This is all about the Iron Ore price, thanks to Brazil. Fortunate yes, planned no!

The ABS reported that

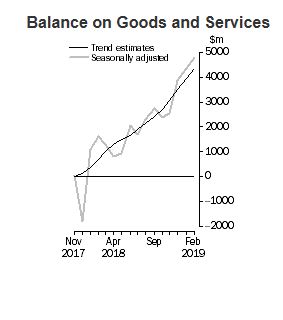

- In trend terms, the balance on goods and services was a surplus of $4,348m in February 2019, an increase of $395m on the surplus in January 2019.

- In seasonally adjusted terms, the balance on goods and services was a surplus of $4,801m in February 2019, an increase of $450m on the surplus in January 2019.

This from Westpac.

The trade surplus rose to $4.8bn in February, up from a revised $4.35bn.

That exceeded expectations (market median $3.7bn and Westpac $3.8bn).

Exports: exceeded expectations, +0.2% vs a forecast -0.9%. The key surprise, the expected pull-back in gold failed to materialise.

Imports: were softer than anticipated, -1.1% vs a forecast +1.1%

Additional detail

Export earnings have been boosted by higher commodity prices, particularly for coal and iron ore. In February, metal ore export earnings (including iron ore) jumped by $1.0bn to $9.6bn, a record high – as anticipated. The spot iron ore price soared to US$85/t in the month as global supply was dented by the tailings dam tragedy in Brazil. Coal exports fell sharply, down $0.8bn on weaker volumes. Gold exports, up $1.4bn in January, held at high levels in February, down only $140mn.

Comments

The trade balance has strengthened from a $2.9bn surplus on average in the December quarter to a $4.6bn on average surplus in the March quarter. The bulk of this improvement likely reflects higher commodity prices. The lift in prices is boosting Australia’s national income, which is flowing through to higher tax revenues – providing governments with additional fiscal flexibility, as evident in recent budget updates. However, despite this, wages growth remains sluggish.