Join the stream live and ask a question via the chat. We will also have our new post code engine online…

Tag: Mortgage Stress

Stressing About Financial Stress

We discuss the concept of financial stress and illustrate this with an extract from our household surveys, ahead of the latest results which we will discuss on Tuesday. https://youtu.be/8gO_29PUDw8

National Debt Helpline: https://ndh.org.au/

https://mozo.com.au/family-finances/where-to-find-free-financial-counselling-services-in-australia

Mortgage, Rental And Investor Stress Rose In July 2020

DFA has released our latest results from our rolling 52,000 household surveys. As a result of the economic slowdown (which was already underway before COVID) and exacerbated by the COVID restrictions, more households are falling into financial stress.

We define stress in cash flow terms – money in and money out – for both rental and mortgage stress, with those in negative cash flow flagged as stressed. Investor stress is assessed by different means, including negative cash flow, extended vacancy rates, intention to sell and other factors. In the round while the various Government support schemes, and repayment holidays, plus rental freezes are assisting, the downward trajectory in finances is clear, and explains the rising stress.

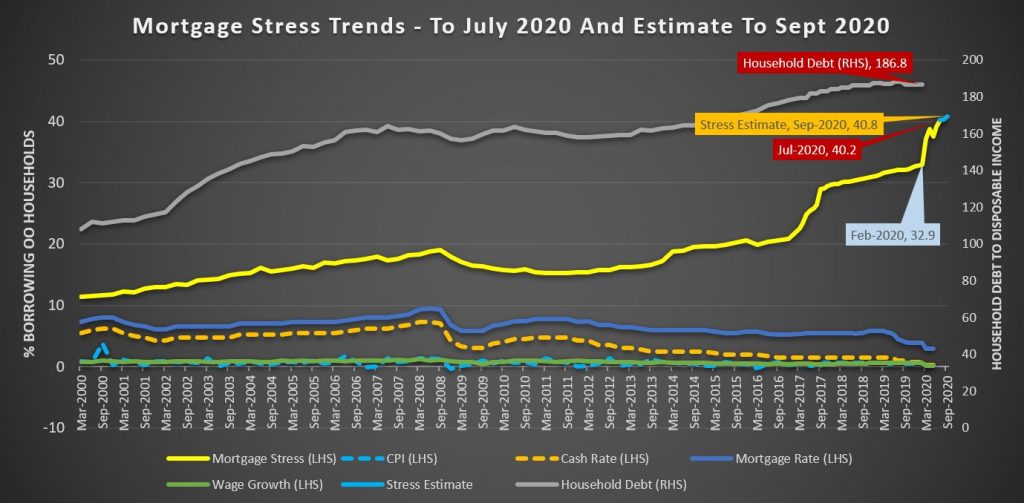

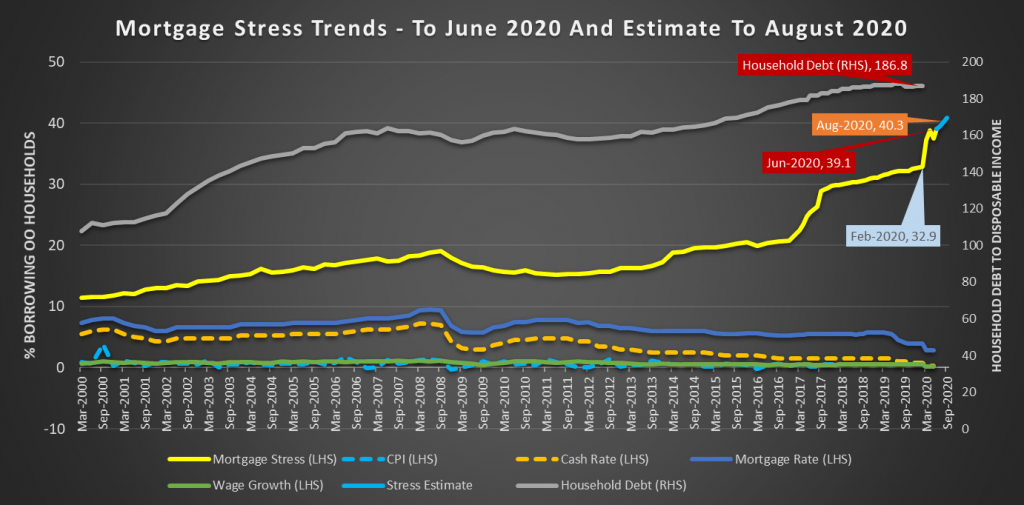

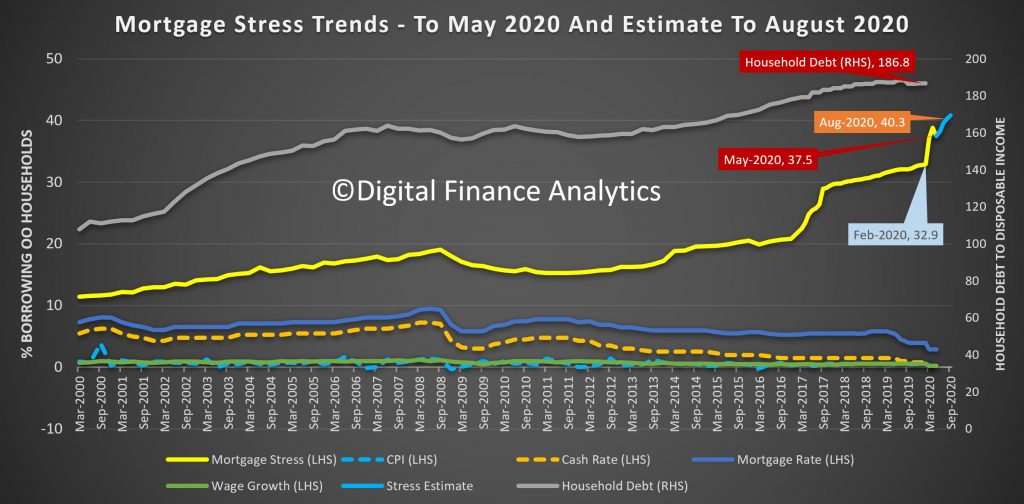

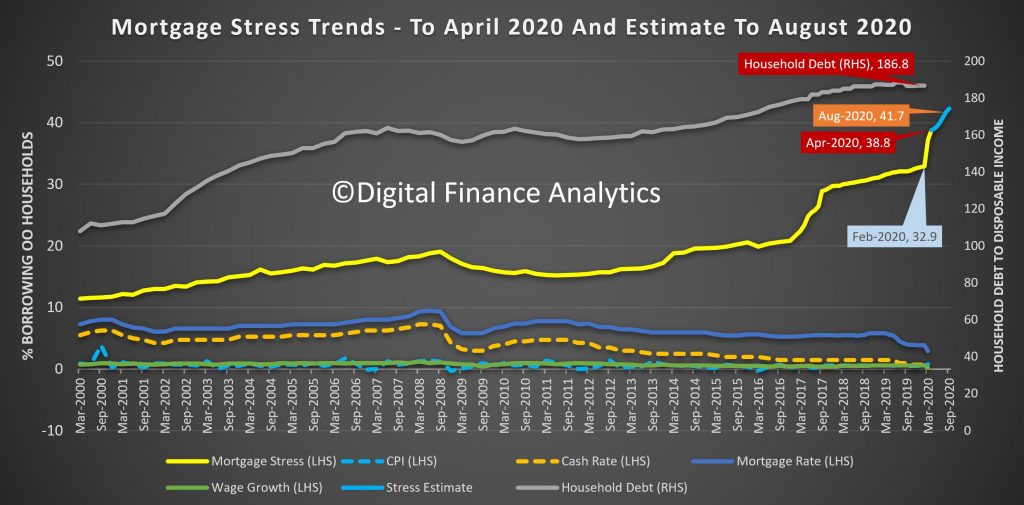

Mortgage stress rose to its highest level ever at 40.2 of households. We expect this to climb higher as support is moderated, and banks have hard conversations about recommencing repayments. Morgan Stanley commissioned a survey of mortgagors as part of some research on the impact of the coronavirus, and found that 55 per cent of them have received some form of income support. Household debt ratios continue to rise (thanks also to the capitalised interest and repayment holidays).

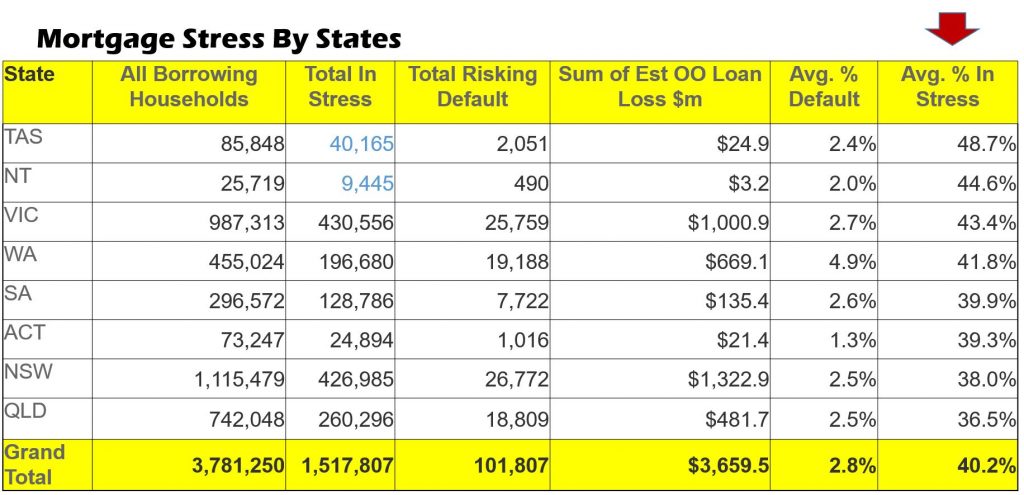

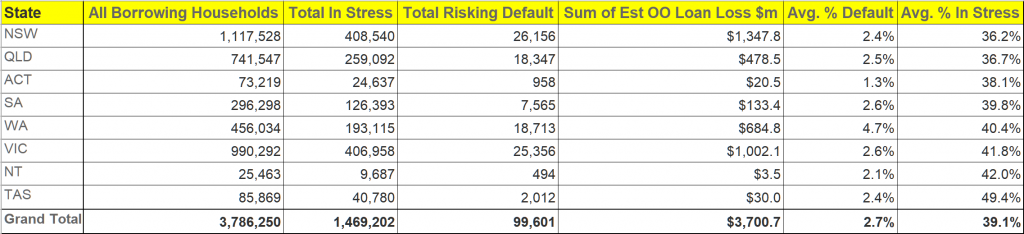

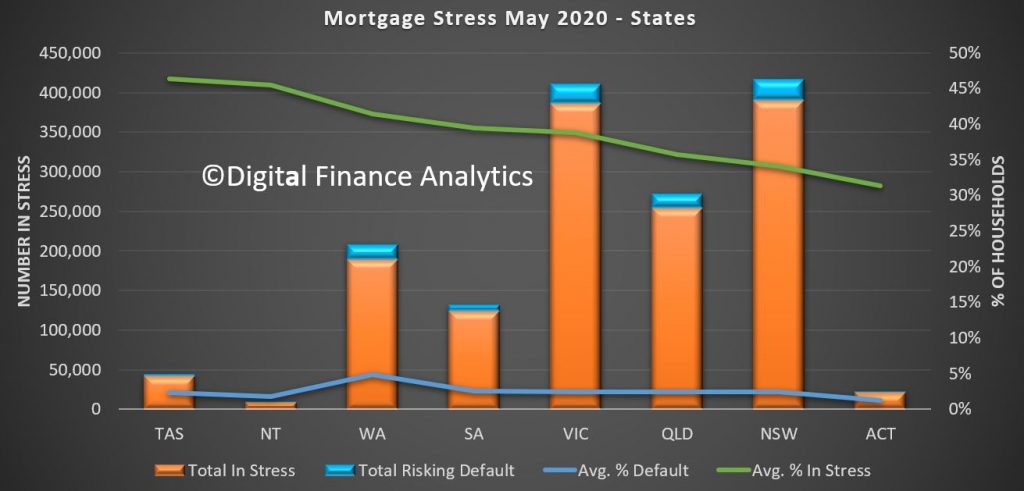

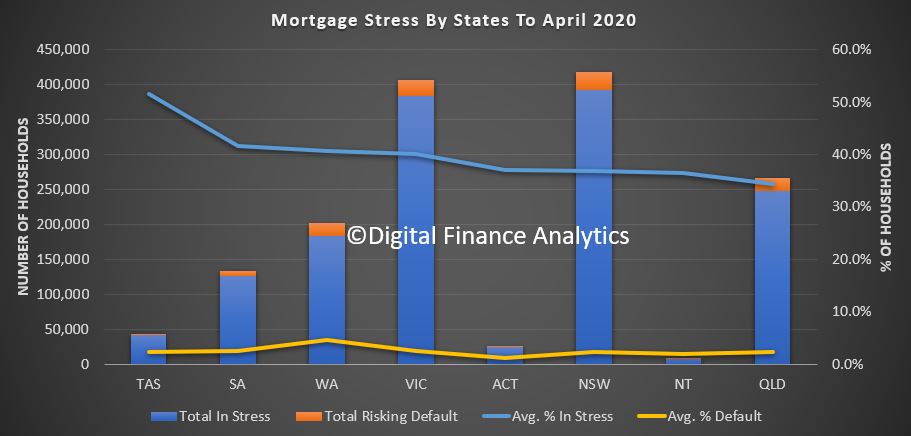

Two states saw a slight decline in the month, TAS and NT, as restrictions were somewhat eased,though both states have the highest stress percentages. But households in VIC rose by more than 15,000 from last month and NSW by more than 12,000. Overall more than 1.5 million households are impacted, up from 1.45 million last month.

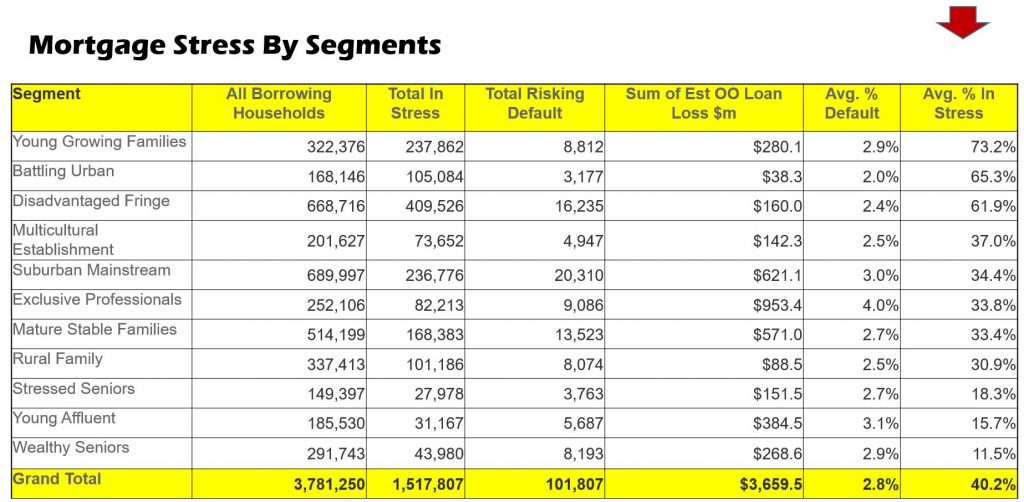

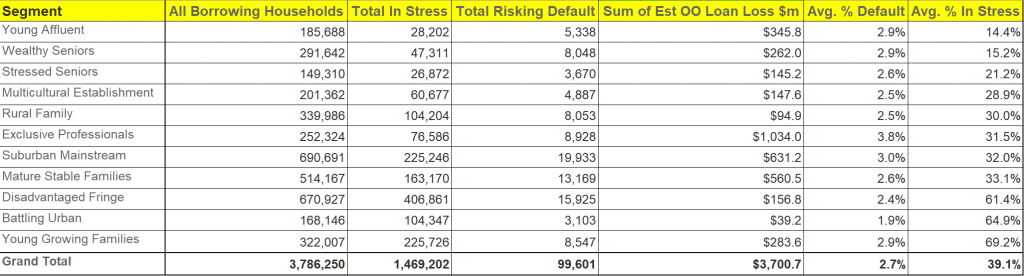

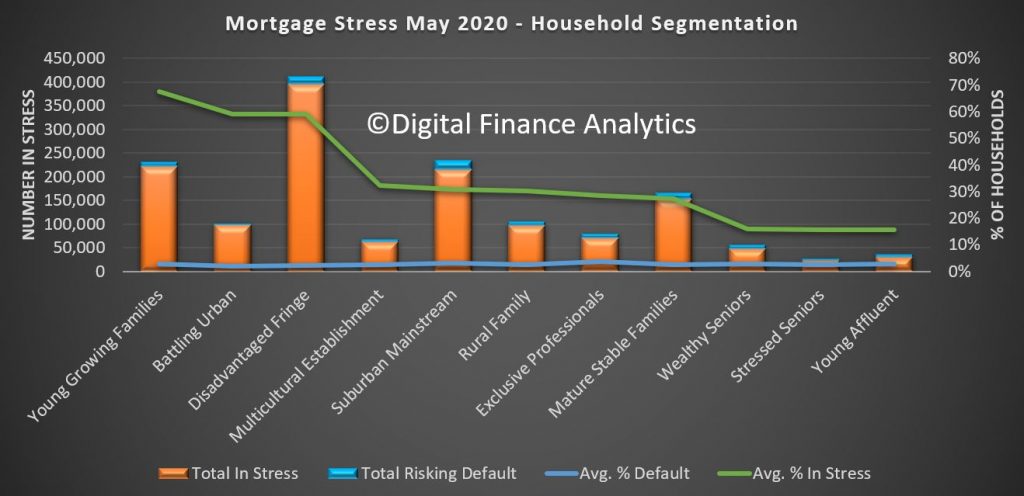

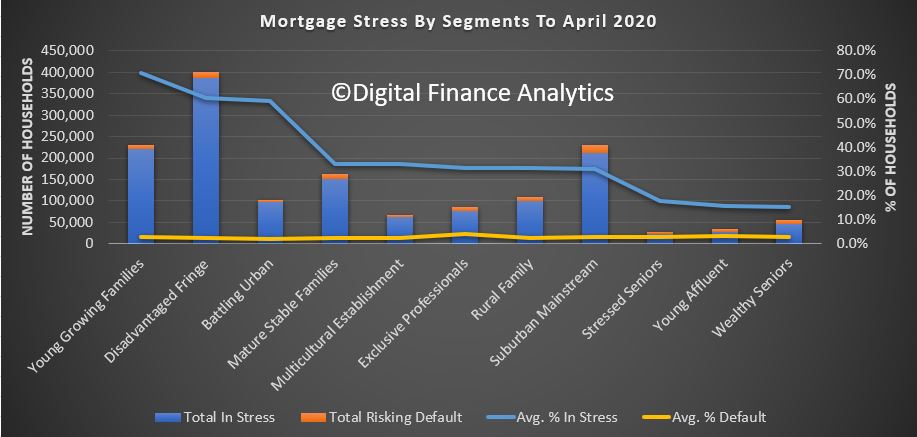

Across the segments, Young Growing Families are most exposed – this includes recent cohorts of first time buyers. Affluent households continue to be impacted, as unemployment is becoming structural. The RBA recently flagged an official rate of ~10% later in the year. The true rate is significantly higher.

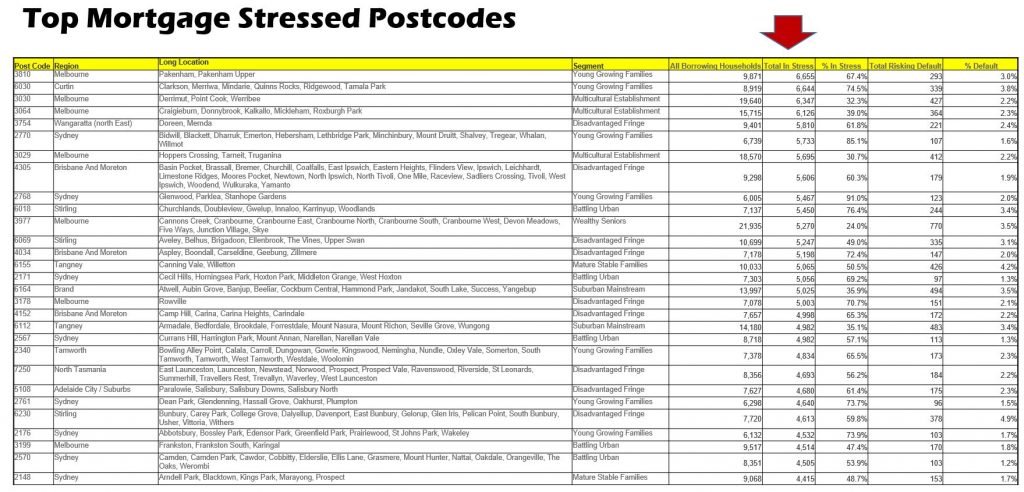

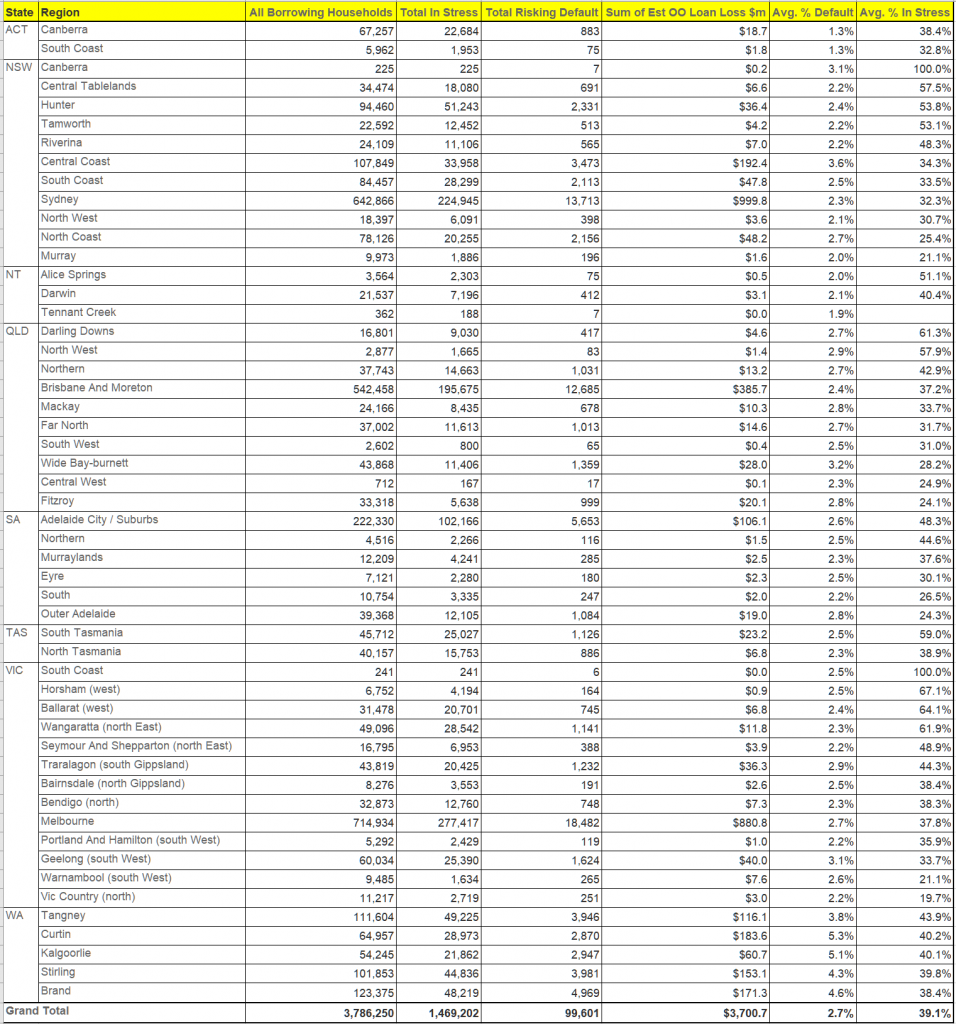

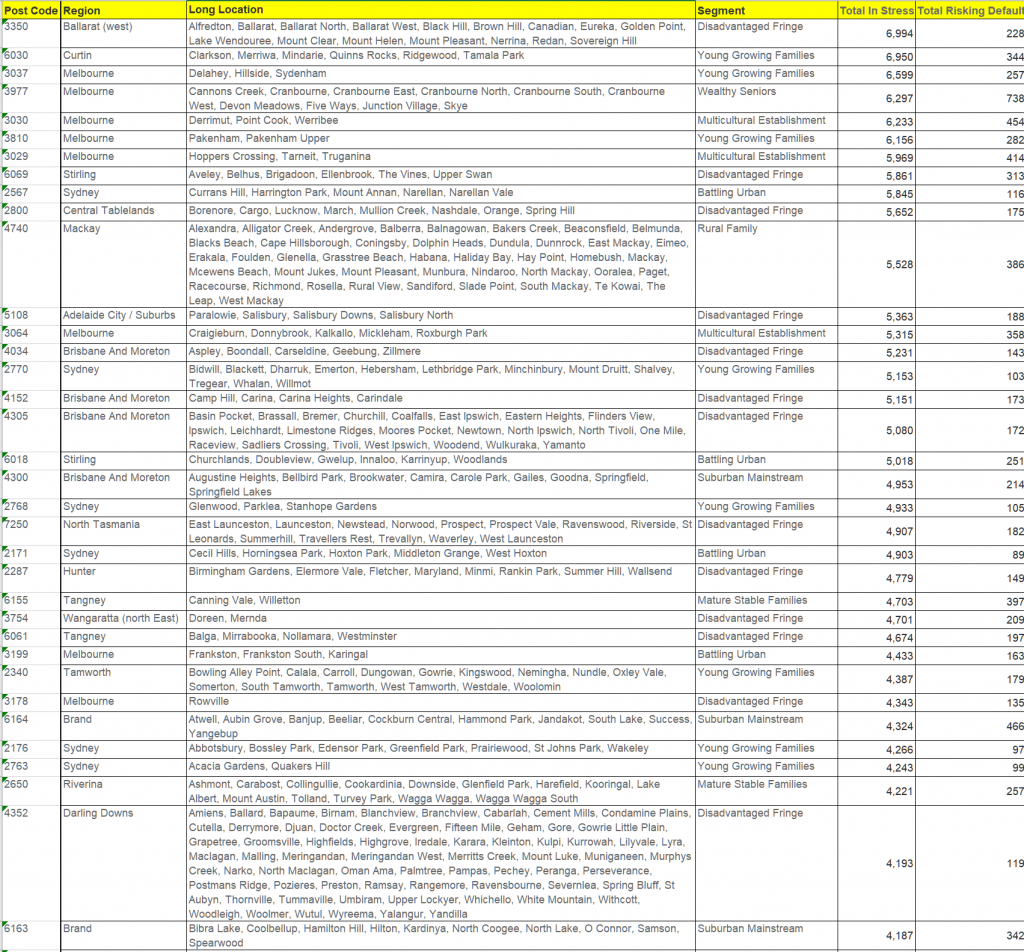

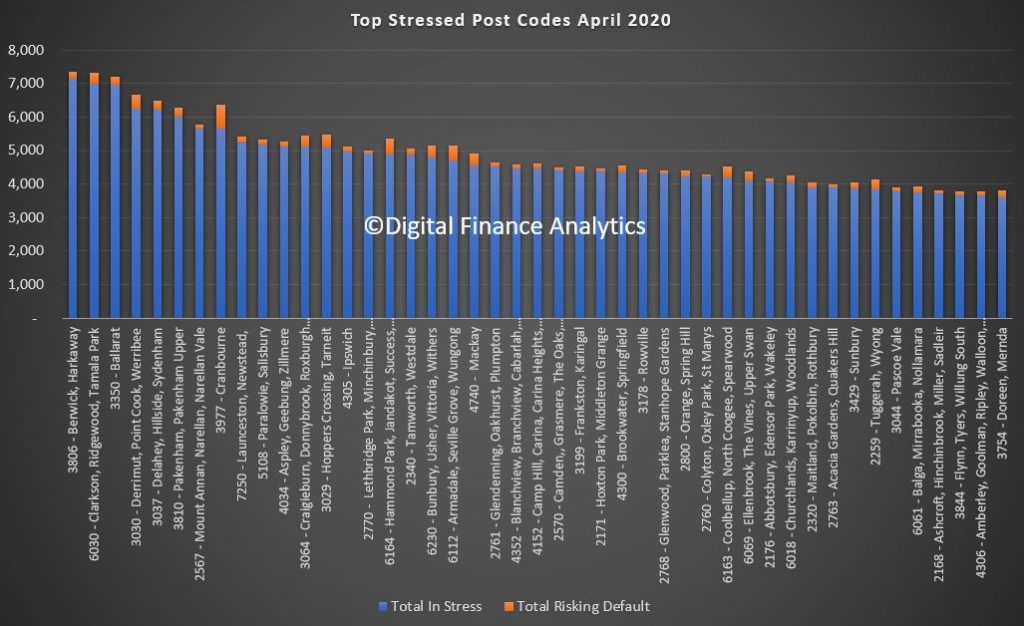

Looking in more detail at the post codes with the largest counts, many are fringe areas where there are many new estates, large houses on small lots driven by the construction boom. However a number of regional centres are also impacted. VIC is particularly exposed.

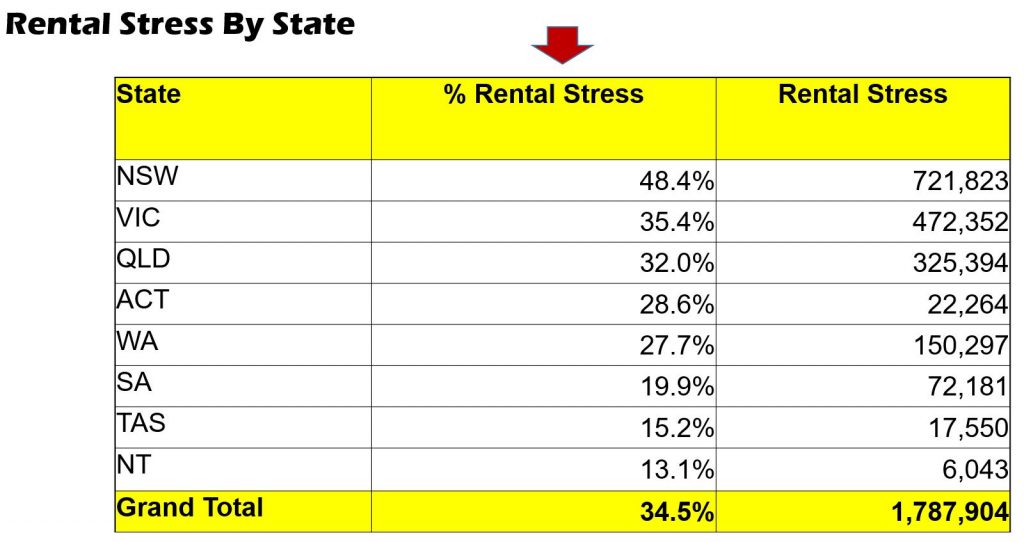

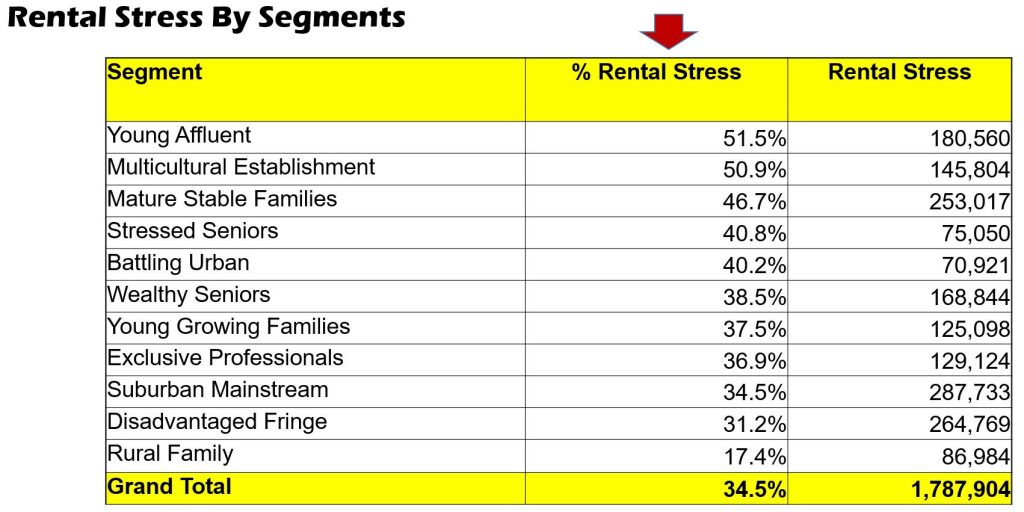

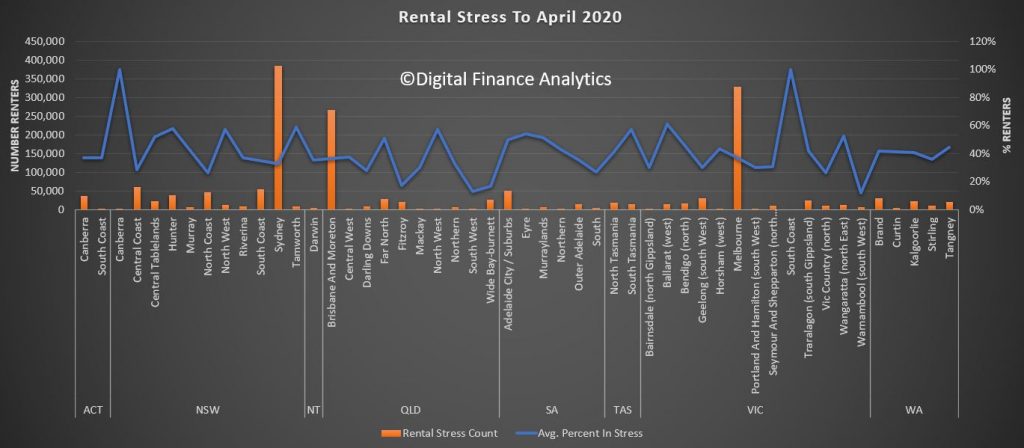

Turning to rental stress, we see a rise of tenants struggling with repayments. There is confusion for some as to whether their rents are on hold, or simply accruing. We are seeing more households planning to move back with family and friends. Stress is highest in NSW and VIC, with a significant spike in the largest states.

Across the segments, Young Affluent and Multicultural Groups are most exposed, linked with both students suddenly without part-time work, and the shrinking of the gig economy. However in terms of numbers of stressed renters more mainstream families are caught.

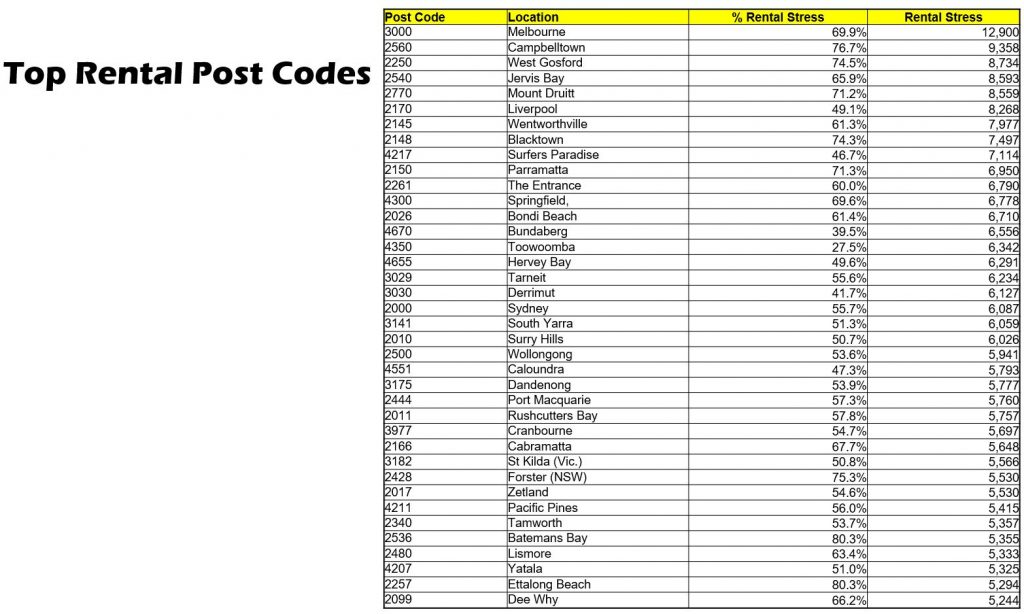

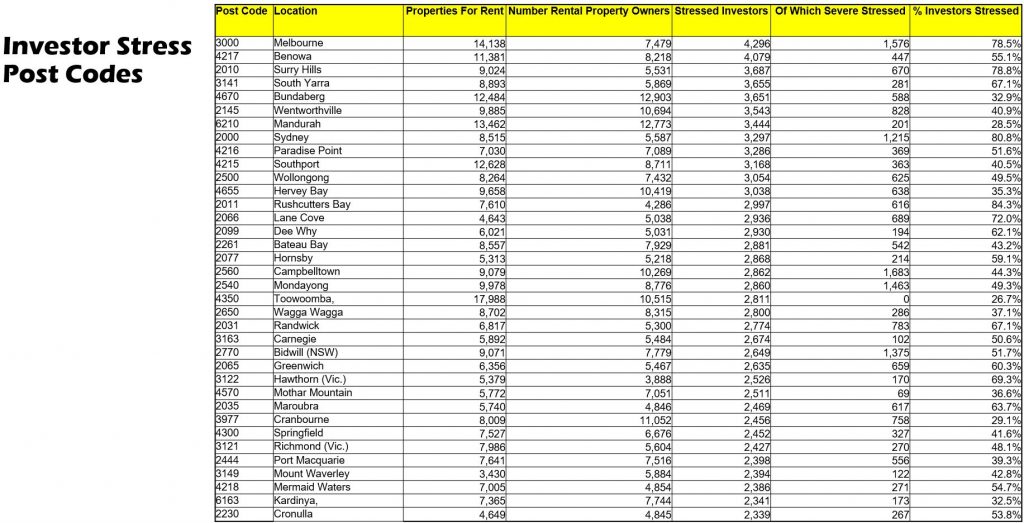

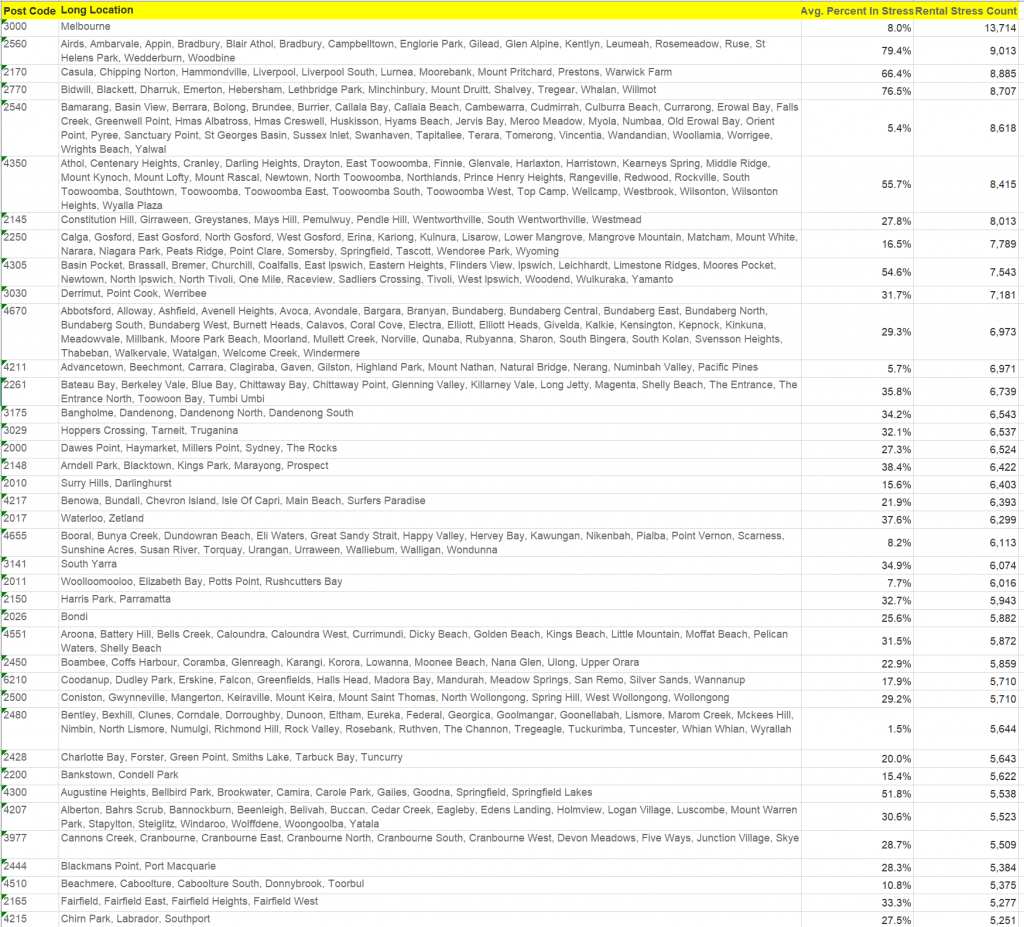

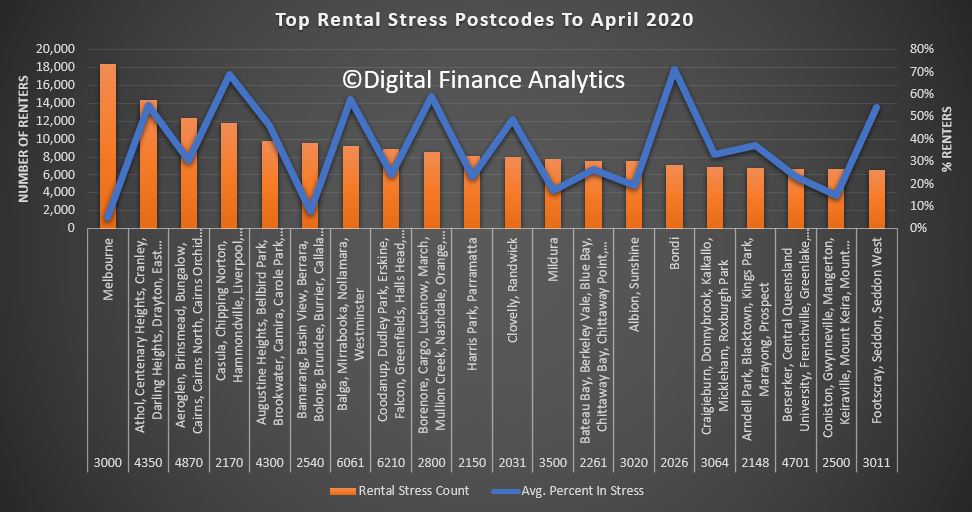

The post code distribution is illuminating, with Melbourne 3000 the standout high risk post code. Then comes both areas of Western Sydney and the Central Coast.

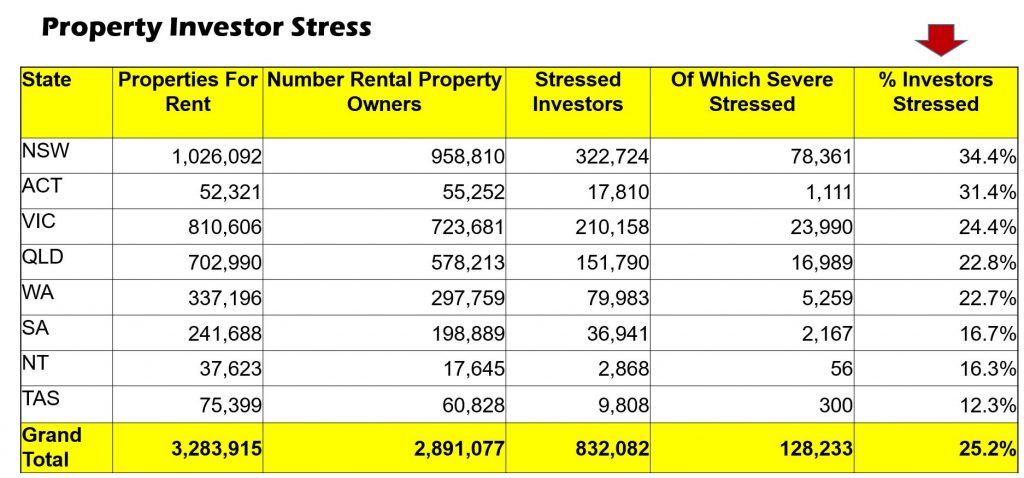

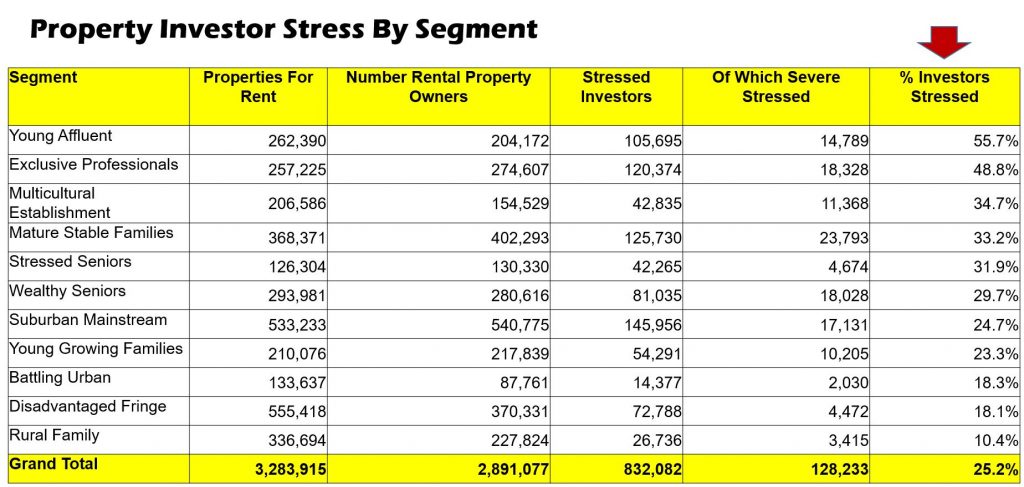

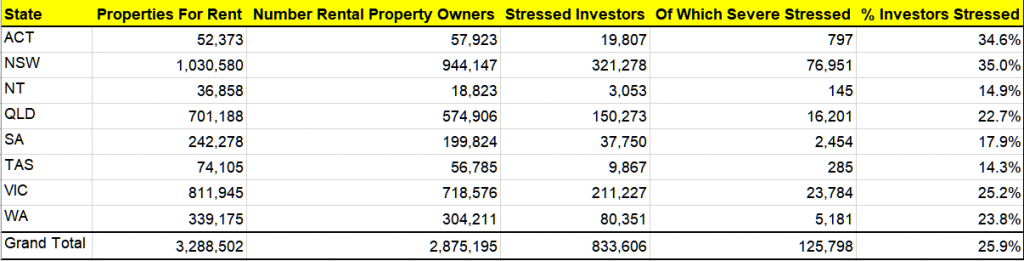

Finally turning to our latest analysis of Stressed Property Investors (based on their place of residence not where their properties are located), we see that 25% of investors are stressed, and overall 12% are actively considering selling. The highest rates of stress are in the NSW and ACT.

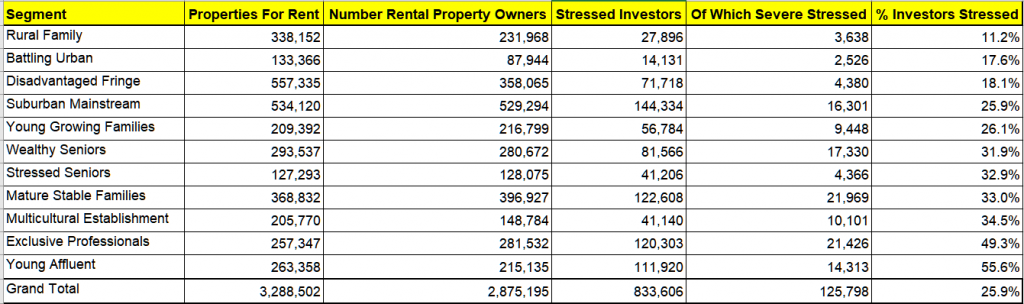

By segment, Young Affluent and Exclusive Professional Property Investors are the most stressed, not least because of the higher proportion of multiple investment property held. Many Young Affluents have multiple (cheaper) high-rise investments which are losing value.

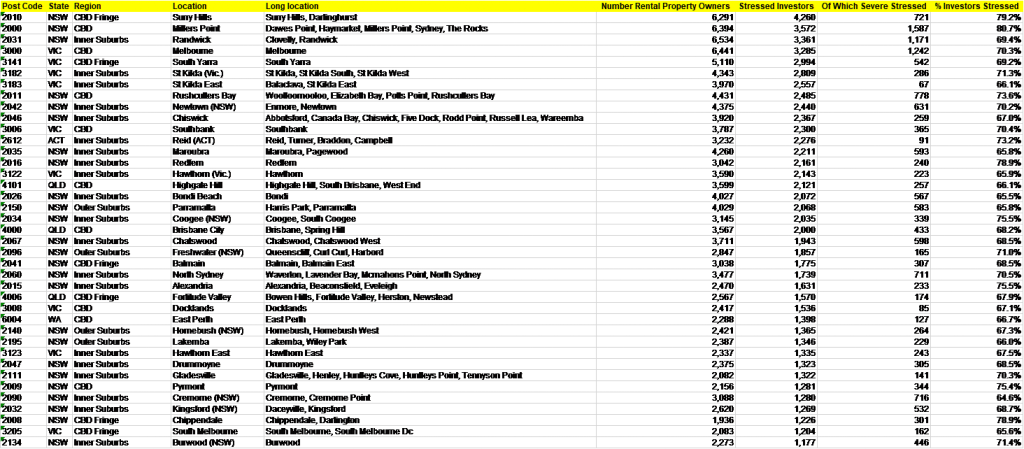

Melbourne 3000 holds the unenviable record for the highest count of stressed Investors (which may well correlate to the high rental stress). Mandurah, in WA, where prices have dropped 38% from peak appears near the top as many Investors have been in difficulty for years, and are unable to sell due to negative equity. Watch and learn….

We expect the banks to be tougher on property holders in these high risk areas, compared to others as the discussions about payment restarts after September.

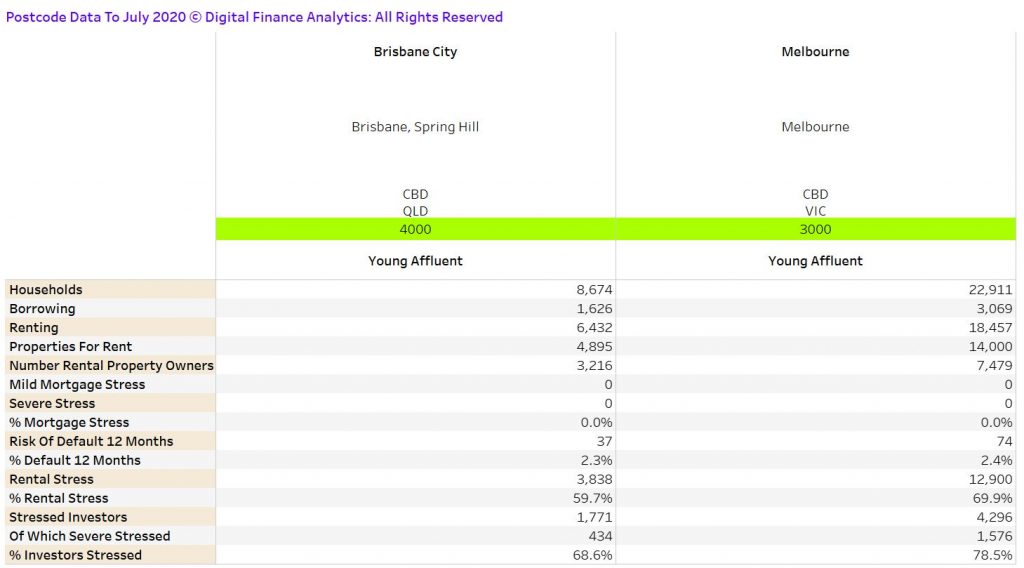

To make the point, here is the full data for 3000 and 4000. The pinch points here are clearly related to investment property.

We can provide post code level data for most locations across the country, or you can subscribe via Patreon to receive a full monthly update.

Finally, we discussed this analysis at length on our recent live stream:

Mortgage, Rental And Investor Stress All Higher

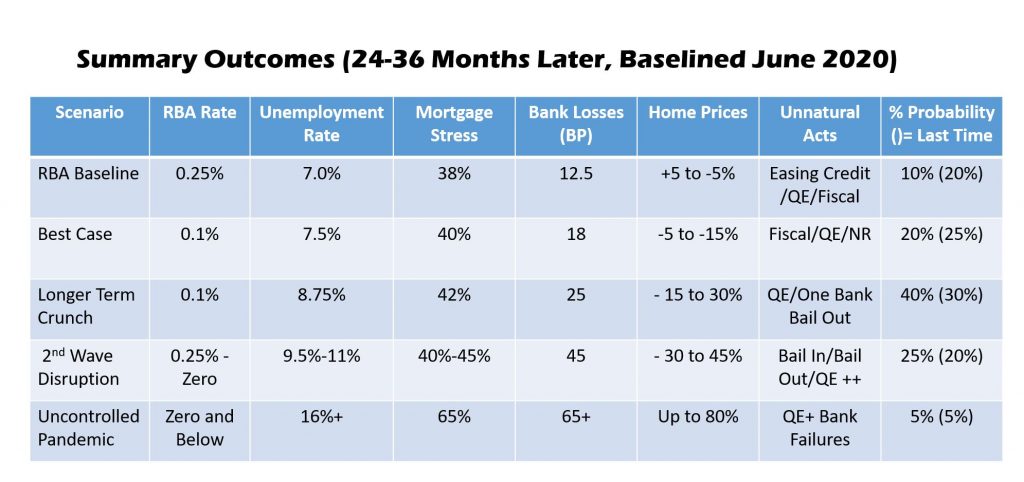

Digital Finance Analytics has released the results of our rolling 52,000 household surveys to the end of June, which reveals that mortgage stress rose to 39.1%, compared with 37.5% in May. In addition, rental stress was 39.4%. Moreover, a larger number of property investors with a mortgage (51.3%) are underwater from a cash-flow perspective. This is new analysis which suggests investors are caught in the financial crisis headlights.

We discussed all this on our live stream last night, where we also updated our price scenarios:

June Mortgage Stress Update

We measure stress in cash-flow terms, money in, money out, rather than a set percentage of income dedicated to paying mortgage or rental payments. If the net income flows are lower than the net payment outflows, households are classified as stressed. These households will cut back on expenditure, put more of credit cards, or tap into deposits. While, they may have access to other assets – for example investment properties or share portfolios, negative cash flow remains a significant challenge.

This equates to 1.47 million owner occupied mortgage holders under financial pressure, and 1.7 million households in rental accommodation. More than 820,000 property investors are in difficulty.

The complex interplay of higher unemployment, JobSeeker and JobKeeper, together with the 490,000 mortgages with payment deferrals provides the backcloth for our analysis. However, by examining the financial flow status of households we have noted some realignment of households in the past month, with more casual and part-time workers able to return to work, but a significant rise in structural unemployment as larger companies, such as larger retailers, big consulting firms, and finance firms, make reductions in staff. These permanent cuts reflect the rightsizing of businesses in reaction to the economic downturn. Then we have the new Melbourne lock-down.

Mortgage Stress

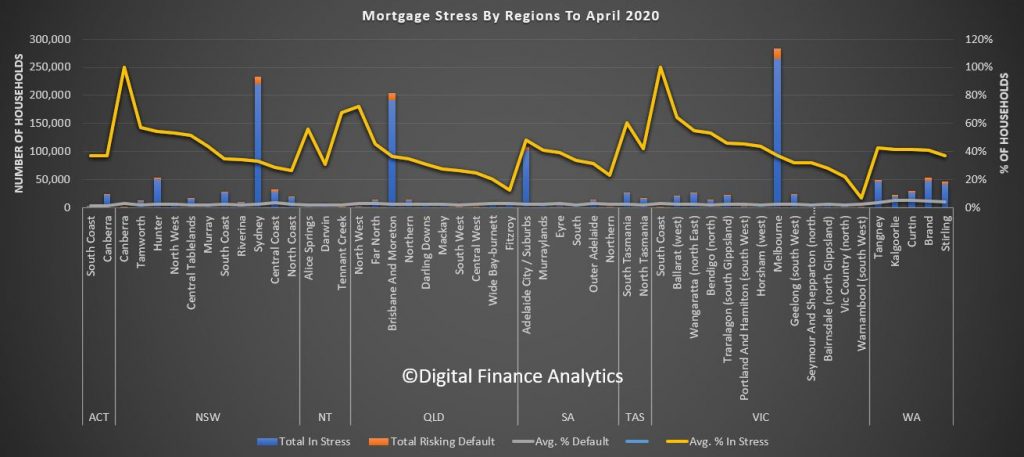

Turning to the detailed analysis, across the states, Tasmania has the highest proportion of households in mortgage stress, at 49.4%, followed by the NT and Victoria. However, the largest counts of stressed mortgage holders are in NSW, with 408,540 and VIC with 406,958. The highest risk of default rates are found in WA at 4.7%, VIC at 2.6% and SA at 2.6%.

Within our household segments, the highest mortgage stress levels are among Young Growing Families, at 69.2% of households, which includes cohorts of recent first-time buyers, with more than 225,000 households at risk. Next, those on the urban fringe, are also exposed, along with more typical battlers. We are also seeing a rise in affluent stress, where households on higher incomes are experiencing significant issues. The Exclusive Professional segment, the top few percent on an income basis, include 31.5% stressed, which equates to more than 76,000 households across the country. Significantly, in value terms, they hold around 28% of all default risk to the banks by value.

Mortgage stress is apparent not just in the main urban centres, but across the regions. This is a structural not caused by COIVD, but amplified by it.

Stress varies by post code. Here are the top 30:

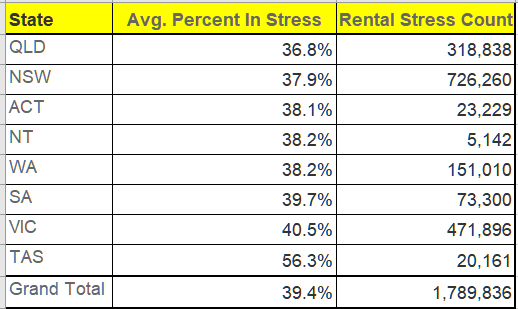

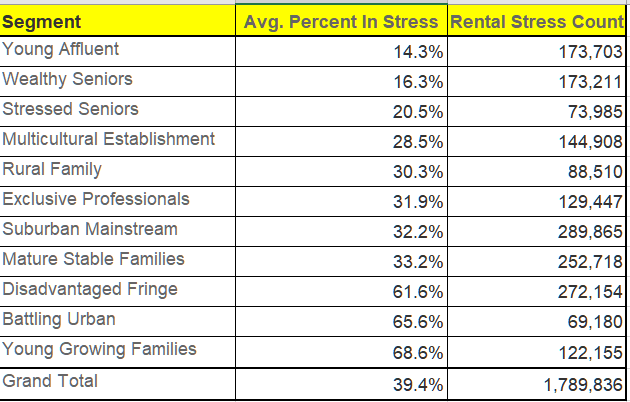

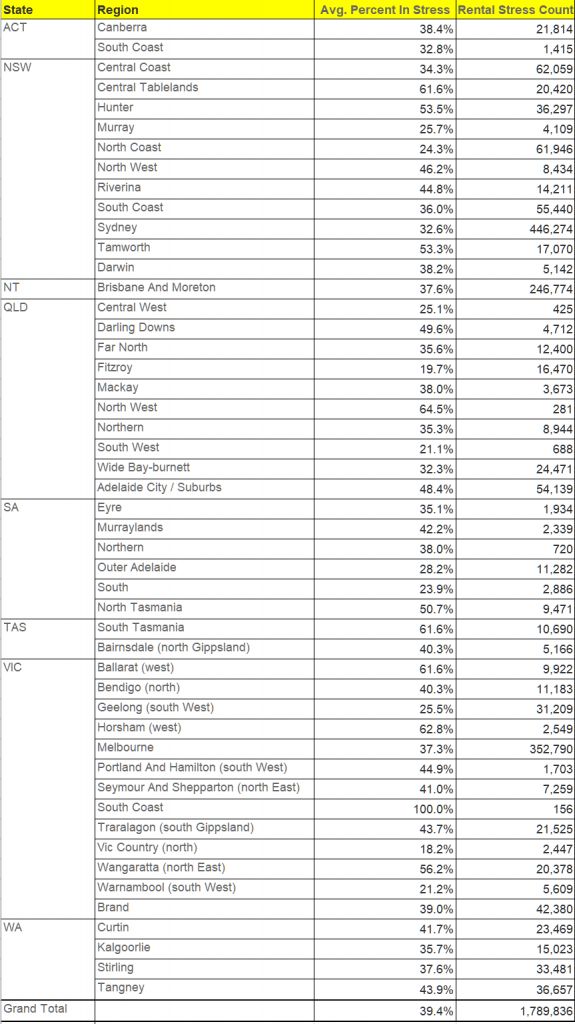

Rental Stress

Turning to rental stress, the patterns are somewhat similar. The highest stress among renters is found in TAS at 6.3%, followed by VIC at 40.5% and SA at 39.7%. Whilst on a percentage basis the lowest levels of stress are in QLD (36.8%) and NSW, 37.9%, in fact the largest count of stressed households in also in NSW, as here the proportion of households renting is the highest (reflecting the poor affordability of housing in the state, despite rents falling in real terms.

Across the DFA household segments, once again, Young Growing Families are most stressed, at 68.6%, whereas the largest counts are among suburban mainstream households (289,000), Disadvantaged Fringe (272,000) and Mature Stable (252,000).

Once again rental stress is widely distributed across the regions, and should not be regarded as a capital city problem.

Rental stress by postcode

Property Investor Stress

Finally, for the first time we are also reporting on property investors, and their property holdings. Across Australia, there are around 3.2 million properties available for letting (including short-term AirBnB type rentals as well as longer term residential). This excludes motels and hotel accommodation.

These properties are owned by around 2.8 million entities, including households and businesses. Around half the property available is covered by investment mortgages, which equates to around 1.65 million borrowers.

Of these 2.8 million entities, around 830,000 on a cash-flow basis, are not making sufficient to recover the costs of owning and letting their properties (stressed investors) of which 126,000 are severely stressed, most often because of low occupancy, or high repair costs. This is around 25.9% of all investment property, and 51.3% of mortgaged properties.

One complexity when analysing the more detailed footprint of investment property is that many owners live in different post codes to the properties they own. To account for this, we report the number of properties based on the location of the property itself, while the number of property investors and their stress status are reported on the basis of their home address, not the address of the property. That said, more than half reside in the same post code as their investment property.

NSW has the highest proportion of stressed investors at 35%, or around 321,000.

By segment, the most highly stressed investors are Young Affluent and Exclusive Professional investors (many of whom have multiple investment properties, so the pain is magnified).

The top stressed investor postcodes include areas close the CBD of Sydney and Melbourne, including Surry Hills, Millers Point and Randwick in Sydney and Melbourne CBD, South Yarra and St Kilda in Melbourne.

The full stress series is available via our Patreon page for US$50 plus GST. You can subscribe there to receive full monthly updates.

Final Reminder: DFA Live Q&A 8pm Sydney Tonight – Mortgage, Rental And Investor Stress

Tonight we discuss the latest results from our surveys, to end June 2020. Where are the stress hot spots – and how are property investors fairing? Ask a question live via the YouTube chat – and we will have our postcode database on line to answer specific queries.

Mortgage Stress Eases A Little In May

The latest DFA household survey results for May 2020, from our rolling 52,000 survey reveals a slight fall in households in mortgage stress, from over 38% last month to 37.5%. This still means 1.4 million households are experiencing cash flow issues, despise the Government support programmes and Bank repayment holidays. The full pack is available for download.

Before COVID, the rate was up to 32.9%, thanks to rising costs and flat incomes, and the rate would have been significantly higher without JobSeeker, JobKeeper and Bank repayment holidays. Ahead, of the September “cliff” when the supports are removed we are projecting a further rise to 40.3%, though if the supports are tapered, this might be lower in reality.

To assess mortgage stress we do not use a set percentage of income going on mortgage repayments, rather we look at total cash flow – money in and money out. If households are under water they are deemed to be in stress. More than 10% under water, then severe stress. Of course they may have assets like deposits, or put more on credit cards, but generally households under pressure spend less, hunker down, and some, 2-3 years later end up selling or even defaulting. Stress indicators are an early warning sign of potential issues ahead.

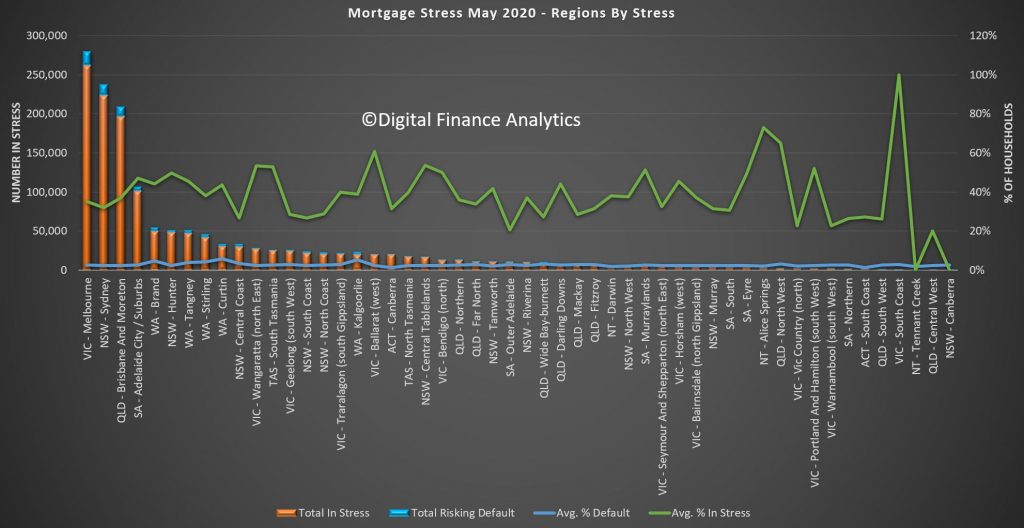

Across the states, Tasmania has highest proportion of households in stress (a function of lower incomes,recently rising home prices and mortgages and a stalled tourist sector in the state). The largest counts are found in NSW and VIC, whereas the highest default projection rates are found in WA.

Across our segments, young growing families, including first time buyers, are the most stressed. However we also see a rise in “affluent stress”

Stress exists across the regions, this is not just a major City story. In fact some of the most stressed areas include regional Victoria and New South Wales. The percentages of households in stress do vary.

Nationally the most stressed post codes include Ballarat 3350, Hillside and Sydneham 3037, 6030 which includes Clarkson and Tamala Park, and 3030 Werribee and Point Cook. Many of these areas include large swathes of relatively newly built property on small urban estates. Cranbourne 3977 carries the largest number of households risking default.

You can look at the detail behind our analysis. Click on the image to load or save the PDF file. You will need to have Acrobat installed.

You can also watch our live show where we discuss mortgage stress and report on a range of individual households.

Finally, I discussed our research with Nucleus Wealth in their Podcast Series:

DFA Live On Mortgage And Rental Stress – HD Replay Edition [Podcast]

This is the edited edition, with behind the scene sequences added. The original edition, with live chat is available here: https://youtu.be/Q_6Bo_JYBJw

Get The Latest On Mortgage and Rental Stress Live Tonight

Mortgage Stress Up Again In April

The latest DFA mortgage stress data, derived from our rolling household surveys reveals than an additional 100,000 households joined the cash-flow stressed in April, bringing the percentage of households to more than 38%, which equates to more than 1.4 million.

The trajectory is still set to reach more than 41% by August. Our estimates take account of the enhanced JobSeeker, JobKeeper and Bank mortgage repayment holidays. Given the ABS reported around 650-700,000 employed people have lost work since mid-March, we expected these increases to track close to our estimates.

A reminder, we define mortgage stress in cash flow terms, rather than a set proportion of income. One other factor in play is that many households relied on multiple incomes and the loss of just one is sufficient often to push people into stress. Defaults are likely to follow, but not immediately, as people draw on savings, put more on credit, or simple hunker down for a time.

Across our segments, young growing families, at more than 70%, are at risk, follower by those battling on the urban fringe. But we continue to see a growth in more affluent households also being hit.

Across the states, Tasmania contains the highest levels of mortgage stress, thanks to the over-reliance on tourism and recent price rises relative to income. Some lenders have become more cautious here, with many investors unable to secure a mortgage repayment holiday.

Across the regions we see pockets rising in regional areas, as well as the main urban centres. Mortgage stress is not just a big-city disease.

By postcode, Melbourne post code 3806, Berwick and Harkaway now leads the way with more than 7,000 households in the district under pressure. VIC figures strongly with the top 5, with 3350 Ballarat, 3030 Werribee and 3037 Sydenham all impacted. Second though behind 3806 is WA code 6030 which includes Clarkson and Tamala Park. Most of these areas are high growth development corridors, where prices and incomes are above average. Within these areas there are also a sizable number of property investors.

Finally, there are 1.7 million households in rental stress – defined again in cash flow terms. This equates to nearly 40% of all renting households. The regional variations are again quite stark with stress peaking in Canberra and the South Coast (where bush fire damage remains).

Melbourne post code 3000 recorded the highest count of rental stress, thanks to large numbers of high-rise units being built there, the loss of student and AirB&B clients and simple oversupply. But post codes in Queensland and NSW are also badly hit.

Given the trajectory of the economic downturn, we expect stress to continue to build. The most significant question is the impact of the “cliff” in September where mortgage repayments and rental default freezes, at the same time when Government support schemes all are expected to terminate. Given that the June unemployment figure will likely to 10% (the true figure much higher) and according to the RBA unemployment will remain elevated through 2021, there is little prospect of the trends reversing anytime soon, even at current low interest rates.

Individual households will need to consider cutting their losses in these circumstances and as a result we expect the supply of rental property will rise, and a hike in property to list will follow later.

This has the hallmark of a long slow” U” not a “V” shaped recovery.

Mortgage Stress To The Moon

The latest from our Household Surveys.