Introduction

Using data from various sources including the RBA and APRA, we have estimated the gross and net additional payments households are making to financial institutions in Australia, following the RBA cash rate lifts from May 2022 to date.

We have only included owner occupied and investor loans, as these are the main foci of debt, but of course higher rates have also been applied to SME’s, personal loans and credit cards, but these are excluded from this analysis. These findings are indicative only.

Approach

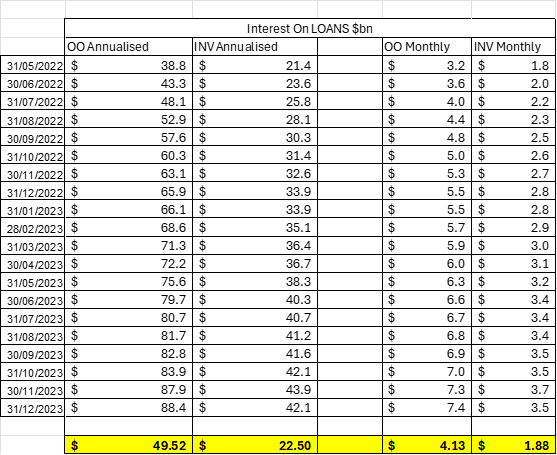

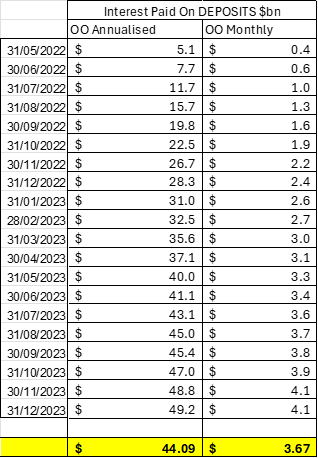

We took the loans outstanding data from the RBA monthly series, for both owner occupied and investor loans from their monthly series. We took the average interest rate charged on these loans again from relevant RBA data sources. We also took the total deposit pools held by the banks, using data from APRA (authorised depository institutions) and the typical interest paid from the RBA rate series.

During the period under review, the net value of loans and deposits grew, so we used the average balance each month. We applied the average interest rate charged to each balance, and compared the outcome in May 2022 to December 2023, the period over which interest rates rose. The different between the May 2022 to December 2023 is the gross increase in payments households were forced to make.

We also provided a net offset calculation because banks in the period also provided higher rates, at least to some extent on deposits, calculated with a similar method. These payments went to different households of course.

Note we have not included any assessment of capital being repaid during this period, as we worked on gross average balances. But this effectively isolates the impact of the higher rates.

Results

On a gross basis, banks received an additional $49.52 billion on an annualised basis between May 2022 and December 2023, on owner occupied loans, and $22.5 billion on investment loans. Together this is worth around $70 billion annualised. This translates to $4.13 billion per month for owner occupied loans and $1.88 billion for investor loans.

Turning to deposits, banks paid out and additional $44.09 billion on an annualised between May 2022 and December 2023, or $3.67 billion per month.

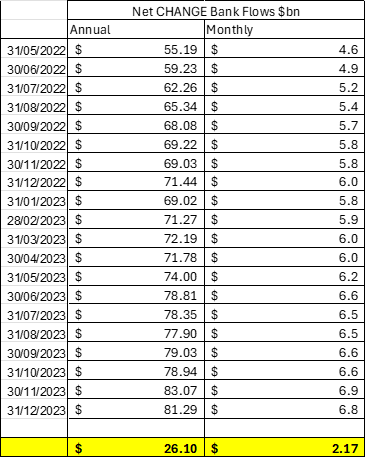

Offsetting the deposit interest paid to the mortgage interest received, Banks received an additional $26.1 billion from households on an annualised basis, or $2.17 billion per month.

We would also make the point that the interest paid by some households are generally returned to asset rich savers, not the same households. So it would be appropriate to cite the gross impact, rather than the net impact if this distinction is made.

This is in addition to returns deposited with the RBA under the Term Funding Facility.