Here is an excellent article from Nucleus Wealth which spells out the true issues around property investment. So many investors have their heads in the sand!

The net effect is that at current prices, finding scenarios where property won’t lose you money over ten years is not that easy. Which means most buyers in today’s market should be doing so as a lifestyle choice rather than as an investment choice.

Recently, we have seen a few Nucleus investors cash in their capital and profits and take the real estate plunge. This, of course, is sometimes more a lifestyle choice than an economic one. Being locked five months in a small flat with a partner and boisterous progeny while working off a kitchen table can often change one’s perspectives.

So what can economic conditions do I need to retain my deposit?

Given this is more about sanity than economics I start from the position that I am happy to walk away with no real profit after 10 years but I want to at least retain close to my initial capital.

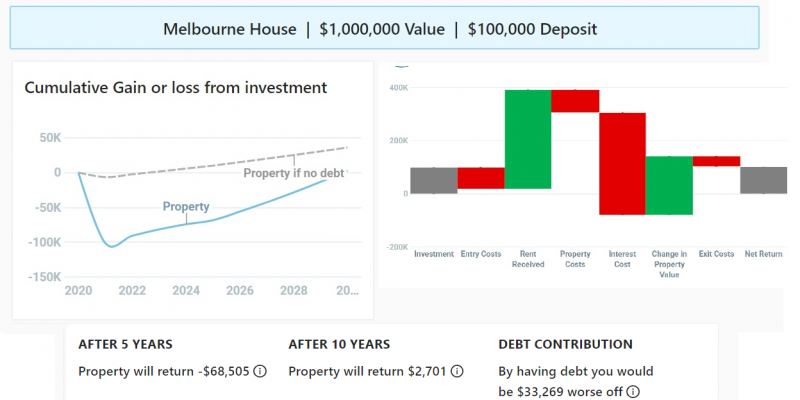

To look at the various implications we will use the Nucleus Wealth Property calculator. To start I need some initial details. Let’s take the case of my son as a working example. Say he is in Melbourne, has $100K saved for the deposit and has found his dream house available for $1m. The banks are willing to lend him the balance – no mean feat in this credit environment. Let us assume he intends to live in this house so there are no negative gearing tax benefits and he intends selling it in 10 years to move to the Bahamas as he expects to be an empty nester (a true dreamer).

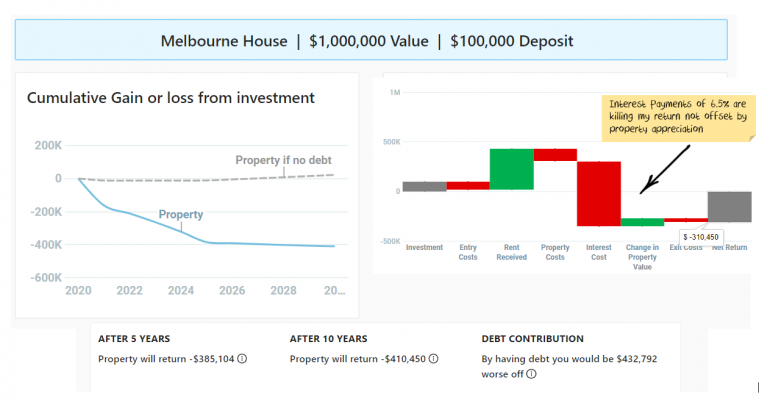

Thus using our Property Calculator and given we are optimists expecting a recovery from the COVID downturn we choose “Good Economic Conditions”, and use all the designated defaults to get:

Gulp!.. that’s not good… The problem with good economic conditions is that interest rate rises will limit your capital growth, and with 90% debt load the interest payments hurt. Note we are using rent received as rent “avoided” in these scenarios.

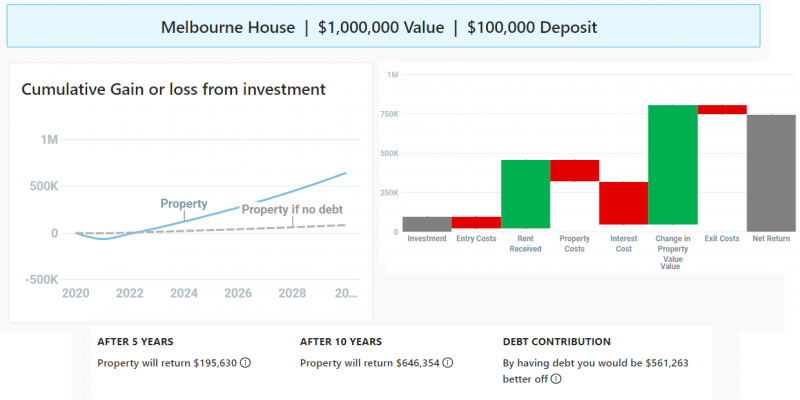

Perhaps we need to be even more optimistic so we choose “Property Paradise” conditions…which yields:

That’s more like it!! he can now afford a jacuzzi and a seaview. However a quick look at the underlying assumptions for Property Paradise yields …

While we are optimists, alas I am also a realist…. I tell him it is highly improbable he can lock-in 2.75% for 10 years, nor do I believe a 6% nominal Rent Growth year after year is realistic.

Thus we decide to input our own assumptions.

The first thing to note about the calculator is that by default it is designed for property investors that intend to rent their property. Thus as an owner-occupier (and as we are misers) we can reduce the re-investment in the property (depreciation rates to $600+halving repair assumptions) and dial down the other costs. The rental income should be viewed as money saved not paying rent, so the variables about lost rent/vacancies can be dialled down to 0.

That done, now we come to the key assumption for the calculator (and the investment outcome). What is my expectation for property prices? Investing in property implies we have an expectation property prices will recover over the next 10 years. This expectation of a property price rise can be incorporated into the calculator in a number of ways:

- decreasing the Gross Rental yield

- increasing the Mortgage Cost / Wage ratio

- increasing the Property Price / Wage ratio

- or increasing the default setting of the Mortgage Cost / Rent ratio.

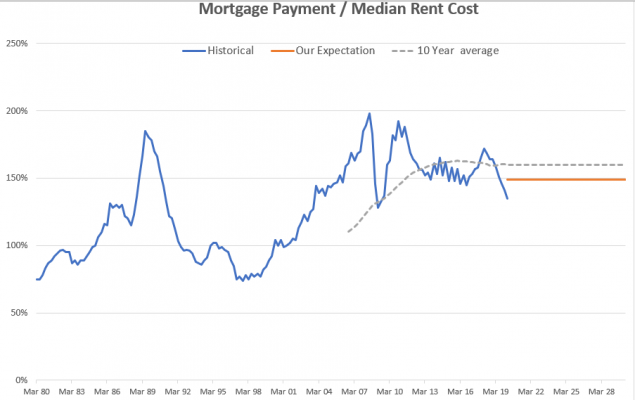

We choose to alter the ratio of Mortgage Cost to Rent ratio as it is probably the easiest ratio to get a handle on. Data suggests this ratio is currently at 134%, but the long term graph suggests the 10-year average is closer to 160%.

With our expectation of post-COVID economic recovery and a resumption of Immigration to drive property demand, we take the view that this ratio should retrace toward its 10 year average of 160% (I chose to use 148% a rough midpoint between these values).

With that key assumption locked in, it is time to pull the various economic levers (inflation, rental growth, mortgage rate) to find a breakeven investment such as:

So what economic expectation does my break-even result imply?

- The inflation rate would need to be 2%. This is at the lower end of the RBA band of 2-3% so not an unreasonable forecast over ten years, even if inflation is unlikely to be there anytime soon.

- Rental growth needs to be 2.5% (+0.5% real). Over a ten year period this is possible. Given the slump in rents, and lack of immigration it is going to need a lot of growth in the second half of the decade.

- Lastly, I need to pay an average 4% mortgage rate over the 10 years. While historically this is unprecedented, we are in atypical times and low-interest rates look to persist. A quick internet search shows Credit Unions are offering a 10 year fixed rates that are not too far off this mark, so perhaps it is an achievable goal.

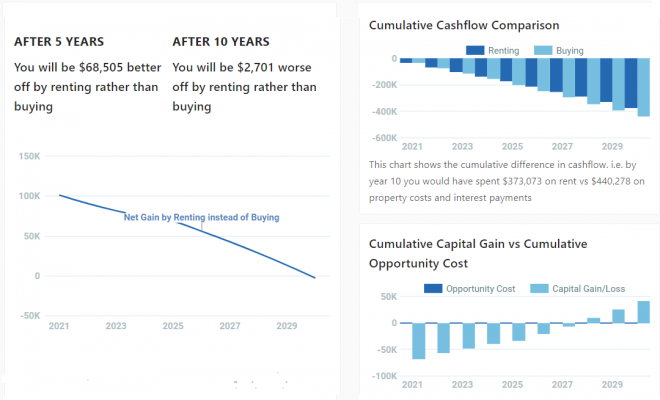

As a good cross-check, using the “Compare Renting vs Buying” function in the calculator, we can confirm we are near break-even (with an assumed 0% return on the $100K over the period).

The calculator also highlights how the benefit of a geared property is mostly achieved at the tail end of the investment. i.e. if he only stays in the property for 5 years, he will be about $60k worse off than if he rented for the same period. i.e. on the assumed property with stamp duty, mortgage insurance and other entry costs he will be out over $80k. Add in $20k to sell the property on the other side and his $100k is gone, relying on capital growth to make up the difference.

Where to from here?

Using the calculator we can thus find other scenarios that achieve break-even property result (1.5% inflation, 2% real Rental growth which then means I can lock in a more attainable 4.5% mortgage rate). Alternatively, a more aggressive property price forecast of 160% (i.e. the 10-year average) mortgage cost to rent ratio means inflation could be 3%, rental growth of 3.5%, and my mortgage interest rate can now be a very achievable 5%.

Armed with these base-line cases a user can now test the sensitivities of these assumptions or explore their own expectations to assess the risks/benefits involved in not persevering with living and working on that kitchen table.

The net effect is that at current prices, finding scenarios where property won’t lose you money over ten years is not that easy. Which means most buyers in today’s market should be doing so as a lifestyle choice rather than as an investment choice.