On Thursday Australia’s jobless rate rose to 3.8 per cent in March, which was broadly in line with the market’s expectations, and ahead of crucial March quarter inflation data due next Wednesday. The economy added 27,900 full-time roles and lost 34,500 part-time jobs in the month.

This very slight rise in the unemployment figure to 3.8 per cent last month showed February’s unexpected drop to 3.7 per cent was not an aberration after all. It’s further evidence of the continued strong state of the Australian labour market.

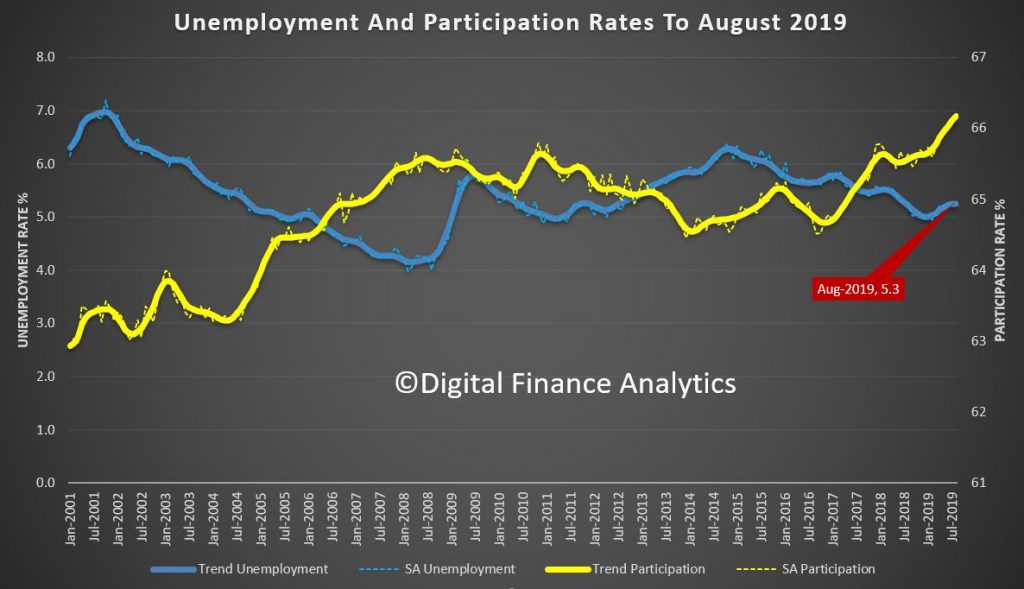

So, forget rate cuts for now, as this can only make it harder for the Reserve Bank to consider any start to rate cuts in the foreseeable future. Reserve Bank governor Michele Bullock’s mantra is that the path of interest rates will depend on the data. And this is one more data point indicating the resilience of the economy. Actually, despite record immigration, the employment-to-population ratio fell marginally in the month but is still at close to the historically high levels of last year.

This continues what I think is a really wonky series on employment, as I have discussed before. As in many economies, thanks to sample issues, and definitional issues they are hard to read. Indeed, Australia’s labor market report is a volatile series and both economists and policymakers tend to look through month-to-month fluctuations. So, Thursday’s data was widely anticipated following holiday season-affected readings since December. The ABS noted that employment flows have now returned “to a more usual pattern” after recent instability. The incoming and outgoing samples this time around were certainly a little less volatile. But I still take the results with a truck load of salt!

http://www.martinnorth.com/

Go to the Walk The World Universe at https://walktheworld.com.au/

Today’s post is brought to you by Ribbon Property Consultants.