In the June RBA Bulletin, there was an article which describes how the RBA executes its market interventions to effect a cash rate change. It is important to understand these inner workings, despite it appearing complicated on first blush.

And consider this, this tool box is being used by many central banks around the world to direct the financial system.

In summary, the RBA’s operations in domestic markets support the implementation of monetary policy. The most important tool to guide the cash rate to the target set by the Board is the interest rate corridor. To support this, the RBA pursues daily open market operations in order to keep the pool of exchange settlement (ES) balances at the appropriate level for the cash market to function smoothly. The daily market operations are conducted to offset the effects on liquidity of the many transactions between the banking system and the Australian Government. Open market operations are primarily conducted through repos and FX swaps. These provide flexibility for liquidity management and also help to manage risk for the RBA’s balance sheet.

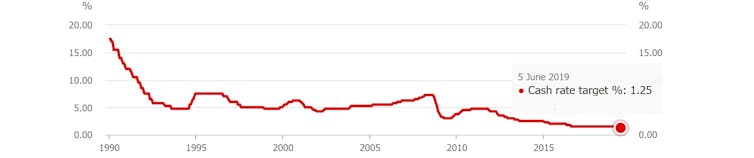

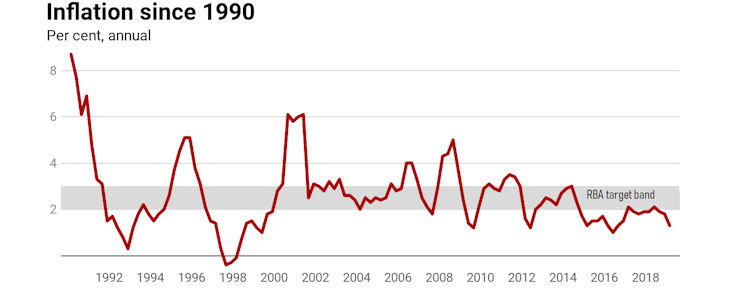

The cash rate is a key determinant of interest rates in domestic financial markets and hence underpins the structure of the interest rates that influence economic activity and financial conditions more generally.

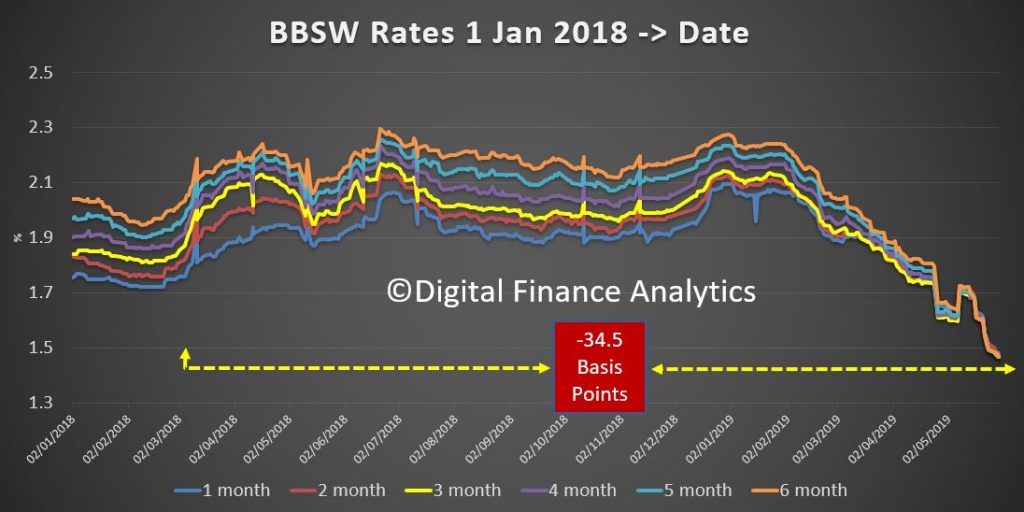

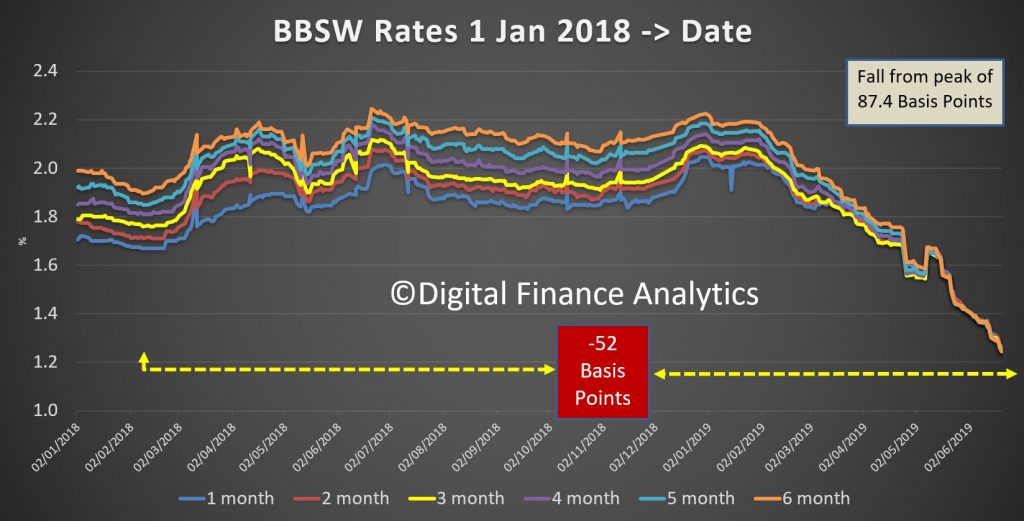

This helps to explain the sharp falls in the BBSW rates, which are now around 87 basis points lower than the recent peak. Such a fall has been engineered.

The cash rate is an effective instrument for implementing monetary policy because it affects the broader interest rate structure in the domestic financial system. The cash rate is an important determinant of short-term money market rates, such as the bank bill swap rate (BBSW), and retail deposit rates (Graph 1). These rates – as well as a number of other factors – then influence the funding costs of financial institutions and the lending rates faced by households and businesses. As a result, the cash rate influences economic activity and inflation, enabling the RBA to achieve its monetary policy objectives. However, while changes in the cash rate are very important, they are not the only determinant of market-based interest rates. Other factors, such as expectations, conditions in financial markets, changes in competition and risks associated with different types of loans are also important.

The Cash Market and the Interest Rate Corridor

The RBA implements monetary policy by setting a target for the cash rate. This is the interest rate at which banks lend to each other on an overnight unsecured basis, using the exchange settlement (ES) balances they hold with the RBA. ES balances are at-call deposits with the RBA that banks use to settle their payment obligations with other banks. Banks are required to have a positive (or zero) ES balance at all times, including at the end of each day. It is difficult for institutions to predict whether they will have adequate funds at the end of any particular day, which generates the need for an interbank overnight cash market. Those banks that need additional ES balances after they have settled all payment obligations of their customers, borrow from banks with surplus ES balances. The interbank cash market is the mechanism through which these balances are redistributed between participants.

The RBA sets the supply of ES balances to ensure that the cash market functions smoothly by providing an appropriate level of ES balances to facilitate the settlement of interbank payments. The RBA manages the supply of ES balances available to the financial system through its open market operations (see below). Excessive ES balances could lead institutions to lend below the target cash rate, while a shortage might result in the cash rate being bid up above the target.

The interest rate corridor ensures that banks have no incentive to deviate significantly from the cash rate target when borrowing or lending in the cash market. Banks can borrow ES balances overnight on a secured basis from the RBA at a margin set 25 basis points above the cash rate target. As a result, banks have no need to borrow from other banks at a higher rate. Similarly, banks receive interest on their surplus ES balances at 25 basis points below the cash rate target. Therefore, they have no incentive to lend to other banks at a lower rate.

The operation of the interest rate corridor means that there is no need for the RBA to adjust the supply of ES balances to bring about a change in the cash rate (Graph 2 and Graph 3). For example, when the RBA lowered the cash rate target by 25 basis points from 1.5 per cent to 1.25 per cent in early June, the rates associated with the corridor also moved lower, to be 1.0 per cent on overnight deposits and 1.5 per cent on overnight loans (down from 1.25 per cent and 1.75 per cent). A bank that would have previously required a return above 1.25 per cent to lend ES balances in the cash market is, under the new corridor, willing to lend at a lower return. And so a bank wanting to borrow cash pays a lower rate than before. Similarly, if the RBA had instead raised the cash rate by 25 basis points from 1.5 per cent, the corridor would have moved up, to be 1.5 per cent to 2.0 per cent. A bank that would have previously lent surplus ES funds to another in the cash market at 1.50 per cent would, under the new corridor, no longer have an incentive to do so. Indeed, it would require a higher return to lend ES balances, rather than leaving those funds in its ES account and receiving 1.50 per cent from the RBA. Hence, a bank wanting to borrow in the cash market would have to pay a higher interest rate than it did previously.

In other words, interbank transactions automatically occur within the interest rate corridor without the RBA needing to undertake transactions beyond its usual market operations to manage liquidity.

The incentives underlying the corridor guide the cash rate to the target and ordinarily all transactions occur at the rate announced by the RBA. The last time there was a small deviation in the published cash rate (which is a weighted average of all transactions in the cash market) from the target (of 1 basis point for two days) was in January 2010 (Graph 4). The lack of deviation of the cash rate from the target has brought about a self-reinforcing market convention where both borrowers and lenders in the cash market expect to transact at the prevailing target rate. This market convention helps to address the uncertainty that banks would otherwise face about the price at which they can borrow sufficient ES balances to cover their payment obligations each day. In 2018, daily transactions in the overnight interbank market were typically between $3 billion and $6 billion.

As in Australia, many other central banks implement monetary policy with an interest rate corridor to guide the policy rate. The width of the corridor tends to differ, typically from 50 to 200 basis points. The choice of the width of the corridor is seen as a reflection of a trade‐off between interest rate control and the desire to avoid the central bank becoming an intermediary in the money market. All other things being equal, cross-country studies suggest that a narrower corridor is preferred by central banks that have a strong preference for low volatility of short-term interest rates, whereas a wider corridor is usually preferred by central banks that seek to encourage more interbank trading activity.

Over the past 10 years, many central banks (other than the RBA) have significantly expanded their balance sheets. This has resulted in significantly more liquidity in their respective systems and so banks typically do not need to borrow funds in the overnight cash market. In these cases, the policy rate typically converges toward the rate on deposits paid by the central bank; this is often referred to as a ‘floor system’. Small changes in liquidity in such a system do not tend to have much effect on the policy rate.

Liquidity Management and Open Market Operations

Transactions between the government (which banks with the RBA) and the commercial banks would, by themselves, change the supply of ES balances on a daily basis. ES balances in accounts of commercial banks increase whenever the government spends out of its accounts at the RBA. Similarly, when the government receives cash into its accounts at the RBA, such as from tax payments or debt issuance, ES balances decline. The RBA monitors and forecasts these changes actively through the day. It offsets (i.e. ‘sterilises’) these changes in ES balances with its daily open market operations so that government receipts and payments do not affect the aggregate level of ES balances. If transactions that affect system liquidity were not offset by the RBA, ES balances would be much more volatile and the payments system would suffer frequent disruptions (Graph 5). Ultimately this is likely to lead to a more volatile cash rate.

The main tools used in open market operations are repurchase (repo) agreements and foreign exchange swaps. Both repos and foreign exchange swaps involve a first and a second leg (Figures 1 and 2):

- The first leg of a typical repo in open market operations (which injects ES balances) involves the RBA providing ES balances to a bank and the bank providing eligible debt securities as collateral to the RBA. Taking collateral safeguards the RBA against loss in the case of counterparty default. The second leg, which occurs at an agreed future date, unwinds the first leg: the bank returns the ES balances and the RBA returns the securities to the bank.

- The first leg of a foreign exchange swap designed to inject ES balances into the system involves the RBA providing ES balances to a bank and the bank providing collateral in the form of foreign currency to the RBA (typically US dollars, euros or Japanese yen). The second leg, at the agreed future date, consists of the bank returning the ES balances and the RBA returning the foreign exchange.

Repos and swaps provide more flexibility for liquidity management than outright purchases or sales of assets since they involve a second leg (when the transaction unwinds) with a date chosen to support liquidity management on that day. It also allows the RBA to accept a much broader range of collateral, such as unsecured bank paper, than it would be willing to purchase outright. By contrast, buying (and then selling) securities outright requires the RBA to take on the price and liquidity risk associated with owning the assets outright. Conducting open market operations by buying and selling government securities outright, while also ensuring that the RBA’s market operations do not affect liquidity in the bond market, would require more government securities than are available in Australia.

The size of daily open market operations is based on forecasts of daily liquidity flows between the RBA’s clients (mainly the Australian Government) and the institutions with ES accounts. In a typical round of market operations, a public announcement is made at 9.20 am that the RBA is willing to auction ES balances against eligible collateral for a certain number of days (ranging from two days to several months, with an average term of around 30 days). Institutions have 15 minutes to submit their bid. The RBA ranks these bids from highest to lowest repo rate and then allocates ES balances to the highest bidders until the amount the RBA intends to auction has been dealt. All auction participants are informed electronically about their allocation. If they have been successful, they will pay the rate at which they bid for the amount allocated. The aggregate results of the auction, including the amount dealt, the average repo rate and the lowest repo rate accepted are published.

Market Operations and the RBA Balance Sheet

The transactions entered into as part of open market operations are reflected in changes in the RBA’s balance sheet. Changes in the size and composition of liabilities (mainly issuance of banknotes and government deposits) may need to be offset via open market operations to ensure that the availability of ES balances remains appropriate for the smooth functioning of the cash market (Graph 6).

Open market operations affect the asset side of the balance sheet (Graph 7). When the RBA purchases securities under repo, it has a legal claim on the security that was transferred as collateral for the duration of the repo. These claims appear as assets on the balance sheet, along with outright holdings of domestic government securities. When the RBA uses foreign exchange swaps to supply Australian dollars into the local market, the foreign currency-denominated investments associated with the swap are also reflected as assets on the balance sheet. The choice between using repo, foreign exchange swaps or outright purchases to adjust the supply of ES balances is determined by market conditions and pricing. When a large amount of ES balances needs to be supplied or drained, such as when a government bond matures, the RBA might choose to do so using a combination of instruments.

The RBA supplies ES balances not only for monetary policy implementation but also to facilitate the functioning of the payment system. Over recent years, the RBA has been providing more ES balances to banks to enable the settlement of payments outside normal banking hours, such as through direct-entry and the New Payments Platform. These ES balances are supplied under ‘open repos’. An open repo is set up in a similar way to the repo explained in Figure 1, with the initial leg transferring ES balances to banks in return for eligible debt securities as collateral. However, the date of the second leg is not specified, so it is open ended. The ES balances are available (and the claim on securities remain on the RBA’s balance sheet) until the open repo is closed out. These ES balances provided under open repo are held purely to facilitate the effective operation of the payments system after hours and cannot be lent overnight in the cash market. As a result, they have no implications for the implementation of monetary policy. Currently, these balances are around $27 billion. The remainder of ES balances that are available for trading in the cash market are referred to as ‘surplus ES balances’, and are the focus of daily open market operations. Recently, surplus ES balances have been around $2–3 billion. This amount has increased in recent years as demand for balances has risen, partly in response to new prudential regulations on liquidity.