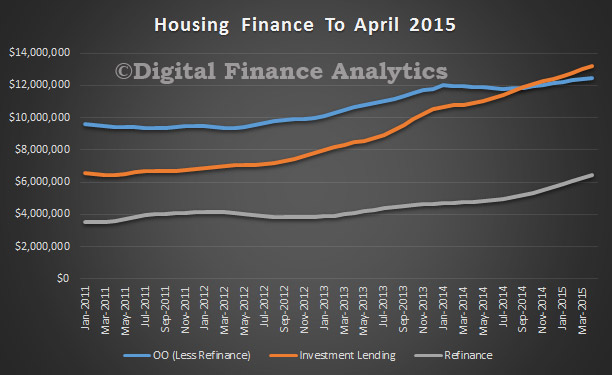

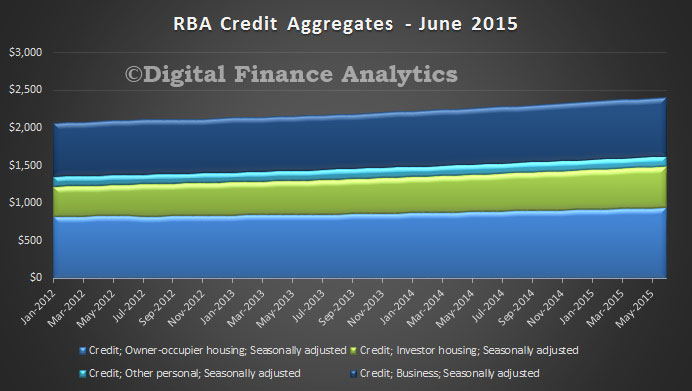

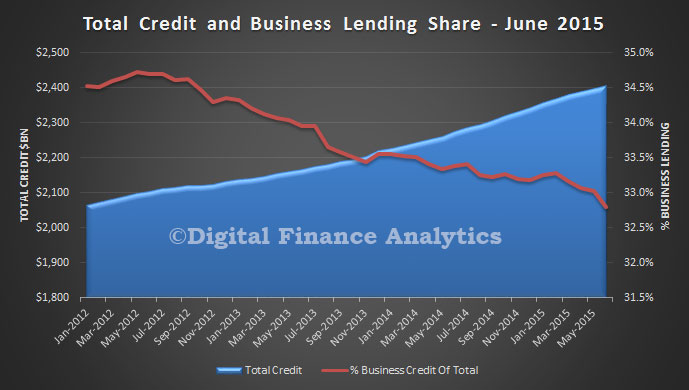

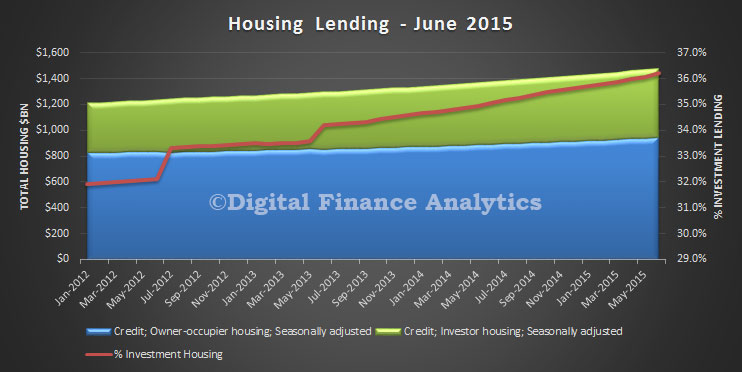

The latest data form the RBA on credit aggregates to June 2015, tells the continuing story of growing investment property lending, and a relative reduction in lending to business. The data on total loans outstanding (stock) shows there was a fall in lending to business in the month of 0.36%, which translates to a growth of 4.3% for the year to $789 bn. On the other hand, lending for housing rose 0.6% in the month, and 7.3% for the year, (higher than last year at 6.4%) to $1,481 bn. Owner occupied housing rose 0.47% to $945 bn, whilst investment lending grew 1.10% to $536 bn. Other personal lending rose 0.15% to $137 bn.

Total lending to business as a share of all lending fell again to 32.8%, this is not healthy as productive growth comes from business investing in their futures. This is not as strong as we need to sustain the economy.

Total lending to business as a share of all lending fell again to 32.8%, this is not healthy as productive growth comes from business investing in their futures. This is not as strong as we need to sustain the economy.

Looking at the mix of lending for housing, investment lending was up to 36.2%. It has never been higher. This inflates house prices, and banks balance sheets, but the wealth is artificial, and unproductive.

Looking at the mix of lending for housing, investment lending was up to 36.2%. It has never been higher. This inflates house prices, and banks balance sheets, but the wealth is artificial, and unproductive.

Finally we think there are some funnies in these numbers, which when we have completed the analysis of the APRA monthly banking statistics, we will comment on further. Suffice it to say, it seems maybe some loans were reclassified last month from owner occupied to investor loans, so might be distorting the data.

Finally we think there are some funnies in these numbers, which when we have completed the analysis of the APRA monthly banking statistics, we will comment on further. Suffice it to say, it seems maybe some loans were reclassified last month from owner occupied to investor loans, so might be distorting the data.