Finance Brokers Association of Australia (FBAA) has lodged its response to the royal commission’s interim report, arguing that brokers should not be “forced into even more documentary disclosure” regarding commissions and reiterating its support of the current remuneration structure, via The Adviser.

The interim report from the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry was released at the end of September, raising a swathe of questions regarding the mortgage broking industry.

In the report, the commission questioned some aspects of broker remuneration (including the perceived conflicts of upfront and trail commissions based on loan value and the now largely defunct volume-based commissions), outlined that there was “no simple legal answer” for explaining whom an intermediary (such as a broker) acts for, and questioned the need for a new duty on brokers.

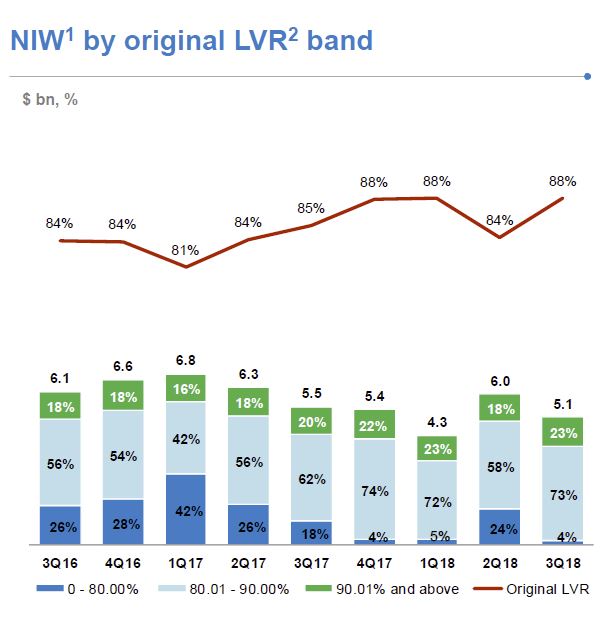

“[I]t will be important to consider whether value and volume-based remuneration of intermediaries should be forbidden,” the commissioner wrote in his report, outlining findings from ASIC’s remuneration review that found that broker loans are marginally larger and have slightly higher loan-to-value ratios (LVRs).

While the full responses to the financial services royal commission have not yet been officially released, the Finance Brokers Association of Australia (FBAA) has revealed that it has tabled a “substantive submission” focusing on disclosure obligations, remuneration structures, compliance with existing laws, and the commission’s call for greater regulation.

Speaking of the association’s submission, FBAA managing director Peter White warned of any wholesale changes to the current broker remuneration model, arguing that major change may be detrimental to the industry.

“We are concerned that a change to the existing structure without fully understanding the impact of any proposed model may simply disrupt a stable and important profession with no corresponding improvement,” Mr White said.

“The majority of misconduct has been due to market participants failing to follow existing laws. This shows that further reforms should not be contemplated until there is compliance with current laws.”

The FBAA also said that its submission disputes claims that lenders paying value-based upfront and trail commissions could be a possible breach of the National Consumer Credit Protection Act (NCCP).

“The relevant section does not prohibit conflicts of interest, only those causing disadvantage, yet the term disadvantage is imperfect and can’t be relied on. It’s our submission that the laws already in place strike an appropriate balance,” Mr White said.

Touching on remuneration disclosure to brokers, the FBAA emphasised that brokers already provide “lengthy disclosure documents”, while the NCCP Act ensures that clients are well informed about the costs and commissions.

“We don’t want brokers to be forced into even more documentary disclosure and that view accords with ASIC’s findings that consumers can disengage because of information overload,” Mr White said.

The managing director of the FBAA concluded that that while the association agrees with the commission’s interim report that improvements could be made, he “agreed” that new laws or regulations are not necessarily the answer.

“Some of the responses to the royal commission have verged on emotional or value proposition statements, and while most have merit, we have deliberately taken a strong legal approach to our language to ensure our messages are clearly understood by the commissioner, a High Court Judge,” Mr White said.

The seventh round of hearings for the final round of the financial services royal commission will be held at the Lionel Bowen Building in Sydney from 19 to 23 November and at the Commonwealth Law Courts Building in Melbourne from 26 to 30 November.

The hearings will focus on “causes of misconduct and conduct falling below community standards and expectations by financial services entities (including culture, governance, remuneration and risk management practices), and on possible responses, including regulatory reform”.

It is expected that the seventh round will be the final round of the financial services royal commission, unless Commissioner Hayne requests, and is granted, an extension.

Commissioner Kenneth Hayne is expected to release his final report, which will include the topics of the fifth, sixth and seventh rounds of hearings (focusing on superannuation, insurance and “policy questions arising from the first six rounds”, respectively) by 1 February 2019.