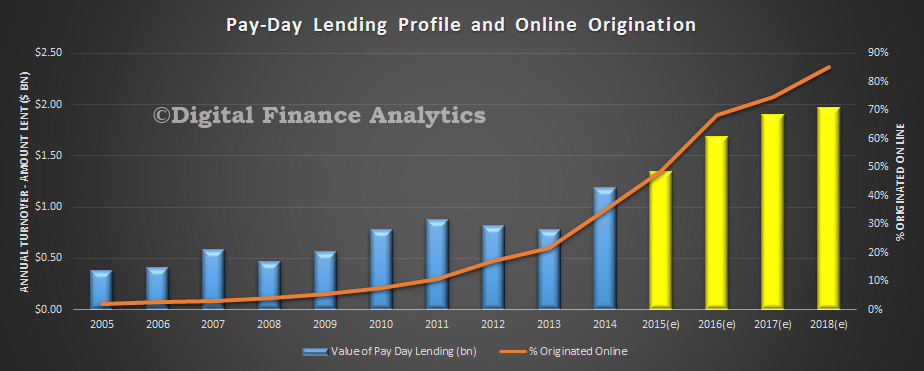

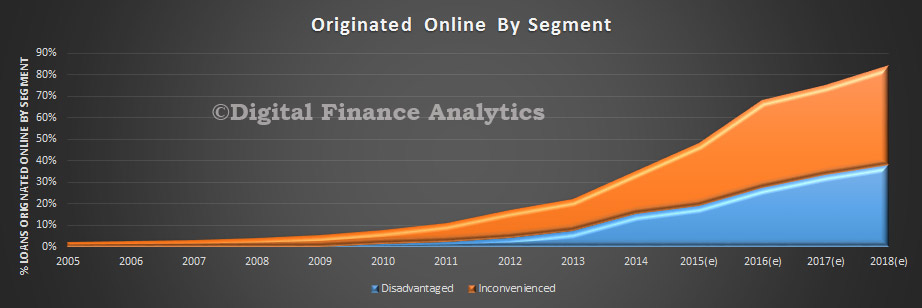

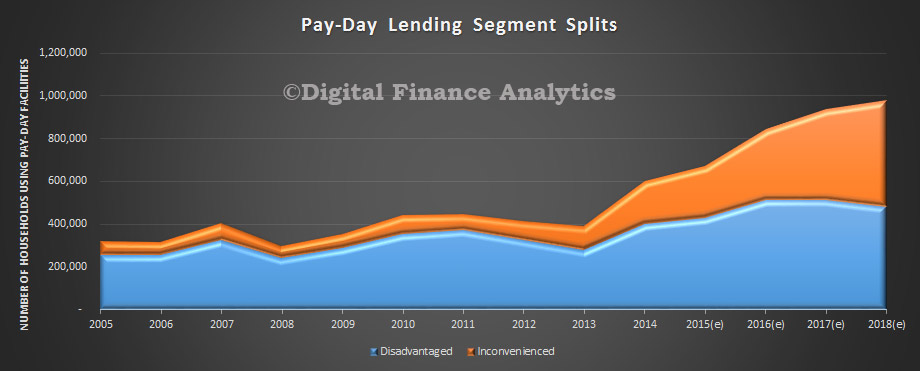

The Government is establishing a review of the small amount credit contract (SACC) laws and related provisions in the National Consumer Credit Protection Act 2009 (Credit Act). This is much needed given the projected rise in the number of financially distressed household, and the rise in the size of the payday sector, especially delivered online.

The establishment of the review fulfils a statutory requirement under the Credit Act, to examine and report on the effectiveness of the law relating to SACCs.

Terms of reference

- The review will make recommendations about the effectiveness of, and where necessary recommend changes to, the following:1.1 the requirement to obtain and consider a consumer’s bank account statements in subsections 117(1A) and 130(1A) of the Credit Act;1.2 the rebuttable presumption that a loan is unsuitable where the consumer is in default under another SACC or has held two other SACCs in the past 90 days in subsections 118(3A), 123(3A), 131(3A) and 133(3A) of the Credit Act;

1.3 the prohibitions on entering into, or increasing the credit limit of, a loan contract that has a term of 15 days or less with a consumer, and on suggesting or assisting a consumer to do so in sections 124A, 133C and 133CA of the Credit Act;

1.4 the requirement to display a warning statement about the alternatives available to SACCs in sections 124B, 133C and 133CB of the Credit Act;

1.5 the cap on fees and charges (including the maximum of a 20 per cent establishment fee and of a monthly 4 per cent fee) in sections 23A, 31A, 31B and 39A of the National Credit Code;

1.6 the requirement that consumers who default under a SACC must not be charged an amount that exceeds twice the amount of the relevant loan in section 39B of the National Credit Code; and

1.7 the power to introduce specific protections for particular groups of consumers in sections 133C and 133CC of the Credit Act and the protections for consumers who receive 50 per cent or more of their income under the Social Security Act 1991 in regulation 28S of the National Consumer Credit Protection Regulations 2010.

- The review will make recommendations on:2.1 whether a national database of SACCs should be established and if so, by whom and how it should be funded; and2.2 whether any additional provisions relating to SACCs should be included in the Credit Act, the accompanying regulations, or the National Credit Code.

- The review will make recommendations on whether any of the provisions which apply to SACCs should be extended to regulated consumer leases.

- The review will make recommendations that take into account:

- competition;

- fairness;

- innovation;

- efficiency;

- access to finance;

- regulatory compliance costs; and

- consumer protection.

- In examining the issues set out above, the review should also consider whether the laws relating to SACCs and regulated consumer leases are appropriate for the current economic climate and whether they will continue to meet Australia’s evolving needs.

- The review should conduct consultations with stakeholders, and hold public meetings where appropriate.

- The review will not recommend the establishment of an additional body or the establishment of a further review(s).

- The review will not recommend changes to any area of the law that the Commonwealth does not have the direct power to regulate.

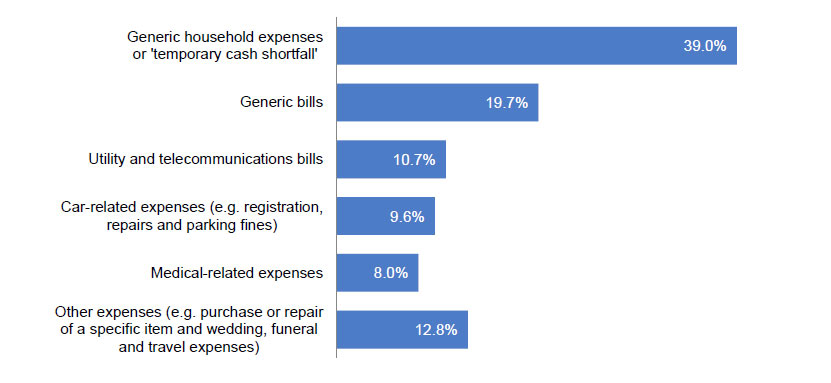

In their statement, the Government recognises that small amount lenders can play an important role in the economy by providing credit to consumers who are excluded from mainstream forms of finance. The Government wants to ensure that the regulatory framework strikes the right balance by protecting vulnerable consumers without imposing an undue regulatory burden on industry.

SACCs are loans of less than $2,000 to the consumer with a maximum term of 12 months. Since 2013, the Credit Act has placed specific obligations on SACC providers, including a cap on costs and a rebuttable presumption that a loan is unsuitable where the customer is in default under another small amount loan.

The Government’s review also provides an appropriate opportunity to consider the laws that apply to regulated consumer leases. A consumer lease allows a customer to lease an item (for example, a fridge), until the term of the lease finishes, when the item is returned to the lease provider. Consumer leases regulated under the Credit Act include those that are for a set period of four months or longer.

While the customer base for small amount loans and regulated consumer leases is similar, many of the regulatory requirements for SACCs do not apply to consumer leases. The review will consider whether the provisions that apply to SACCs should be extended to consumer leases.

The review will be chaired by Ms Danielle Press, the CEO of Equipsuper, who will be joined by panel members Ms Catherine Walter AM, Deputy Chair of Funds Management Victoria, and Mr Stephen Cavanagh, Partner at HWL Ebsworth.

As part of the consultation process, the panel will call for submissions from interested parties and will consult widely with stakeholders. The terms of reference for the review are attached.

The panel will report by the end of this year.