We look at industry vehicle sales figures, which continue to track weaker. https://www.fcai.com.au/about

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

We look at industry vehicle sales figures, which continue to track weaker. https://www.fcai.com.au/about

Carmageddon continues…. We look at industry vehicle sales figures, which continue to track weaker.

https://www.fcai.com.au/about

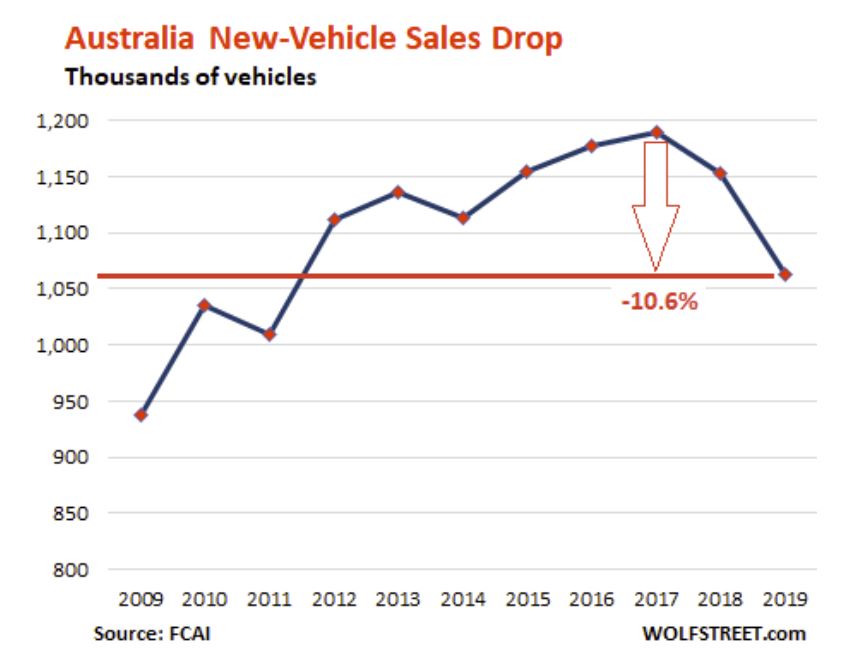

Latest data from the The Federal Chamber of Automotive Industries (FCAI), the peak representative organization for companies who distribute new passenger vehicles, light commercial vehicles and motorcycles and all-terrain vehicles in Australia further confirms the economic slow down.

This sales data, supplied by the industry (the ABS no longer reports on this category due to budget constraints), was calculated through the automotive industry’s statistical service, VFACTS, which will be enhanced through system improvements from 1st January 2020. This data is, as necessary, verified against the national registration data base and, when confirmed, vehicles are accepted into the monthly VFACTS reporting system.

But in summary, for the full calendar year 2019, a total of 1,062,867 new vehicles were recorded as sold, a 7.8 per cent decrease on full year 2018. The 2019 figure of 1,062,867 is the lowest annual sales result reported in VFACTS since 2011.

This gives a combined decline from the historic peak in 2017 of 10.8%. The sales declines in 2019 got worse all year, well before the horrific bushfires began. On a monthly basis, 84,239 new vehicle sales were recorded for December 2019, a decrease of 3.8 per cent from December 2018.

They said 2019 reflects a tough year for the Australian economy, with challenges including tightening of lending, movements in exchange rates, slow wages growth and, of course, the extreme environmental factors our country is experiencing.

SUV sales which now hold 45.5 per cent of the total market, a 2.5 percentage point increase from 2018.

Continuing the full year comparison, light commercial vehicle share grew by 0.6 percentage points to claim 21.2 per cent of the market, while passenger motor vehicles decreased by 3.1 percentage points to 29.7 per cent.

While holding the largest share of market, sales of SUVs declined for full year 2019 by 2.4 per cent compared to 2018, sales of passenger vehicles declined by 16.5 per cent and sales of light commercial vehicles declined by 5.2 per cent.

The Toyota HiLux again claimed the title of number one selling vehicle in 2019 across all categories, with 47,649 sales. The HiLux was followed by the Ford Ranger, again number two in the market with 40,960 sales, followed by the Toyota Corolla (30,468), the Hyundai i30 (28,378) and the Mitsubishi Triton (25,819).

Across the brands, Toyota led the market in 2019 with 19.4 per cent market share, followed by Mazda (9.2 per cent), Hyundai (8.1 per cent), Mitsubishi (7.8 per cent) and Ford (6.0 per cent).

Note that the full data is only available for paying VFACTS subscribers!

And sales are also down in other major markets, as “Carmageddon” Spreads.

The ABS released the April 2015 sales today. Hard to read the data, as there are some significant variations between the trend estimate and the seasonally adjusted figures, though on both measures Sport Utilities continued to shine.

The trend estimate (our preferred view) for April 2015 was 95 288, an increased by 0.5% when compared with March 2015. This was the highest April result on record. When comparing national trend estimates for April 2015 with March 2015, sales of Sports utility and Other vehicles increased by 1.9% and 0.1% respectively. Over the same period, Passenger vehicles decreased by 0.4%.

Seven of the eight states and territories experienced an increase in new motor vehicle sales when comparing April 2015 with March 2015. Tasmania recorded the largest percentage increase (1.6%), followed by Queensland (1.1%) and the Northern Territory (0.9%). Over the same period, Western Australia was the only jurisdiction to record a decrease in sales (0.1%).

Seven of the eight states and territories experienced an increase in new motor vehicle sales when comparing April 2015 with March 2015. Tasmania recorded the largest percentage increase (1.6%), followed by Queensland (1.1%) and the Northern Territory (0.9%). Over the same period, Western Australia was the only jurisdiction to record a decrease in sales (0.1%).

Turning to the seasonally adjusted estimates, the April 2015 seasonally adjusted estimate (94 888) has decreased by 1.5% when compared with March 2015. When comparing seasonally adjusted estimates for April 2015 with March 2015 sales of Passenger and Other vehicles decreased by 8.3% and 0.6% respectively. Over the same period, Sports utility vehicles increased by 7.4%.

Turning to the seasonally adjusted estimates, the April 2015 seasonally adjusted estimate (94 888) has decreased by 1.5% when compared with March 2015. When comparing seasonally adjusted estimates for April 2015 with March 2015 sales of Passenger and Other vehicles decreased by 8.3% and 0.6% respectively. Over the same period, Sports utility vehicles increased by 7.4%.

Five of the states and territories experienced a decrease in new motor vehicle sales when comparing April 2015 with March 2015. The Australian Capital Territory recorded the largest percentage decrease (6.1%) followed by Queensland (4.8%) and Western Australia (2.8%). Over the same period, the Northern Territory recorded the largest increase in sales (3.2%).

The ABS just released their statistics to January 2015. In line with DFA policy, we focus on the trend estimates. The January 2015 trend estimate (92 219) has decreased by 0.1% when compared with December 2014.

When comparing national trend estimates for January 2015 with December 2014, sales of Sports utility and Other vehicles increased by 0.1% and 1.0% respectively. Over the same period, Passenger vehicles decreased by 0.7%.

Six of the eight states and territories experienced a decrease in new motor vehicle sales when comparing January 2015 with December 2014. Western Australia recorded the largest percentage decrease (0.9%), followed by both South Australia and the Australian Capital Territory (0.6%). Over the same period, Tasmania recorded the largest increase in sales of 2.2%.

The ABS data for December, released today shows that the vehicle sales trend estimate of 92,618 decreased by 0.1% when compared with November 2014. The trend estimate has now decreased by 0.1% for five consecutive months, from a peak in 2012.

When comparing national trend estimates for December 2014 with November 2014, sales of Sports utility and Other vehicles both increased by 0.5% respectively. Over the same period, Passenger vehicles decreased by 0.8%. The rotation towards Sports utilities continues.

When comparing national trend estimates for December 2014 with November 2014, sales of Sports utility and Other vehicles both increased by 0.5% respectively. Over the same period, Passenger vehicles decreased by 0.8%. The rotation towards Sports utilities continues.

Five of the eight states and territories experienced a decrease in new motor vehicle sales when comparing December 2014 with November 2014. Western Australia recorded the largest percentage decrease (1.3%), followed by the Australian Capital Territory (1.2%) and South Australia (1.1%). Over the same period, both Victoria and the Northern Territory recorded the largest increase in sales of 0.3%. Queensland and WA have been showing the most consistent falls in recent months.

Five of the eight states and territories experienced a decrease in new motor vehicle sales when comparing December 2014 with November 2014. Western Australia recorded the largest percentage decrease (1.3%), followed by the Australian Capital Territory (1.2%) and South Australia (1.1%). Over the same period, both Victoria and the Northern Territory recorded the largest increase in sales of 0.3%. Queensland and WA have been showing the most consistent falls in recent months.