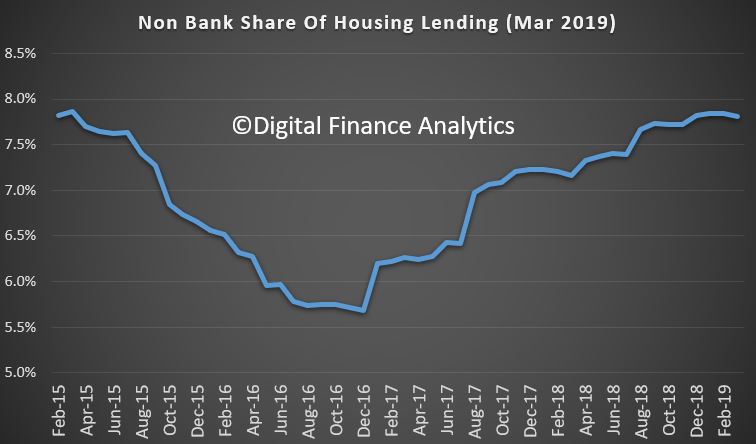

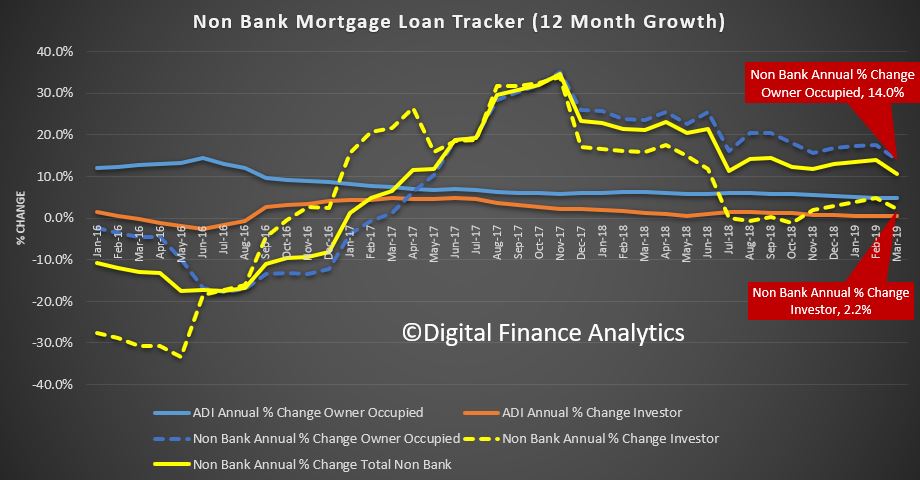

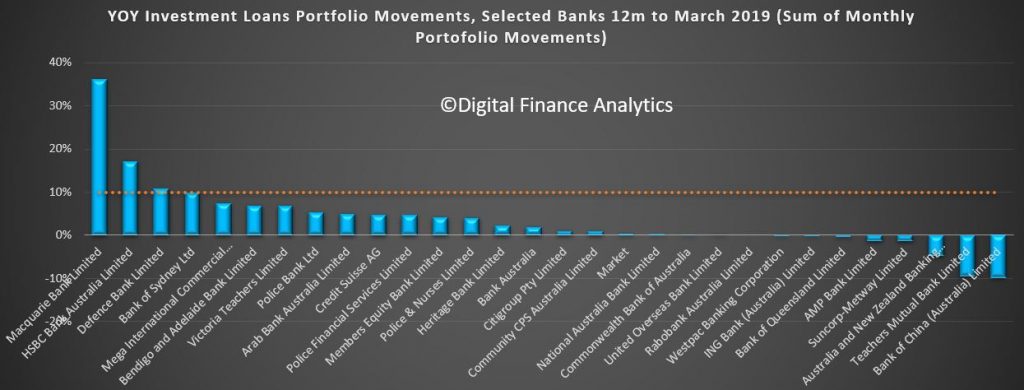

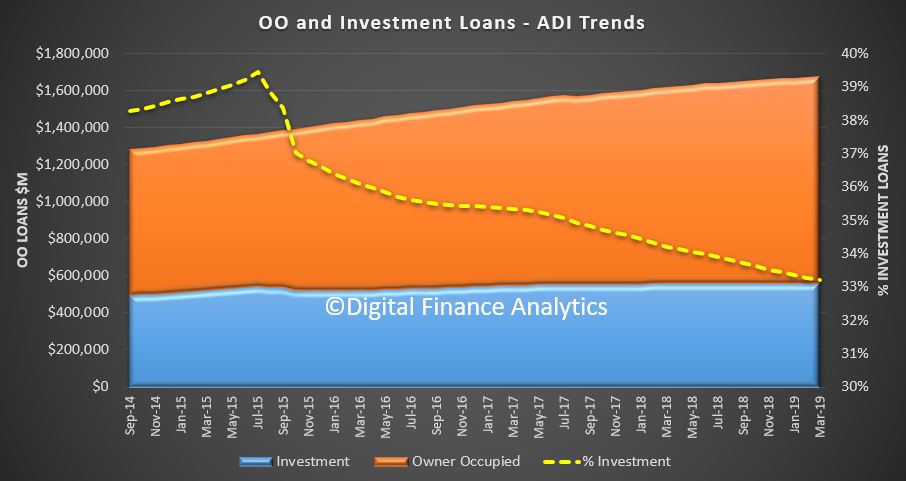

“An important driver of the slowdown in Australia’s housing market has been tighter credit availability, partly as a consequence of the regulator – the Australian Prudential Regulation Authority – tightening lending conditions, which has made it relatively more difficult to purchase a property, particularly for investors,” Moody’s noted.

“These serviceability requirements were eased in May.

“Expectations of further lending reductions flowing on from RBA cash rate reductions will also breathe life into the property market and add weight to our view that the national housing market will reach a trough in the third quarter of 2019 and gradually improve thereafter.”

However, Moody’s warned that a resurgence in the housing market activity could further expose the economy to risks associated with high levels of household debt.

“This could see the household leverage-to-GDP ratio climb, making Australia stand out further amongst its peers,” Moody’s stated.

“This is an undesirable position to be in, particularly given the questions around sustainability of the potentially rising debt load.”

Moreover, recent changes in the regulatory landscape have been interpreted by some observers as as a sign that the economy could be at risk of falling into recession amid growing internal and external headwinds.

Treasurer Josh Frydenberg recently acknowledged that “international challenges” could pose a threat to the domestic economy.

Fears of a looming recession have prompted some observers, including the CEO of neobank Xinja, Eric Wilson, to encourage borrowers to pocket mortgage rate cuts passed on following the RBA’s decision to lower the cash rate.

Mr Wilson claimed that resisting the urge to accrue more debt would help borrowers build a buffer against downside risks in the economy.

The Australian Bureau of Statistics’ (ABS) Australian National Accounts data for the quarter ending March 2019, reported GDP growth of 0.4 per cent, with annual growth slowing to 1.8 per cent – the weakest since September 2009.

However, Moody’s economist Katrina Ell has said she expects the RBA’s monetary policy agenda to help revive the economy.

“The combination of increased monetary policy stimulus, expectations of the housing market reaching a trough in the third quarter of 2019, and fiscal policy playing a relatively supportive role including via income tax cuts should boost GDP growth to 2.8 per cent in 2020,” Ms Ell said.