The latest and updated edition of our flagship report “The Property Imperative” is now available free on request with data to October 2018. This is volume 11.

This Report is a distillation of our research in the finance and property market, using data from our household surveys and other public data. We provide weekly updates via our blog – the Property Imperative Weekly, and our YouTube Channel, but twice a year publish this report.

This Report is a distillation of our research in the finance and property market, using data from our household surveys and other public data. We provide weekly updates via our blog – the Property Imperative Weekly, and our YouTube Channel, but twice a year publish this report.

The past six months has seen a significant shift in momentum as home prices have moved lower across many of the main centres, auction clearance rates have eased, and more property stock is added to the market, thanks to more new builds and as more owners try (or are forced) to sell.

Many of the “experts” have changed their tune and are expecting to see further falls in home prices ahead, although the extent and speed of these falls remains uncertain. Meantime more households are in financial stress, as incomes remain constrained, costs of living rise, and returns from investments look shaky. No surprise to see mortgage delinquencies are rising, though they are still in an absolute sense very low.

At its heart, home price growth is fundamentally linked to credit availability and thanks to belated tightening from APRA, the fallout from the Royal Commission into Financial Services Misconduct, and the Productivity Commission and ACCC work, lending standards continue to tighten.

Whilst some still spruik future growth thanks to migration, government intervention, or first time buyer appetite, these factors pale into insignificance against the global backcloth of rising interest rates, slowing global growth and broader political and economic uncertainty.

As a result, we have revised our property price scenarios which are driven by our household surveys, and modelling, and believe that a 40% peak to trough fall in home values in the main eastern states is quite conceivable. But even smaller falls will have a significant impact, in terms of broader economic growth, the negative household wealth effect, and will impact the banks and their profitability.

We believe that 2019 will become a critical year, with the potential for the property sector to move into territory not seen in a generation or more. The final report from the Royal Commission, expected in February will be a significant event, despite the fact that even now, the RBA and Treasury are warning the Commission that further lending tightened has economic risks attached. But a generation of too lose lending needs to be addressed, rather than just reverting to a further cycle of debt induced growth. That is the policy battleground we discuss in this edition.

We will continue to track market developments in our Property Imperative weekly video blogs, and publish a further update in about six months’ time.

If you are seeking specific market data from our Core Market Model, reach out, and we will endeavour to assist.

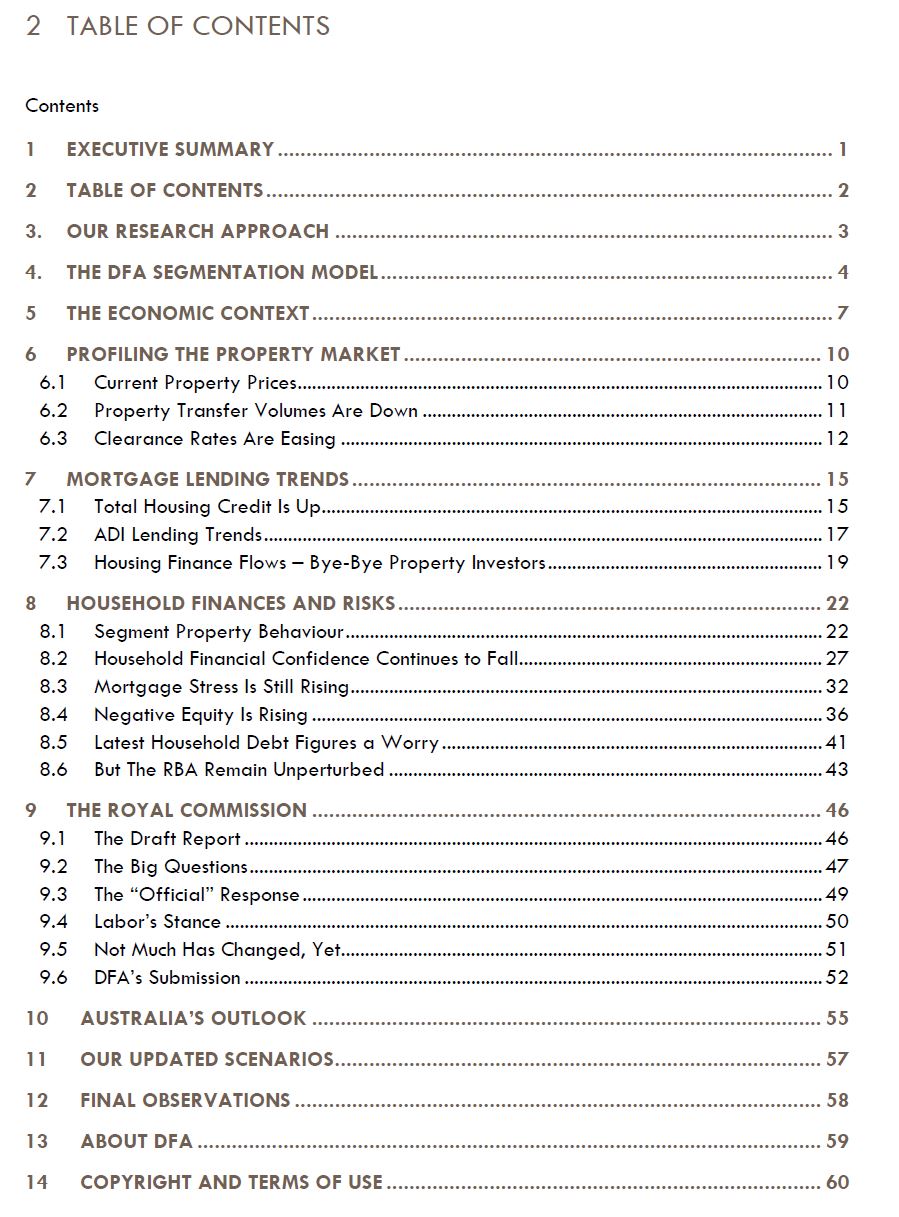

Here is the table of contents:

Request the free report [60 pages] using the form below. You should get confirmation your message was sent immediately and you will receive an email with the report attached after a short delay. Note that reports are sent in batches, so please allow time for the system to processes your request.

Request the free report [60 pages] using the form below. You should get confirmation your message was sent immediately and you will receive an email with the report attached after a short delay. Note that reports are sent in batches, so please allow time for the system to processes your request.

Note this will NOT automatically send you our ongoing research updates, for that register here.

[contact-form to=’mnorth@digitalfinanceanalytics.com’ subject=’Request for The Property Imperative Report 11′][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Email Me The Report’ type=’radio’ options=’Yes Please’ required=’1′ /][contact-field label=’Comment If You Like’ type=’textarea’/][/contact-form]