Steve Mickenbecker is the Group Executive, Financial Services at Canstar. In this discussion we explore the rate options and whether fixing a mortgage at the moment is a smart move.

Tag: Mortgage Rates

Rates: How Low Will They Go? – With Steve Michenbecker

Steve Mickenbecker is the Group Executive, Financial Services at Canstar. I discuss the recent rates changes across the markets in Australia, consider the implications for savers, and touch on negative rates down the track.

When Is A Rate Not THE Rate? – With Steve Mickenbecker

I discuss mortgage rates with Canstar’s Steve Mickenbecker, and how its possible to save thousands of dollars over the life of a mortgage. We discuss the “apathy tax” and what we can do about it!

RBA Says Borrowers With Older Mortgages Pay Higher Interest Rates

For variable-rate mortgages, older loans typically have higher interest rates than new loans, even for borrowers with similar characteristics. This means that existing borrowers who are able to refinance with another lender or negotiate a better deal with their existing lender can achieve interest savings. This box examines the extent to which borrowers with older mortgages pay higher interest rates and considers the drivers of this. From the RBA Statement On Monetary Policy.

Interest rates are higher on older loans

The difference in interest rates between new and outstanding variable-rate home loans increases with the age of the loan. Just under half of all variable-rate home loans in the Reserve Bank’s Securitisation Dataset were originated four or more years ago. Currently, these loans have an interest rate that is around 40 basis points higher than new loans (Graph C.1). For a loan balance of $250,000, this difference implies an extra $1,000 of interest payments per year.

Some of the difference in rates between older and newer mortgages can be explained by a shift in the mix of different types of variable-rate mortgages over time. In particular, the share of interest-only and investor loans in new lending has declined noticeably in recent years and these tend to have higher interest rates than other loans. Nevertheless, even within given types of mortgages, older mortgages still tend to have higher interest rates than new mortgages. The right-hand panel of Graph C.1 shows this for principal-and-interest owner-occupier loans, which account for around 55 per cent of mortgages. Moreover, higher interest rates for older loans has been a feature of variable-rate mortgages for several years (Graph C.2).

There is strong competition for new borrowers

In part, the variation in interest rates paid by different borrowers reflects their creditworthiness or the riskiness and features of loans. In addition, it reflects the different interest rates offered by different lenders. However, the time at which the mortgage was taken out also has an important influence on the interest rate paid. This reflects the tendency for competitive pressures to be strongest for new and other borrowers who are in the process of shopping around for a loan.

The discounts that borrowers receive have increased in recent years

Very few borrowers actually pay interest rates as high as the standard variable rates (SVRs) published by lenders. While SVRs are the reference rates against which variable-rate loans are priced, lenders also advertise a range of interest rates that are materially lower than their SVRs.[1], [2] In addition, most individual borrowers are offered, or may be able to negotiate, further discounts on the interest rate applied to their loan. For instance, the major banks’ ‘package’ mortgage interest rates for owner-occupier loans currently attract a discount of around 50–100 basis points to SVRs.[3] The lowest advertised rates are around 100 basis points lower than those package rates, and a few borrowers receive even larger discounts.

Indeed, in recent years, the average discounts relative to SVRs offered by major banks on new variable-rate mortgages have grown, widening from around 100 basis points in 2015 to more than 150 basis points in 2019 (Graph C.3). By increasing the discounts on rates for new or refinancing borrowers over time, rather than lowering SVRs, banks are able to compete for new borrowers without lowering the interest rates charged to existing borrowers. So the rise in the average differential between SVRs and interest rates charged on outstanding variable-rate loans reflects the increased discounting on more recently originated loans. The discounts borrowers receive on loans are usually fixed over the life of the loan, although they can be renegotiated. Indeed, interest rates charged on outstanding variable-rate loans have declined by more than SVRs in recent times in part because well-informed borrowers have been able to negotiate a larger discount with their existing lender, without the need to refinance their loan.

In January 2020, the Reserve Bank began publishing more detailed monthly data on mortgage interest rates paid by households on new and existing mortgages (see ‘Box D: Enhancing the Transparency of Interest Rates’), which may help more households to make better-informed choices about their mortgages.

Endnotes

Lenders usually advertise a number of SVRs; often the applicable rate will depend on whether the property will be used for an owner-occupied or investment purpose, and whether the borrower elects to repay the principal of a loan or the interest only. [1]

For more information see RBA (2019), ‘Box D: The Distribution of Variable Housing Interest Rates’, Statement on Monetary Policy, November, pp 59–60. [2]

A typical package mortgage has additional features beyond a ‘basic’ mortgage, such as an offset account, but will attract a higher fee. It may be offered in conjunction with discounts on other products, such as credit cards and insurance policies.

CBA Withholds Some Of The Rate Cut Margin

Commonwealth Bank has responded to the Reserve Bank of Australia’s cash rate decision by reducing home loan interest rates.

New Standard Variable Rates

- Owner Occupied Principal and Interest Standard Variable Rate home loans reduced by 0.13% per annum (p.a) to 4.80% p.a.

- Investor Principal and Interest Standard Variable Rate home loans reduced by 0.13% p.a. to 5.38% p.a.

- Owner Occupied Interest Only Standard Variable Rate home loans reduced by 0.13% p.a. to 5.29% p.a.

- Investor Interest Only Standard Variable Rate home loans reduced by 0.25% p.a. to 5.64% p.a.

New Fixed Rates

- 2 and 3 Year Owner Occupied Principal and Interest Fixed Rates in the Wealth Package reduced to 2.99% p.a. available from Thursday.

Commonwealth Bank has responded to the Reserve Bank of Australia’s (RBA) cash rate decision by reducing the Standard Variable Rate (SVR) for home loan customers by between 0.13% p.a. and 0.25% p.a.

“Today’s announcement means our SVR for Owner Occupied customers, with Principal and Interest repayments, will be at record low levels,” Angus Sullivan, Group Executive Retail Banking Services said.

“As the Reserve Bank cash rate has reached record lows, we face a difficult balancing act between the multiple, valid interests of our stakeholders. Particularly given it is currently not feasible to pass on the full rate reduction to more than $160 billion of our deposits which are at, or near, zero rates.

“In balancing these interests, we have carefully considered how to best meet the needs of over 6 million savings customers – who may find it challenging to make ends meet with record low savings interest rates – with the needs of our 1.6 million home loan customers, who want to pay less on their mortgages; and the needs of our shareholders, many of whom are retirees who rely on our dividend.

“In this environment, while reducing the SVR for home loan customers by between 0.13% p.a. and 0.25% p.a., we have also decided to limit the base rate reduction for savings customers in our popular NetBank Saver product to 0.05%. These changes are in addition to the fee removals, fee reductions and pre-emptive fee alerts we have already introduced, which have helped save our customers over $415 million.

“We are also announcing a new 2.99% p.a. 2 and 3 year Owner Occupied Principal and Interest Fixed Rate, available to new and existing Wealth Package customers taking out a Fixed Rate loan. This allows customers who prefer certainty to lock-in this historically low rate. This means we have reduced our 2 and 3 year Fixed Rates by 0.80% p.a. since July for Owner Occupied Principal and Interest customers,” Mr Sullivan said.

For Owner Occupied customers paying Principal and Interest, the SVR has reduced by 0.57% p.a. since June, which on a $400,000 home loan equates to a reduction in the minimum monthly repayment of $140 or an annual saving of $1680.

For Investor customers paying Interest Only, the SVR has reduced by 0.75% p.a. since June, which on a $400,000 home loan, equates to a monthly saving of $250 or an annual saving of $3000.

Customers who have questions regarding today’s rate change are encouraged to speak to one of our home lending specialists in branch or over the phone.

- The new SVR will take effect on 22 October 2019

- The new Fixed Rates will be available to new and existing customers switching to a Fixed Rate on 3 October 2019

- The NetBank Saver base rate reduction will take effect on 4 October 2019

The Banks Respond To The Cash Rate Cut

The big four all announced cuts in their variable mortgage rate (around 75% of borrowers are on variable rates), but the amount of the cuts and the timing does vary between banks.

Both the RBA Governor and The Treasurer on the record said the banks should pass through the full cuts. Borrowers should shop around and demand a better rate – which is always good advice!

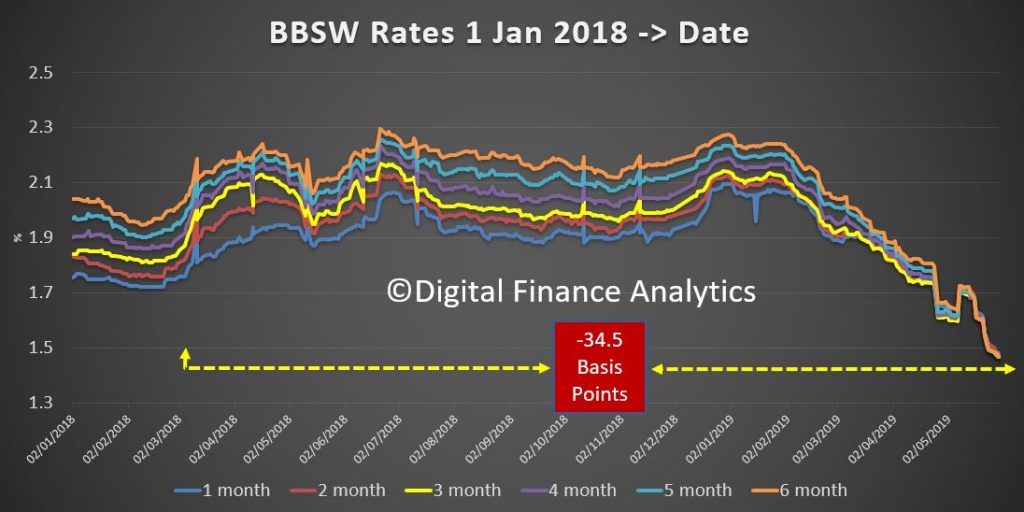

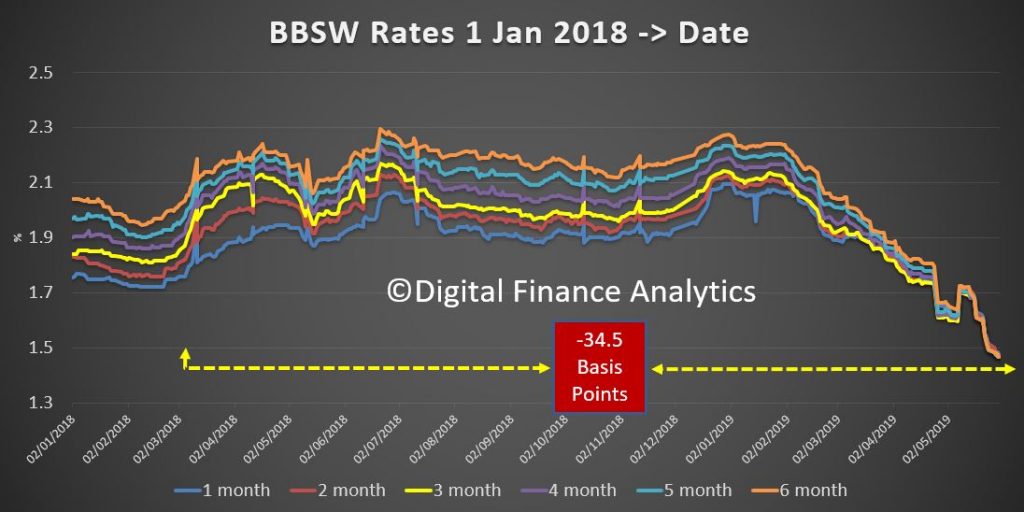

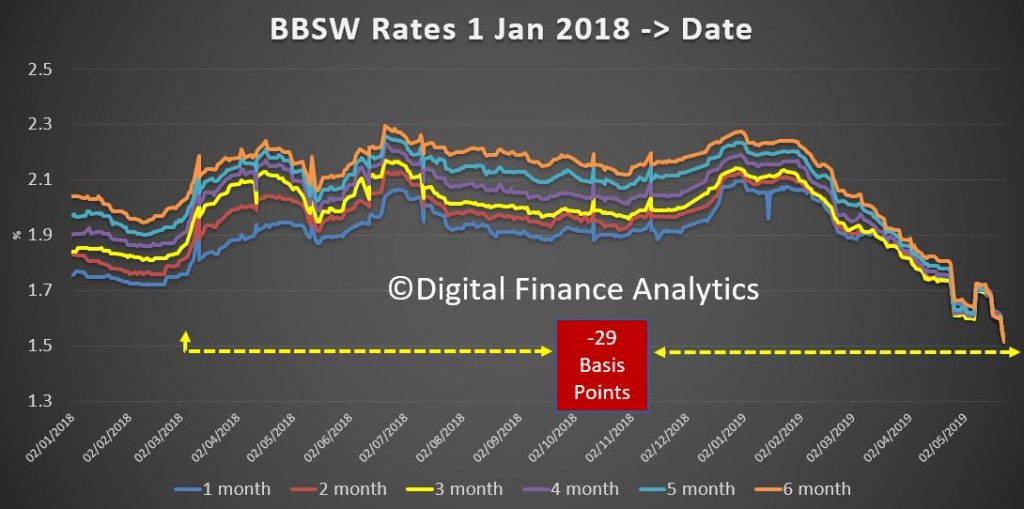

The funding position of the banks, as represented by the BBSW is also supportive of a pass though.

Analysts were expecting about half to pass through, which would be neutral to profits, thus, those who pass through more will see their margins compressed, and it is certain they will cut deposits rates to alleviate this. Funny how deposit rate cuts are hardly reported, and never make the headlines.

As a rule of thumb, a 5 basis point net margin reduction translates into a 1% fall in profit.

One problem is that many call deposits are close to zero now, so expect a bigger trimming of term deposit rates. We also expect some savers to pull funds from deposits to try other investments with a higher return, though with higher risks.

This is how the majors came out:

ANZ

Their Australian variable mortgage rates to decrease by 18 basis points, which is 7 basis points lower than the RBA 25 basis point cash rate cut. This will be effective from the 14th June.

CBA

Their Australian variable rate home loans will decrease by 25 basis points. This will be effective from 25th June. Given their better systems this is a deliberate delay in my view, to protect profits.

NAB

Their Australian variable rate home loans will decrease by 25 basis points. This will be effective from the 14th June.

Westpac

Their Australian variable mortgage rate will decrease by 20 basis point, though its Investor interest-only home loans will reduce by 35 basis points. This will be effective from the 18th June.

Generally investment mortgages now carry a higher mortgage rates than owner occupied lending of course.

Regionals and smaller players already have margin pressures and competitive disadvantage to cope with, yet they will have to keep their rates in line with the market to maintain new and existing business flows.

We are entering a diabolical phase in our interest rate history, and this signals ongoing economic weakness.

RBA Cuts As Expected

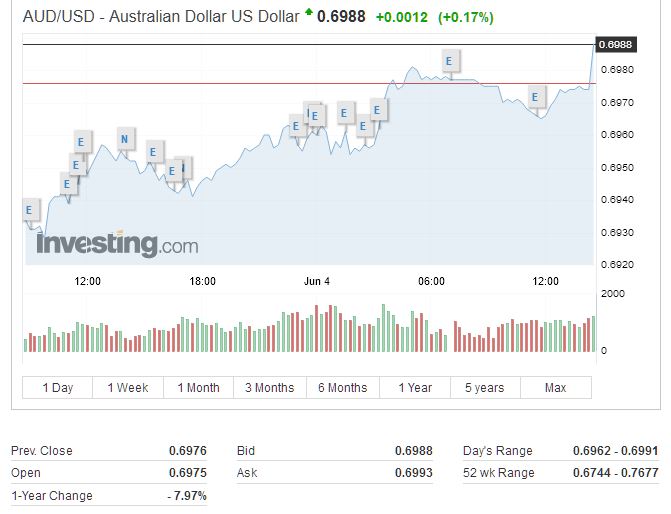

The RBA has reduced the cash rate by 0.25% today as expected. Further signs of a weakening economy, exposed to the international risks which are rising.

Given the BBSW has moved towards the banks in recent times, there is no excuse not to pass the full cut to existing borrowers. The question is, will they?

The RBA will continue to look at the labour figures, which suggests a rise in unemployment (which we expect) will lead to more rate cuts.

The Aussie USD rate rose, which is not what the RBA intended.

This is what the RBA said:

At its meeting today, the Board decided to lower the cash rate by 25 basis points to 1.25 per cent. The Board took this decision to support employment growth and provide greater confidence that inflation will be consistent with the medium-term target.

The outlook for the global economy remains reasonable, although the downside risks stemming from the trade disputes have increased. Growth in international trade remains weak and the increased uncertainty is affecting investment intentions in a number of countries. In China, the authorities have taken steps to support the economy, while addressing risks in the financial system. In most advanced economies, inflation remains subdued, unemployment rates are low and wages growth has picked up.

Global financial conditions remain accommodative. Long-term bond yields and risk premiums are low. In Australia, long-term bond yields are at historically low levels. Bank funding costs have also declined further, with money-market spreads having fully reversed the increases that took place last year. The Australian dollar has depreciated a little over the past few months and is at the low end of its narrow range of recent times.

The central scenario remains for the Australian economy to grow by around 2¾ per cent in 2019 and 2020. This outlook is supported by increased investment in infrastructure and a pick-up in activity in the resources sector, partly in response to an increase in the prices of Australia’s exports. The main domestic uncertainty continues to be the outlook for household consumption, which is being affected by a protracted period of low income growth and declining housing prices. Some pick-up in growth in household disposable income is expected and this should support consumption.

Employment growth has been strong over the past year, labour force participation has been increasing, the vacancy rate remains high and there are reports of skills shortages in some areas. Despite these developments, there has been little further inroads into the spare capacity in the labour market of late. The unemployment rate had been steady at around 5 per cent for some months, but ticked up to 5.2 per cent in April. The strong employment growth over the past year or so has led to a pick-up in wages growth in the private sector, although overall wages growth remains low. A further gradual lift in wages growth is expected and this would be a welcome development. Taken together, these labour market outcomes suggest that the Australian economy can sustain a lower rate of unemployment.

The recent inflation outcomes have been lower than expected and suggest subdued inflationary pressures across much of the economy. Inflation is still however anticipated to pick up, and will be boosted in the June quarter by increases in petrol prices. The central scenario remains for underlying inflation to be 1¾ per cent this year, 2 per cent in 2020 and a little higher after that.

The adjustment in established housing markets is continuing, after the earlier large run-up in prices in some cities. Conditions remain soft, although in some markets the rate of price decline has slowed and auction clearance rates have increased. Growth in housing credit has also stabilised recently. Credit conditions have been tightened and the demand for credit by investors has been subdued for some time. Mortgage rates remain low and there is strong competition for borrowers of high credit quality.

Today’s decision to lower the cash rate will help make further inroads into the spare capacity in the economy. It will assist with faster progress in reducing unemployment and achieve more assured progress towards the inflation target. The Board will continue to monitor developments in the labour market closely and adjust monetary policy to support sustainable growth in the economy and the achievement of the inflation target over time.

BBSW Lower = Banks Sitting On Margin Advantage

The Bank Bill Swap Rate continues to track down, which means that Banks are sitting on considerable funding advantage, which is being used to discount attractor mortgage rates.

However, there is a strong case now for banks to reverse their out of cycle rate hikes imposed on borrowers over recent months, irrespective of whether the RBA moves the cash rate down next month.

This would help household with their budgets, and help support the weakening economy. They could also stop the rot in terms of falling bank deposit rates.

The question is, will they?

More Mortgage Rate Tweaks

Three banks – two non-major and one ‘big four’ – have announced changes to their loan offerings, several of which cater to customers with a higher LVR, via Australian Broker.

Both Macquarie and ME Bank rolled out home loan rate changes for new customers, while ANZ has implemented changes to its interest-only lending criteria.

“Just when we thought the banks were finding the kitchen a little too hot, we have seen ANZ and ME Bank move to encourage borrowers at the higher end of the LVR scale,” said Canstar’s group executive of financial services, Steve Mickenbecker.

At Macquarie, for both P&I and interest only repayment, owner occupier fixed rate loans will decrease by 0.09% and 0.20% and investment fixed rate loans will decrease by 0.05% and 0.10% for 1-, 2- and 3-year loans.

At ME Bank, owner occupier variable rate loans with principal repayments, for an LVR of more than 90%, will decrease by 0.80%. Investment variable rate loans with P&I repayments, for an LVR of 80% to 90%, will decrease by 0.27%.

This means that ME Bank’s P&I home loan will decrease from 5.26% to 4.46%, potentially saving borrowers tens of thousands in interest over the life of a longer-term loan.

“The reduction for owner occupiers at the very low deposit end of the market sounds bullish, but the reduction leaves ME mid range in the market,” said Mickenbecker.

The changes at both non-major banks went into effect on 15 March 2019.

ANZ announced that, as of 25 March 2019, the interest-only loan term will increase to 10 years, up from five. Additionally, interest-only loans will have a maximum LVR of 90%, up from the current 80% LVR.

According to Mickenbecker, through raising the LVR by 10%, ANZ is responding to its “over-reaction to the APRA tightening and is now moving to restore market share in the slow investor market.”

He continued, “Lengthening the interest only period will provide attractive differentiation in the market, but also give housing prices and wages time to recover before repayments have to increase to accommodate principal reductions. This should also improve customer retention rates.”

ME Bank Hikes Mortgage Rates

ME has announced it will increase its home loan interest rates for both new and existing borrowers by up to 18 basis points, effective 7 February; via The Adviser.

The lender will also increase its advertised new business variable rates by 8 basis points, effective 4 February, following a 10 basis point increase to some advertised new business variable rates in December 2018.

ME CEO, Jamie McPhee, said attributed the bank’s decision to the sustained rise in wholesale funding costs.

“The changes are in response to the sustained increase in the cost of funds,” he said.

“Bank bill swap rates (BBSW) – the key determinant of the cost of funds – have remained elevated.

“It was a difficult decision but we have sought the right balance between delivering a strong customer value proposition across our product range while responding to the sustained increase in funding costs.”

This follows a move from ING Australia, which yesterday announced that, effective from Thursday, 7 February, it will increase its variable mortgage rates for all home loan customers by up to 15 basis points.

The bank’s revised variable home loan rate now starts from 3.93 per cent.

ING’s latest rate rise follows a 10 basis point increase in July 2018, in line with rate moves from several other lenders in response to rising wholesale funding costs.

Since the turn of the year, several lenders have lifted rates out-of-cycle, including NAB and its subsidiary UBank, the Bank of Queensland (BOQ) and Virgin Money.

NAB announced increases of up to 16 basis points on its variable home loan offerings, with its subsidiary UBank also announcing increases earlier this year, lifting its fixed home loan rates by up to basis points.

The Bank of Queensland and Virgin Money have also repriced their mortgages, increasing rates earlier this month by 18 basis points and 20 basis points, respectively.

Throughout 2018, several lenders, including ANZ, the Commonwealth Bank of Australia, and Westpac, also increased rates out-of-cycle.

However, despite the second wave of out-of-cycle rate hikes, some lenders, including Heritage Bank, Adelaide Bank, and Teachers Mutual Bank, have reduced their home loan rates by as much as 32 basis points.