Significantly, he says the temporary measures taken to address too-free mortgage lending will morph into the more permanent focus on amongst other things, further strengthening of borrower serviceability assessments by lenders, strengthened capital requirements for mortgage lending imposed by us, and comprehensive credit reporting being mandated by the Government.

Bank capital

One area that was of interest to this audience last year was the strengthening of banking system capital. On that front, I’m pleased to say we are getting close to the end of the journey.

As some of you would know, the Australian Government conducted a broad-ranging inquiry into the Australian Financial System in 2014. Amongst other things, that inquiry tasked us with ensuring that Australian banks had ‘unquestionably strong’ capital ratios. In July last year, we published a paper setting out the benchmarks that we considered to be consistent with that goal. At a headline level, this required the four major Australian banks to strengthen their capital ratios, relative to end 2016 levels, by around 100 basis points on average to target CET1 ratio of 10.5 per cent (or about 16 per cent on an internationally comparable basis). We also said we expected that strengthening should be achieved by 2020 at the latest.

As things stand, the major banks haven’t quite hit this target yet, but are well on the way to doing so in an orderly fashion. We set a smaller task for the smaller institutions, and they by and large have it covered already.

That capital build-up is important because, as you’re all no doubt aware, we received a Christmas present from the Basel Committee in the form of the long-awaited package of reforms to finalise Basel III. The changes, in total, represent a significant overhaul of many components of the capital framework1.

We have, however, committed to ensure that changes in capital requirements emanating from Basel will be accommodated within the unquestionably strong target we have set. In other words, given the banking system has largely built the necessary capital, the recent Basel announcement does not have any real impact on the aggregate capital needs of the Australian banks. They will change the relative allocation of capital within the system, but not add to the aggregate requirement beyond what has already been announced.

We’ll begin consultation on the proposed approach to implementing Basel III changes in the next week or two. Our initial public release will include indicative risk weights, but these will be subject to further analysis and an impact study to calibrate the final proposed risk weights and ensure we end up with a capital requirement that is consistent with our assessment of unquestionably strong capital levels. We also have some recent input from the Productivity Commission to feed into our deliberations, which we’ll give consideration to as we work through the consultation process.

In terms of timelines, the Basel Committee has agreed to an implementation timetable commencing in 2022, with further phase-ins after that. As I said earlier, we expect banks to be planning to increase their capital strength to exceed the ‘unquestionably strong’ benchmarks by the beginning of 2020. Whether we implement our risk weight changes in line with Basel timeframes or modify that timeline somewhat, it’s unlikely there will be any need for additional phase-in and transitional arrangements given the industry will be well placed to meet the new requirements.

And just quickly on the other key components of the Basel reforms, we instituted the Basel liquidity and funding requirements in line with the internationally agreed timetable – the Liquidity Coverage Ratio (LCR) from 2015, and the Net Stable Funding Ratio (NSFR) from the beginning of this year – in full and without any transition. So the adjustment process to the post-crisis international reforms in Australia has the finish line well in sight.

Housing

The other topic that generated some questions last year concerned housing, and so I thought I should say a few words about our actions in that area.

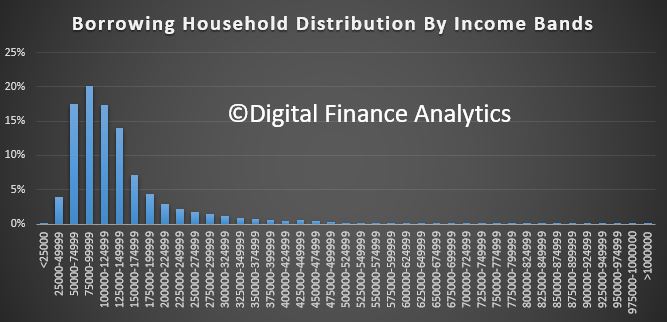

The broad environment – high house prices, high household debt, low interest rates, and subdued household income growth – hasn’t changed greatly over the past 12 months (although in more recent times house price appreciation has certainly slowed in the largest cities – Sydney and Melbourne). Those conditions are not unique to Australia – a number of other jurisdictions continue to battle with somewhat similar conditions and imbalances. What’s notable for Australia, however, is the relatively high proportion of mortgage lending on the banking system’s balance sheet.

Against that backdrop, and amidst strong competitive pressures among lenders, the quality of new mortgage lending and the re-establishment of sound lending standards have been a major focus of APRA for the past few years now. We introduced industry-wide benchmarks on (in 2014) lending to investors and (in 2017) lending on interest-only terms. As I have spoken about many times previously, these are temporary measures we have put in place to deliberately temper competitive pressures, which were having a negative impact on lending practices throughout the industry, and help to moderate the volume of new lending with higher risk characteristics. Left unchecked, the drive for growth and market share was producing an adverse outcome as lenders sought ways to accommodate higher risk propositions to grow new lending volumes. Instead of prudently trimming their sails to reflect an environment of heightened risk, lenders were pressured to sail closer to the wind.

Over time, our interventions have served their purpose and we have seen lending standards improve. Our most recent intervention was in relation to interest-only lending. Imposing quantitative limits is not our preferred modus operandi, but over many years we’d seen interest-only loans become easily available, and options for extending or refinancing on interest-only terms allowed borrowers to avoid paying down debt for prolonged periods. Those loans do, however, provide less protection to borrower and lender when house prices soften, and expose borrowers to ‘repayment shock’ when the loan begins amortising (made worse if it occurs at a time when interest rates are rising from a low base).

Our benchmark of no more than 30 per cent of new lending being on interest-only terms is not overly restrictive for borrowers who genuinely need this form of finance – roughly 1-in-3 loans granted can still be on an interest-only basis – but it has required the major interest-only lenders to establish strategies that incentivise more borrowers to repay their principal. The industry has been quite successful in doing so: recent data for the last quarter of 2017 shows that only about 1-in-5 loans were interest-only, and the number of interest-only loans with high LVRs continued to fall to quite low levels. All of that is positive for the quality of loan portfolios.

While the direction in asset quality is positive, we’re not declaring victory just yet. We still want to see that the improvements the industry has made are truly embedded into industry practice. And we can modify our interventions as more permanent measures come into play. That will include, amongst other things, further strengthening of borrower serviceability assessments by lenders, strengthened capital requirements for mortgage lending imposed by us, and comprehensive credit reporting being mandated by the Government. Through these initiatives, we are laying the platform to make sure prudent lending is maintained on an ongoing basis.

Governance and culture

In addition to improvements in financial strength and asset quality, it’s also critical to the long run health of the financial system that the Australian community has a high degree of confidence that individual financial institutions are well governed and prudently managed. What has become more apparent and pronounced over the past year is that – despite their financial health and profitability – community faith in financial institutions in Australia, as has been the case elsewhere, has been eroded due to too many incidences of poor behaviour and poor customer outcomes. None of these have thus far threatened the viability of any institution, but they have certainly not been without commercial and reputational damage.

While most matters of conduct are primarily the responsibility of our colleagues at ASIC, these issues are nevertheless of great interest to a prudential regulator for what they say about an organisation’s attitudes towards risk. So as with the balance sheet strengthening of the financial system over the past few years, we have also taken a greater interest in efforts to strengthen behaviours and cultures. We can’t regulate these into existence, but we have been working to ensure Australian financial institutions have been giving greater attention to these matters than may have traditionally been the case. On these issues, it’s fair to say the journey continues.