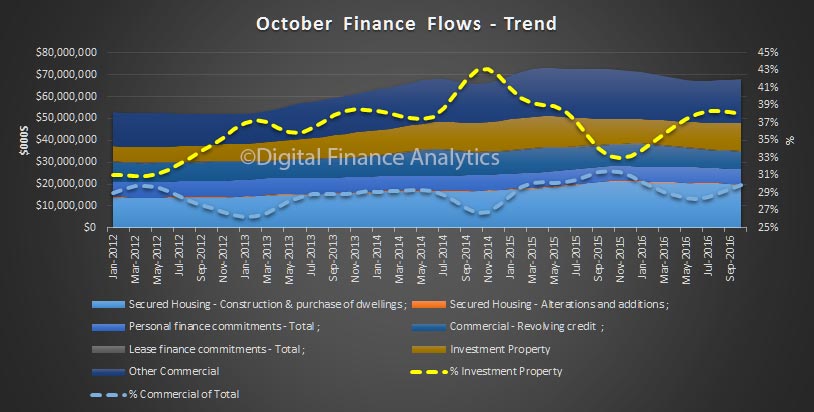

The ABS published the final piece of their May 2017 finance data, showing the flows to May 2017. It really is a rather sad tale. Owner Occupied housing apart, all other lending flows were lower, whether you look at the trend or seasonally adjusted figures.

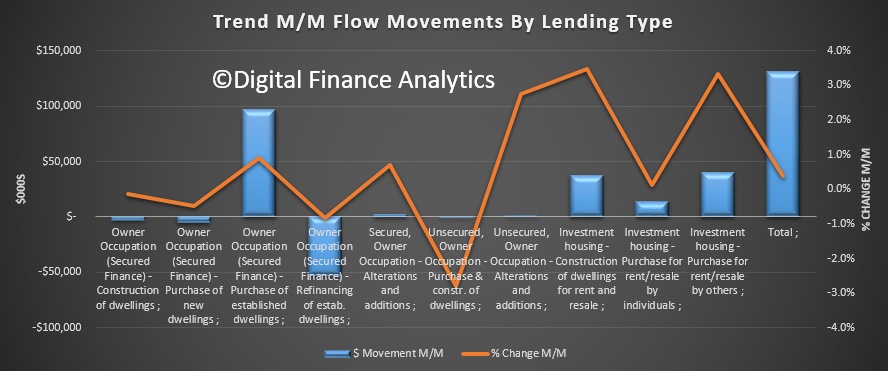

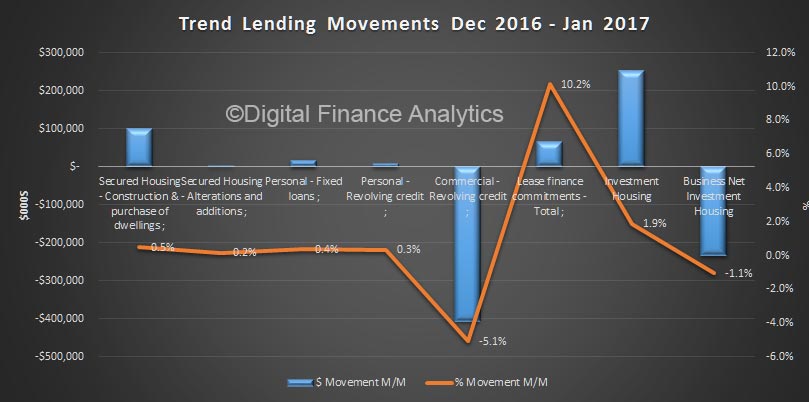

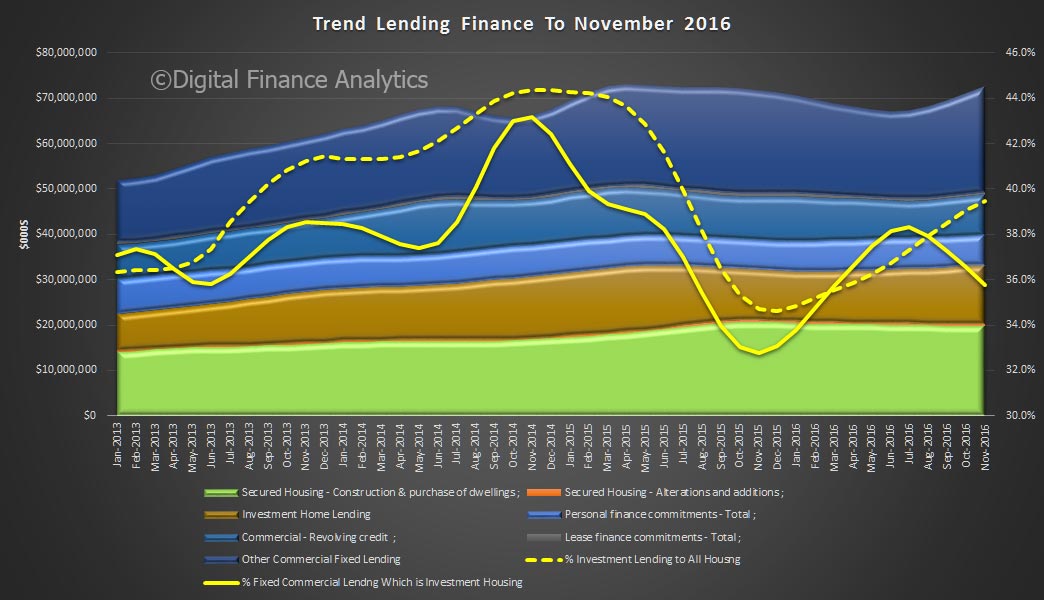

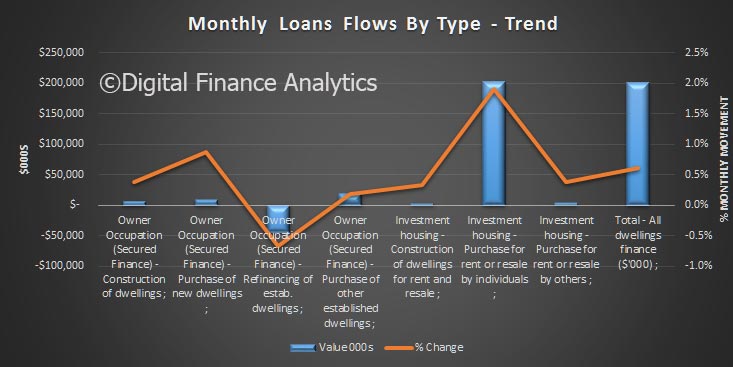

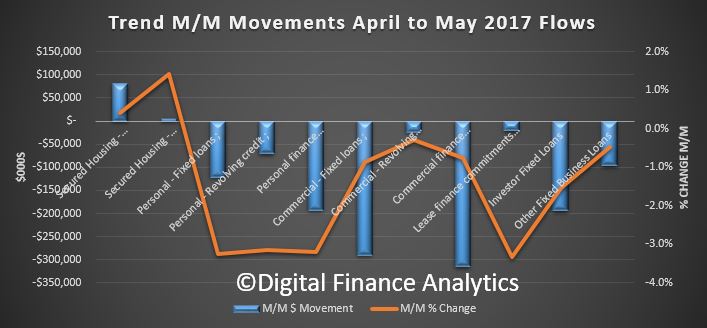

Looking at the moving parts, Secured housing flows rose 0.4% or $80 million, whilst secured housing alterations rose 1.9% or $5m.

Personal credit continues to fall, the flows fell 3.2% of $193 million, with similar rates of decline across both fixed and revolving loans.

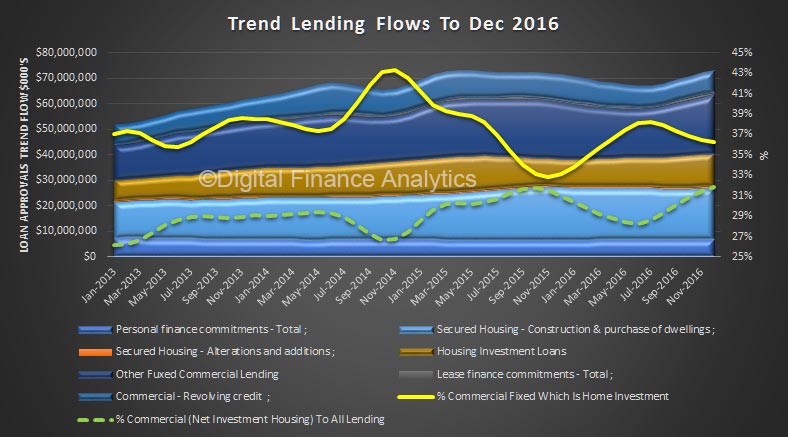

Total commercial lending fell 0.8% of $314 million. Within that lending for investment housing fell 1.5% or $194 million, whilst other fixed commercial lending fell 0.5% or $96 million. Revolving commercial credit fell 0.3% or $24 million. If business confidence is really so strong, why no growth in borrowing – something does not add up!

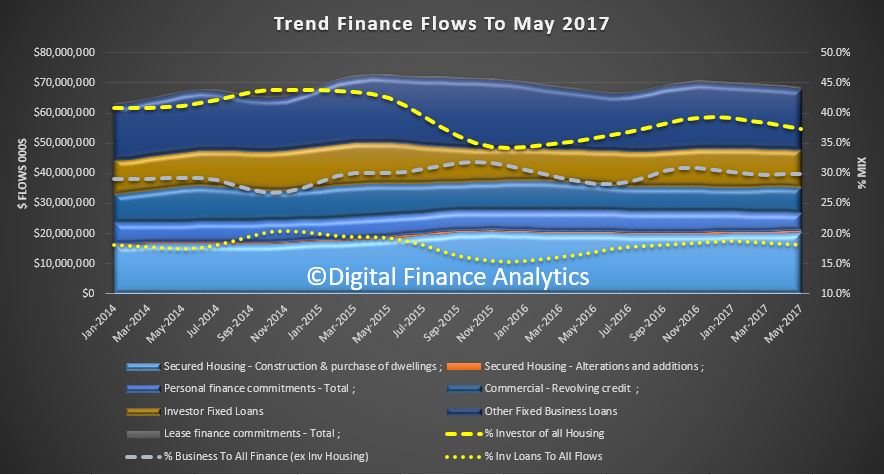

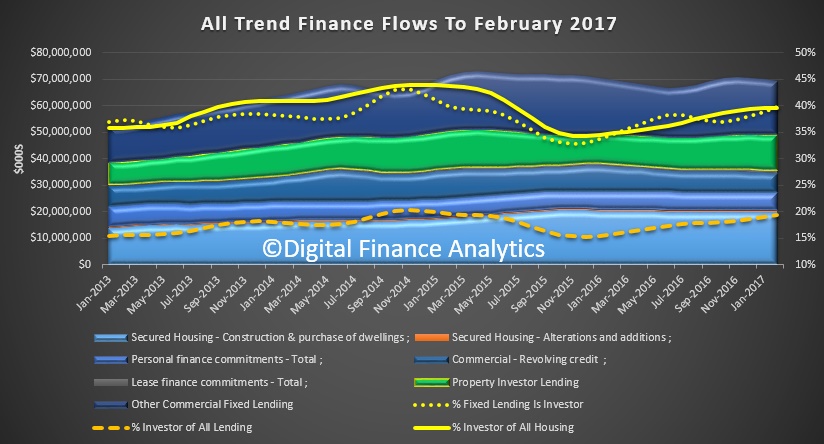

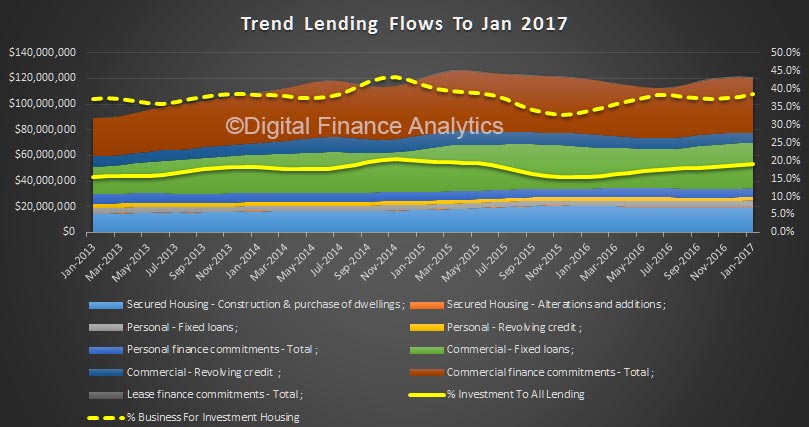

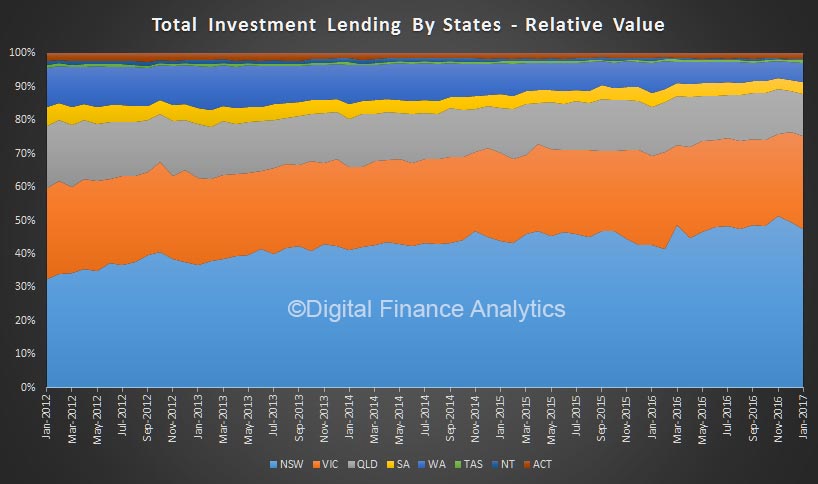

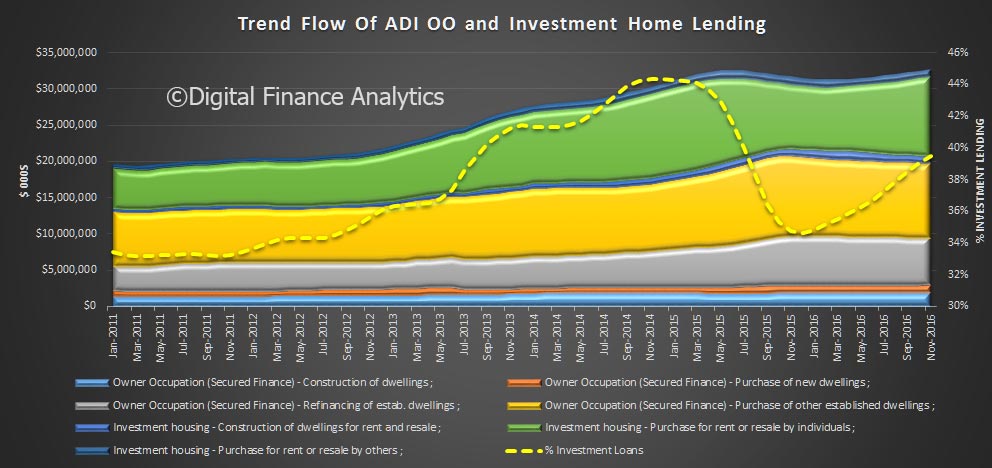

As a result, the total proportion of business lending to total lending stood at 29.9% down from a peak of 30.9% in December 2016. The proportion of investment property lending flows slipped to 18.1% of all lending, and 37.4% of all housing lending.

So whilst the regulatory tightening is crimping demand for investor finance, it is not being replaced with a rise in productive business lending, so commercial finance has fallen. This will put downward pressure on growth, at a time when mortgage interest rates are rising. We cannot see how the future growth expectations from the RBA are going to be met on these figures.

So whilst the regulatory tightening is crimping demand for investor finance, it is not being replaced with a rise in productive business lending, so commercial finance has fallen. This will put downward pressure on growth, at a time when mortgage interest rates are rising. We cannot see how the future growth expectations from the RBA are going to be met on these figures.

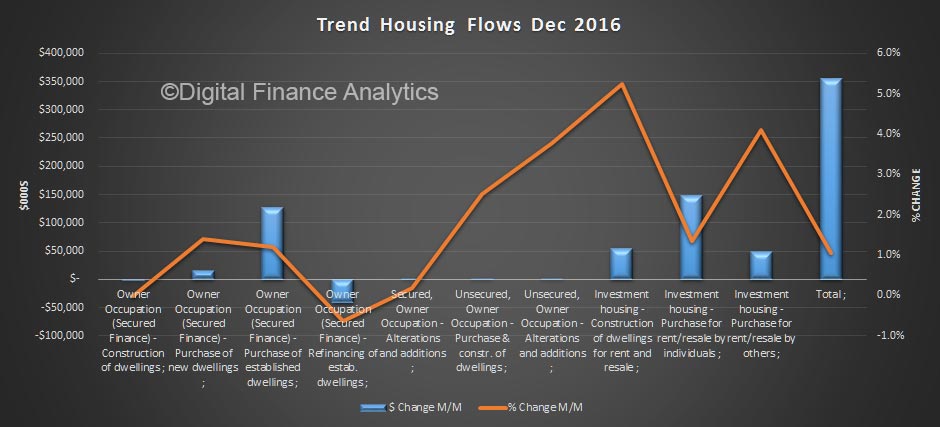

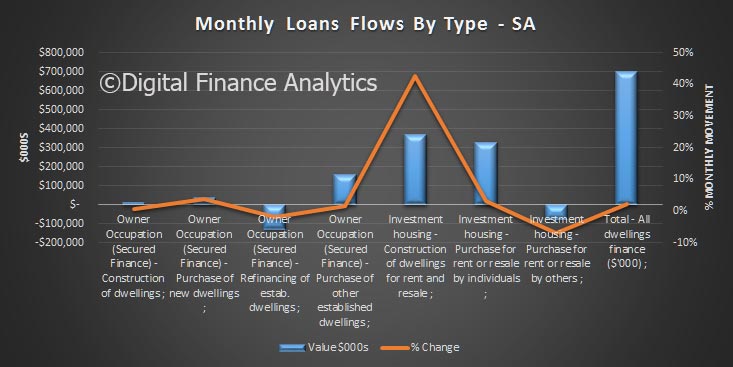

It is clear however, that secured lending for owner occupation which is up a little, will not fill the void. Interestingly the state by state figures show that investor lending remains strongest in the two overheated markets of Sydney and Melbourne. Much of the fall in investment sector lending resides in the other states, who are already experience economic pressure.

The total value of owner occupied housing commitments excluding alterations and additions rose 0.4% in trend terms, and the seasonally adjusted series rose 2.9%.

The trend series for the value of total personal finance commitments fell 3.2%. Fixed lending commitments fell 3.2% and revolving credit commitments fell 3.1%.

The seasonally adjusted series for the value of total personal finance commitments fell 0.5%. Revolving credit commitments fell 3.1%, while fixed lending commitments rose 1.2%.

The trend series for the value of total commercial finance commitments fell 0.8%. Fixed lending commitments fell 0.9% and revolving credit commitments fell 0.3%.

The seasonally adjusted series for the value of total commercial finance commitments fell 6.4%. Revolving credit commitments fell 12.5% and fixed lending commitments fell 4.9%.

The trend series for the value of total lease finance commitments fell 3.3% in May 2017 while the seasonally adjusted series rose 1.1%, following a rise of 4.3% in April 2017.