The latest Video Blog features the recently released Small and Medium Business report. In this short introduction we explore some of the main findings.

Details of the report and how to obtain a free copy are available here.

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

The latest Video Blog features the recently released Small and Medium Business report. In this short introduction we explore some of the main findings.

Details of the report and how to obtain a free copy are available here.

The Australian Competition and Consumer Commission has instituted proceedings in the Federal Court against Woolworths Limited, alleging it engaged in unconscionable conduct in dealings with a large number of its supermarket suppliers, in contravention of the Australian Consumer Law.

The ACCC alleges that in December 2014, Woolworths developed a strategy, approved by senior management, to urgently reduce Woolworths’ expected significant half year gross profit shortfall by 31 December 2014.

It is alleged that one of the ways Woolworths sought to reduce its expected profit shortfall was to design a scheme, referred to as “Mind the Gap”. It is alleged that under the scheme, Woolworths systematically sought to obtain payments from a group of 821 “Tier B” suppliers to its supermarket business.

The ACCC alleges that, in accordance with the Mind the Gap scheme, Woolworths’ category managers and buyers contacted a large number of the Tier B suppliers and asked for Mind the Gap payments from those suppliers for amounts which included payments that ranged from $4,291 to $1.4 million, to “support” Woolworths. Not agreeing to a payment would be seen as not “supporting” Woolworths.

The ACCC also alleges that these requests were made in circumstances where Woolworths was in a substantially stronger bargaining position than the suppliers, did not have a pre-existing contractual entitlement to seek the payments, and either knew it did not have or was indifferent to whether it had a legitimate basis for requesting a Mind the Gap payment from every targeted Tier B supplier.

The ACCC alleges that Woolworths sought approximately $60.2 million in Mind the Gap payments from the Tier B suppliers, expecting that while many suppliers would refuse to make a payment, some suppliers would agree. It is alleged that Woolworths ultimately captured approximately $18.1 million from these suppliers.

“The ACCC alleges that Woolworths’ conduct in requesting the Mind the Gap payments was unconscionable in all the circumstances,” ACCC Chairman Rod Sims said.

“A common concern raised by suppliers relates to arbitrary claims for payments outside of trading terms by major supermarket retailers. It is difficult for suppliers to plan and budget for the operation of their businesses if they are subject to such ad hoc requests.”

“The alleged conduct by Woolworths came to the ACCC’s attention around the time when there was considerable publicity about the impending resolution of the ACCC’s Federal Court proceedings against Coles Supermarkets for engaging in unconscionable conduct against its suppliers,” Mr Sims said.

“Of course, the allegations against Woolworths are separate and distinct from the Coles case.”

The ACCC is seeking injunctions, including an order requiring the full refund of the amounts paid by suppliers under the Mind the Gap scheme, a pecuniary penalty, a declaration, and costs.

These proceedings follow broader investigations by the ACCC into allegations that supermarket suppliers were being treated inappropriately by the major supermarket chains.

Launched today, the Financial Services Disruption Index, which has been jointly developed by Moula, the lender to the small business sector; and research and consulting firm Digital Finance Analytics (DFA) shows that Financial Services are undergoing disruptive change, thanks to customers moving to digital channels, the emergence of new business models, and changing competitive landscapes. Combing data from both organisations, we are able to track the waves of disruption, initially in the small business lending sector, and more widely across financial services later.

The index tracks a number of dimensions. From the DFA Small business surveys (26,000 each year), we measure SME service expectations for unsecured lending, their awareness of non-traditional funding options, their use of smart devices, their willingness to share electronic data in return for credit, and overall business confidence of those who are borrowing relative to those who are not.

Moula data includes SME conversion data, the type of data SMEs share, the average loan amount approved, application credit enquiries, and speed of application processing.

The index stood at 33.02 from May to July 2015, and rose to 33.94 in the August to October period. The higher the score, the greater the disruption. Of note SMEs are becoming more aware of non-traditional unsecured lending options, are becoming more demanding in terms of application processing times, are more willing to share data and are more likely to apply using a smart device. In addition, the loan values being written are rising, more businesses are willing to share richer data, and the confidence levels among borrowing SMEs is on the rise.

Overall, unsecured lending to the SME sector is being disrupted significantly, and we expect the index will continue to trend higher, as awareness of alternatives to traditional banking continues to rise, and more firms apply for credit.

The index is featured in an SMH MySmallBusiness article today.

Small business owners, banks and fintechs can all gain valuable insights from a recent survey of SMEs conducted by research company Digital Financial Analytics (DFA).

The results reinforce the critical importance of cash flow management and identify a number of telling behavioural and demographic trends within this all important sector.

The DFA Small & Medium Business Survey 2015 of 26,000 businesses with turnover of less than $5 million reveals 57% of all business borrowing is for working capital.

Extended payments terms and late payments are the main reasons why managing cash flow has become one of the biggest challenges facing SMEs.

With average debtor days running at between 50 and 60, managing cash is a juggling act that can be made even more difficult by some big customers that display little regard for the plight of their smaller suppliers.

This is where the relationship between the SME and the bank becomes so critical. The extent to which business owners feel their bank is there to support them in tight times is one of the key determinants of satisfaction levels and also the propensity to switch banks.

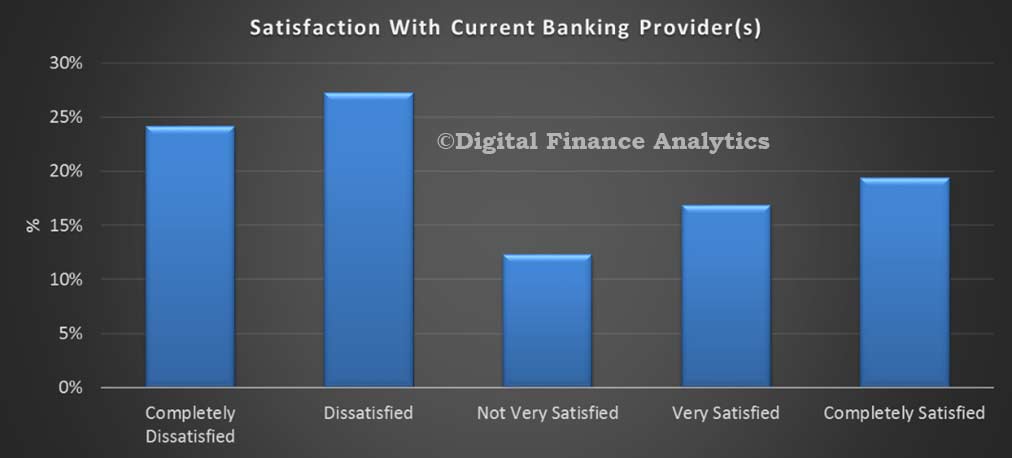

Thirty-five per cent of SMEs surveyed by DFA are either “satisfied” or “completely satisfied” with their bank, so clearly many customers are happy.

But this also means that two in every three business customers have at least some level of dissatisfaction with their bank. The main causes of frustration can be traced to lack of service, compliance requirements and poor understanding by banks of their needs.

So how does satisfaction translate into shifting intentions? Seventy five per cent of SMEs indicated a preparedness to shift for a better deal yet 60% have never changed banks.

This begs the question: why don’t more SMEs change banks?

Possible explanations are that SMEs don’t proactively seek alternative financing proposals because they either feel “it’s all too hard” or “all the banks are pretty much the same anyway”.

Others may have tried to move but have found no joy because they overestimated their attractiveness to another bank.

When it comes to how much profit banks make from their SME customers, 20% of customers generate around 80% of bank profits.

Perhaps surprisingly, 30% of all SMEs are actually unprofitable for the banks. The problem for many business owners is that they don’t know how attractive they are as a customer and this makes it tricky when it comes to negotiating with banks.

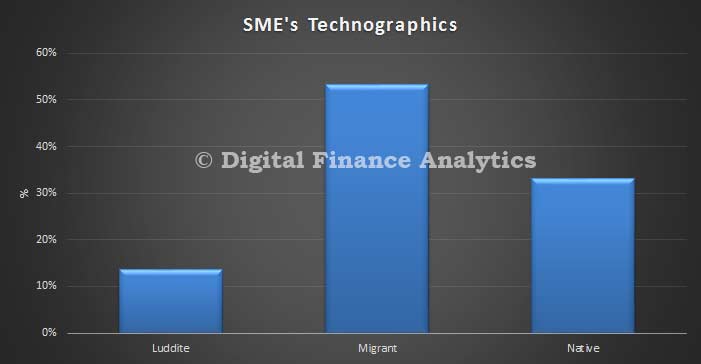

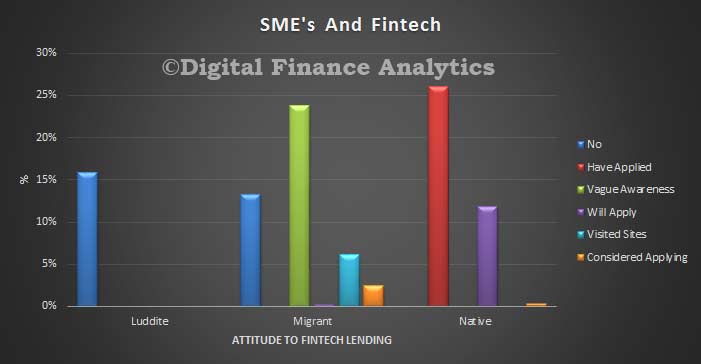

DFA divides business owners into luddites (14%) who are late adopters of technology and hardly use smart devices and services at all; migrants (52%) who are now active users but have had to learn new skills and adapt to the new services; and natives (34%) who have always been digitally aligned. Age is a good proxy for digital take-up with younger business owners firmly in the native category, whilst those over 45 are more likely to be luddites.

Natives are more likely to borrow than migrants, who are more likely to be credit avoiders. The natives also spend considerably more time connected to online services and want all their banking (from product purchase through to service) via smart devices. Natives are significantly more profitable customers for banks in relative terms.

Migrants have a mix of channels with 20% still preferring the bank branch whilst luddites are strong champions of branch access. Luddites provide profitability for branches but as the proportion of luddites decline, it will become even increasingly expensive for banks to support the remaining numbers.

With 86% of businesses either natives or migrants, the future is digital.

Financial Technology (fintech) is a term used to describe the range of innovative digital businesses including online lending and payments platforms.

Creating awareness is one of the many challenges faced by online lenders although many digital natives are very aware and are considering applying or already have applied for an online business loan. Migrants have mixed attitudes to online lenders whilst luddites are just not aware or interested.

Natives are also most likely to consider borrowing via payments platforms like PayPal’s cash flow services, whereas migrants are only using PayPal to make payments and luddites are not engaged at all.

Natives are well advanced in their use of cloud-based services whilst migrants are on the journey. Luddites have not yet started to engage.

According to the DFA survey, 73% of all SMEs are run by men and the bigger the business, the more likely a male will be the boss.

Only 8% of businesses run by females have more than 100 employees, compared with 16% of businesses run by males.

The proportion of SMEs run by females is increasing slowly from 23% in 2006 to 26% in 2010 and now 27%.

Businesses that employ less than four people rely heavily on debt from personal credit cards. This is usually unsecured debt and with 60% of bank write-offs being for unsecured lending. This partly explains why credit card debt is more expensive than secured business debt.

Half of all SMEs will fail within five years of starting up. Failure rates are highest amongst businesses involved in transport, financial services and information media and telecommunications, whist businesses in accommodation, food services and healthcare are less likely to fail.

As challenging as it is to run an SME these days, technology is opening up possibilities for those business owners keen to embrace it.

Banks remain dominant players in lending and payments but increasingly SMEs are able to tap into new avenues of funding and transacting business.

The banks will innovate and also collaborate with fintechs in order to maintain their standing. Despite the advantages the new players possess, we haven’t yet seen how they operate in a severe economic downturn and it’s going to take time for them build critical mass, earn the trust of their customers and produce an acceptable ROE for shareholders.

There will be casualties along the way.

DFA concludes there is a significant opportunity available to players who construct compelling offers to the SME sector.

Understanding the needs and aspirations of small business owners is paramount and the parties who best articulate and most importantly deliver on this this will be the ones that come out on top.

But business owners cannot afford to sit back and wait for things to happen, they need to invest time and effort in exploring what options are available and best suited to their own immediate and future needs.

Neil Slonim is a business banking advisor and commentator and thefounder of theBankDoctor.org, a not-for-profit online resource centre for SMEs dealing with the challenges of funding a small business.

From Australian Broker Online.

Peer-to-peer (P2P) lending is likely to move into residential mortgages in Australia, according to a global peer-to-peer lender.

Speaking to Australian Broker, the CEO of ThinCats Australia, Sunil Aranha, P2P lending globally has already moved into residential mortgages so it is likely that Australia will follow suit.

“In terms of moving platforms into mortgage lending spaces, that has happened in the UK and the US and to a certain extent it will be something that will eventually happen in Australia. There is no reason stopping it, other than today it is not really attractive for anybody because the banks are doing it very well,” Aranha said.

“I don’t think peer-to-peer platforms have much of a part to play [in residential] right now, unless it can add value and the value it can add is to fractionalise lending. But eventually that will become a reality as it has in the UK and the US… That will happen.”

However, Aranha said ThinCats, which operates in the SME lending market, is unlikely to move into residential mortgages.

“We are focussed on business lending. There may be some loans that we do which are secured by second mortgages but the purpose of our loan will really be for a business to be able to use as a cash flow to grow their business,” Aranha told Australian Broker.

“We want to focus on that market that is not serviced, and in my opinion, it is about $10 billion of un-serviced market — which means banks don’t actually lend to that market.”

Since ThinCats Australia – which is 25% owned by leading UK P2P lender, ThinCats UK – launched in December 2014, the platform has arranged loans aggregating close to $2 million to date at interest rates ranging from 11.5% to 14.5%.

The platform has also just welcomed well-known finance commentator, Alan Kohler, as a shareholder.

Looking at 2016, Aranha told Australian Broker that he expects ThinCats to be providing $1 million a month in loans to Australian SMEs.

“In terms of pipeline, I believe that by the second quarter of next year we should be actually doing $1 million plus a month,” he said.

“That is the growth we are currently on so by the end of next year I hope to actually say that purely on organic growth, without something sudden and exciting happening, we should be able to do about $8 million to $10 million next year.”

We released the 2015 edition of our Small and Medium Business report today. Given the intense focus on SME’s the banks claim to have, (and as an alternative to more mortgages to home buyers) we found that at the moment, many SME’s are underwhelmed by the products and services they are getting from their banks. Many cannot get the help they need to grow. Yet many will not look for alternatives.

Whilst around 35% are either satisfied, or completely satisfied with their current banking arrangements, the majority are experiencing some level of dissatisfaction.

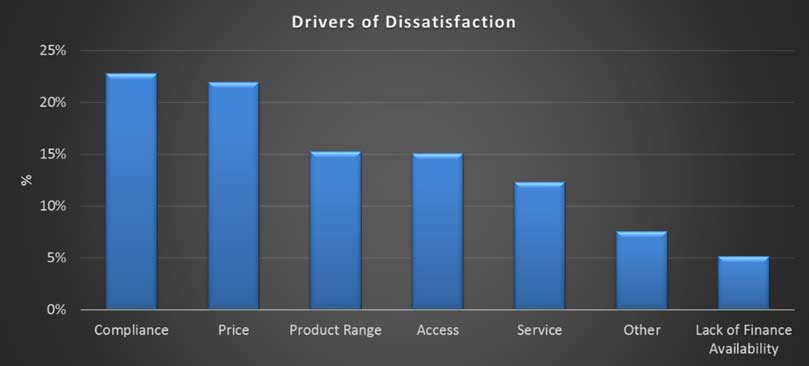

Delving into where the dissatisfaction stems from, we find that the largest element relates to compliance (23%), then price (22%), followed by product range. Poor service drives about 12% of dissatisfaction.

Delving into where the dissatisfaction stems from, we find that the largest element relates to compliance (23%), then price (22%), followed by product range. Poor service drives about 12% of dissatisfaction.

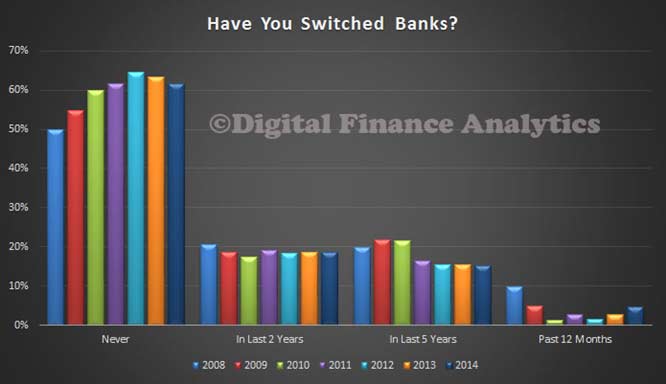

So, given their level of dissatisfaction, would they switch to another player? Looking at a firm’s willingness to switch, around 25% of firms are unlikely to switch, either because they satisfied, or because they perceive no differentiation between players. This means that in theory 75% of business are open to churning, for a better proposition.

So, given their level of dissatisfaction, would they switch to another player? Looking at a firm’s willingness to switch, around 25% of firms are unlikely to switch, either because they satisfied, or because they perceive no differentiation between players. This means that in theory 75% of business are open to churning, for a better proposition.

However, the average time with a bank of more than 6 years, and the distribution shows that far fewer will actually follow through and make a switch. Indeed, it appears that larger organisations are rusted on to their existing providers, whereas smaller firms are more likely to move, if there is reason to do so. Whilst there is a small rise in the number of businesses who have switched recently, overall 60% have never switched.

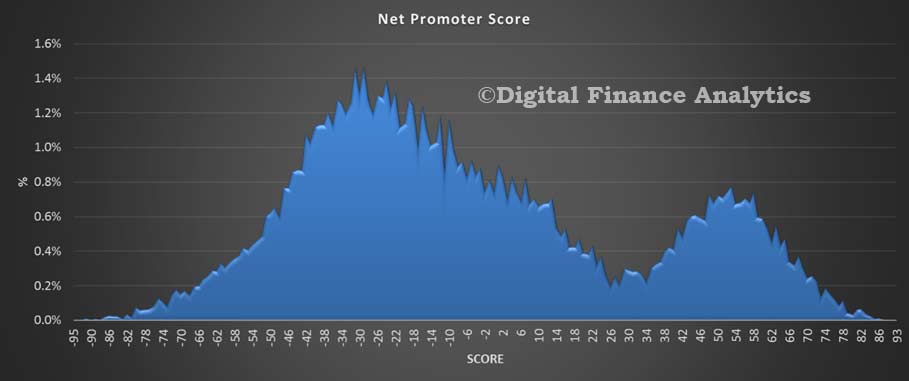

The final perspective is to examine Net Promoter Scores (NPS) which measures the loyalty that exists between a provider and a consumer of services. Comparing those who are promotors with those who are detractors, the average NPS score spread shows that the majority of firms are neutral or negative. There is a secondary peak in the positive region, but even here, there are still some detractors. So this confirms again that firms are not strongly attached to their current provider.

The final perspective is to examine Net Promoter Scores (NPS) which measures the loyalty that exists between a provider and a consumer of services. Comparing those who are promotors with those who are detractors, the average NPS score spread shows that the majority of firms are neutral or negative. There is a secondary peak in the positive region, but even here, there are still some detractors. So this confirms again that firms are not strongly attached to their current provider.

So, in summary, firms are not particularly satisfied with the products and services offered by players in the Australian market.

So, in summary, firms are not particularly satisfied with the products and services offered by players in the Australian market.

Many would in theory be prepared to switch, and yet in practice, do not because either there is no perceived benefit in so doing, or because they are rusted on to long-term relationships, or because the whole switching thing to just too complex and difficult. It would be a distraction from the main game, which is to run their own enterprise.

So it is clear that there is a significant opportunity available to players who construct compelling offers to the SME sector, but only if the promise can be delivered in practice. One really important “selling” message is the extent to which banks understand the needs and aspirations of small business owners. This registered more strongly than the general brand association, or reputational elements in the brand drivers.

You can get a free copy of the latest DFA report here.

The DFA SME survey 2015 is released today. A buoyant SME sector is critical for the future prosperity of Australia not least because one in three Australian households main source of income is derived from employment by small business. In recent years SME’s have been under extreme pressure, with many business owners operating in survival mode.

The DFA Small and Medium Business Landscape report is published annually. This edition contains information from our surveys up to 20 November 2015.

The DFA Small and Medium Business Landscape report is published annually. This edition contains information from our surveys up to 20 November 2015.

We have made some changes to our methodology this year. First the definition of a Small and Medium Business Enterprise has been tightened, to include trading businesses, with an Australian Business Number or Australian Company Number, and with a turnover of up to $5m in the past year.

This has excluded a small number of part-time quasi businesses, or micro businesses, and included a small number of larger businesses, which together better reflects the changing nature of the SME landscape. In this edition, we will describe the current mix of businesses in Australia, based on a number of important parameters, then examine their financial services banking footprint, their use of technology, and finally their attitudes and expectations towards their financial services providers.

Much has changed since our last report, not least the rise in the penetration of digital business, the emergence of Fintech start-ups who are beginning to nibble at the feet of incumbents, and a renewed focus by traditional lenders on the SME sector.

Despite this, we find that many SME’s are still finding it difficult to get the services they require to make their businesses thrive; a considerable proportion are expecting more from lenders when it comes to digital business services; and levels of confidence are rotating away from Western Australia towards the Eastern States, as the mining boom passes. Three quarters of business owners are prepared to switch banks, and many banking incumbents do not pass muster then it comes to service or product delivery expectations.

The SME sector must be considered as somewhat volatile, and this goes some way to explaining why some businesses find it hard to get the help they need to grow their business.

In summary firms are not particularly satisfied with the products and services offered by players in the Australian market. Many would in theory be prepared to switch, and yet in practice, do not because either there is no perceived benefit in so doing, or because they are rusted on to long-term relationships.

It is clear that there is a significant opportunity available to players who construct compelling offers to the SME sector, but only if the promise can be delivered in practice. One really important “selling” message is the extent to which banks understand the needs and aspirations of small business owners. This registered more strongly than the general brand association, or reputational elements in the brand drivers.

You can request a free copy of the 39 page report below.

Finally, a word about our survey methodology. We speak with 26,000 business owners each year via a telephone omnibus survey. During a conversation which can last between 10 and 20 minutes we ask about their business condition, expectations, and financial services footprint. The data is subsequently analysed using a range of propriety tools and methods.

The detailed results from the surveys are made available to our paying clients (details on request), but this report provides an overall summary of some of the main findings. Critically, we do not share the results from our 11 segment granular analysis here and so we have used the number of employed staff as a proxy for segmentation in this report. We also make only brief reference to our state by state findings, which are also covered in the full survey. Feel free to contact DFA if you require more information, or something specific. Our surveys can be extended to meet specific client needs.

Note this will NOT automatically send you our research updates, for that register here.

[contact-form to=’mnorth@digitalfinanceanalytics.com’ subject=’Request The 2015 DFA SME Report’][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Email Me The Report’ type=’radio’ required=’1′ options=’Yes Please’/][contact-field label=’Comment If You Like’ type=’textarea’ /][/contact-form]

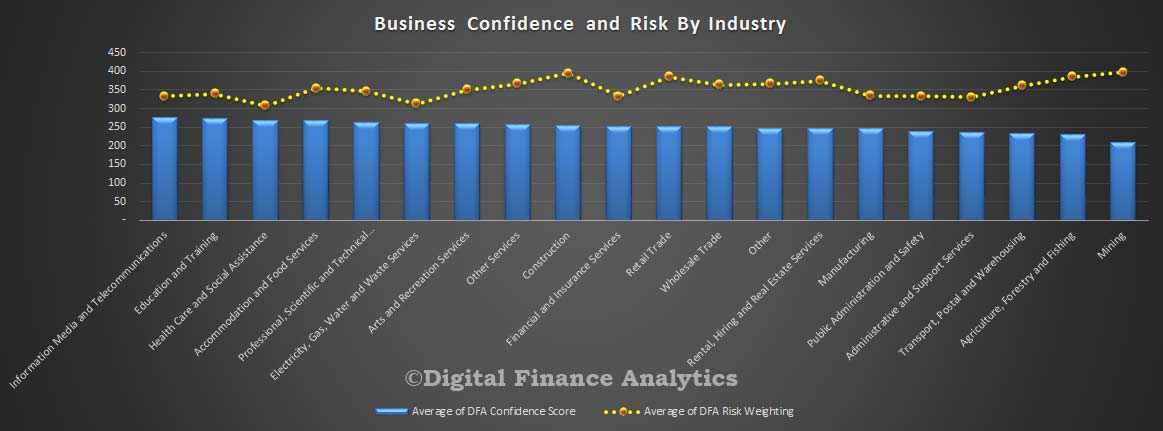

As we continue our original research into the SME sector for our next report, today we feature some of the key highlights relating to the relative confidence among business owners, and an assessment of the relative risk from a lending bank perspective. This is using data from the 26,000 SME DFA survey.

The scores are calculated from a matrix of specific questions in the survey, and also data from our loan book portfolio analysis in terms of the relative potential risk of loss, failure or default.

Looking first at risk and confidence by industry, business owners in the information, media and telecommunications sector are the most confident, whilst those in mining and agribusiness are the least positive. Construction, retail trade and financial services are in the middle of the range. From a risk perspective, construction, mining, retail, agribusiness and transport are among those with higher prospects of default and failure.

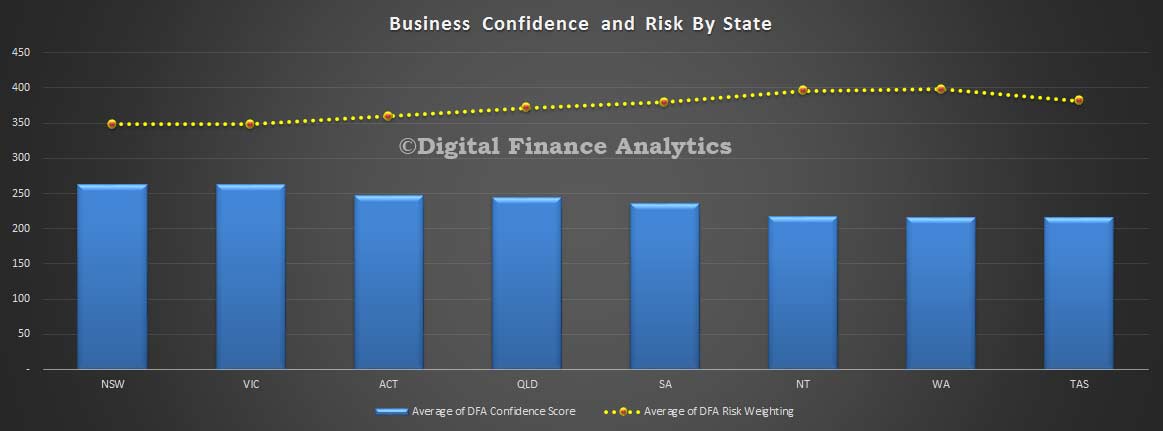

On a state basis, NSW and VIC are the most confident, whilst WA and TAS are the least confident. From a risk perspective, WA and NT have the highest prospect of failure.

On a state basis, NSW and VIC are the most confident, whilst WA and TAS are the least confident. From a risk perspective, WA and NT have the highest prospect of failure.

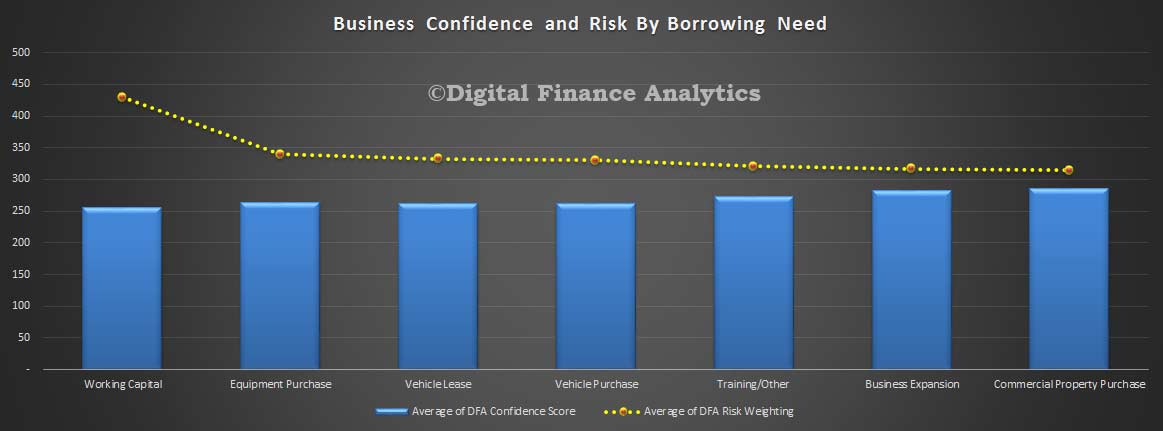

Looking at why businesses are borrowing, we find that the highest risks stem from those seeking to fund working capital – this same group has the lowest confidence rating. Those seeking to borrow for business expansion have higher levels of confidence, and relatively lower risk scores.

Looking at why businesses are borrowing, we find that the highest risks stem from those seeking to fund working capital – this same group has the lowest confidence rating. Those seeking to borrow for business expansion have higher levels of confidence, and relatively lower risk scores.

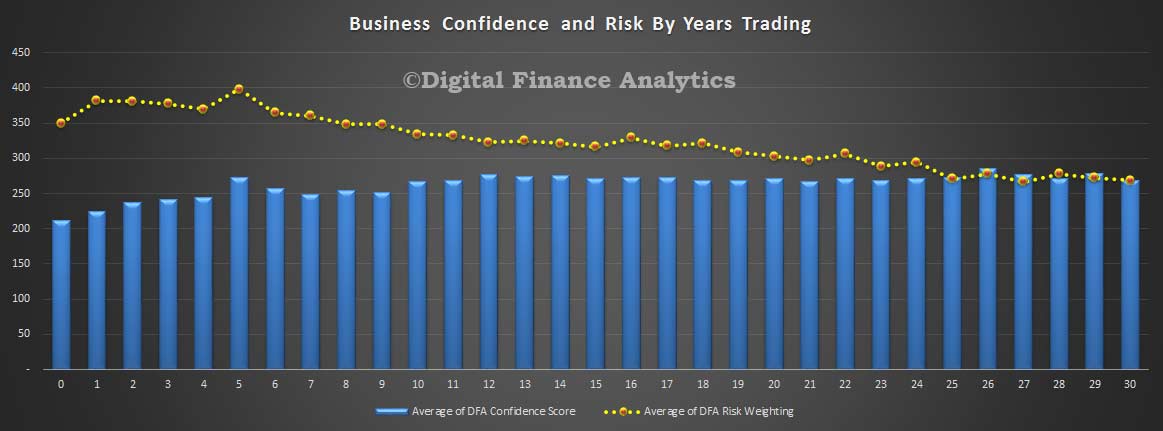

Those businesses who are relatively new (especially under 3 years) have lower confidence, and higher risk, whilst businesses who have been trading for longer have higher confidence levels and lower risks. Remember that about half of businesses will fail within 5 years of commencement, according to our last published SME report, which is still available.

Those businesses who are relatively new (especially under 3 years) have lower confidence, and higher risk, whilst businesses who have been trading for longer have higher confidence levels and lower risks. Remember that about half of businesses will fail within 5 years of commencement, according to our last published SME report, which is still available.

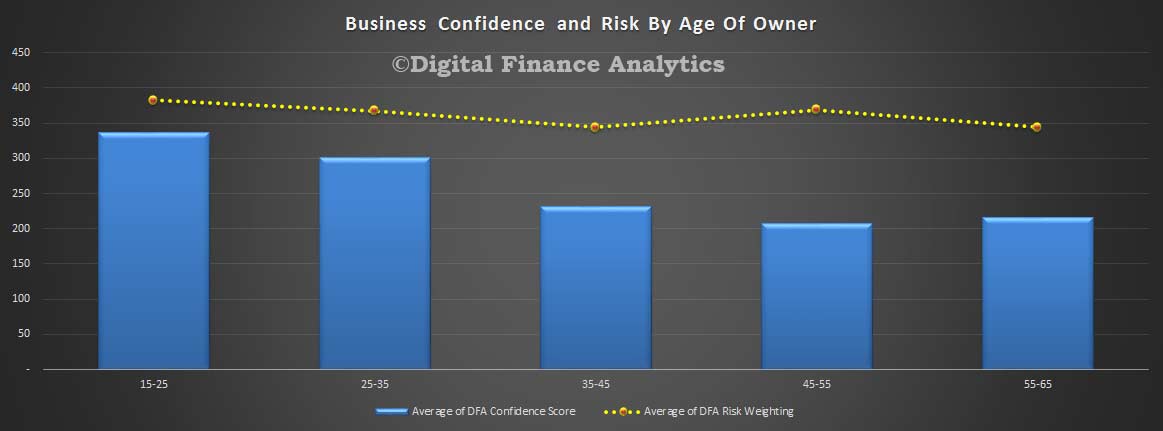

Younger business owners tend to be more confident, but also carry a higher risk rating, The lowest risk age is 34-45 years.

Younger business owners tend to be more confident, but also carry a higher risk rating, The lowest risk age is 34-45 years.

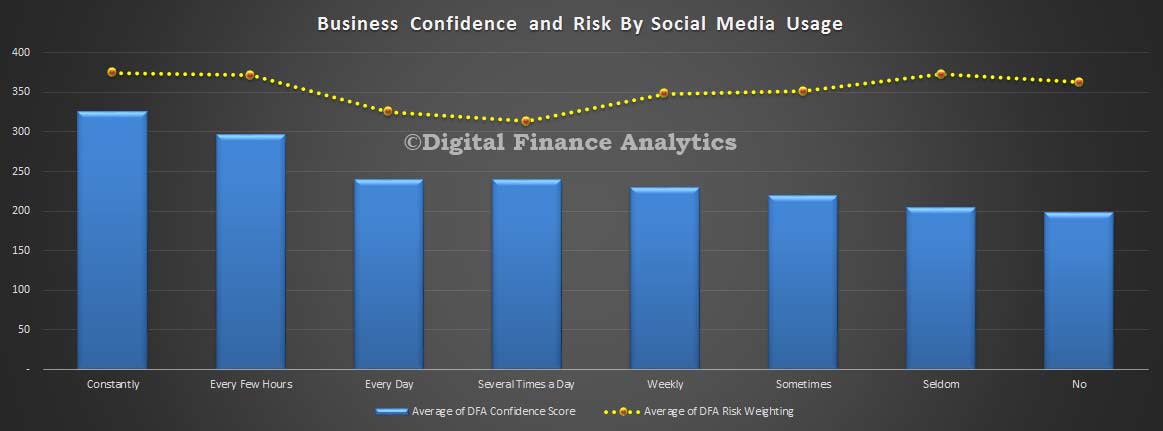

Finally, an interesting snapshot of the use of social media. Those who are heavy users have the highest confidence rating, compared with those who do not use social media at all. On the other hand, the lowest risk scores reside among those who are occasional social media users. Not sure why, but an interesting snippet, nevertheless.

Finally, an interesting snapshot of the use of social media. Those who are heavy users have the highest confidence rating, compared with those who do not use social media at all. On the other hand, the lowest risk scores reside among those who are occasional social media users. Not sure why, but an interesting snippet, nevertheless.

We will publish more highlights from our research later, and the fully updated edition of the SME report will be published in a few weeks.

We will publish more highlights from our research later, and the fully updated edition of the SME report will be published in a few weeks.

Within the DFA Small and Medium Business Surveys, we capture significant information about how these businesses use digital, and their attitudes towards the fast-emerging and potentially disruptive “fintech” sector. Since our last full survey released in mid 2014, and still available on request, much has changed. Today we discuss some of the interesting findings on fintech, in the context of SME’s.

First, looking at how business owners are using digital, (which includes use of smart devices, social media and cloud services) and their preferred channels; the revolution is well underway. We separate business owners into digital luddites (really have not engaged with digital at all), digital migrants (moving to embrace digital, and up the learning curve) and natives (always been digitally at home).

More than half of SME business owners are now migrants, and over 30% natives. This leaves a runt of 12% who are not digitally aware. So, most organisations are well on the way towards digital transformation.

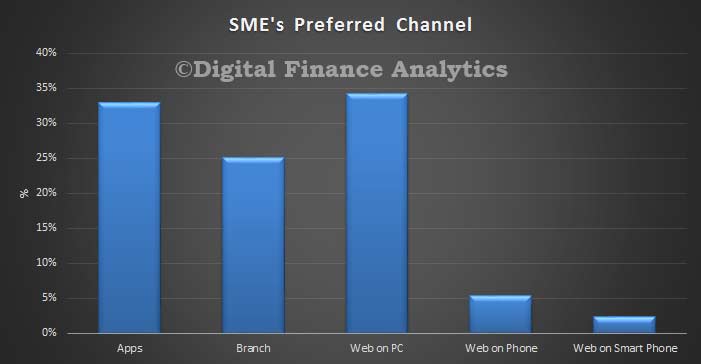

In terms of channel preferences (that’s how they would LIKE to interact, not necessarily how they currently do) the shift to apps and online is stunning. This is not surprising though given the penetration of smart devices, and the fact that many business owners are time-poor. We foreshadowed this in the 2014 report.

In terms of channel preferences (that’s how they would LIKE to interact, not necessarily how they currently do) the shift to apps and online is stunning. This is not surprising though given the penetration of smart devices, and the fact that many business owners are time-poor. We foreshadowed this in the 2014 report.

We next ask about their awareness of fintech. Of those who were aware, (a small but growing band), we then ask about their attitude towards fintech, and especially whether they might consider accessing funding or other services from new, non-traditional players. The results are again quite sensational, with many digital natives now past awareness, and considering applying or already have applied. Migrants have more mixed attitudes, but many are now beyond awareness. Luddites are not engaged at all.

We next ask about their awareness of fintech. Of those who were aware, (a small but growing band), we then ask about their attitude towards fintech, and especially whether they might consider accessing funding or other services from new, non-traditional players. The results are again quite sensational, with many digital natives now past awareness, and considering applying or already have applied. Migrants have more mixed attitudes, but many are now beyond awareness. Luddites are not engaged at all.

So the results highlight the digital transformation underway, and underscores the potential for fintechs to disrupt the market – there are ready customers out there, and as awareness grows, many will seek to embrace. It also begs the question as to how incumbents will respond.

So the results highlight the digital transformation underway, and underscores the potential for fintechs to disrupt the market – there are ready customers out there, and as awareness grows, many will seek to embrace. It also begs the question as to how incumbents will respond.

Our next full and updated SME report will be published later so stay tuned.

At a speech given at Bloomberg in London, Ian McCafferty, external member of the Monetary Policy Committee, argued that the tight credit conditions which followed the financial crisis have now “diminished markedly” for firms – a fact which has important implications for monetary policy.

McCafferty’s analysis indicates that both large and small firms have been broadening their sources of finance away from banks. While large firms have turned increasingly to capital markets, with growing bond and equity issuance, SMEs have been drawing on new alternative sources of lending, including ‘crowdfunding’ and peer-to-peer lending platforms.

McCafferty warned that it was important to recognise that this form of finance is still small compared to bank lending, on which SMEs remain heavily reliant, but added: “alternative finance is growing, and is likely to be a developing feature of the market in future years.”

McCafferty noted that the UK economy continues to face headwinds – notably fiscal consolidation and sub-par growth in the world economy. However, he argued that the reduction the headwinds in business finance is now supporting the normalisation of the economy. With that, he said: “it is reasonable to expect the neutral interest rate – the level of interest rates consistent with full employment and inflation at target – to also move towards more normal levels”.

He concluded: “If we on the MPC are to achieve our ambition of raising rates only gradually, so as to minimise the disruption to households and businesses of a normalisation of policy after a long period in which interest rates have been at historic lows, we need to avoid getting ‘behind the curve’ with respect to the neutral rate. And for me, that provides an additional justification not to leave the start date for lift off too late.”