The Bank of England just published an interesting report on household finances. There are some interesting parallels with Australia.

https://www.bankofengland.co.uk/quarterly-bulletin/2019/2019-q4/the-financial-position-of-british-households

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

The Bank of England just published an interesting report on household finances. There are some interesting parallels with Australia.

https://www.bankofengland.co.uk/quarterly-bulletin/2019/2019-q4/the-financial-position-of-british-households

We look at the latest from the UK short term lending market as another big lender withdraws.

But why inaction here?

https://www.fca.org.uk/data/consumer-credit-high-cost-short-term-credit-lending-data-jan-2019

https://www.bbc.com/news/business-49878277

https://www.bbc.com/news/business-50174367

https://www.theguardian.com/money/2019/oct/25/quickquid-owner-collapses-into-administration

There have been some interesting developments in the short-term lending market in the UK recently. The Financial Conduct Authority in the UK recently published data on the so called high-cost short-term credit (HCSTC) market. HCSTC loans are unsecured loans with an annual percentage interest rate (APR) of 100% or more and where the credit is due to be repaid, or substantially repaid, within 12 months. In January 2015, The FCA introduced rules capping charges for HCSTC loans.

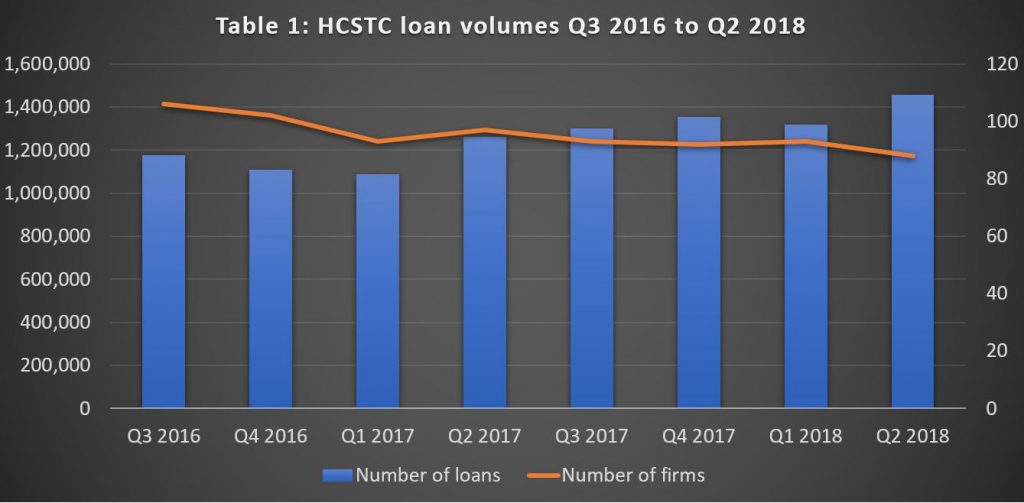

Just over 5.4 million loans originated in the year to 30 June 2018, and that lending volumes have been on an upward trend over the last 2 years. Despite some recovery, current lending volumes remain well down on the previous peak for this market. Lending volumes in 2013, before FCA regulation, were estimated at around 10 million per year.

These data reflect the aggregate number of loans made in a period but not the number of borrowers, as a borrower may take out more than one loan. They estimate that for the year to 30 June 2018 there were around 1.7 million borrowers (taking out 5.4 million loans).

The market is concentrated with 10 firms accounting for around 85% of new loans. Many of the remaining firms carry out a small amount of business – two thirds of the firms reported making fewer than 1,000 loans each in Q2 2018.

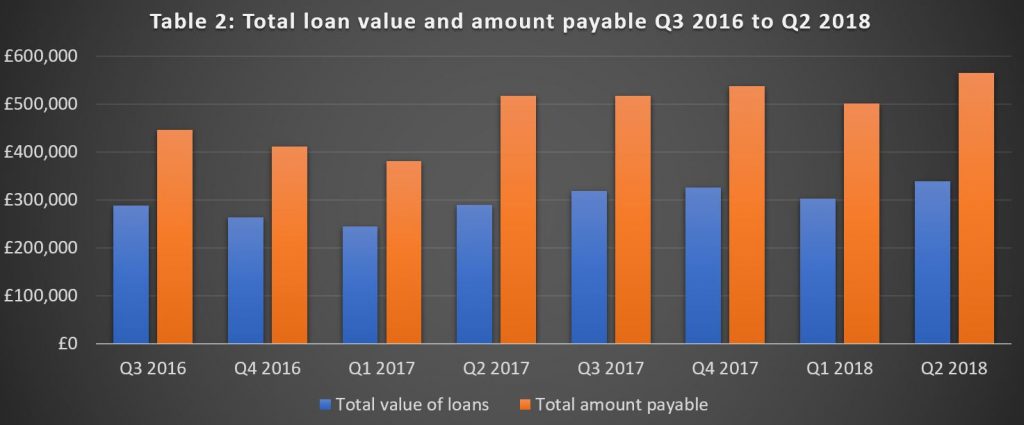

For the year to 30 June 2018, the total value of loans originated was just under £1.3 billion and the total amount payable was £2.1 billion. Figure 2 shows that the Q2 2018 loan value and amount payable mirrored the jump in the volume of loans with loan value up by 12% and amount payable 13% on Q1 2018.

The average loan value in the year to 30 June 2018 was £250. The average amount payable was £413 which is 1.65 times the average amount borrowed. This ratio has been fairly stable over the past 2 years. A price cap introduced in 2015 stipulates that the amount repaid by the borrower (including all charges) should not exceed twice the amount borrowed.

Over the past 2 years the average Annual Percentage Rate (APR) charged for HCSTC has been consistent, hovering around 1,250% (mean value). The median APR value is slightly higher at around 1,300%. Within this there will be variations of APR depending on the features of the loan. For example, the loans repayable by installments over a longer period may typically have lower APRs than single installment payday loans.

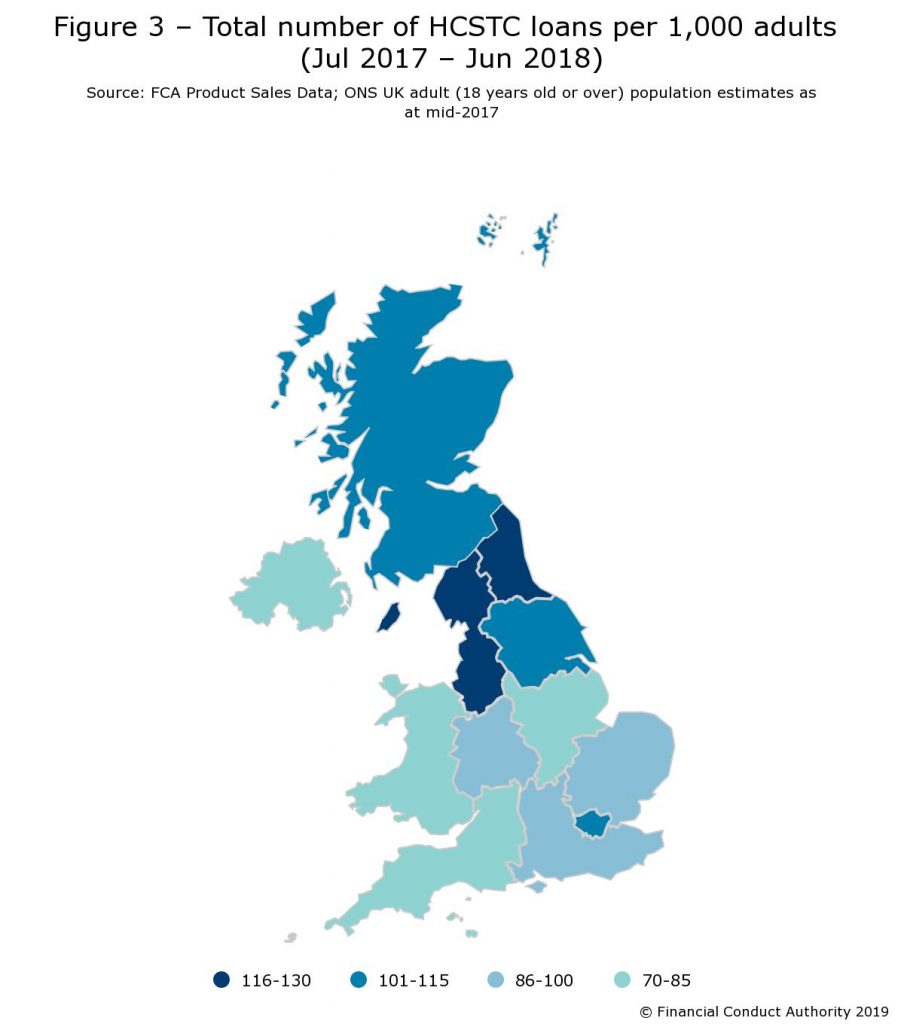

In the UK, the North West has the largest number of loans originated per 1,000 adult population (125 loans), followed by the North East (118 loans). In contrast, Northern Ireland has the lowest (74 loans).

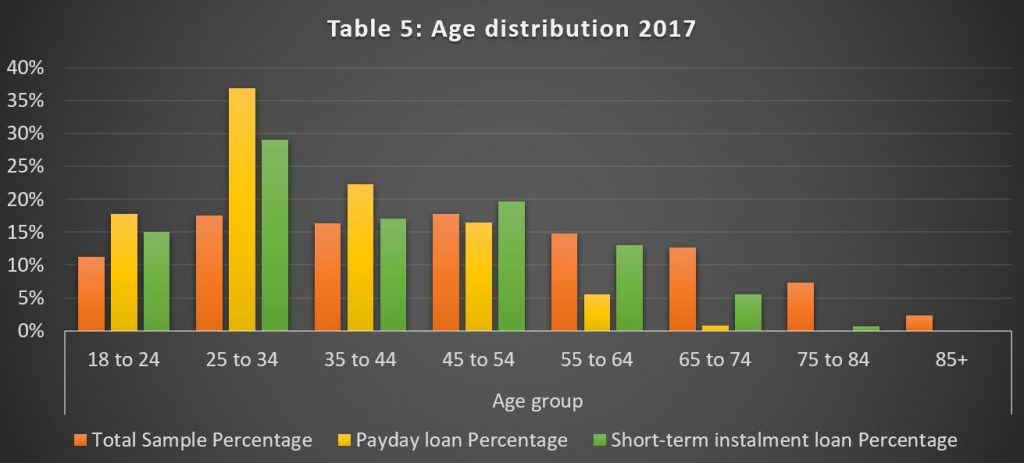

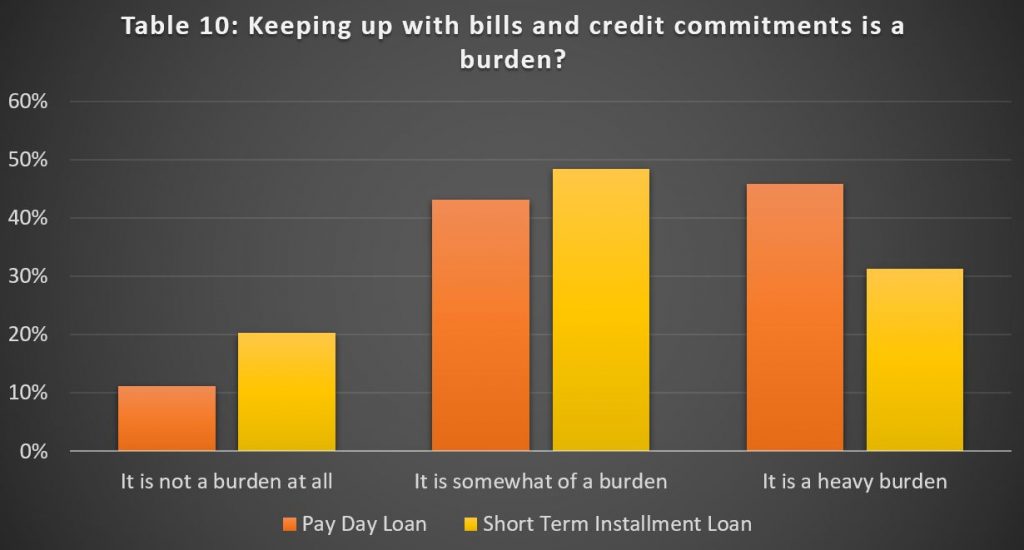

Borrowers between 25 to 34 years old holding HCSTC loans (33.4%) were particularly over-represented compared to the UK adults within that age range (17.5%). Similarly, borrowers over 55 years old were significantly less likely to have HCSTC loans (12.2%) compared to the UK population within that age group (34.8%). The survey also found that 60% of payday loan borrowers and 45% for short-term installment loans were female, compared with 51% of the UK population being female.

61% of consumers with a payday loan and 41% of borrowers with a short-term installment loan have low confidence in managing their money, compared with 24% of all UK adults. In addition, 56% of consumers with a payday loan and 48% of borrowers with a short-term installment loan rated themselves as having low levels of knowledge about financial matters. These compare with 46% of all UK adults reporting similar levels of knowledge about financial matters.

But now the top PayDay lenders are out of business. In August 2018, Wonga, once the biggest payday lender in the UK collapsed and now administrators for the lender have revealed that 389,621 eligible claims have been made since Wonga’s demise. Despite being vilified for its high-cost, short-term loans, seen as targeting the vulnerable, it became a household name and was enormously successful until stricter regulation curtailed its, and other payday loan companies’, lending.

It collapsed in the UK following a surge in compensation claims from claims management companies acting on behalf of people who felt they should never have been given these loans. So far, the compensation bill is £460m, with the average claim £1,181.

Another lender, The Money shop closed earlier this year.

Now QuickQuid, UK’s largest payday lending firm is to close with thousands of complaints about its lending still unresolved. QuickQuid’s owner, US-based Enova, says it will leave the UK market “due to regulatory uncertainty”.

QuickQuid is one of the brand names of CashEuroNet UK, which also runs On Stride – a provider of longer-term, larger loans and previously known as Pounds to Pocket. The UK’s Financial Ombudsman Service said that it had received 3,165 cases against CashEuroNet in the first half of the year. It was the second most-complained about company in the banking and credit sector during that six months.

Back in 2015, CashEuroNet UK LLC, trading as QuickQuid and Pounds to Pocket, agreed to redress almost 4,000 customers to the tune of £1.7m after the regulator raised concerns about the firm’s lending criteria.

More than 2,500 customers had their existing loan balance written off and more almost 460 also received a cash refund. (The regulator had said at the time that the firm had also made changes to its lending criteria.)

“Over the past several months, we worked with our UK regulator to agree upon a sustainable solution to the elevated complaints to the UK Financial Ombudsman, which would enable us to continue providing access to credit,” said Enova boss David Fisher.

“While we are disappointed that we could not ultimately find a path forward, the decision to exit the UK market is the right one for Enova and our shareholders.”

So this could be the twilight of the PayDay industry in the UK, as better education, and other lending options, plus tighter regulation bite.

Meantime in Australia its worth reflecting that proposed changes to SACC loans here (Small Amount Credit Contracts) have not progressed despite an earlier investigation, and we will be talking about the impact of this inaction in a later post.

Given the pressures on households here, we are concerned that more will reach for short term loans to tide them over, despite the high costs and risks from repeat borrowing, all made easier still via the proliferation of online portals. The debt burden on households is high and rising.

The latest from the UK suggests inflation will fall below the 2% lower bounds as downside risks to growth build and the Brexit issue still haunts the halls. The Bank held the current rate, and will continue its market operations to stimulate the economy.

The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. At its meeting ending on 19 June 2019, the MPC voted unanimously to maintain Bank Rate at 0.75%.

The Committee voted unanimously to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £10 billion. The Committee also voted unanimously to maintain the stock of UK government bond purchases, financed by the issuance of central bank reserves, at £435 billion.

The MPC’s most recent economic projections, set out in the May Inflation Report, assumed a smooth adjustment to the average of a range of possible outcomes for the United Kingdom’s eventual trading relationship with the European Union and were conditioned on a path for Bank Rate that rose to around 1% by the end of the forecast period. In those projections, GDP growth was a little below potential during 2019 as a whole, reflecting subdued global growth and ongoing Brexit uncertainties. Growth then picked up above the subdued pace of potential supply growth, such that excess demand rose above 1% of potential output by the end of the forecast period. As excess demand emerged, domestic inflationary pressures firmed, such that CPI inflation picked up to above the 2% target in two years’ time and was still rising at the end of the three-year forecast period.

Since the Committee’s previous meeting, the near-term data have been broadly in line with the May Report, but downside risks to growth have increased. Globally, trade tensions have intensified. Domestically, the perceived likelihood of a no-deal Brexit has risen. Trade concerns have contributed to volatility in global equity prices and corporate bond spreads, as well as falls in industrial metals prices. Forward interest rates in major economies have fallen materially further. Increased Brexit uncertainties have put additional downward pressure on UK forward interest rates and led to a decline in the sterling exchange rate.

As expected, recent UK data have been volatile, in large part due to Brexit-related effects on financial markets and businesses. After growing by 0.5% in 2019 Q1, GDP is now expected to be flat in Q2. That in part reflects an unwind of the positive contribution to GDP in the first quarter from companies in the United Kingdom and the European Union building stocks significantly ahead of recent Brexit deadlines. Looking through recent volatility, underlying growth in the United Kingdom appears to have weakened slightly in the first half of the year relative to 2018 to a rate a little below its potential. The underlying pattern of relatively strong household consumption growth but weak business investment has persisted.

CPI inflation was 2.0% in May. It is likely to fall below the 2% target later this year, reflecting recent falls in energy prices. Core CPI inflation was 1.7% in May, and core services CPI inflation has remained slightly below levels consistent with meeting the inflation target in the medium term. The labour market remains tight, with recent data on employment, unemployment and regular pay in line with expectations at the time of the May Report. Growth in unit wage costs has remained at target-consistent levels.

The Committee continues to judge that, were the economy to develop broadly in line with its May Inflation Report projections that included an assumption of a smooth Brexit, an ongoing tightening of monetary policy over the forecast period, at a gradual pace and to a limited extent, would be appropriate to return inflation sustainably to the 2% target at a conventional horizon. The MPC judges at this meeting that the existing stance of monetary policy is appropriate.

The economic outlook will continue to depend significantly on the nature and timing of EU withdrawal, in particular: the new trading arrangements between the European Union and the United Kingdom; whether the transition to them is abrupt or smooth; and how households, businesses and financial markets respond. The appropriate path of monetary policy will depend on the balance of these effects on demand, supply and the exchange rate. The monetary policy response to Brexit, whatever form it takes, will not be automatic and could be in either direction. The Committee will always act to achieve the 2% inflation target.

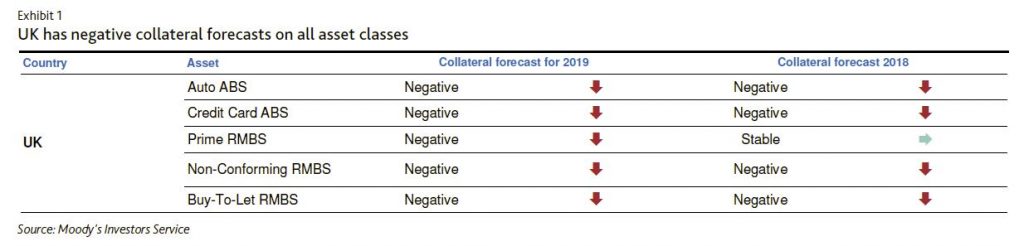

According to Moody’s, on 7 January, UK trade unions published their annual report, which warned about a credit crisis as UK average non-mortgage household debt jumped above £15,000, almost 50% higher than before the 2008 financial crisis. The increase in household debt leaves borrowers vulnerable to sudden economic stress, such as that which might crystallise in a no-deal Brexit scenario. An incremental increase in unemployment would have negative consequences for highly leveraged consumers. Higher joblessness, reduced real wages and, to a lesser extent, lower refinancing availability would increase delinquencies and defaults in consumer loan pools backing residential mortgage-backed securities (RMBS) and asset-backed securities (ABS).

Additionally, softening house prices can exacerbate the negative effect of rising defaults on RMBS. In case of a severe economic stress, the macroeconomic outlook for the UK would weaken, leading to a decline in house prices nationwide, which would have a mixed effect regionally across the UK. We expect more negative consequence in regions with higher unemployment and in industries that are more materially affected by such a stress scenario. However, we expect that any deceleration in house prices will be less severe than during the 2008-09 financial crisis given less inflationary stresses within the market. The performance of buy-to-let (BTL) and nonconforming transactions would weaken, especially for some recently originated collateral pools that have assets with relatively weaker underwriting standards. The performance of credit card ABS collateral would also deteriorate, especially for those pools with more exposure to highly leveraged obligors.

We have negative collateral forecasts for all UK consumer sectors

Our forecasts are negative for all UK consumer sector collateral. Our collateral performance forecasts over the next 12-18 months address the direction of expected losses for the market in general, not specific collateral pools among the deals we rate.

In normal circumstances, the absolute level of household debt is not necessarily as important as affordability measures such as the ratio of payment or loan to disposable income. Given the low interest rate environment, affordability is still relatively high for UK borrowers. However, sudden economic stress that leads to negative real wage growth and increasing unemployment has the potential to change matters.

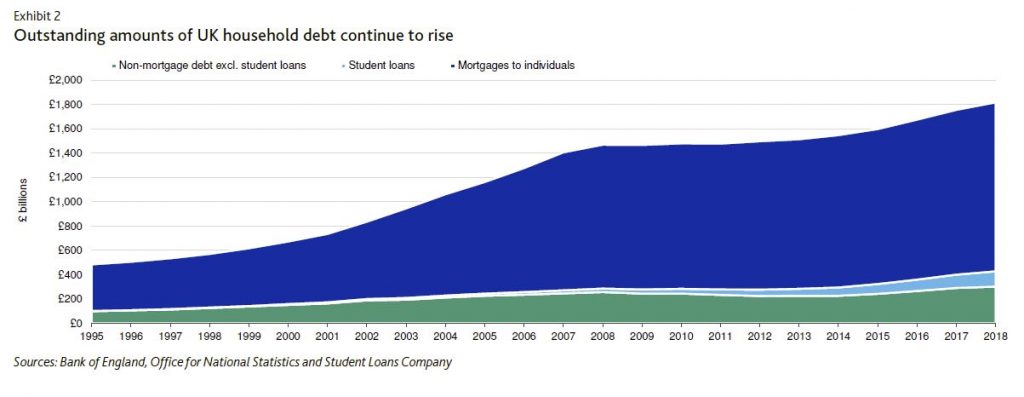

The average household debt figure in the trade union’s analysis is based on data from Bank of England, Office for National Statistics and the Student Loans Company. It excludes mortgages but includes everything else (i.e., credit cards, personal loans, payday loans and student loans), which deviates from the Bank of England’s definition of non-mortgage household debt.

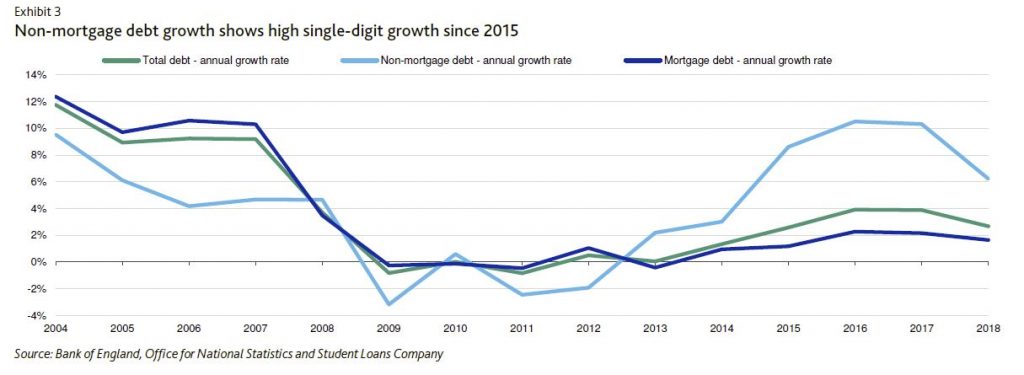

The rapid growth of non-mortgage (mainly unsecured) debt has contributed to household debt since 2013 after years of constrained credit in the aftermath of the 2008 financial crisis. The growth patterns of mortgage and non-mortgage debt have switched gears compared with pre-crisis patterns: non-mortgage debt (e.g., credit cards and consumer loans) have had a high single-digit growth rate since 2015, with slightly slowing growth in 2018 to a level of 6%, whereas pre-crisis, mortgage debt had these high growth rates. The 2018 data shows that UK households had average non-mortgage debt of approximately £10,000, even excluding student loans, and this is in line with levels reported in 2008.

On Monday, Rightmove, a UK online real estate portal, reported that asking prices for UK homes for sale fell 2.3% in August from July, the largest decline since Rightmove began publishing such data, according to Moody’s.

The slowdown, which comes amid heightened uncertainty over Brexit, is credit negative for UK mortgage securitisations because it indicates a possible increase in loan severity as well as further delays in sales, as sellers seek to maximise prices and buyers wait for prices to fall further. The prospect of further house price declines, combined with recent tax increases and tightening underwriting criteria, will impel some buy-to-let landlords and borrowers under stress to sell their properties, resulting in further house price decreases.

In addition, a weaker housing market risks lessening borrowers’ willingness to repay their loans given that declining house prices reduce the equity in their properties. This could particularly affect regions with high average loan-to-value (LTV) ratios, such as London and the southeast, as well as the non-conforming mortgage market in general, since the average LTVs for non-conforming mortgages are typically higher than for prime or buy-to-let mortgages. However, the potential effect of decreasing house prices on borrowers is mitigated in the UK by lenders having full recourse to the borrower in case of default.

Uncertainty surrounding Brexit has increased the average time it takes to sell a property and increased the stock of properties being offered for sale throughout the UK, but particularly in London. The average time to sell a property in London increased by 13% in August from the same month last year, while in the UK as a whole it rose by 3.6%. Additionally, the number of UK properties under offer increased by 6% in August from the year-earlier period, signalling a slowdown in the sales process.

Following the changes in demand and supply, asking prices in London decreased by 1.2% between August 2017 and August 2018. This decline accelerated over the past month, with asking prices dropping by 3.1% compared with July 2018. The situation was less severe for the UK as whole, with prices dropping 2.3% during August, but increasing 1.1% from the same month last year.

The last significant house price drop in the UK was during the financial crisis (2007-08). However, the level of borrower indebtedness and the house price increases before the financial crisis were greater than in the run-up to the current house price decrease. Also, new origination has been more prudent from banks and building societies post crisis. Therefore, we would expect that any upcoming house price decrease would be smaller that during the previous financial crisis.

An intensification of political divisions within the UK and slow progress in negotiations with the EU means there is such a wide range of potential Brexit outcomes that no individual scenario has a high probability, Fitch Ratings says.

We no longer believe it is appropriate to identify a specific base case. An acrimonious and disruptive “no deal” Brexit is a material and growing possibility.

Fitch’s prior base-case assumption following the 19 March draft withdrawal agreement – that the UK would leave the EU in March 2019 with a transition period until around December 2020 and a framework for a future Free-Trade Agreement – looks more uncertain. This scenario no longer ranks as significantly more likely than other possible outcomes.

The UK government’s 6 July plan faces opposition from ‘remainers’ and ‘brexiteers’ and has led to close parliamentary votes on Brexit legislation, underlining the depth of division within the ruling Conservative Party and parliament on the future relationship with the EU. Any deal is likely to provoke brinkmanship and may not gain parliamentary approval. This could trigger a general election and greater talk of a second referendum.

The time available to finalise a withdrawal agreement is getting shorter, while the UK and EU remain wide apart. The European Commission has expressed fundamental concerns on aspects of the UK plan. Without more EU flexibility on the indivisibility of the four freedoms (goods, capital, services, and labour), in the context of no physical Irish border, this implies the UK would need to abandon red lines regarding free movement of people and the jurisdiction of the European Court of Justice. Such concessions would make it even more difficult to secure parliamentary passage for a Brexit deal.

Potential outcomes include the UK leaving the EU in March, with a transition agreement and a framework on future trade relations. These range from something based around the UK’s 6 July plan, to initial WTO terms with a commitment to seek a future free trade agreement, to closer alignment with the EU through Single Market and/or Customs Union membership.

“No deal” is also a material possibility. This would substantially disrupt customs, trade and economic activity, with the depth of disruption depending on how quickly a “bare bones” deal could be reached.

Extending the withdrawal period is a more remote possibility, requiring unanimous approval by the European Council in agreement with the UK government. The UK remaining in the EU cannot be excluded if there is a second referendum. As things stand, in our view, no single outcome has a high probability.

Political, economic and institutional uncertainty stemming from the negotiations is reflected in the Negative Outlook on the UK’s ‘AA’ sovereign rating. An outcome that adversely affected growth prospects could lead to a downgrade, as we said when we affirmed the rating in April. Political developments that impede a clear determination of the UK’s future relationship with the EU or undermine the economic policy framework and economic performance are also negative rating sensitivities.

Our most recent macroeconomic forecasts point to GDP growth slowing to 1.3% this year. We forecast stronger growth of 1.7% in 2019 and 2020, in line with the UK economy’s potential growth. But this assumes a smooth Brexit. In a more disruptive Brexit we could substantially reduce our growth forecasts and change our unemployment and inflation assumptions.

Our current forecasts are consistent with the general government deficit falling moderately to 1.4% of GDP in 2020 from 1.9% in 2017, allowing government debt-to-GDP to decline to 83.5% from 87.7%. An adverse Brexit scenario involving a sharp growth slowdown in 2019 and anaemic recovery in 2020 could see the deficit rise towards 2.5% of GDP in the near term, other things equal. In this scenario, debt-to-GDP would decline more gradually over 2019 and 2020.

A severe enough shock could reverse the downward trajectory in the ratio since 2015. Worsening public finances leading to a rising government debt ratio could also lead to a downgrade of the UK.

The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment.

At its meeting ending on 1 August 2018, the MPC voted unanimously to increase Bank Rate by 0.25 percentage points, to 0.75%. The Committee voted unanimously to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £10 billion. The Committee also voted unanimously to maintain the stock of UK government bond purchases, financed by the issuance of central bank reserves, at £435 billion.

Since the May Inflation Report, the near-term outlook has evolved broadly in line with the MPC’s expectations. Recent data appear to confirm that the dip in output in the first quarter was temporary, with momentum recovering in the second quarter. The labour market has continued to tighten and unit labour cost growth has firmed.

The MPC’s updated projections for inflation and activity are set out in the August Inflation Report and are broadly similar to its projections in May.

In the MPC’s central forecast, conditioned on the gently rising path of Bank Rate implied by current market yields, GDP is expected to grow by around 1¾% per year on average over the forecast period. Global demand grows above its estimated potential rate and financial conditions remain accommodative, although both are somewhat less supportive of UK activity over the forecast period. Net trade and business investment continue to support UK activity, while consumption grows in line with the subdued pace of real incomes.

Although modest by historical standards, the projected pace of GDP growth over the forecast is slightly faster than the diminished rate of supply growth, which averages around 1½% per year. The MPC continues to judge that the UK economy currently has a very limited degree of slack. Unemployment is low and is projected to fall a little further. In the MPC’s central projection, therefore, a small margin of excess demand emerges by late 2019 and builds thereafter, feeding through into higher growth in domestic costs than has been seen over recent years.

CPI inflation was 2.4% in June, pushed above the 2% target by external cost pressures resulting from the effects of sterling’s past depreciation and higher energy prices. The contribution of external pressures is projected to ease over the forecast period while the contribution of domestic cost pressures is expected to rise. Taking these influences together, and conditioned on the gently rising path of Bank Rate implied by current market yields, CPI inflation remains slightly above 2% through most of the forecast period, reaching the target in the third year.

The MPC continues to recognise that the economic outlook could be influenced significantly by the response of households, businesses and financial markets to developments related to the process of EU withdrawal.

The Committee judges that an increase in Bank Rate of 0.25 percentage points is warranted at this meeting.

The Committee also judges that, were the economy to continue to develop broadly in line with its Inflation Report projections, an ongoing tightening of monetary policy over the forecast period would be appropriate to return inflation sustainably to the 2% target at a conventional horizon. Any future increases in Bank Rate are likely to be at a gradual pace and to a limited extent.

The UK household sector’s worsening financial health reduces consumer resilience to income or interest rate shocks and presents risks for UK consumer loan portfolios, Fitch Ratings says in a new report. Consumer credit has been a key driver of rising household debt.

UK households’ swing into an aggregate net financial deficit position over the last year is almost unprecedented, having only previously occurred briefly during the late 1980s. Greater residential investment is a factor, but the household saving ratio has declined steadily since the mid-1990s to an historical low of 4.9% last year. This has been partly due to lower private pensions saving relative to income.

More recently, the UK household debt to income ratio has risen, retracing more than a third of its post-global financial crisis decline (in contrast with the US), and is likely to keep rising given the sector’s financial deficit. This has been largely driven by growing consumer credit, notably car loans.

Low interest rates mean the rise has yet to increase the debt service burden. We calculate that the effective interest rate on all UK household debt fell to 3.3% last year. The fall in the effective interest rate has saved household borrowers GBP20 billion-25 billion in interest payments since 2009.

But weaker household finances reduce the resilience of consumer spending – by far the largest demand component of UK GDP – to shocks. A major interest rate shock appears unlikely (we forecast the UK base rate to rise gradually, to 1.25% by end-2019), but a more immediate shock could come from tightening credit supply. The impact of the Brexit referendum on real wages may be fading, but Brexit uncertainty creates risks of a bigger shock to growth and employment.

Any performance deterioration in UK consumer loans would be from a very strong level. The charge-off rate on bank-financed consumer credit hit a record low of 1.7% in 4Q17. We forecast a modest rise in UK unemployment this year, to 4.7%, implying that charge-offs, which are closely correlated with changes in unemployment, will head back up to 2%-3%.

Fitch-rated consumer ABS deals have substantial headroom to absorb any performance deterioration. For example, the lowest long-term charge-off assumption we currently apply to any prime UK credit card trust is 5%, following the sharp increase in competition in credit card lending since 2013.

UK auto ABS deals have also performed strongly and benefit from structural credit protection, although if unemployment rose and consumer demand fell, both credit risk and residual value risk, which has become more prominent with the rise of the personal contract purchase (PCP) product, could increase.

UK banks are highly exposed to UK households, but mostly through mortgages, with consumer credit accounting for just 10% of banks’ lending to the sector. Recent stress testing by the Bank of England highlighted strong capital buffers against severe consumer credit losses. Nevertheless, high household debt is a constraint in our assessment of UK banks’ operating environment, and currently caps UK domestic banks’ Viability Ratings in the ‘a’ range, all else being equal.

Non-bank financial institutions are more exposed, although their specialist nature means any impact from deteriorating performance would vary across the industry.

The UK economy remains in the doldrums, so no surprise, the cash rate remains unchanged. In fact the small rises made before have translated directly to lower home prices, reflecting the highly leverage state of many households. GDP is expected to grow by around 1¾% per year on average over the forecast period. Household consumption growth remains subdued. CPI inflation fell to 2.5% in March, lower than expected.

At its meeting ending on 9 May 2018, the MPC voted by a majority of 7-2 to maintain Bank Rate at 0.5%. The Committee voted unanimously to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £10 billion. The Committee also voted unanimously to maintain the stock of UK government bond purchases, financed by the issuance of central bank reserves, at £435 billion.

The preliminary estimate of GDP growth in the first quarter was 0.1%, 0.3 percentage points lower than expected in February. This is likely in part to have reflected adverse weather in late February and early March. Survey indicators suggest that growth was somewhat stronger in Q1 than implied by the preliminary estimate.

Despite the near-term softness, the MPC’s central forecast for economic activity is little changed from that in the previous Report. In the MPC’s central forecast, conditioned on the gently rising path of Bank Rate implied by current market yields, GDP is expected to grow by around 1¾% per year on average over the forecast period. On the expenditure side, growth continues to rotate towards net trade and business investment and away from consumption. Although business investment is still restrained by Brexit-related uncertainties, it is being supported, like exports, by strong global demand and accommodative financial conditions. Household consumption growth remains subdued, in line with the modest growth in real income over the forecast period.

Wage growth and domestic cost pressures are firming gradually, broadly as expected. The MPC continues to judge that the UK economy has a very limited degree of slack. Hiring intentions have remained strong and, over the past three months, the unemployment rate has fallen slightly further. While modest by historical standards, the projected pace of GDP growth over the forecast is nonetheless slightly faster than the diminished rate of supply growth, which averages around 1½% per year. In the MPC’s central projection, therefore, a small margin of excess demand still emerges by early 2020, feeding through into higher rates of pay growth and domestic cost pressures.

CPI inflation fell to 2.5% in March, lower than expected at the time of the February Report. The inflation rates of the most import-intensive components of the CPI appear to have peaked. The MPC judges that the impact of the past depreciation of sterling on CPI inflation, while remaining significant, is likely to fade a little faster than previously thought. Taking external and domestic influences together, CPI inflation is projected to fall back slightly more quickly than in February, reaching the target in two years. These projections are conditioned on a gently rising path for Bank Rate over the next three years.

In the exceptional circumstances presented by Brexit, as specified in its remit, the MPC has been balancing any significant trade-off between the speed at which it intends to return inflation sustainably to the target and the support that monetary policy provides to jobs and activity. The prospect of excess demand over the forecast period has reduced the degree to which it is appropriate for the MPC to accommodate an extended period of inflation above the target. The Committee’s best collective judgement therefore remains that, were the economy to develop broadly in line with the May Inflation Report projections, an ongoing tightening of monetary policy over the forecast period would be appropriate to return inflation sustainably to its target at a conventional horizon. As previously, however, that judgement relies on the economic data evolving broadly in line with the Committee’s projections. For the majority of members, an increase in Bank Rate was not required at this meeting. All members agree that any future increases in Bank Rate are likely to be at a gradual pace and to a limited extent.

The Bank of England’s Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment.