The new focus on employment outcomes is an outcome of Phase 1 of the Review of the Reserve Bank Act 1989, which the Coalition Government announced in November 2017.

“The Reserve Bank Act is nearly 30 years old. While the single focus on price stability has generally served New Zealand well, there have been significant changes to the New Zealand economy and to monetary policy practices since it was enacted,” Grant Robertson said.

“The importance of monetary policy as a tool to support the real, productive, economy has been evolving and will be recognised in New Zealand law by adding employment outcomes alongside price stability as a dual mandate for the Reserve Bank, as seen in countries like the United States, Australia and Norway.

“Work on legislation to codify a dual mandate is underway. In the meantime, the new PTA will ensure the conduct of monetary policy in maintaining price stability will also contribute to employment outcomes.”

A Bill will be introduced to Parliament in the coming months to implement Cabinet’s decisions on recommendations from Phase 1 of the Review. As well as legislating for the dual mandate, this will include the creation of a committee for monetary policy decisions.

“Currently, the Governor of the Reserve Bank has sole authority for monetary policy decisions under the Act. While clear institutional accountability was important for establishing the credibility of the inflation-targeting system when the Act was introduced, there has been greater recognition in recent decades of the benefits of committee decision-making structures,” Grant Robertson said.

“In practice, the Reserve Bank’s decision-making practices for monetary policy have adapted to reflect this, with an internal Governing Committee collectively making decisions on monetary policy. However, the Act has not been updated accordingly.”

The Government has agreed a range of five to seven voting members for a Monetary Policy Committee (MPC) for decision-making. The majority of members will be Reserve Bank internal staff, and a minority will be external members. The Reserve Bank Governor will be the chair.

“It is my intention that the first committee of seven members would have four internal, and three external members. Treasury will also have a non-voting observer on the MPC to provide information on fiscal policy,” Grant Robertson said.

The MPC is expected to begin operation in 2019 following passage of amending legislation. There will be a full Select Committee process for the legislation.

Reserve Bank Governor-Designate, Adrian Orr, said that the PTA recognises the importance of monetary policy to the wellbeing of all New Zealanders.

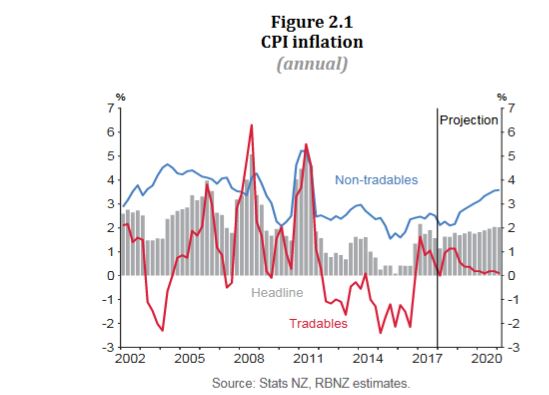

“The PTA appropriately retains the Reserve Bank’s focus on a price stability objective. The Bank’s annual consumer price inflation target remains at 1 to 3 percent, with the ongoing focus on the mid-point of 2 percent.

“Price stability offers enduring benefits for New Zealanders’ living standards, especially for those on low and fixed incomes. It guards against the erosion of the value of our money and savings, and the misallocation of investment.”

Mr Orr said that the PTA also recognises the role of monetary policy in contributing to supporting maximum sustainable employment, as will be captured formally in an amendment Bill in coming months.

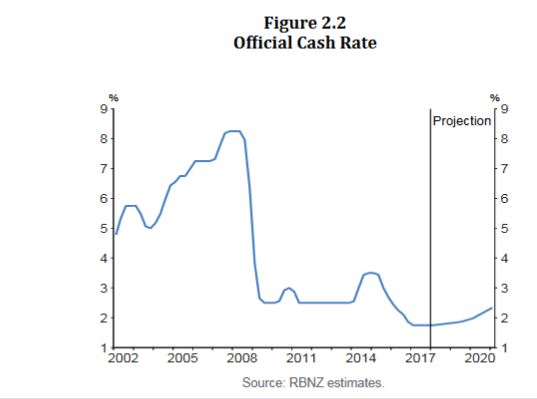

“This PTA provides a bridge in that direction under the constraints of the current Act. The Reserve Bank’s flexible inflation targeting regime has long included employment and output variability in its deliberations on interest rate decisions. What this PTA does is make it an explicit expectation that the Bank accounts for that consideration transparently. Maximum sustainable employment is determined by a wide range of economic factors beyond monetary policy.”

Mr Orr said that he welcomes the intention to use a monetary policy committee decision-making group, including both Bank staff and a minority of external members.

“Legislating for this committee will give a strong basis for the Bank’s use of a committee decision-making process. Widening the committee to include external members also brings the benefit of diversity and challenge in our thinking, while enhancing the transparency of decision-making and flow of information.”

Phase 2 of the Review is being scoped. It will focus on the Reserve Bank’s financial stability role and broader governance reform. Announcements on the final scope will be made by mid-2018 and subsequent policy work will commence in the second half of 2018.