We review the latest NAB survey, the Westpac ASIC case and the RBA’s latest excuses.

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

We review the latest NAB survey, the Westpac ASIC case and the RBA’s latest excuses.

We review the latest NAB survey, the Westpac ASIC case and the RBA’s latest excuses.

ASIC has commenced proceedings in the Federal Court against National Australia Bank (NAB) for breaches of the law arising from failures with its Introducer Program.

ASIC alleges that between 3 September 2013 and 29 July 2016, NAB accepted information and documents in support of consumer loan applications from third party introducers who were not licensed to engage in credit activity.

As a result, ASIC alleges NAB breached s31(1) of the National Consumer Credit Protection Act 2009 (National Credit Act) which prohibits credit licensees from conducting business with parties engaging in credit activity without an Australian credit licence (ACL). ASIC also alleges that NAB breached its obligations under s47 of the National Credit Act requiring it to engage in credit activities efficiently, honestly and fairly and to comply with the Act.

The proceedings relate to the conduct of 16 bankers accepting loan information and documentation from 25 unlicensed introducers in relation to 297 loans.

One of the key objectives of the National Credit Act’s licensing regime is consumer protection. The imposition of a licensing regime was intended to address concerns that third-party referrers (including brokers and introducers) may misrepresent consumers’ financial details to ensure loans are approved, and their commissions are paid, in circumstances where the consumers’ true financial position means that the loan should not be made.

ASIC is asking the Court to find that NAB breached the National Credit Act and to impose a civil penalty on NAB for doing so. The maximum penalty for one breach of s31(1) of the National Credit Act, during the time of contravention, was 10,000 penalty units, or $1.7 to $1.8 million.

The proceeding will be listed for directions on a date to be determined by the Court.

Since at least 2000, NAB operated the credit industry’s largest referral program, known as the ‘Introducer Program’, whereby a third-party introducer could ‘spot and refer’ a potential customer to NAB in exchange for commission if the customer entered into a loan with NAB. Between 2013 to 2016, NAB’s Introducer Program generated $24 billion dollars’ worth of loans.

Introducers referring customers through the Introducer Program were only to provide NAB with the potential customer’s name and contact details. In order for an introducer to provide NAB with further information or documents, the law required that the introducer be authorised under an ACL.

ASIC’s investigation uncovered that NAB bankers overstepped the ‘spot and refer’ requirement by accepting information and documentation from the 25 unlicensed introducers, including completed home loan applications, payslips, copies of customer identification documents and more. This behaviour can pose a serious risk to consumers, as ASIC also identified that in some instances the documents provided to NAB by the unlicensed introducers were false.

During the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, NAB identified that misconduct in their Introducer Program went undetected until 2015 for reasons including:

The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry Interim Report Volume 2: Case Studies details a range of misconduct in relation to the NAB Introducer Program (page 1 -16). This includes:

In July 2018, ASIC banned Mr Awad (who is one of the 16 bankers identified in the present proceedings) from engaging in credit activities and providing financial services for a period of seven years.

Mr Awad was found to have given NAB false payslips, letters of employment, and entered false referee contact details in NAB’s lending systems in multiple home loan applications. A majority of the false documentation submitted to NAB by Mr Awad was provided to him by a real estate agent who was previously registered as a NAB Introducer.

On 20 August 2019, Mr Alwan (who is not one of the 16 bankers identified in these proceedings) pleaded guilty to one count of ‘intention to defraud by false or misleading statement’, an offence under the NSW Crimes Act. The charge relates to Mr Alwan’s conduct in relation to 24 home loan applications which he falsely told NAB were referred by his uncle’s business ‘Suit Club’, a registered NAB Introducer. This resulted in NAB paying Suit Club $56,955 worth of commission. In October 2018, ASIC permanently banned Mr Alwan from engaging in credit activities and providing financial services for the same misconduct.

On 25 March 2019, NAB announced that it will be terminating the Introducer Program on 1 October 2019.

NAB’s update today reported an unaudited statutory net profit of $1.70 billion in the third quarter 2019, and unaudited cash earnings of $1.65 billion. This is a 1% rise in cash earnings compared with 3Q18.

They said that revenue was up 1%, thanks to a rise in SME lending and slightly higher group margins. Net interests margins increased mainly due to lower short-term wholesale funding costs. Expenses were flat, with efficiencies offsetting high compliance and risk costs.

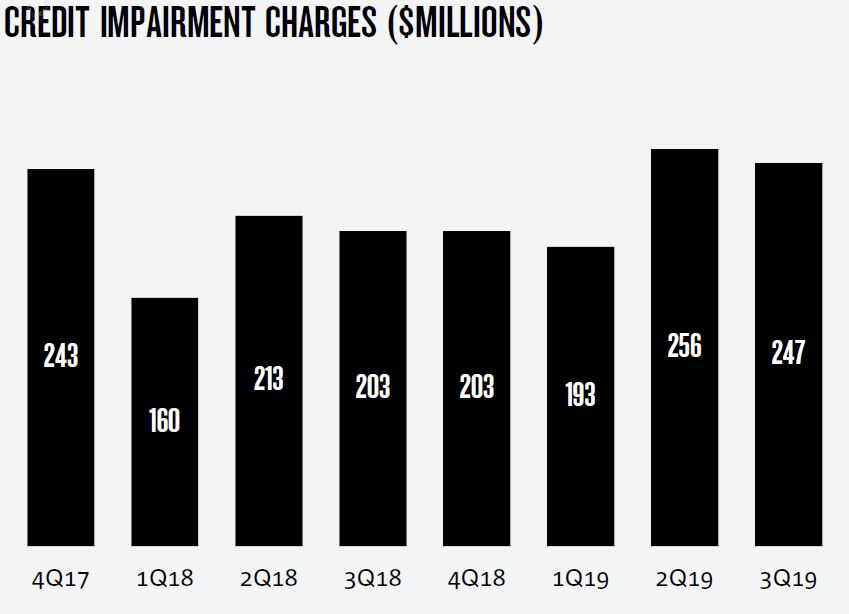

They reported that credit impairment charges increased 10% to $247 million compared to 1H19 quarterly average. The ratio of collective provisions to credit risk weighted assets increased 2 basis points to 96 basis points from March to June.

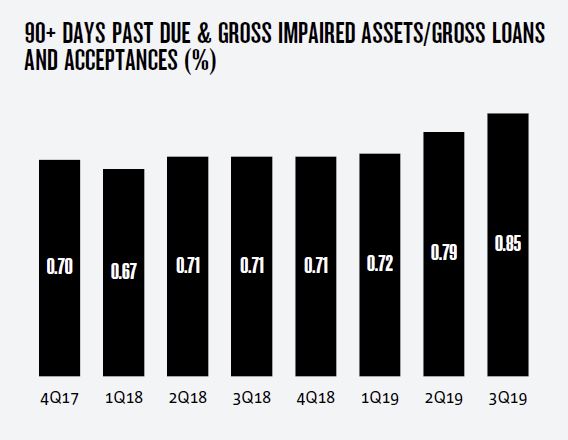

The ratio of 90+ days past due and gross impaired assets to gross loans and acceptances increased from 0.79% to 0.85%, largely due to rising Australian mortgage delinquencies.

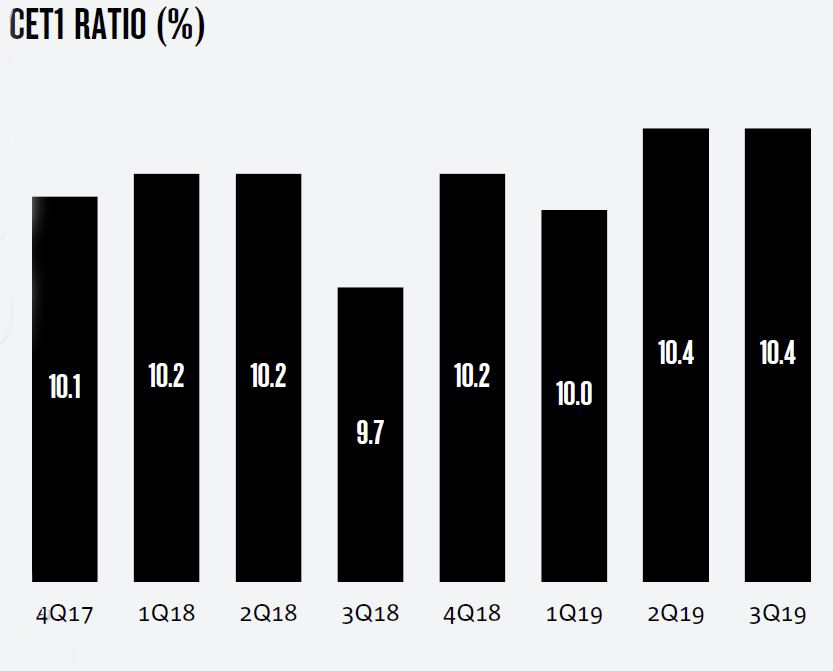

CET1 remains at 10.4%, the APRA leverage ratio is 5.4%, the liquidity ratio (LCR) quarterly average was 128% and the net stable funding ratio (NSFR) was 113%.

NAB late on Friday 26 July 2019 begun contacting approximately 13,000 customers to advise that some personal information provided when their account set up was uploaded, without authorisation, to the servers of two data service companies.

NAB’s security teams have contacted the companies, who advise that all information provided to them is deleted within two hours.

NAB Chief Data Officer, Glenda Crisp, said the compromised data included customer name, date of birth, contact details and in some cases, a government-issued identification number, such as a driver’s licence number.

“We take the privacy and the protection of customer information extremely seriously and I sincerely apologise to affected customers. We take full responsibility,” she said.

“The issue was human error and in breach of NAB’s data security policies.”

Ms Crisp said it was not a cyber-security issue. No NAB log-in details or passwords have been compromised – and NAB’s systems remain secure.

“Our number one priority is to support our customers. We are moving quickly to proactively contact every person affected.”

NAB is calling, emailing or writing to each impacted customer individually. A dedicated, specialist support team is in place, available to them 24/7.

If government identification documents need to be reissued, NAB will cover the cost.

NAB will also cover the cost of independent, enhanced fraud detection identification services for affected customers.

Importantly there is no evidence to indicate that any of the information has been copied or further disclosed.

NAB is advising impacted customers that they do not need to take any action with their account.

“We have reviewed these customers’ accounts, over and above our rigorous normal checks, and have not identified any unusual activity. We will continue to monitor 24/7 to protect our customers’ accounts,” Ms Crisp said.

NAB has also notified and is working with industry regulators, including the Office of the Australian Information Commissioner.

Ms Crisp said: “We take full responsibility. We can assure you that we understand how this happened and we are making changes to ensure this does not happen again.”

NAB has updated its mortgage serviceability assessment policy, becoming the final big four bank to amend its policy in response to APRA’s new guidance. Via The Adviser.

It has lowered its interest rate floor to 5.5 per cent and increased its interest rate buffer to 2.5 per cent, effective for all new home loan applications from 5 August.

The revisions have come in response to the Australian Prudential Regulation Authority’s (APRA) changes to its home lending guidance, in which it scrapped the 7 per cent interest rate floor for mortgage assessments and increased the buffer rate to 2.5 per cent.

Commenting on the changes, NAB’s chief customer officer, consumer banking, Mike Baird said: “NAB welcomes the updated APRA guidelines on home lending serviceability.

“We believe now is the right time to change the approach to how the affordability rate floor is determined, given the continuing low interest rate environment.”

He added: “As a responsible lender, serviceability is assessed using a number of factors and we consider all lending applications on a case-by-case basis.”

NAB is the latest lender to amend its serviceability policy, joining the likes of ANZ, Westpac, the Commonwealth Bank, Macquarie, Suncorp, MyState Bank. Bendigo and Adelaide Bank, the Bank of Sydney, and Auswide Bank.

NAB has matched ANZ’s rate floor of 5.5 per cent, and has undercut CBA and Westpac, who dropped their floor rates to 5.75 per cent.

However, as it stands, Macquarie has the lowest floor rate (5.3 per cent), with MyState on the opposite side of the spectrum, dropping its floor rate to just 6.2 per cent.

All the aforementioned lenders have also increased their buffer rates to 2.5 per cent.

Other lenders are expected to follow suit, including non-banks, with Resimac, which, along with the rest of the non-bank sector is not formally bound by APRA’s guidance, also confirming that it is reviewing its policy.

Former chief executive of the Royal Bank of Scotland, Ross McEwan has been appointed to the role of group chief executive officer and managing director.

Mr McEwan has been chief executive of the Royal Bank of Scotland since 2013 and led the bank through significant change and recovery.

Mr McEwan will start at NAB no later than April 2020 when his obligations to RBS are wrapped up and will be invited to join the board of NAB at that time.

NAB chairman-elect Philip Chronican said NAB was pleased with its appointment of Mr McEwan given his long-standing knowledge of the banking industry.

“Ross McEwan is the ideal leader for NAB as we seek to transform our operations and culture firmly around leading customer service, experience and products,” Mr Chronican said.

“Ross brings a compelling range of experience across finance, insurance and investment with a track record of delivering important and practical improvements for customers. RBS has been through many of the same challenges which NAB now faces around culture, trust and reputation.”

Mr McEwan who was group executive of retail banking at CBA for five years said he looked forward to returning to Australia.

“It is a privilege to return to Australia and lead NAB at a crucial time for the bank, its customers, employees, shareholders and the broader community.

“There are a number of areas where NAB can extend its lead, such as business banking, agriculture and health, and other areas where I believe we should consistently lead such as customer service. We must also meet and exceed the expectations of our many stakeholders,”he said.

The new appointment means Mr Chronican will now take over Dr Ken Henry’s role as chairman in mid-Novemeber.

The board will put other interim management arrangements suitable to APRA in place if required before Mr McEwan starts.

The Australian Prudential Regulation Authority (APRA) is applying additional capital requirements to three major banks to reflect higher operational risk identified in their risk governance self-assessments.

APRA has written to ANZ, National Australia Bank (NAB) and Westpac advising of an increase in their minimum capital requirements of $500 million each. The capital add-ons will apply until the banks have completed their planned remediation to strengthen risk management, and closed gaps identified in their self-assessments.

The increase in capital requirements follows APRA’s decision in May last year to apply a $1 billion dollar capital add-on to Commonwealth Bank of Australia (CBA) in response to the findings of the APRA-initiated Prudential Inquiry into CBA.

Following the CBA Inquiry’s Final Report, APRA wrote to the boards of 36 of the country’s largest banks, insurers and superannuation licensees asking them to gauge whether the weaknesses uncovered by the Inquiry also existed in their own companies. Although the self-assessments raised no concerns about financial soundness, they confirmed that many of the issues identified in the Inquiry were not unique to CBA. This included the need to strengthen non-financial risk management, ensure accountabilities are clear, cascaded and enforced, address long-standing weaknesses and enhance risk culture.

APRA Chair Wayne Byres said: “Australia’s major banks are well-capitalised and financially sound, but improvements in the management of non-financial risks are needed. This will require a real focus on the root causes of the issues that have been identified, including complexity, unclear accountabilities, weak incentives and cultures that have been too accepting of long-standing gaps.

“The major banks play a vital role in the stability of the entire financial system, and APRA expects them to hold themselves to the highest standards of risk governance. Their self-assessments reveal that they have fallen short in a number of areas, and APRA is therefore raising their regulatory capital requirements until weaknesses have been fully remediated,” Mr Byres said.

APRA supervisors continue to provide tailored feedback to other banks, insurers and superannuation licensees that provided self-assessments to APRA. Where weaknesses have been identified, the level of supervisory scrutiny is being increased as remediation actions are implemented. Where material weaknesses exist, APRA is also considering the need for the application of an additional operational risk capital requirement.

National Australia Bank has finally introduced Apple Pay to its customers with the service live from this morning after months of customer feedback requesting the service after Apply Pay went live with two of the other big four banks.

ANZ customers have had access to the service for a while now and can even withdraw money from the ATM using the service. CBA launched the service earlier in the year.

This service will allow NAB customers to pay via their apple devices and is available for NAB personal and business customers with NAB to contact eligible customers to let them know about its arrival.

NAB chief customer experience officer Rachel Slade said they had been listening to customers who wanted the service and were proud to finally launch it.

“We’re continuing to listen to customer feedback and take action to become the bank our customers want.

“As part of our transformation we are investing significantly in our technology and digital services to support our customers to manage their money how they choose,” said Ms Slade.

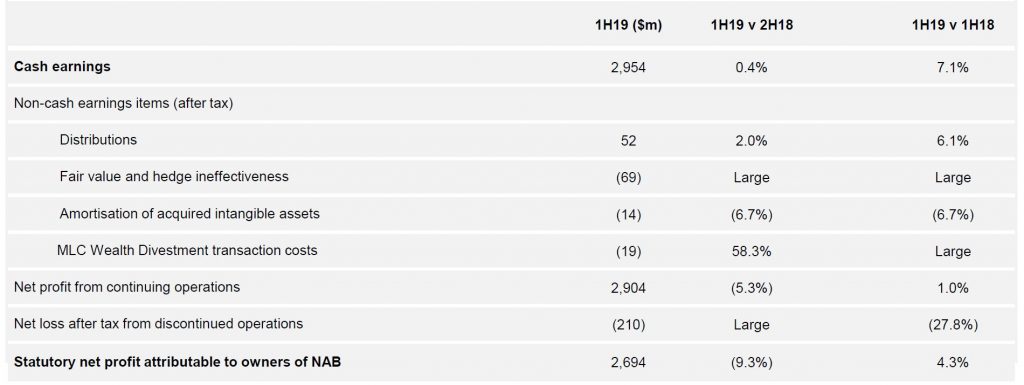

NAB reported their IH2019 results today. The statutory net profit in 1H19 was $2,694 million dollars, which is 9.3% lower compared with the 2H18, but 4.3% higher than 1H18.

Significantly they dropped the dividend to 83 cents per share, a drop of 16.2% compared with 1H18 – this was more than was anticipated by the market. But this is still an annualised dividend of circa 6.4%, compared with CBA and ANZ who are around 5.7%. This will help NAB build capital.

The cash ROE excluding restructuring and customer remediation was down 60 basis points to 13%, compared to ANZ’s 11.7%.

There were a number of one-offs which impacted the cash earnings, (their preferred measure) of $2,954 million, which is up 0.4% from 2H18, and 7.1% from 1H18.

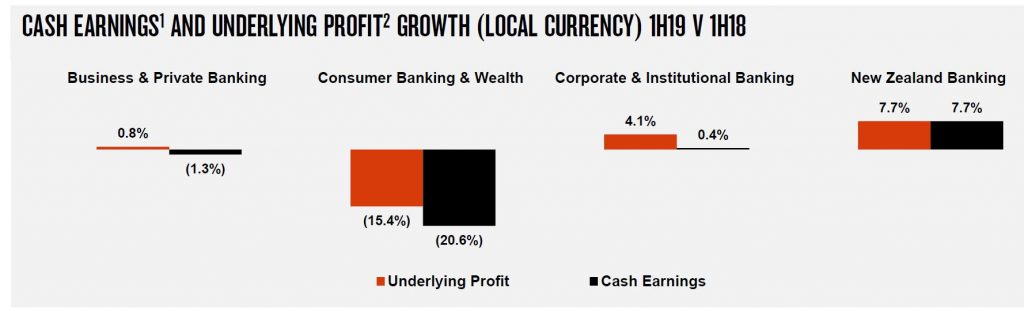

Consumer Banking dropped cash earnings by 20.6%.

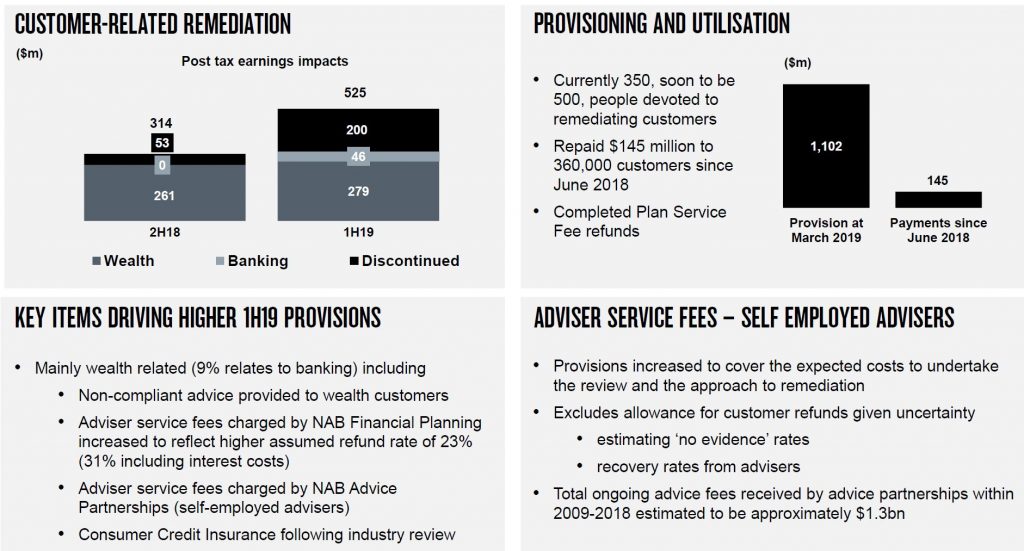

Customer remediation provisions stood at $1,102 million, and they plan to have 500 people devoted to this activity.

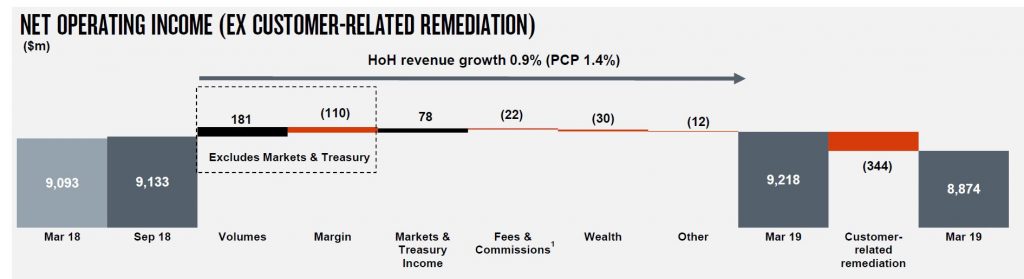

Overall income was higher, thanks to volume, but offset by margin compression of $110 million, a fall in fees and commissions, down $22 million and a customer remediation charge of $334 million, to give a net lower income of $8,874 million.

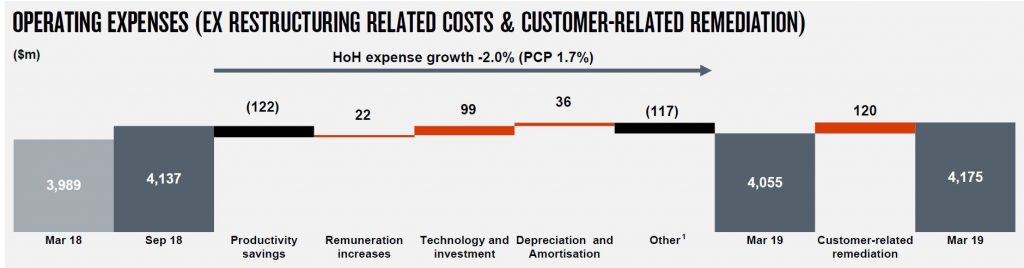

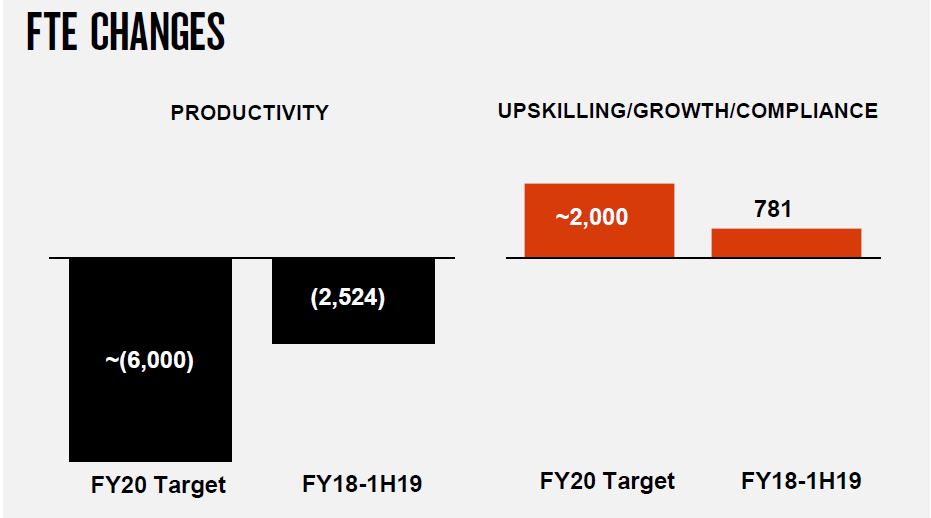

Operating expenses were flat(ish), but total FTE rose from 33,283 in 2H18 to 33,790 in 1H19.

They said that the banks is midway through its 3 year transformation program with additional investment target of $1.5bn, and that cost savings and FTE reduction are broadly on track.

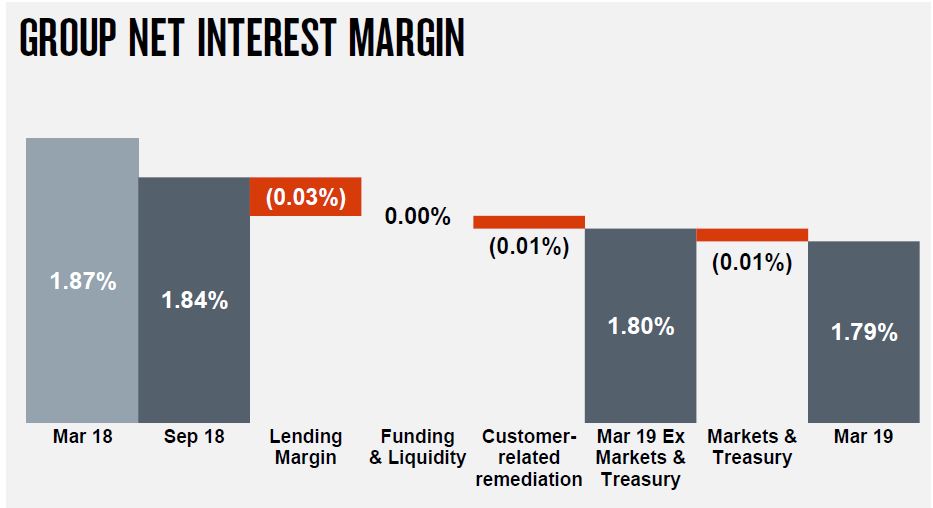

Group net interest margin fell 7 basis points. Of course NAB delayed their Australian mortgage book repricing, and clearly this cost. Corporate and Institutional helped support the result. The subsequent mortgage repricing may help ahead.

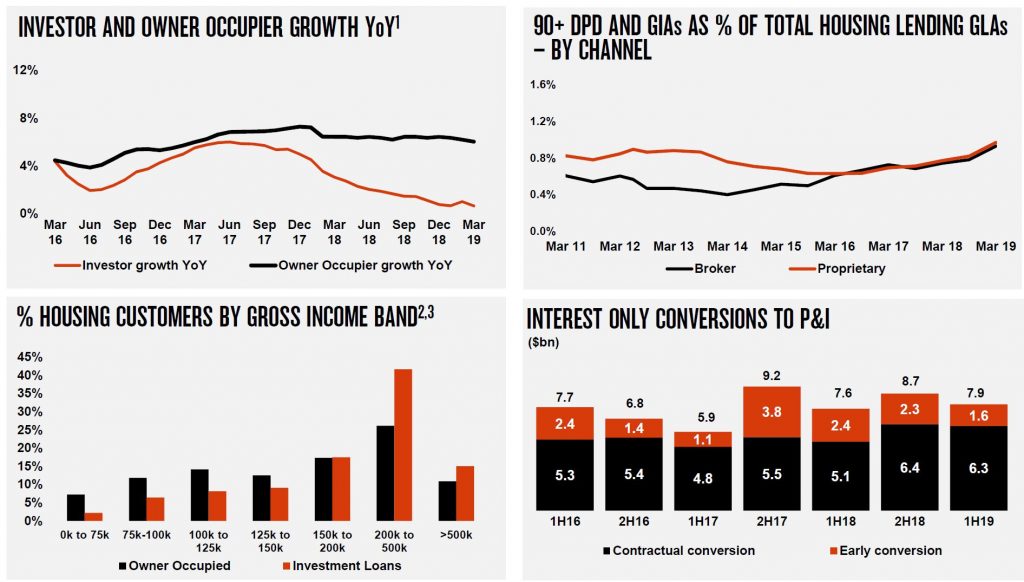

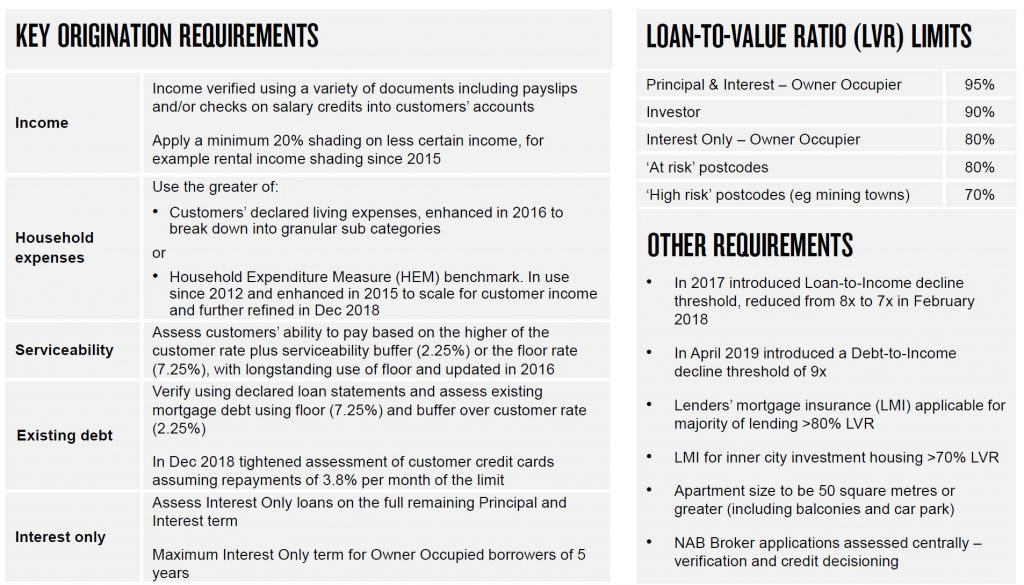

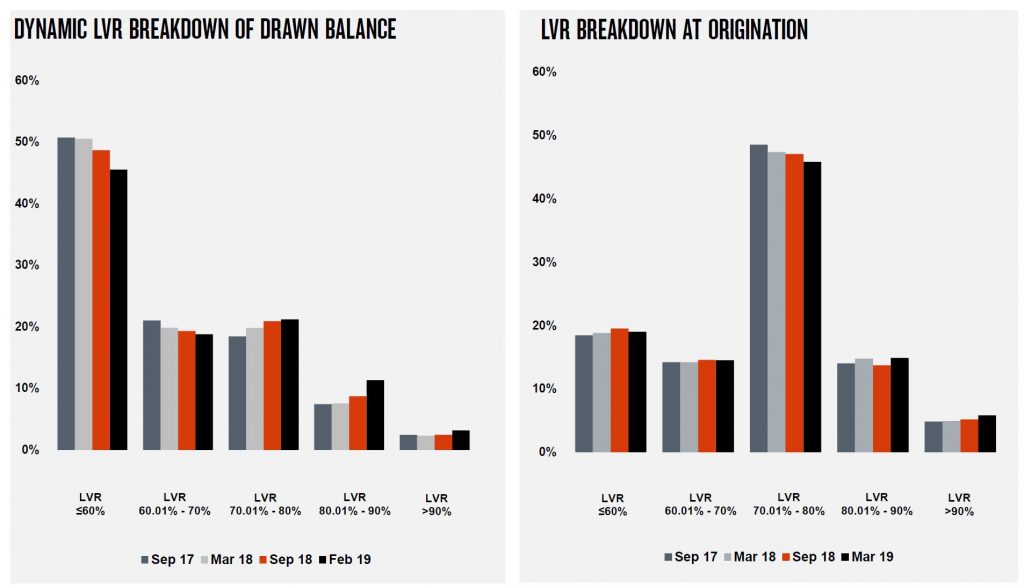

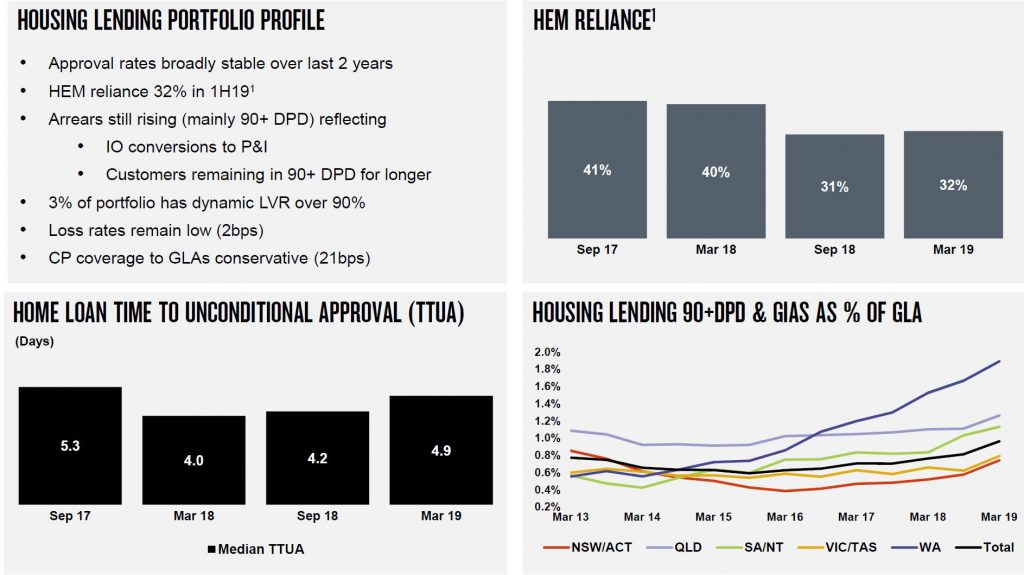

Home lending in Australia shows that approvals rates have remained stable over the past 2 years, and that reliance on HEM has fallen to 32% in March 19, compared with 41% in September 2017.

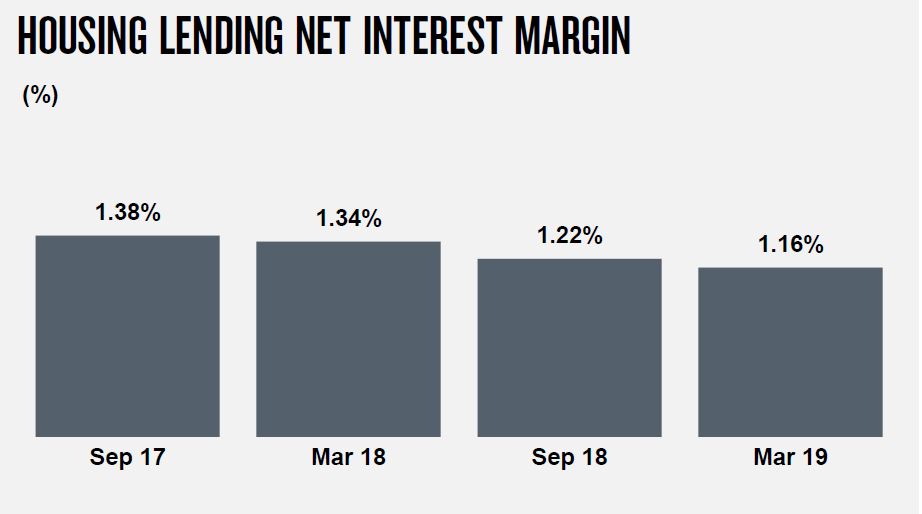

Net interest margin across Australian home loans fell 6 basis points from Sep 18 to Mar 19, and continues the slide from 2017.

Loan growth slowed, especially investor lending, and defaults are similar in both proprietary and broker channels now

They implemented Comprehensive Credit Reporting (CCR) for mortgages in February 2019 (first major bank to reach this milestone).

Lending standards have become tighter.

LVR Bands still include loans above 80% (and rising).

Default are rising, with 90 day+ defaults partly attributed to the conversion of interest only loans to P&I. WA has the highest levels, but other states also rose.

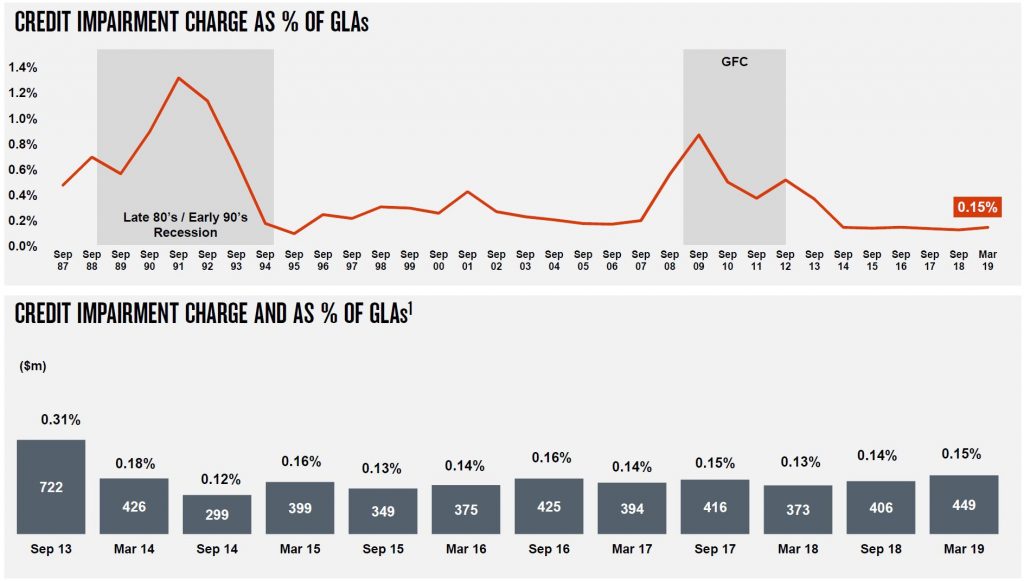

Group credit impairments rose to 0.15% of GLA’s.

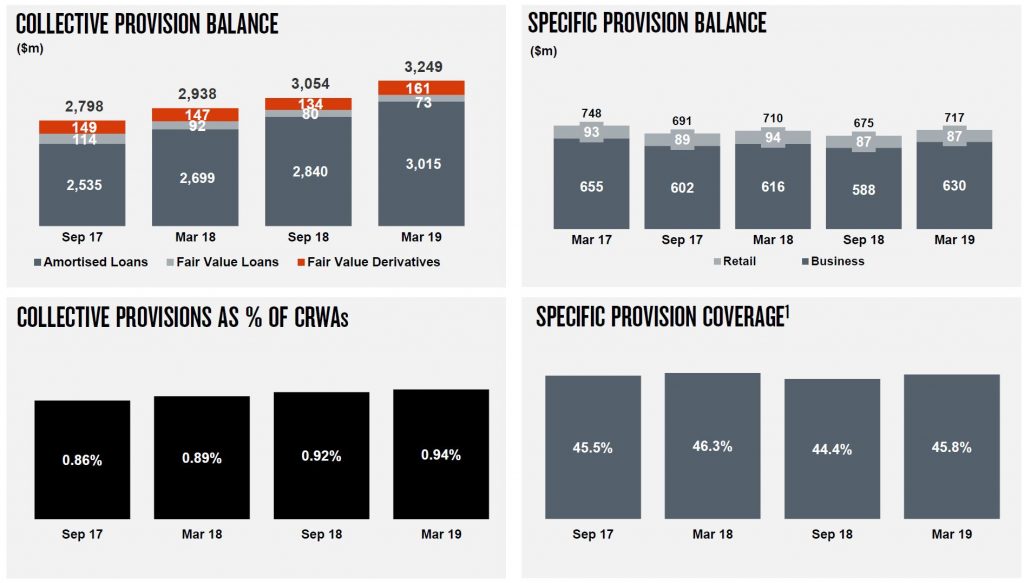

The group provisions are higher, as are the specific provision balances.

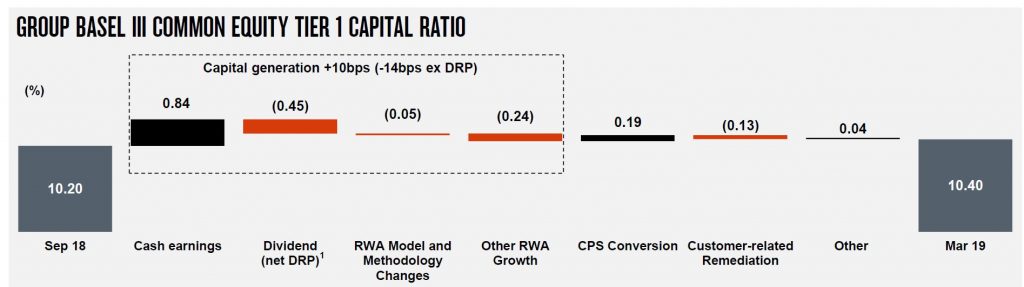

The CET1 ratio is 10.40, up from 10.20 in Sep 18, and they say they are on track for “unquestionably strong”.

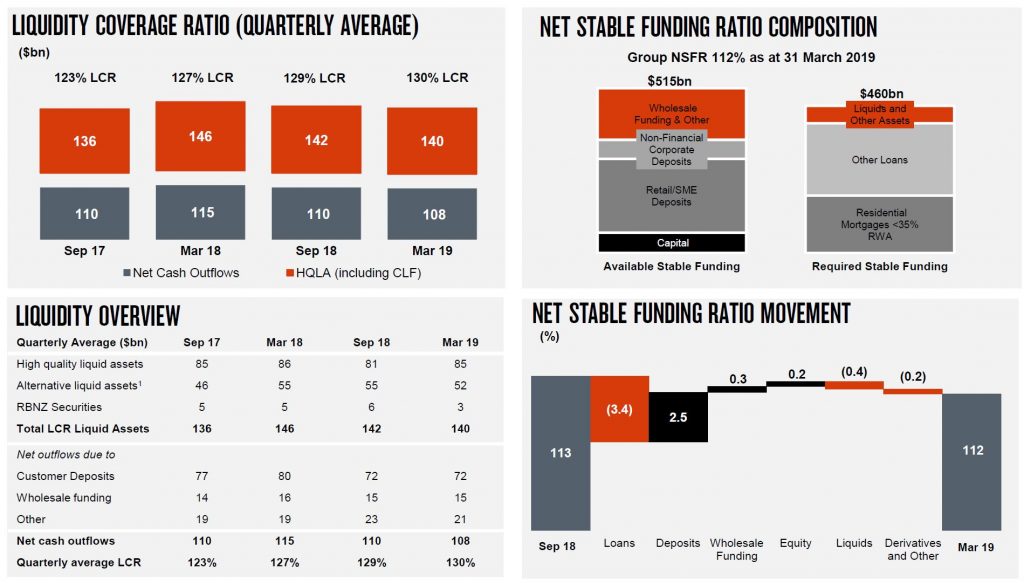

The LCR and NSFR remain strong.

So the underlying franchise still looks in reasonable shape, but the weakening housing sector needs to be watched.