The IMF just released an interim World Economic Outlook update. The baseline global growth forecast has been revised down modestly relative to the April 2016, but more negative outcomes are a distinct possibility. The global economy is projected to expand 3.1 percent this year and 3.4 percent in 2017, according to the IMF.

The economies of the United Kingdom (U.K.) and Europe will be hit the hardest by fallout from the June 23 referendum, which prompted a change of government in Britain. Global growth, already sluggish, will suffer as a result, putting the onus on policy makers to strengthen banking systems and deliver on plans to carry out much-needed structural reforms.

Before the June 23 vote in the United Kingdom in favor of leaving the European Union, economic data and financial market developments suggested that the global economy was evolving broadly as forecast in the April 2016 World Economic Outlook (WEO). Growth in most advanced economies remained lackluster, with low potential growth and a gradual closing of output gaps. Prospects remained diverse across emerging market and developing economies, with some improvement for a few large emerging markets—in particular Brazil and Russia—pointing to a modest upward revision to 2017 global growth relative to April’s forecast.

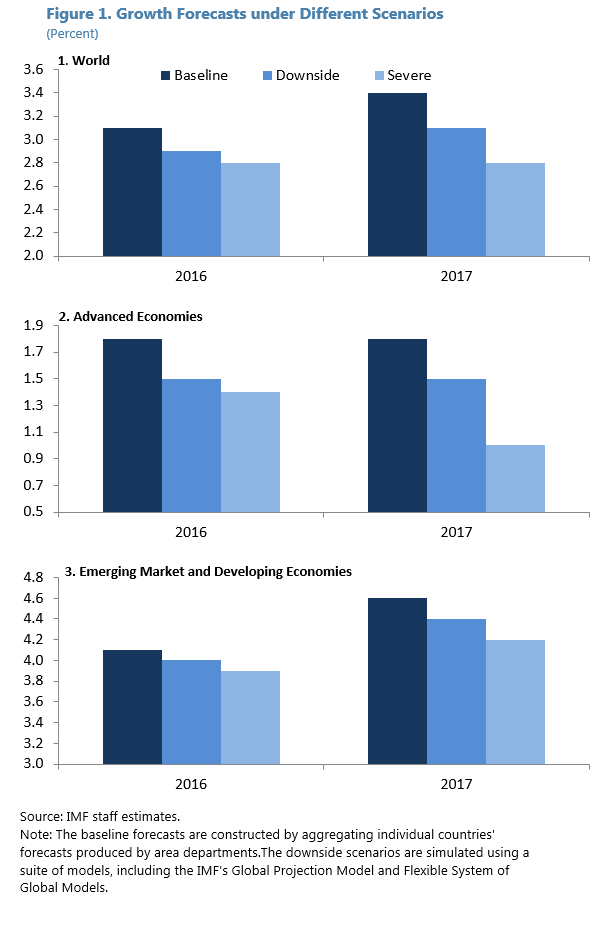

Because the future effects of Brexit are exceptionally uncertain, the report outlined two scenarios that would reduce world growth to less than 3 percent this year and next.

The outcome of the U.K. vote, which surprised global financial markets, implies the materialization of an important downside risk for the world economy. As a result, the global outlook for 2016-17 has worsened, despite the better-than-expected performance in early 2016. This deterioration reflects the expected macroeconomic consequences of a sizable increase in uncertainty, including on the political front. This uncertainty is projected to take a toll on confidence and investment, including through its repercussions on financial conditions and market sentiment more generally. The initial financial market reaction was severe but generally orderly. As of mid-July, the pound has weakened by about 10 percent; despite some rebound, equity prices are lower in some sectors, especially for European banks; and yields on safe assets have declined.

In the first, “downside” scenario, financial conditions are tighter and consumer confidence weaker than currently assumed, both in the U.K. and the rest of the world, until the first half of 2017, and a portion of U.K. financial services gradually migrates to the euro area. The result would be a further slowdown of global growth this year and next.

The second, “severe” scenario, envisages intensified financial stress, particularly in Europe, a sharper tightening of financial conditions and a bigger blow to confidence. Trade arrangements between the U.K. and the EU would revert to World Trade Organization norms. In this scenario, “the global economy would experience a more significant slowdown” through 2017 that would be more pronounced in advanced economies.

With “Brexit” still very much unfolding, the extent of uncertainty complicates the already difficult task of macroeconomic forecasting. The baseline global growth forecast has been revised down modestly relative to the April 2016 WEO (by 0.1 percentage points for 2016 and 2017, as compared to a 0.1 percentage point upward revision for 2017 envisaged pre-Brexit). Brexit-related revisions are concentrated in advanced European economies, with a relatively muted impact elsewhere, including in the United States and China. Pending further clarity on the exit process, this baseline reflects the benign assumption of a gradual reduction in uncertainty going forward, with arrangements between the European Union and the United Kingdom avoiding a large increase in economic barriers, no major financial market disruption, and limited political fallout from the referendum. But more negative outcomes are a distinct possibility.

A more thorough assessment of the global outlook will be presented in the October 2016 WEO.