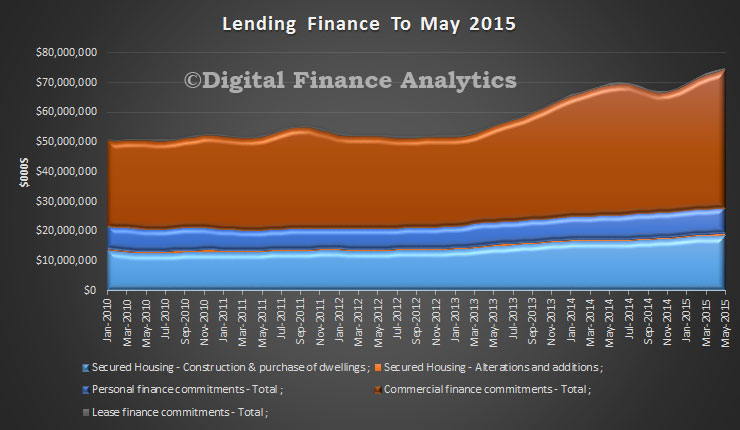

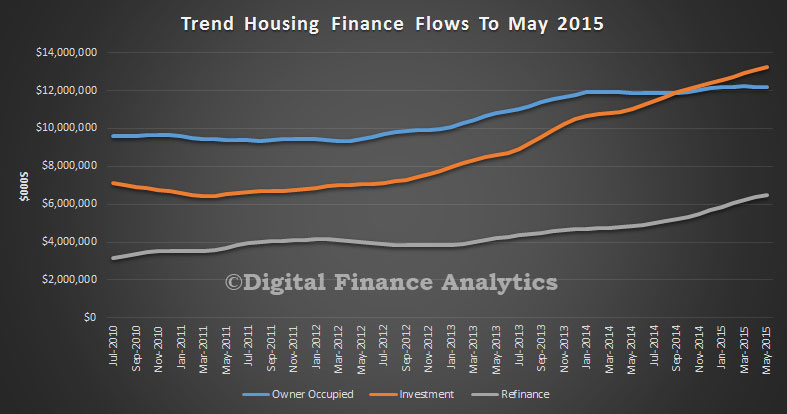

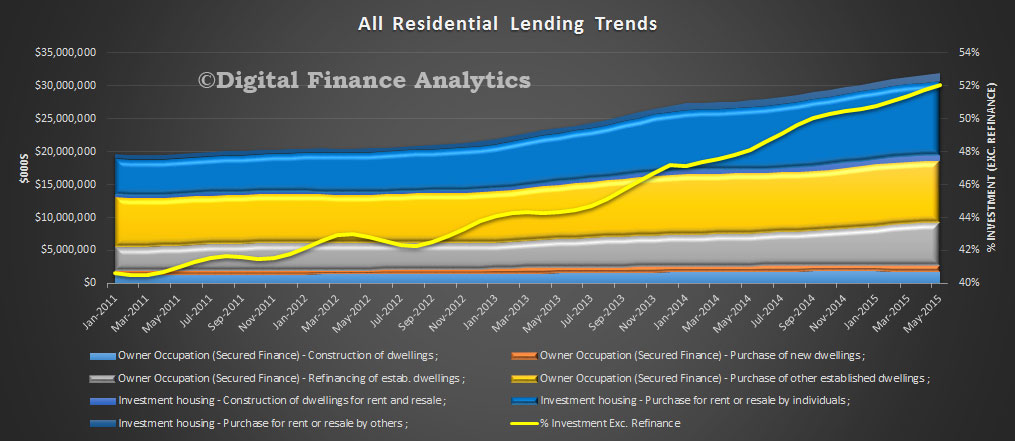

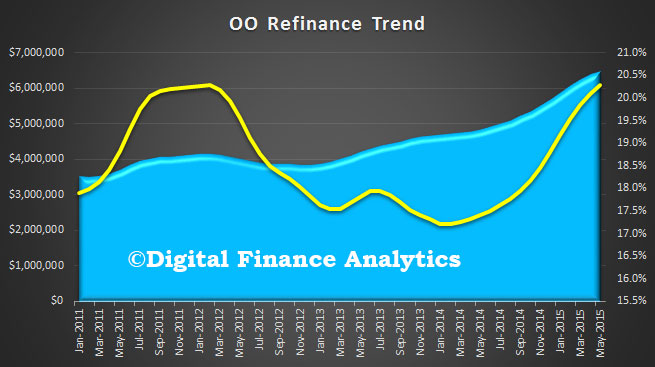

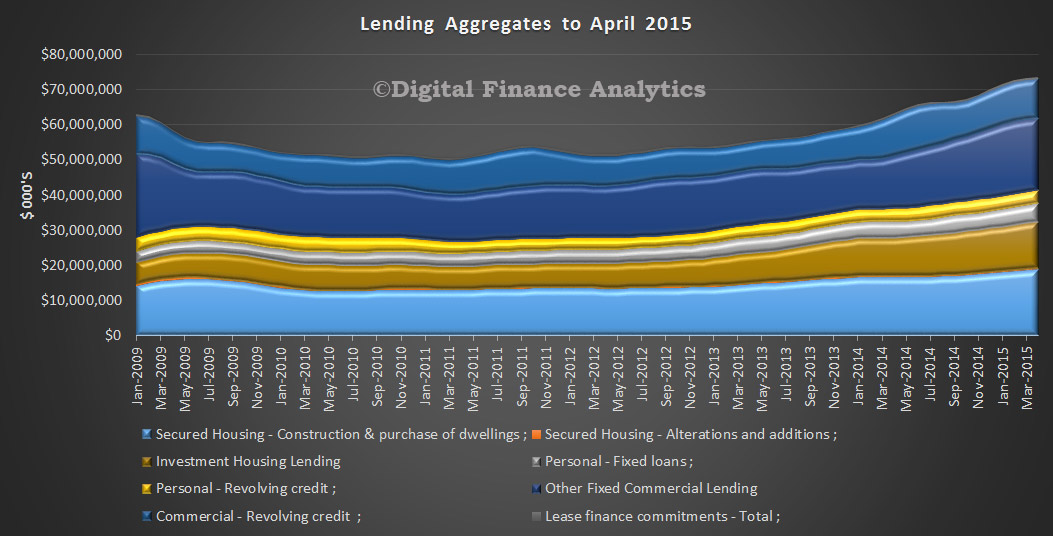

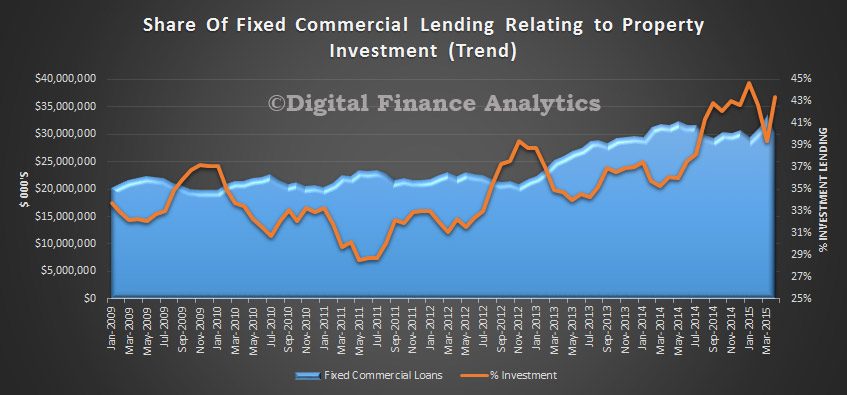

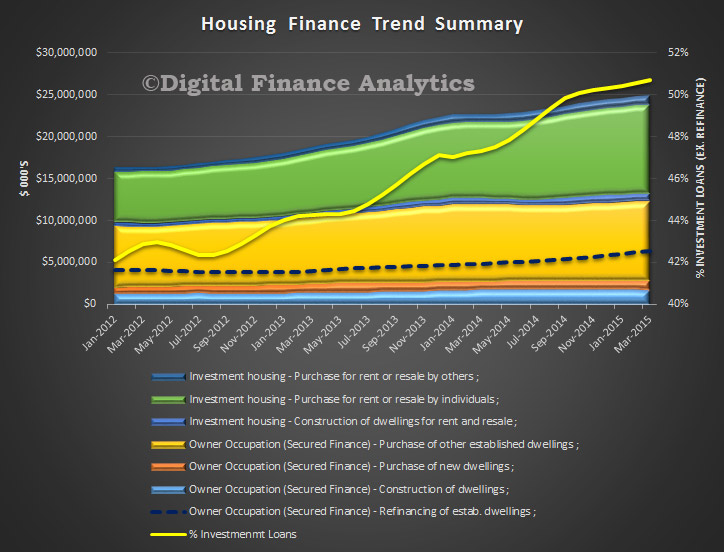

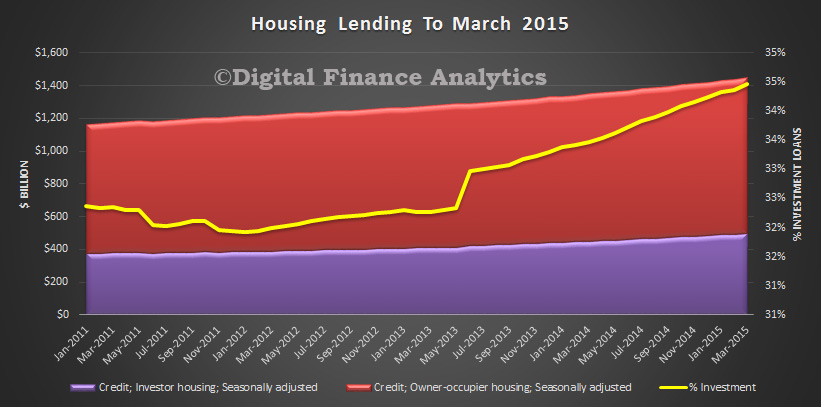

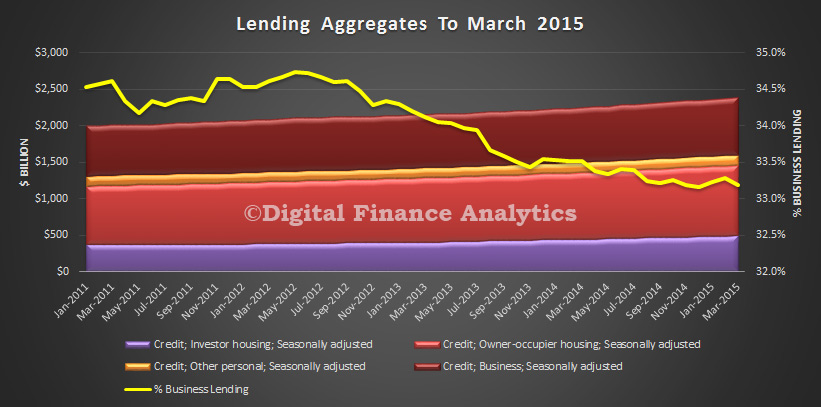

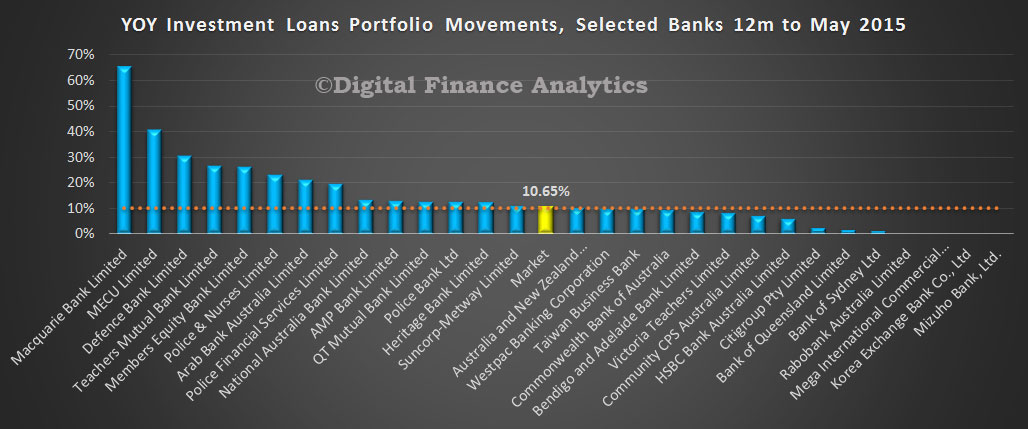

The latest APRA data on ADI’s banking statistics showed us a few interesting angles. Looking at housing first, total lending for residential property rose to $1.36 trillion, with owner occupied loans rising 0.57% in May, and investment loans rising 0.99%. These translate into year on year growth rates of 6.33% for owner occupied loans and 10.65% for investment loans, which is above the APRA “watch” rate of 10%. Housing lending for investors is still going gangbusters, as our earlier analysis from the RBA confirmed. The difference between the $1.36 trillion and the $1.47 trillion is the non bank sector.

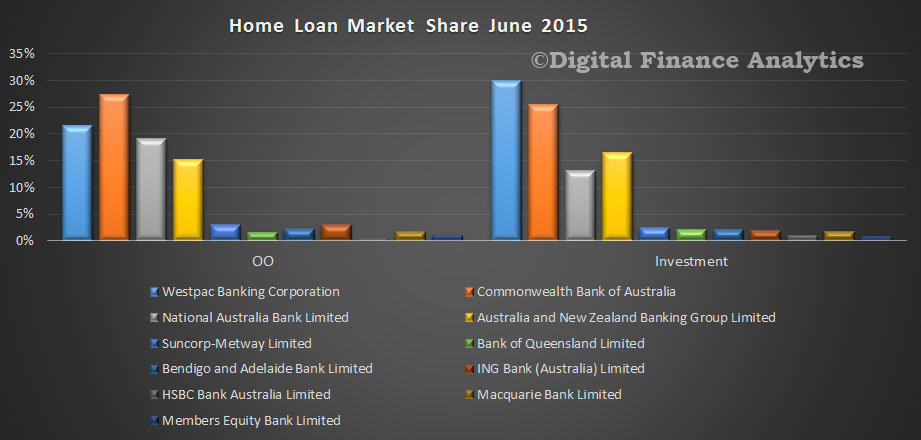

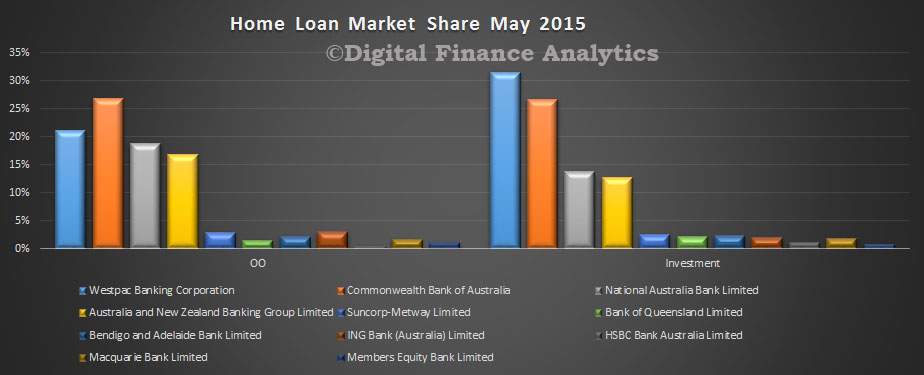

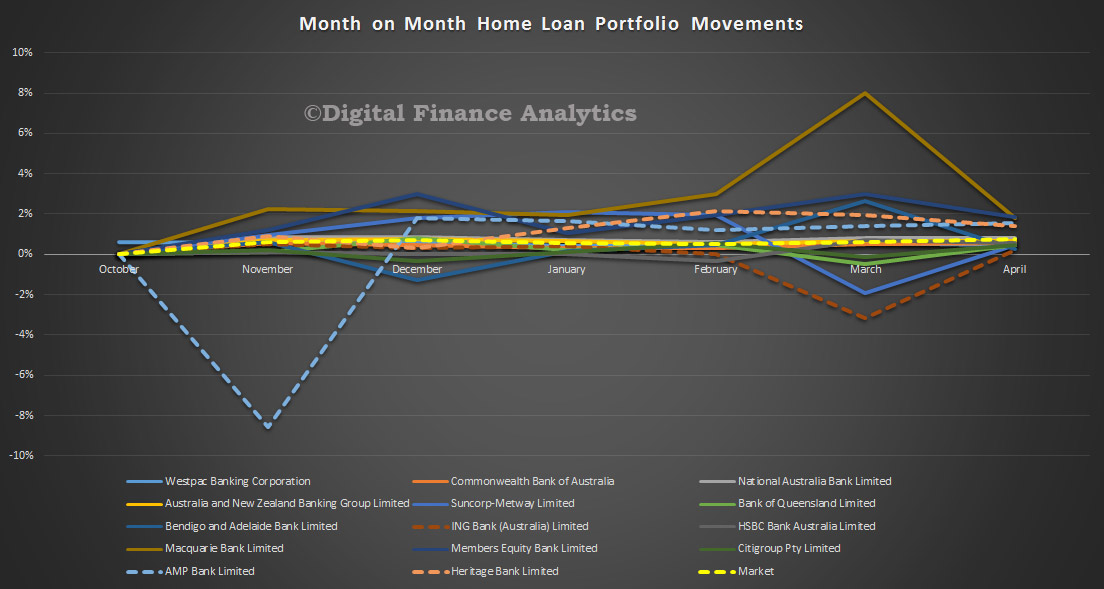

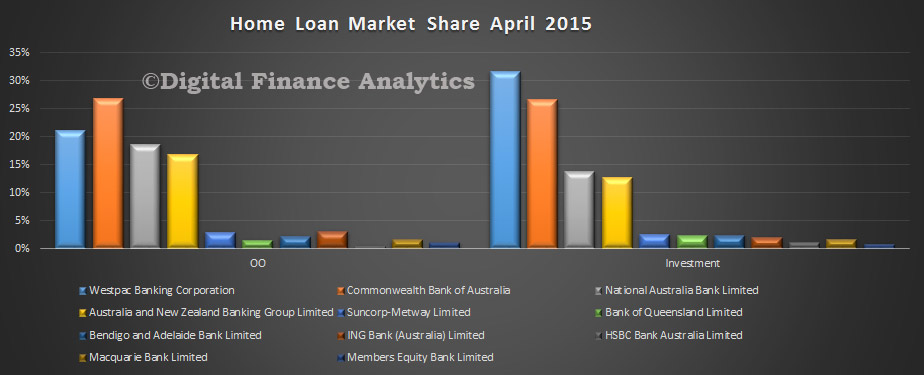

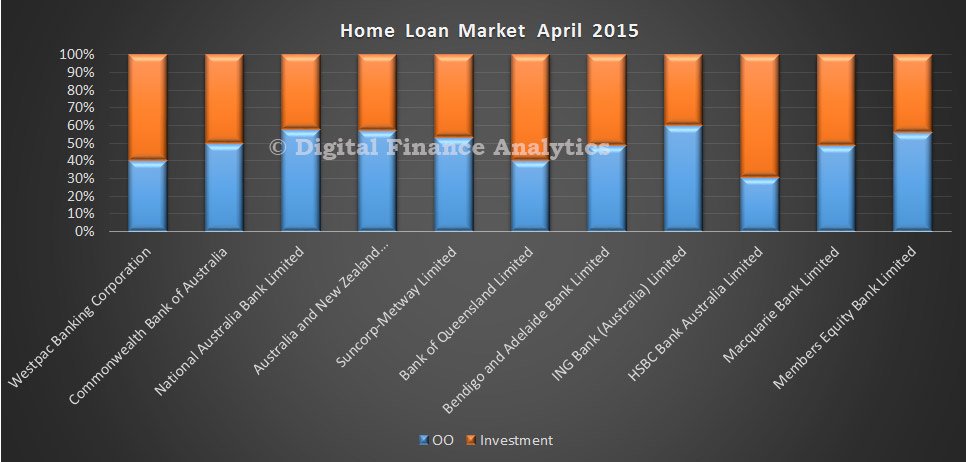

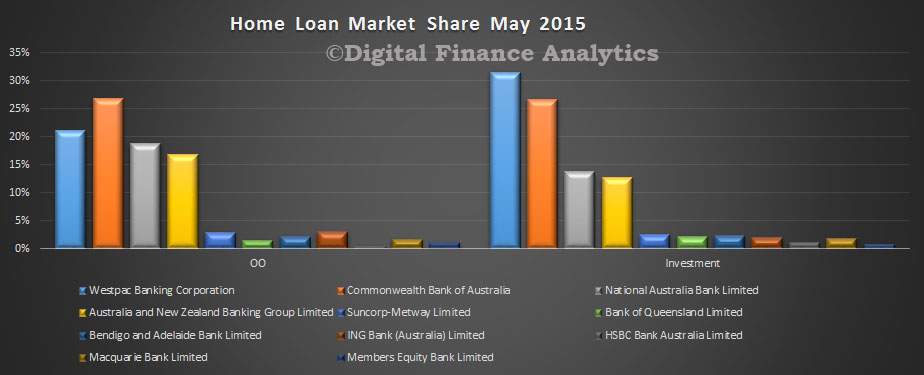

Looking in more detail at the individual lenders, CBA still leads the majors in the owner occupied loan stakes, and Westpac is ahead on investment mortgages, by a distance.

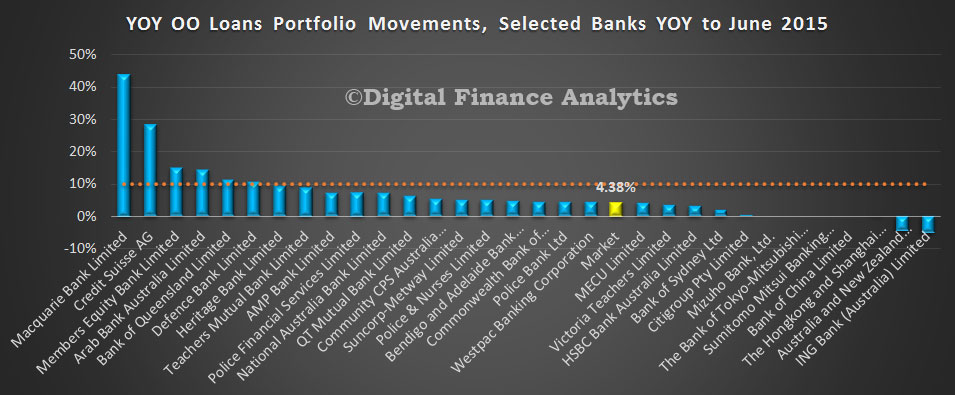

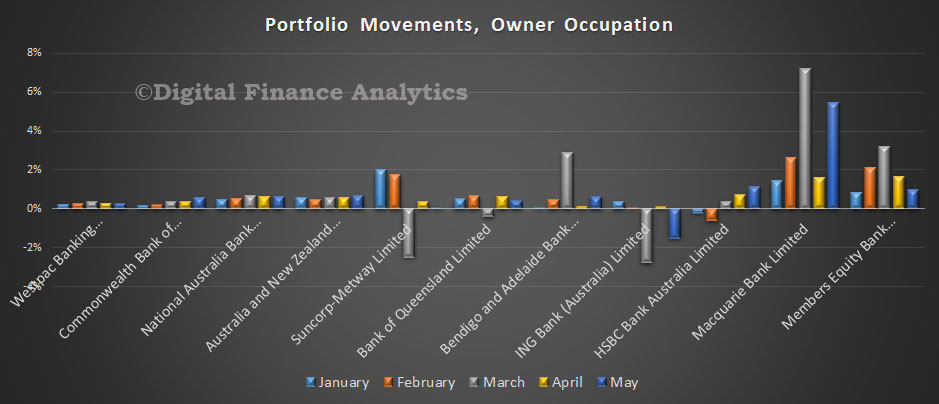

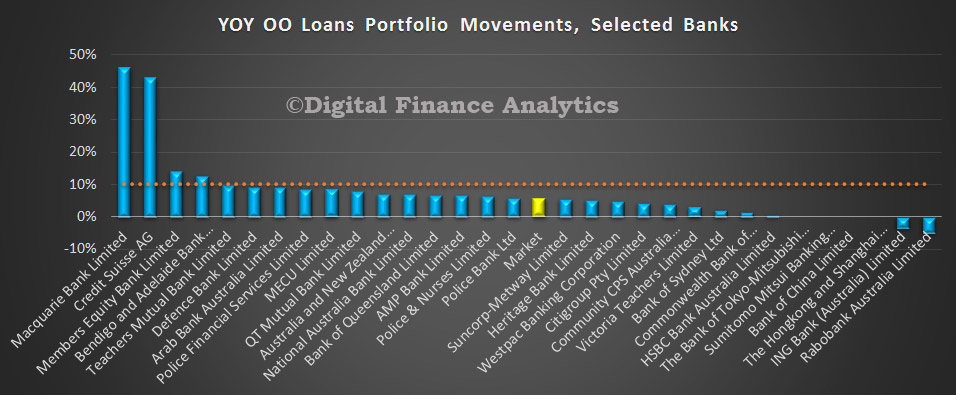

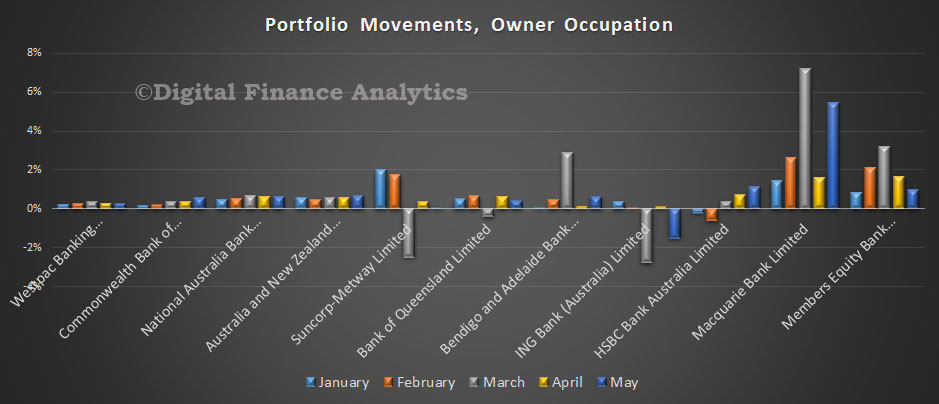

More detailed portfolio analysis shows that ANZ and NAB have been more aggressive on owner occupied loan growth than the other majors, but some of the smaller players are still making hay; Macquarie and Members Equity in particular.

More detailed portfolio analysis shows that ANZ and NAB have been more aggressive on owner occupied loan growth than the other majors, but some of the smaller players are still making hay; Macquarie and Members Equity in particular.

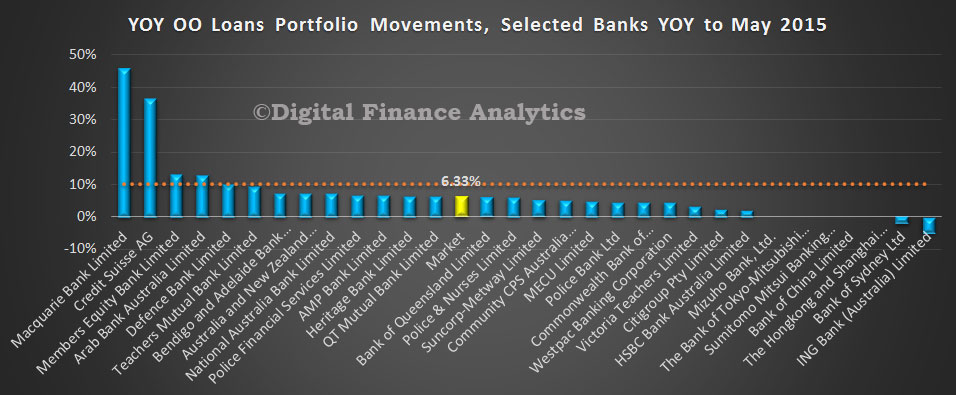

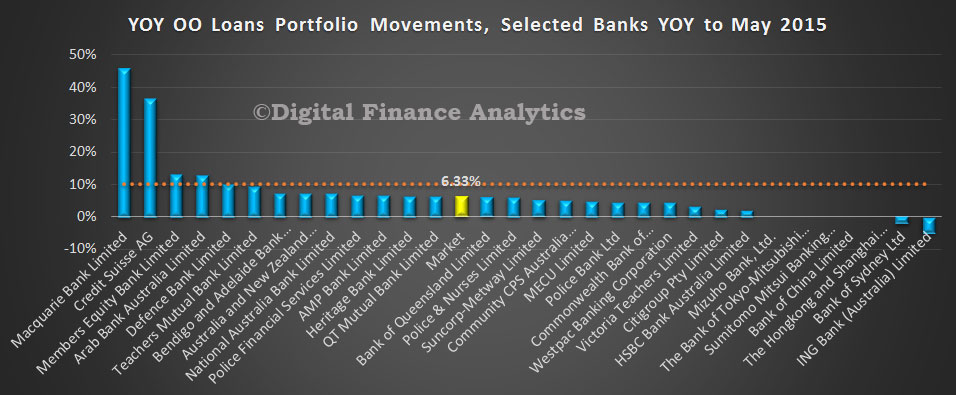

The average growth rate over the last 12 months was 6.33%, and we see many players below this, and ING’s portfolio share falling.

The average growth rate over the last 12 months was 6.33%, and we see many players below this, and ING’s portfolio share falling.

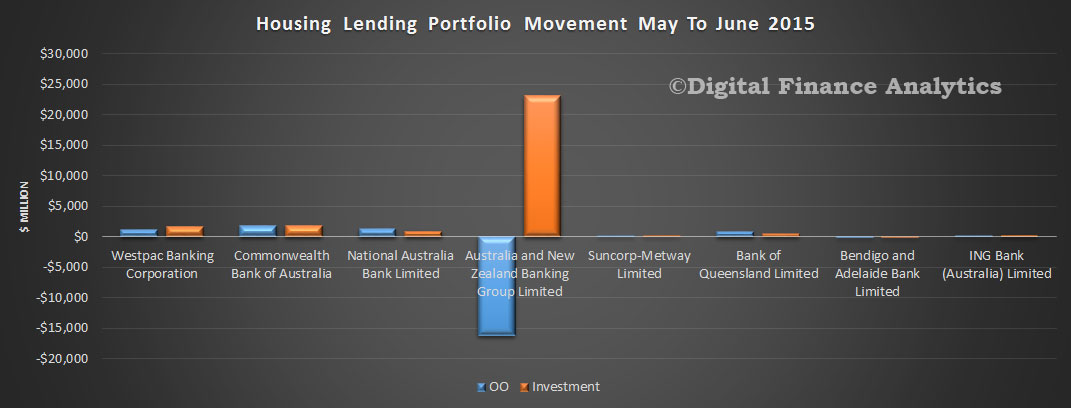

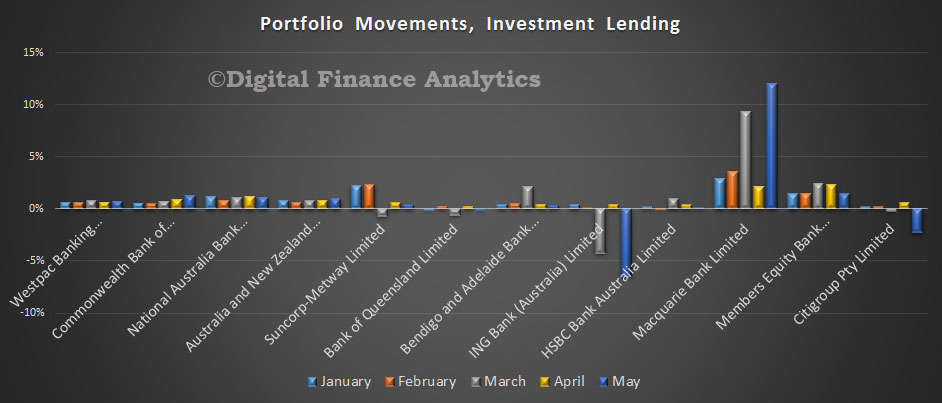

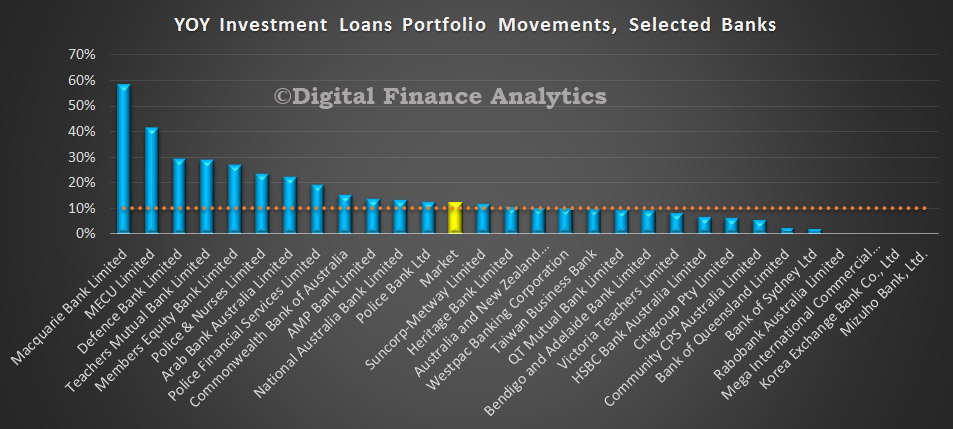

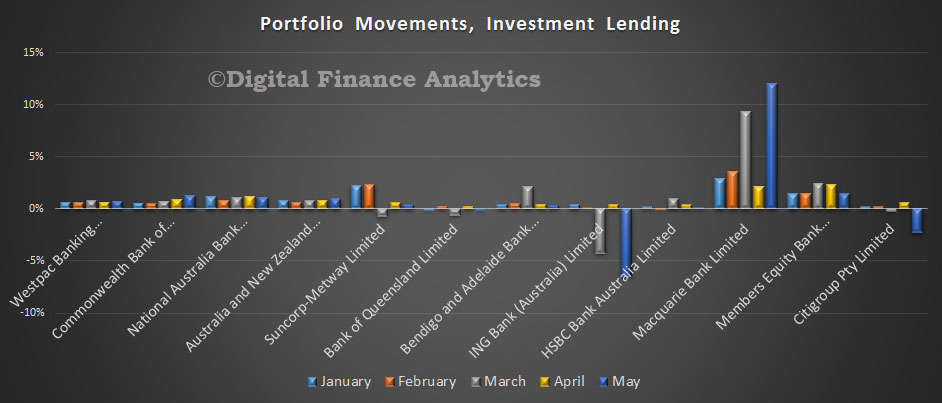

Turning to portfolio movements on investment loans, Westpac has slowed their growth relative to the other majors, and Macquarie is still lending hard.

Turning to portfolio movements on investment loans, Westpac has slowed their growth relative to the other majors, and Macquarie is still lending hard.

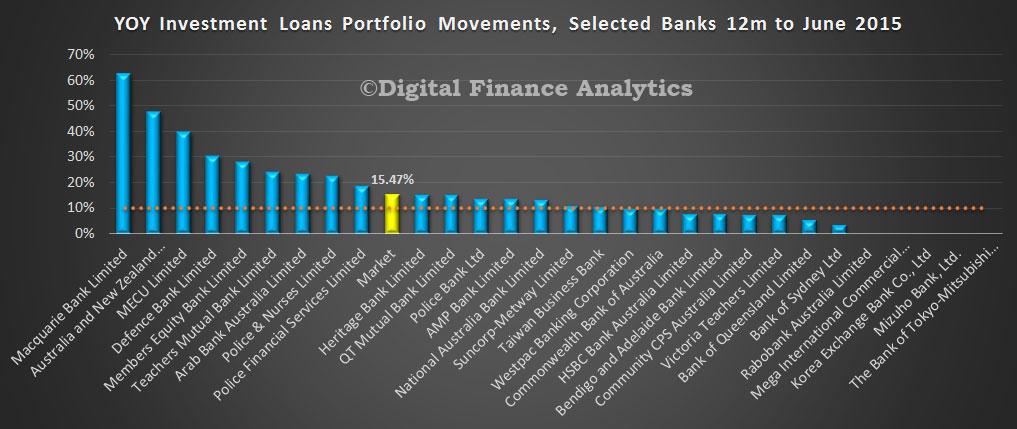

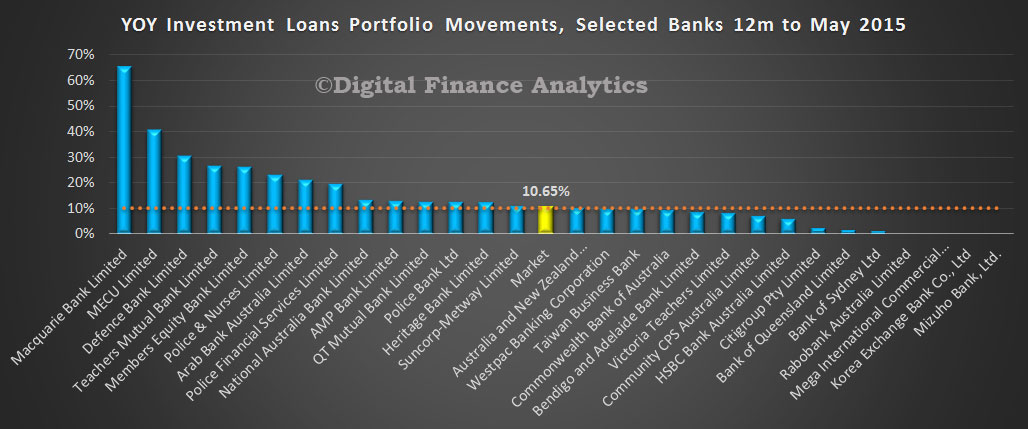

The market average growth over the past year was 10.65%, above the 10% APRA “alert” level. Some of the smaller players are well above (and we think APRA was concerned about some of these players and their rapid growth). We also see several of the majors above the threshold and they might expect to receive a “please explain” letter from the regulator. That said, no-one is clear on when the 10% hurdle should be measured from, so they might have until December to get into line. If they do, they would be required to slow their growth in coming months. There are some signs of discounts falling and LVR thresholds lowering. The regulatory noose may be tightening, but so far to little effect.

The market average growth over the past year was 10.65%, above the 10% APRA “alert” level. Some of the smaller players are well above (and we think APRA was concerned about some of these players and their rapid growth). We also see several of the majors above the threshold and they might expect to receive a “please explain” letter from the regulator. That said, no-one is clear on when the 10% hurdle should be measured from, so they might have until December to get into line. If they do, they would be required to slow their growth in coming months. There are some signs of discounts falling and LVR thresholds lowering. The regulatory noose may be tightening, but so far to little effect.

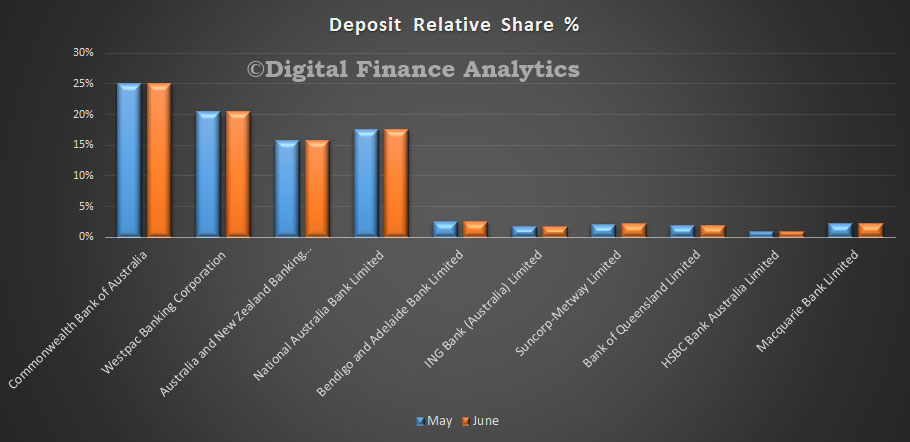

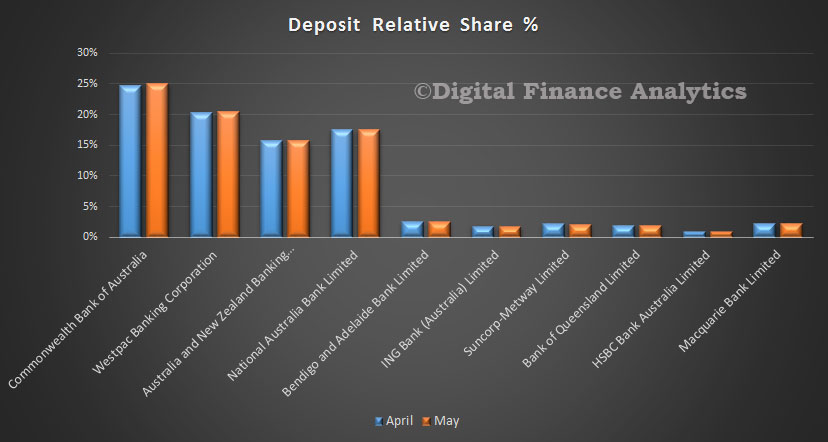

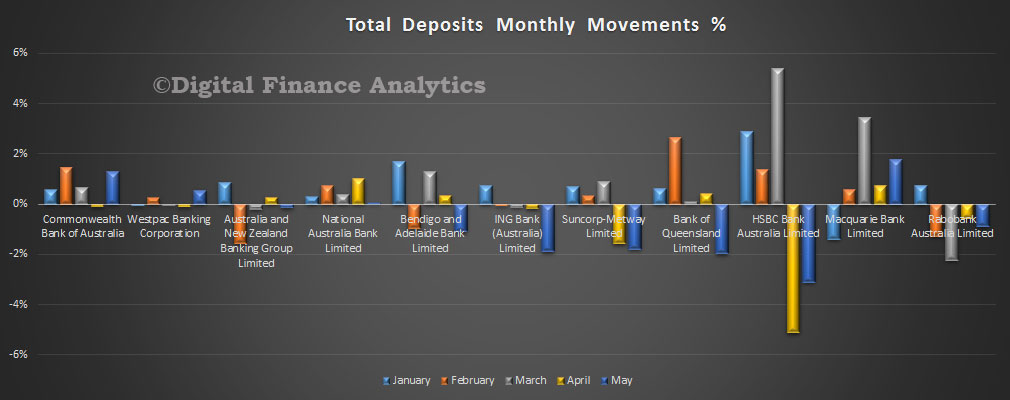

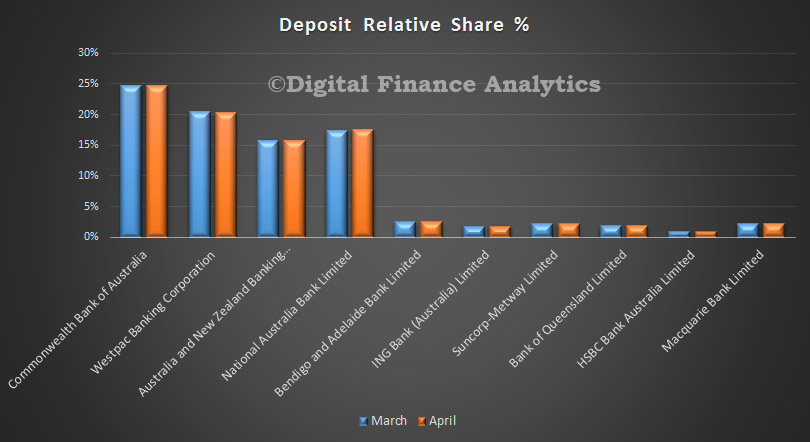

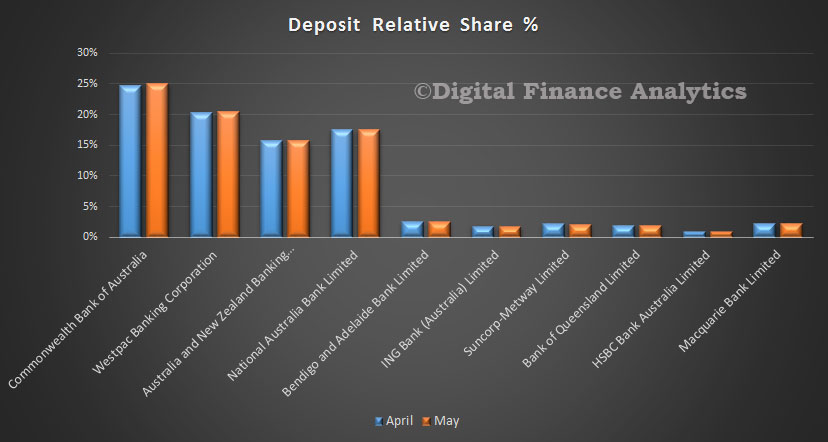

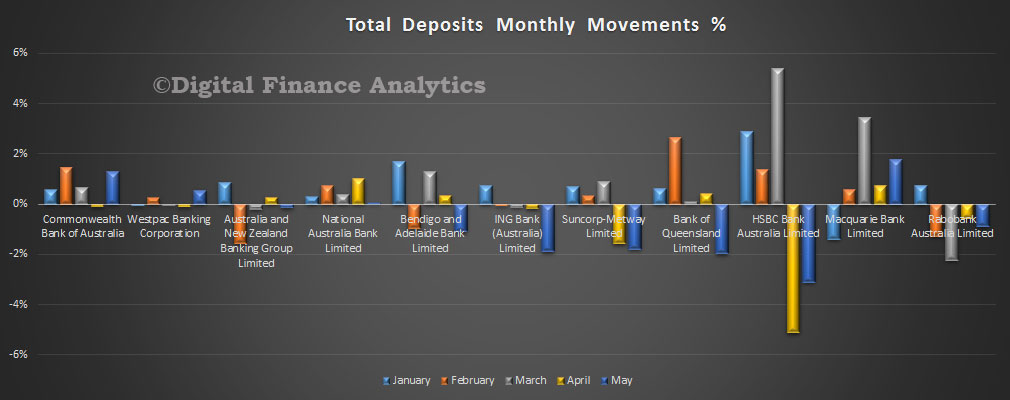

Turning to deposits, we saw growth of 0.04% to $1,83 trillion.

Turning to deposits, we saw growth of 0.04% to $1,83 trillion.

CBA picked up share a little at the expense of some of the smaller lenders, including ING, Bendigo, Suncorp, Bank of Queensland and Rabobank. Many of the smaller players have cut their deposit rates harder to “manage” profitability (i.e. squeeze savers).

CBA picked up share a little at the expense of some of the smaller lenders, including ING, Bendigo, Suncorp, Bank of Queensland and Rabobank. Many of the smaller players have cut their deposit rates harder to “manage” profitability (i.e. squeeze savers).

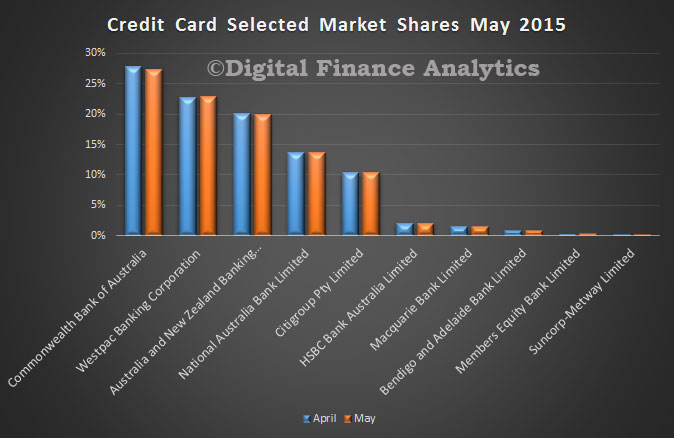

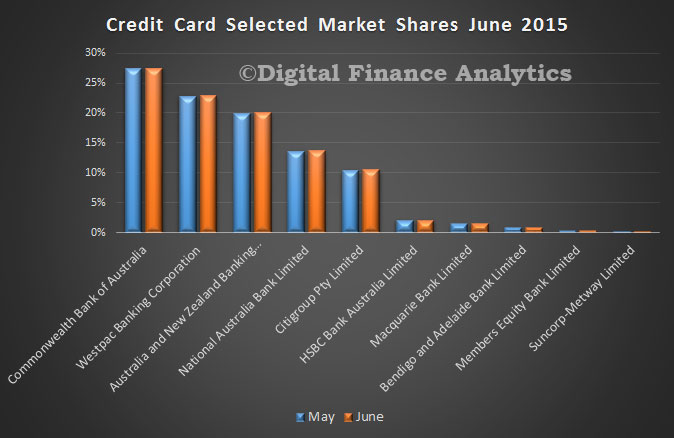

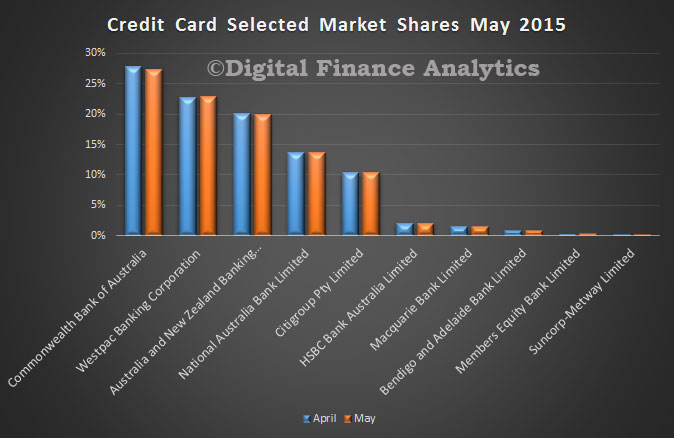

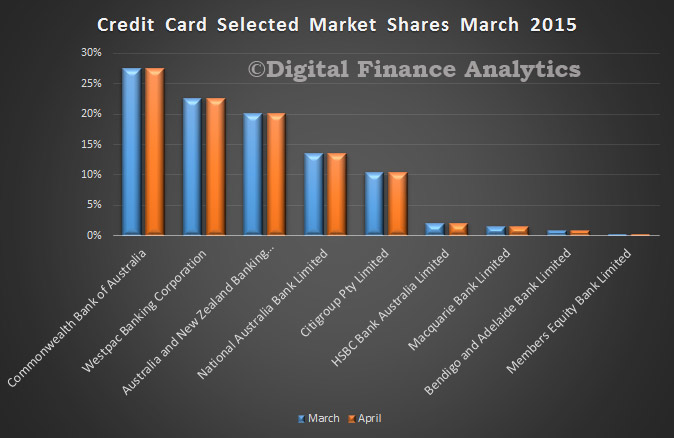

Finally, credit cards, total borrowing fell 0.38% in the month, to $41.2 billion. Little overall change in position, though we note CBA lost a little share, whilst Westpac gained slightly. The current focus on card interest rates may have an impact in coming months, but little impact so far.

Finally, credit cards, total borrowing fell 0.38% in the month, to $41.2 billion. Little overall change in position, though we note CBA lost a little share, whilst Westpac gained slightly. The current focus on card interest rates may have an impact in coming months, but little impact so far.