More evidence of the global fragility of the financial markets on Friday.

Turkey’s finance minister, Berat Albayrak, unveiled a new plan for their economy on August 10th.

The new economic stance will be one with “determination” — that’s a key part of it, Albayrak says. It will “transform” Turkey’s economy. It will also have a “strategic” and “powerful infrastructure.”

But Donald Trump, tweeted that he would double tariffs on Turkish steel and aluminium products.

As a result, the lira plummeted further. In the course of an hour, it reached a new low of 6.80 to the dollar, marking its worst daily performance in over a decade. It recovered a little afterwards, but has lost about 40% of its value against the dollar since the start of the year.

Many fear the fallout could spread beyond Turkey’s border, prompting traders to abandon riskier assets like stocks in search of safe-havens like gold, yen and Treasuries.

Many fear the fallout could spread beyond Turkey’s border, prompting traders to abandon riskier assets like stocks in search of safe-havens like gold, yen and Treasuries.

Volatility, as measured by the “fear index”, rose nearly 17%, underlying investor concerns about the broader impact of a possible crash in Turkey’s economy.

The exposure to a slump in Turkey’s economy is “pretty international,” though limited to the banking sector, said Tim Ash, a senior EM strategist at Bluebay Asset Management.

The exposure to a slump in Turkey’s economy is “pretty international,” though limited to the banking sector, said Tim Ash, a senior EM strategist at Bluebay Asset Management.

Data from the Bank for International Settlements showed that Japanese banks are owed $14 billion, U.K. lenders $19.2 billion and the United States about $18 billion.

The Turkish Lira also moved the same way against the Euro.

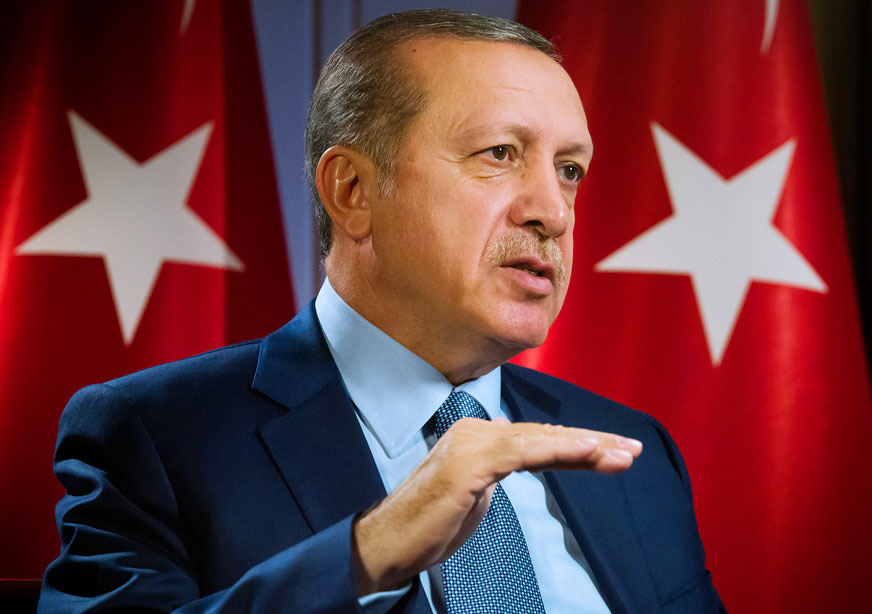

“We’re not going to lose the economic warfare” being waged against Turkey said President Recep Tayyip Erdogan.

“We’re not going to lose the economic warfare” being waged against Turkey said President Recep Tayyip Erdogan.

Erdogan is boasting of Turkey’s 7.4 percent growth rate in the first quarter. Forget about the exchange rate, he says. “It’s going to be better.”

Erdogan is boasting of Turkey’s 7.4 percent growth rate in the first quarter. Forget about the exchange rate, he says. “It’s going to be better.”