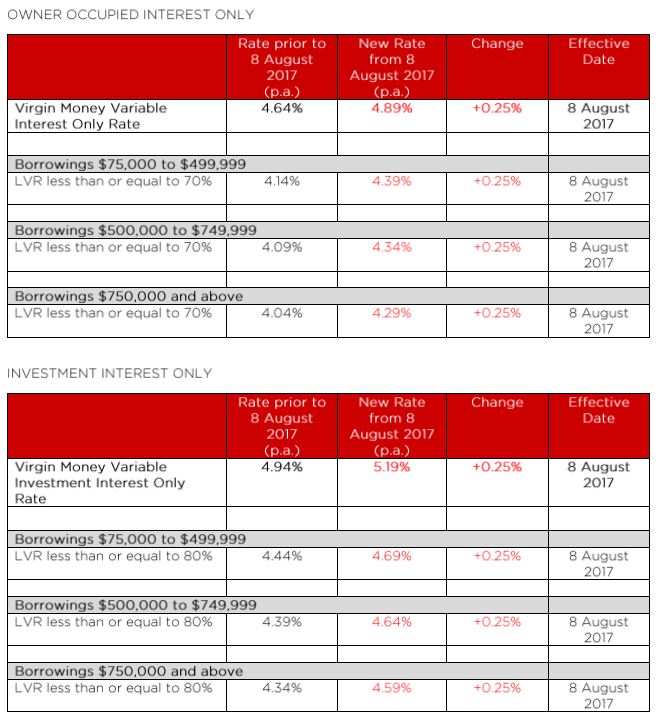

Advantedge Financial Services (Advantedge) today announced it will increase the interest rate on all new and existing variable rate interest only home loans by 0.35% p.a., effective Tuesday 8 August 2017.

Advantedge is part of the National Australia Bank Group (NAB) and is Australia’s leading wholesale funder and distributor of white-label home loans.

Australian Broker. says from today, the interest rate on all new fixed rate interest only home loans will increase by 0.35% p.a.

These changes apply to both owner occupier and residential investor home loans, across all of Advantedge’s white label partners.

Brett Halliwell, general manager of Advantedge, said these changes will ensure Advantedge complies with regulatory requirements, including managing interest only lending for residential mortgages.

“Our products are highly competitive and delivered with exceptional service,” Halliwell said.

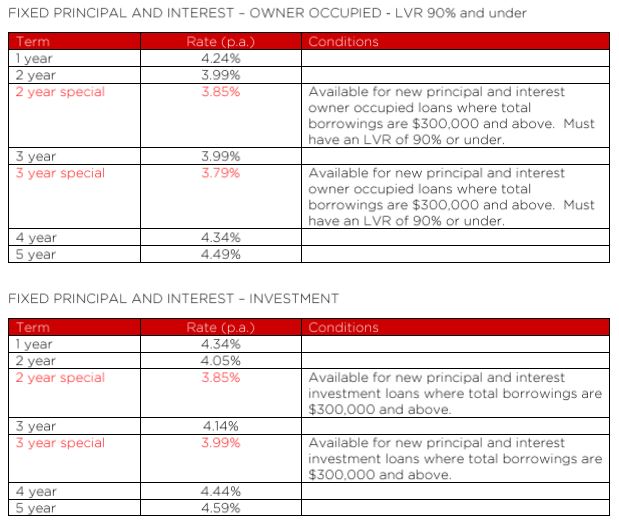

“Advantedge is focused on ensuring a positive customer and broker experience, and we continue to offer highly competitive variable rate special offers for new principal and interest lending.”

Currently, Advantedge is offering a special 3.74% p.a. principal and interest variable rate for new owner occupier borrowers, and 4.24% p.a. for new principal and interest investor borrowers. Eligibility criteria apply.

“We encourage all brokers to discuss with customers whether a principal and interest home loan may be more suitable for them,” Halliwell said.