Analysis released today by Digital Finance Analytics reveals that in the coming 12 months around 124,000 interest only loans will need to be switched to principal and interest loans. This is drawing data from our rolling household surveys. This translates to an estimated value of $47 billion, and represents a significant proportion of all IO loans coming up for review. Of these 97.5% are for investment properties.

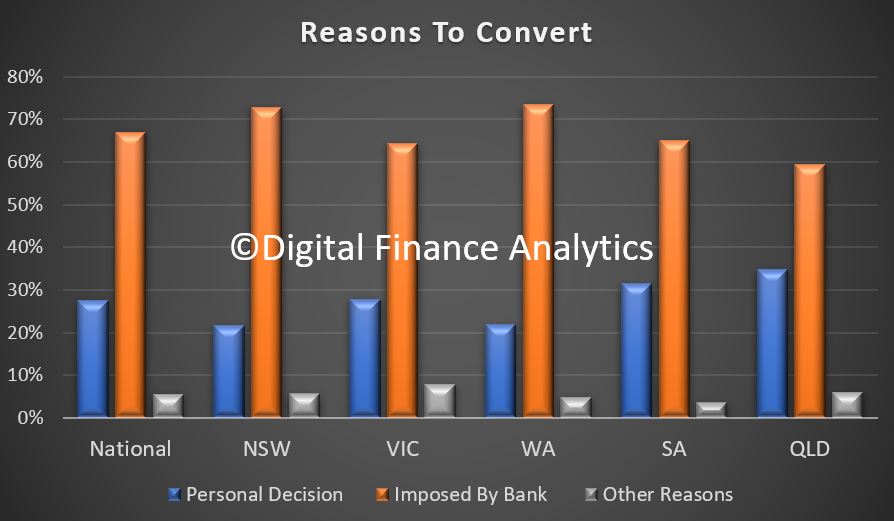

The reason why households are converting varies, with around 27% deciding to switch, while 67% were persuaded by their lender. There are state variations. NSW and WA had the highest proportion of “forced” moves.

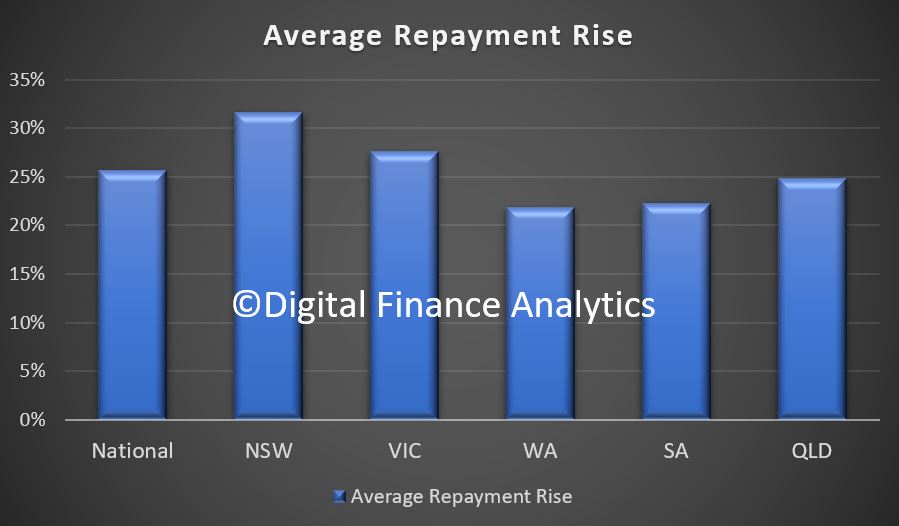

The average repayments will rise by 25.6%, with the highest in NSW at 31.6%.

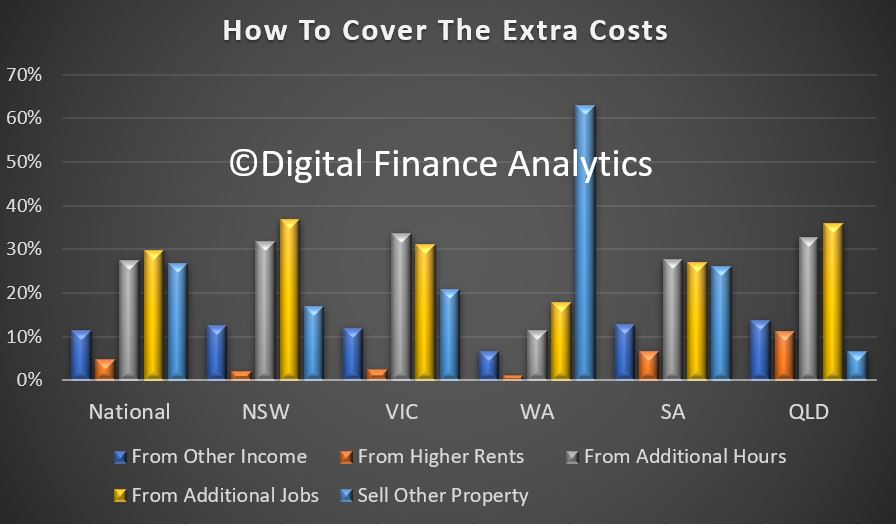

We then asked about what steps owners would take to cover the extra costs. On average 11.5% said they could cover form other income, from higher rents 4.5%, from selling other property 26.7%, and the remaining will require extra employment, either by way of extra hours, or from additional jobs. Again there are state differences.

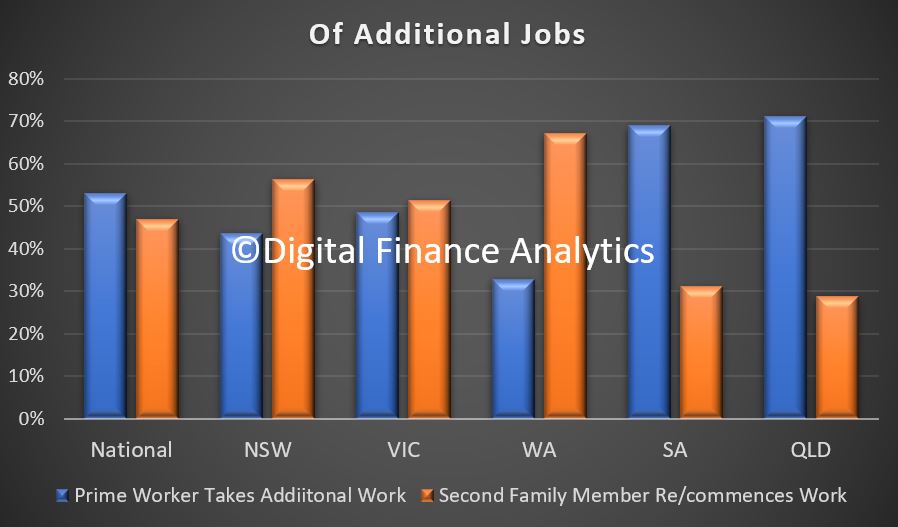

In terms of extra jobs, on average 53% of the extra work will be taken by the primary worker, while 47% will be taken by a second family member (often the spouse). It varies across the states.

This of course is all predicated on more work being available. Perhaps this is one reason why mortgage delinquencies are rising?