Given the May government’s weakness and instability, and the ongoing toxic, Brexit-laced personal and political divisions within the cabinet, not much was expected from Philip Hammond’s Autumn 2017 budget. He did not disappoint.

During a rambling, hour-long speech of nearly 8,000 words, weak jokes torturously delivered were interspersed with a raft of policy announcements whose sum total fell far short of resetting UK economic policy away from austerity. This was not a budget to redress the “burning injustices” and interests of the “just about managing”, which the prime minister once promised would be the mission of her government.

Hammond’s announcements fell far short of the £4 billion in investment required to redress the impact of a lost decade of cuts in welfare, including the freeze on benefits. Or the £4 billion required to maintain services in the National Health Service in England in 2018-19. And little to redress the financial unsustainability of England’s schools or its local government.

Hammond’s statement announced token investment in driverless vehicles, but onlookers could be forgiven for thinking that this was the anaemic budget of a driverless government. Like his next-door-neighbour in 10 Downing Street, Hammond lacks the necessary gumption to lead the UK economy at this critical juncture.

The Autumn 2017 budget represented the opportunity to make good Hammond’s July 2016 promise “to reset fiscal policy if we deem it necessary to do so in the light of the data that will emerge over the coming months”. The data that has emerged subsequently should have convinced him that the time for a reset was long overdue. Austerity has clearly failed to revive the British economy and there is an urgent need to prepare businesses – and not just government departments – for Brexit.

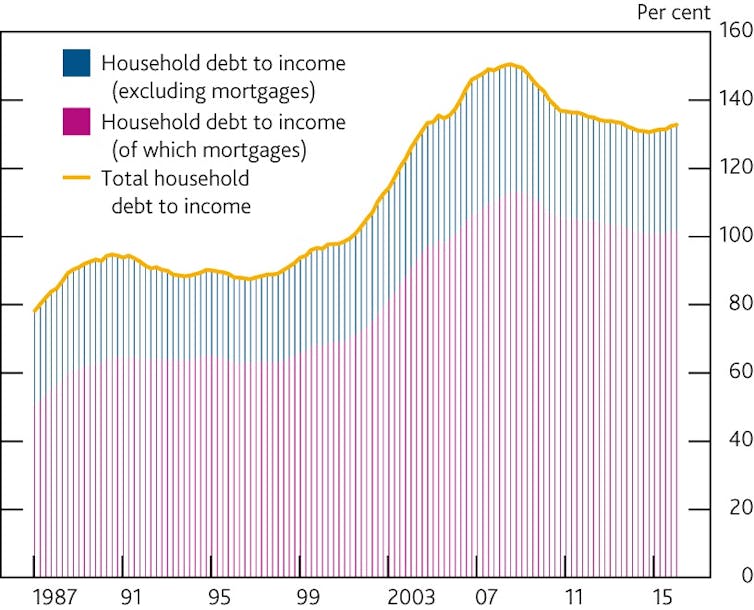

Rising debt

Austerity – the notion of balancing the books by cutting spending – has singularly failed to rebalance the nation’s finances. Since Hammond’s appointment as chancellor, a further £176 billion has been added to the UK’s public sector net debt, which now stands at more than £1,790 billion. This has maintained the pattern since May 2010, which has seen the Cameron-Clegg coalition’s “unavoidable deficit reduction plan” add £772.5 billion to public sector net debt.

The budget now forecasts that in 2022-23, public sector net debt will still be £1,909 billion or 79.1% of GDP, and the government will be borrowing £25.6 billion or 1.1% of GDP.

This is contrary to what Hammond’s predecessor George Osborne promised would have been achieved by 2015-16. When the Conservatives came into government in June 2010, Osborne promised “to raise from the ruins of an economy built on debt a new, balanced economy where we save, invest and export”.

That new, balanced economy has proven to be a fiction. In 2016, the UK ran a record current account deficit of £115.5 billion, equivalent to 5.9% of GDP, and a trade deficit of £43 billion, equivalent to 2.2% of GDP.

There was little in the latest budget to reverse these trends. Instead, the independent Office for Budget Responsibility (OBR) downgraded its forecasts for real GDP growth between 2017-18 and 2021-22 from 7.5% to 5.7%. The British economy is now forecast to grow by less than 2% in each year of the current parliament, and, as the OBR also noted, this contrasts with “a pick-up in other advanced economies”.

Storing problems for the future

The budget concluded with a raft of announcements to address the housing crisis in England, including the abolition of Stamp Duty on properties up to £300,000. This was Hammond’s crowd-pleasing rabbit out of the hat. But the OBR has observed that “the main gainers from the policy are people who already own property” rather than first-time buyers, and will likely push up prices, thus making properties less affordable.

Official government statistics have revealed that over the past 20 years, land values have increased by 479% and property values by 203%. The latest budget has done nothing to reverse these trends towards investment in property and rent-seeking, rather than in the real economy of businesses.

David Willetts, who until May 2015 was complicit in the implementation of austerity, as a cabinet minister in the Cameron-Clegg coalition government, recently warned:

We are reshaping the state and storing problems for the future by creating a country for older generations. The social contract is a contract between the generations and in Britain it is being broken.

The truth is more stark than that. Philip Hammond’s failure to reset UK economic policy by perpetuating fundamentally flawed austerity policy means the May government is reshaping the state and storing problems for the future by creating a country for older, rentier and asset-rich interests. This risks breaking down the political contract between the governing elite at Westminster and the people of Britain.

Author: Senior Lecturer in Politics, University of Hull