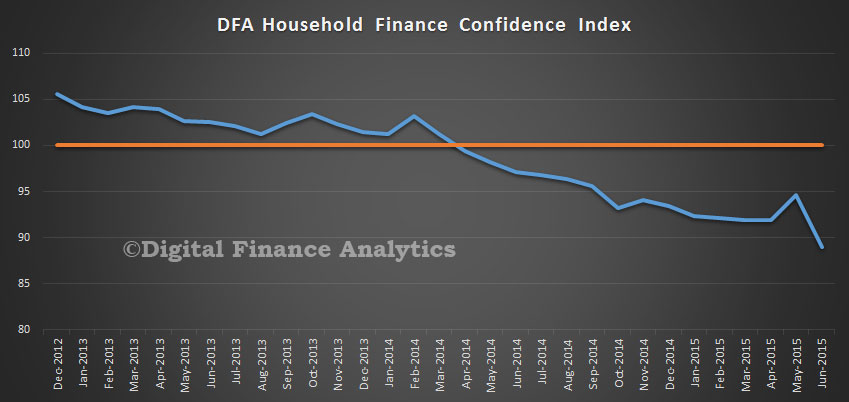

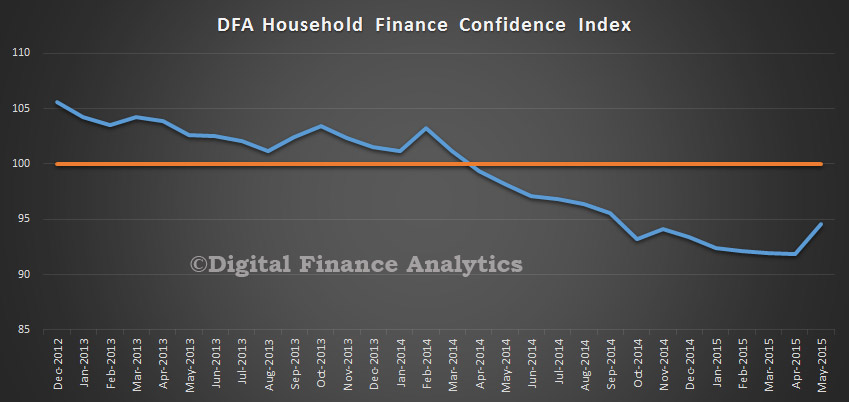

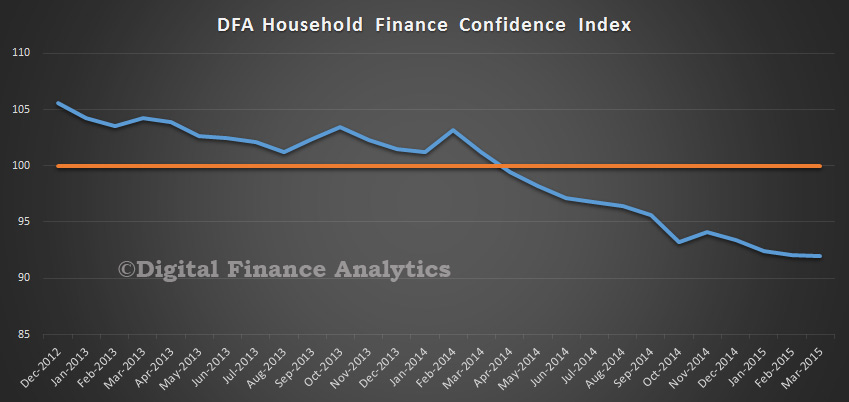

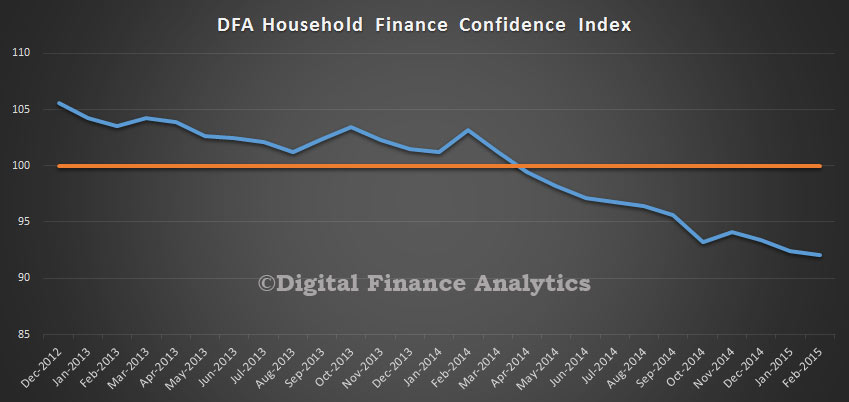

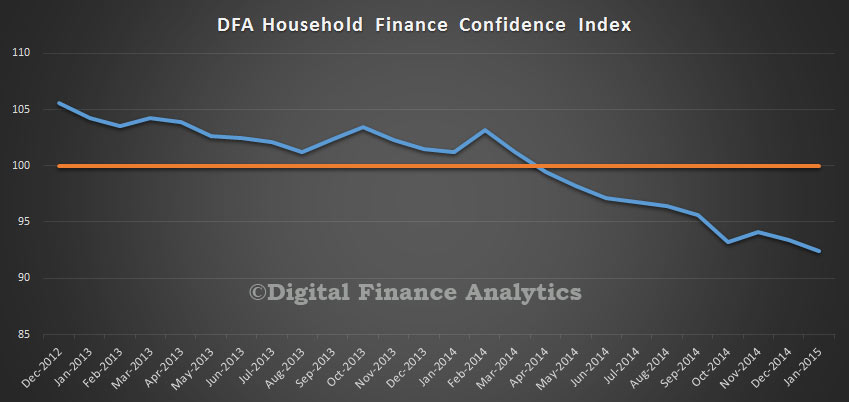

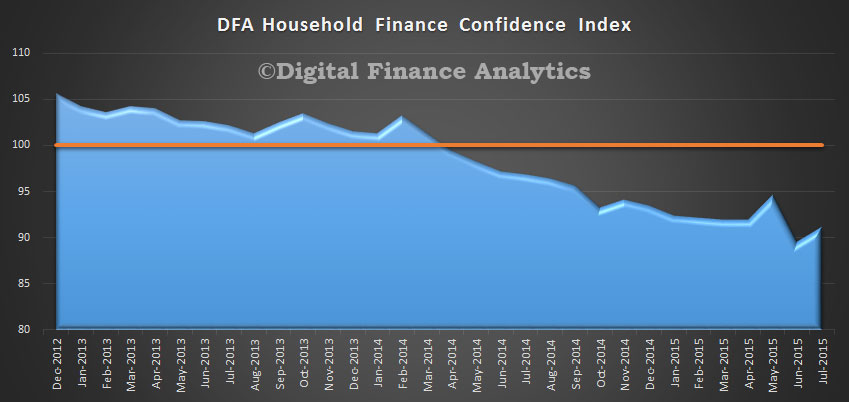

We released the latest DFA Household Finance Confidence today, incorporating results from our household surveys to end July. The overall index recovered a little from its all time low last month, rising to 91. This is still below a neutral setting. The index has been below water since April 2014.

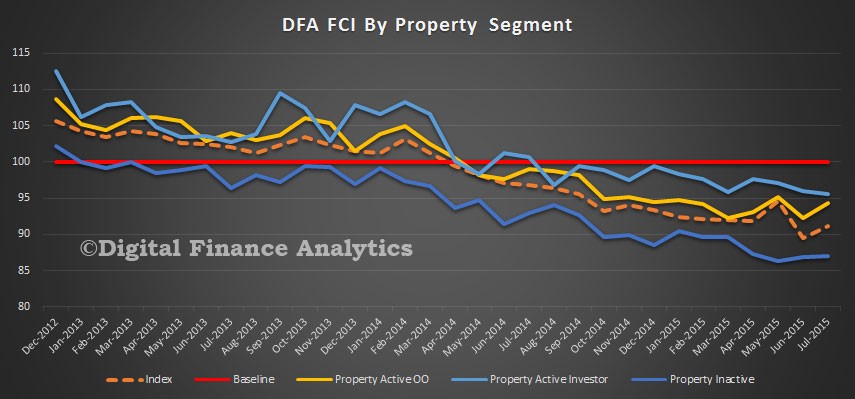

This month we pulled out data from the 26,000 survey responses, segmented by our master property categories. We found that households who are property inactive (those renting, living with parents or friends, or homeless) consistently registered a lower score, at 87 this month, and we see a falling rating since we started this analysis in 2012. On the other hand, those households with investment property consistently rated higher, because of the wealth effects of rising property values, and because their incomes were more stable. Owner occupied households fell between the two extremes, though we noted a kick-up this month, thanks to the prospect of potentially cheaper loans ahead. We also see a subtle fall in the confidence of property investors, who are reacting to recent hikes in interest rates for investment properties. Could this be the first sign of an investment sector slow-down?

This month we pulled out data from the 26,000 survey responses, segmented by our master property categories. We found that households who are property inactive (those renting, living with parents or friends, or homeless) consistently registered a lower score, at 87 this month, and we see a falling rating since we started this analysis in 2012. On the other hand, those households with investment property consistently rated higher, because of the wealth effects of rising property values, and because their incomes were more stable. Owner occupied households fell between the two extremes, though we noted a kick-up this month, thanks to the prospect of potentially cheaper loans ahead. We also see a subtle fall in the confidence of property investors, who are reacting to recent hikes in interest rates for investment properties. Could this be the first sign of an investment sector slow-down?

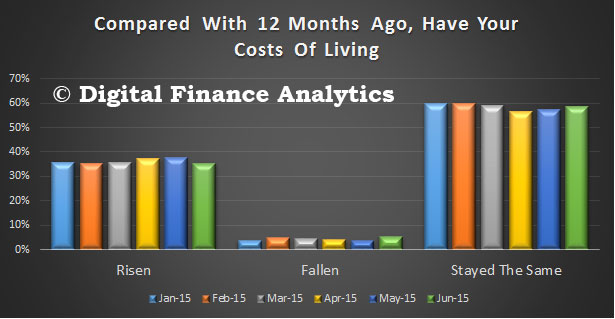

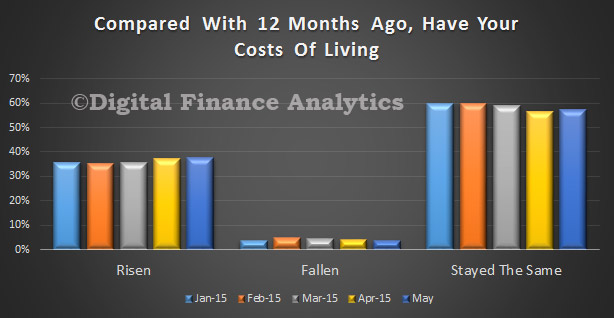

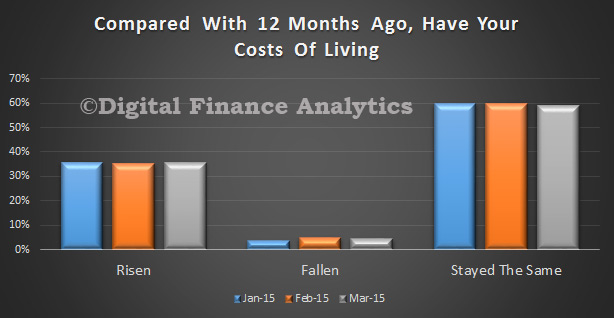

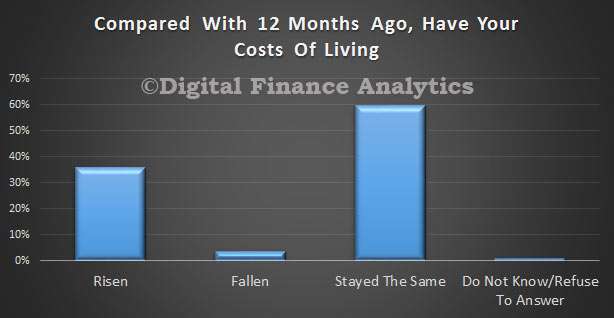

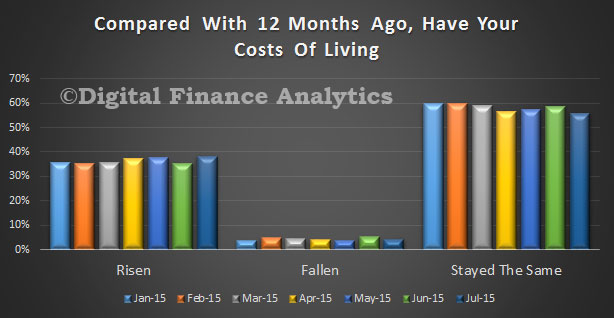

Now turning to the All Australia aggregate data, we see that costs of living continue to worry households, with 38% of households saying their costs were rising, up 3% on last month, and a similar fall in those who said there was no change to their costs. Households identified costs relating to council rates, food, fuel and overseas purchases as the main reasons for the rise. Those families burdened with child care costs and health related expenditure also suffered significant increases.

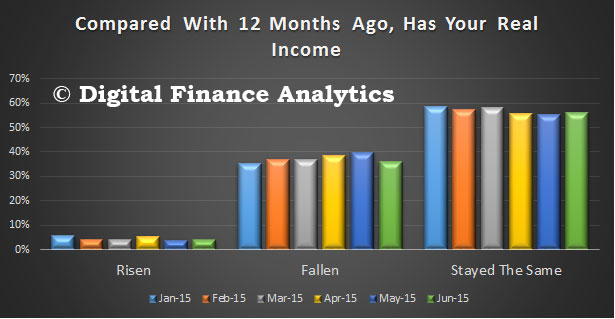

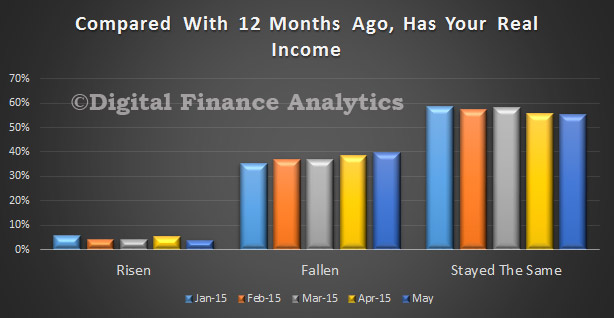

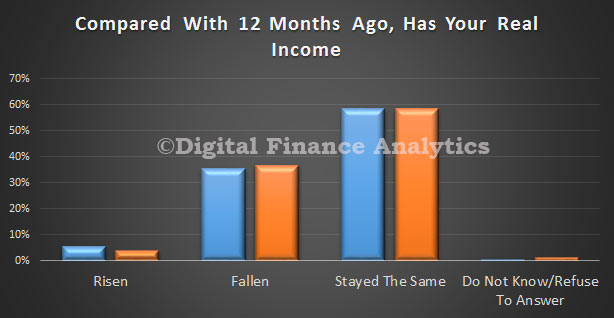

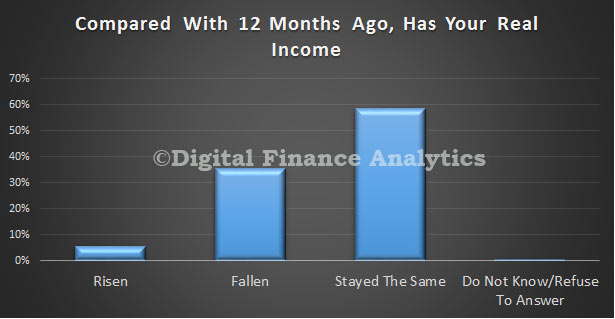

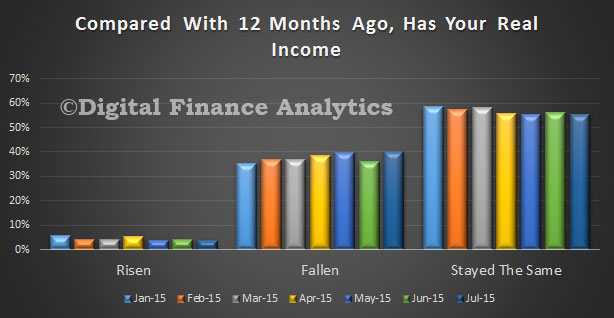

Turning to income, 4% more households this month said their income was falling in real terms, and 40% of households fall into this category. As well as wages being static or falling, households also saw falls in the interest paid on bank deposits. Only 4% said their incomes had risen, these tended to be households receiving dividend income from stocks. Just over 55% of households said their incomes had not changes (though as highlighted above, their costs had), so many are feeling the pinch.

Turning to income, 4% more households this month said their income was falling in real terms, and 40% of households fall into this category. As well as wages being static or falling, households also saw falls in the interest paid on bank deposits. Only 4% said their incomes had risen, these tended to be households receiving dividend income from stocks. Just over 55% of households said their incomes had not changes (though as highlighted above, their costs had), so many are feeling the pinch.

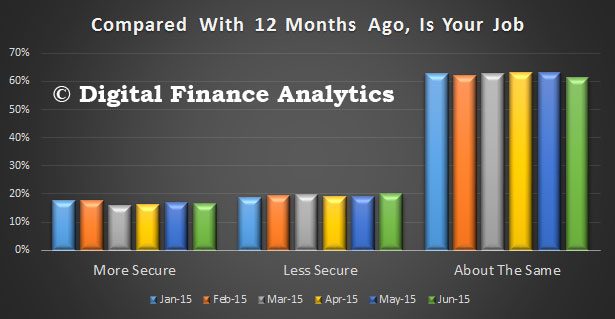

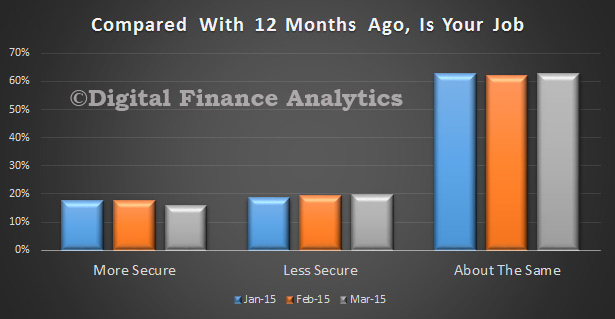

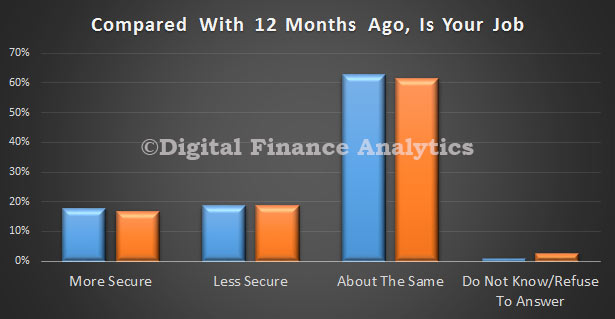

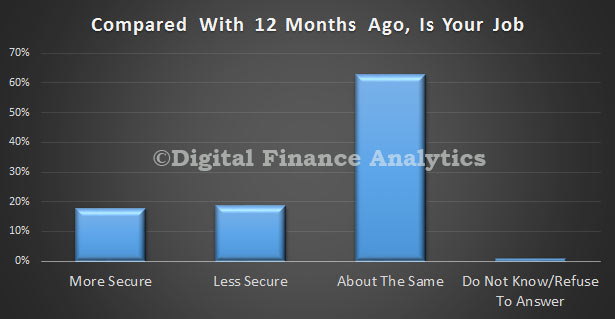

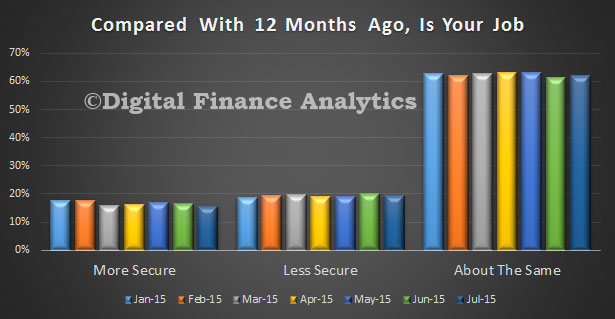

Next, looking at job security, those households who felt more secure in their jobs fell by nearly 1%, to 16% of households. More than 62% of households felt no difference in their level of job security. There were significant state and industry variations however, with those in WA and SA the most concerned, and registering a fall in security, whilst NSW and VIC both registered higher rates of job security.

Next, looking at job security, those households who felt more secure in their jobs fell by nearly 1%, to 16% of households. More than 62% of households felt no difference in their level of job security. There were significant state and industry variations however, with those in WA and SA the most concerned, and registering a fall in security, whilst NSW and VIC both registered higher rates of job security.

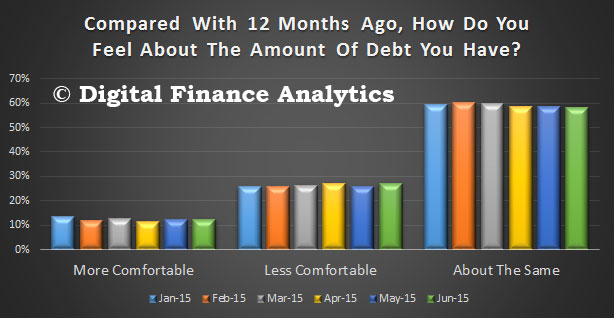

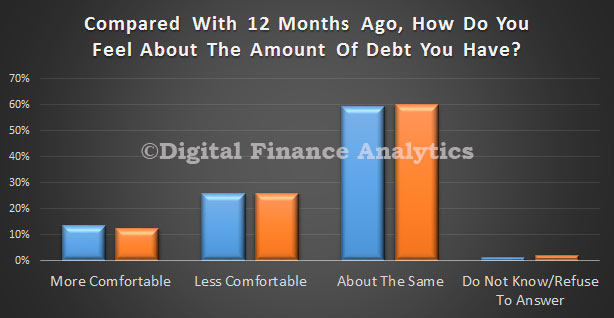

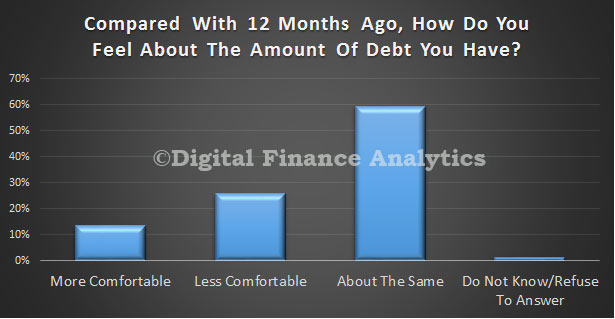

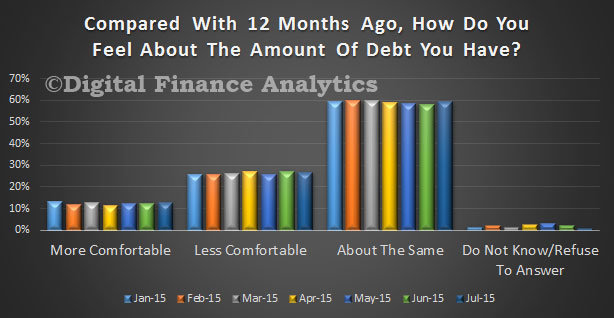

Looking at household debt (which is very high at the moment), 13% of households were more comfortable at their levels of debt, whilst 26% were less comfortable, and 60% were as comfortable as last time. Low interest rates are allowing households to manage high debt, but of course they are highly leveraged, and would be impacted if interest rates were to rise. Most households expect rates to remain low for the next couple of years.

Looking at household debt (which is very high at the moment), 13% of households were more comfortable at their levels of debt, whilst 26% were less comfortable, and 60% were as comfortable as last time. Low interest rates are allowing households to manage high debt, but of course they are highly leveraged, and would be impacted if interest rates were to rise. Most households expect rates to remain low for the next couple of years.

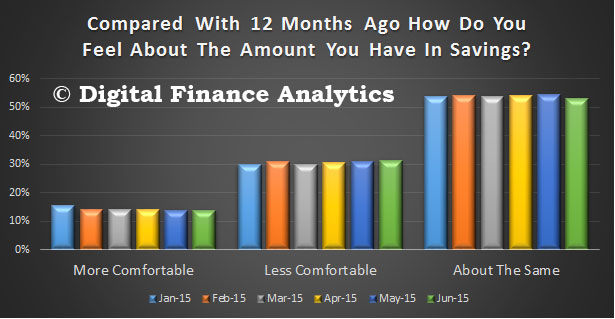

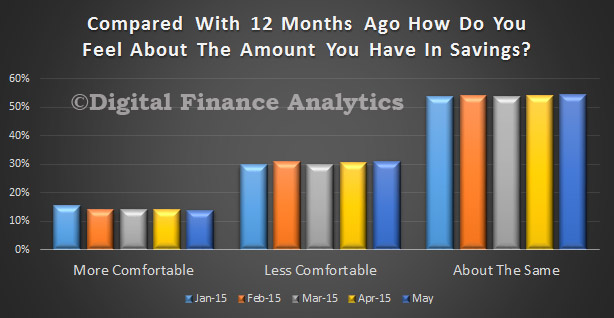

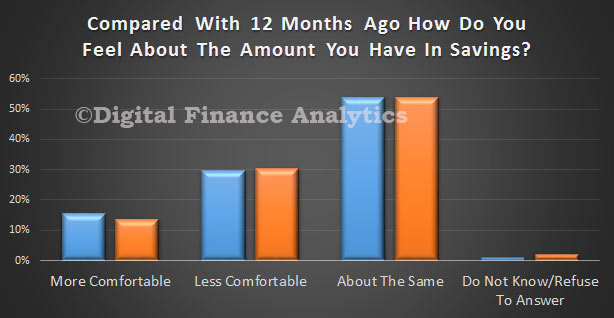

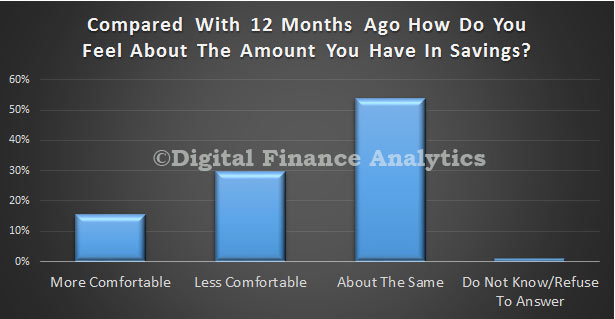

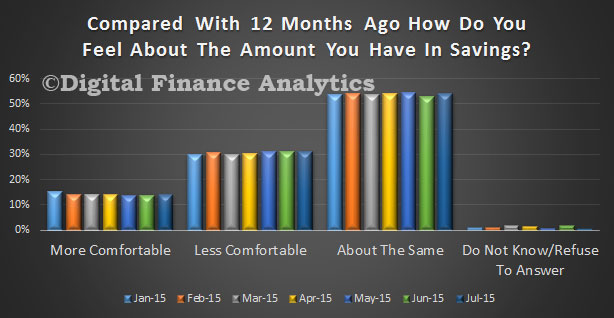

Turning to savings, 14% of households were more comfortable with the savings they had, little changed from last month, whilst 54% were as comfortable as last month. Households commented on the difficulty of finding a good home for their savings, in the current low interest rate environment, and were concerned that adjusted returns were worth next to nothing. We also noted an increase in those households unable to get access to $2,000 within a week in an emergency. Around 15% of households are in this category, and the majority are those who are property inactive.

Turning to savings, 14% of households were more comfortable with the savings they had, little changed from last month, whilst 54% were as comfortable as last month. Households commented on the difficulty of finding a good home for their savings, in the current low interest rate environment, and were concerned that adjusted returns were worth next to nothing. We also noted an increase in those households unable to get access to $2,000 within a week in an emergency. Around 15% of households are in this category, and the majority are those who are property inactive.

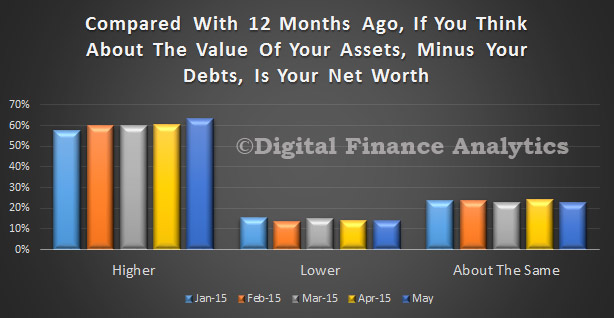

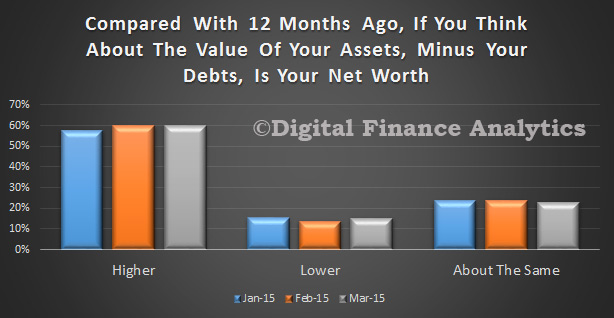

Finally, we look at net worth. Those households in the eastern states with property are feeling better off thanks to continued rises in property prices. Those with investment properties were feeling particularly smug. However, those in WA, NT and QLD were more more concerned about the trajectory of house prices, and saw their net worth falling – 62% of households saw their net worth rise, up 2%, whilst 14% saw it fall.

Finally, we look at net worth. Those households in the eastern states with property are feeling better off thanks to continued rises in property prices. Those with investment properties were feeling particularly smug. However, those in WA, NT and QLD were more more concerned about the trajectory of house prices, and saw their net worth falling – 62% of households saw their net worth rise, up 2%, whilst 14% saw it fall.

So overall, slowing wage growth and rising costs of living are counterpointed by rises in property prices, and low interest rates. However, bearing in mind that rates are unusually low and house price growth unusually high (for some), we do not see the fundamentals in place for a significant boost to household financial confidence any time soon. Therefore we expect households to spend conservatively, continue to save, and seek higher investment returns from higher risk asset classes.

So overall, slowing wage growth and rising costs of living are counterpointed by rises in property prices, and low interest rates. However, bearing in mind that rates are unusually low and house price growth unusually high (for some), we do not see the fundamentals in place for a significant boost to household financial confidence any time soon. Therefore we expect households to spend conservatively, continue to save, and seek higher investment returns from higher risk asset classes.