I caught up with the Co-Founder and CEO, David Boyd of Credit Card Compare, on their announcement of expansion into Singapore.

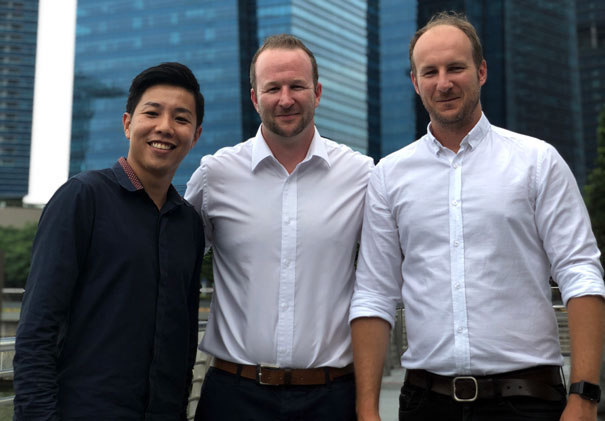

Kwok (A Co-Founder of Finty), David & Andrew Boyd.

Kwok (A Co-Founder of Finty), David & Andrew Boyd.

Credit Card Compare does what it says on the tin, by providing a website for prospective credit card customers to select and compare the features and benefits of a wide range of Australian credit cards. In fact, the business, which started in a domestic setting a decade ago has thrived, and now has around 150,000 people seeking advice each month via the site.

When customers get a card approved from the bank, they receive a referral fee but do not handle the application or credit assessment processes, so Credit Card Compare is essentially a lead generating platform for lenders. The trick of course is to get current data passed back from the banks and David said that given the legacy systems in some organisations, this can be a challenge. They have some additional enhancements in the works, which we will see down the track. As yet they do not provide advice on which card is best, but simply make it possible for consumers to compare cards on a range of standard parameters and prioritise the features which they believe are most important.

The announcement of Credit Card Compare’s acquisition of Singapore based start-up, Finty.com highlights their desire to reach out and expand into selected Asian markets. Singapore has a unique credit card market, in that as well as card applicants being enticed with cash back, rewards and points, Finty enriches the rewards they receive, and as a result has a significant footprint in the market, despite relatively modest numbers of applications. In that market, customer rewards for taking a card are paid once approved, and most card holders possess a battery of separate cards for different purposes, for example, travel, expenses, and shopping. The average Singaporean would somewhere between six to eight cards, a much higher number than in Australia where most people only have one or two cards.

David sees significant growth potential across Asia, and also potentially some leverage from Finty.com back into the Australian business, seeing a win-win between the two businesses, with niche expertise from Singapore paired with executional capability in Australia.

Given the release of the ASIC report into Credit Cards, where they underscore the fact that many households have the wrong cards for their purchase and repayment behaviour, it seems to me that Credit Card Compare is well placed to bring greater sophistication into the local Australian market, whilst growing across the region. A nice trick to pull off if they can do it.