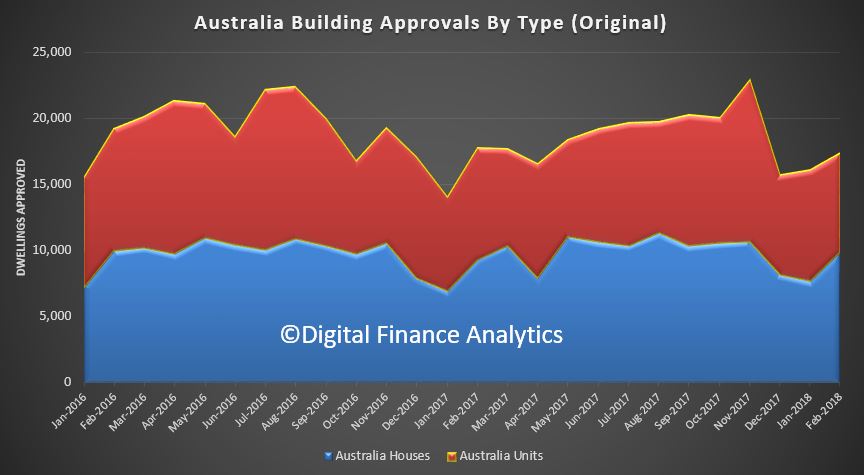

The latest ABS data on residential building approvals were released today.

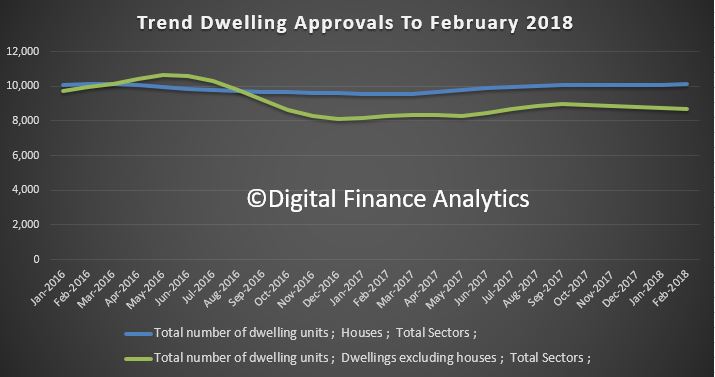

The number of dwellings approved in Australia fell for the fifth straight month in February 2018 in trend terms with a 0.1 per cent decline.

Approvals for private sector houses have remained stable at around 10,000 for a number of months. But unit approvals have fallen for five months.

Overall, building activity continues to slow from its record high in 2016. And the sizeable fall in the number of apartments and high density dwellings being approved comes at a time when a near record volume are currently under construction. If you assume 18-24 months between approval and completion, then we still have 150,000 or more units, mainly in the eastern urban centres to come on stream. More downward pressure on home prices.

This helps to explain the rise in 100% loans on offer via some developers plus additional incentives to try to shift already built, or under construction property.

Here is the data displayed in original terms. Whilst house approvals remains relatively stable, unit approvals are more volatile. This is explained by the changing demand profile as overseas investors and local investment property purchasers retreat. As we discussed recently, this is thanks to tighter lending standards making mortgages more difficult to come by, lower capital growth making investment property less attractive, and stronger controls on overseas investors, both in terms of moving capital to purchase, and local regulations and tighter supervision.

Here is the data displayed in original terms. Whilst house approvals remains relatively stable, unit approvals are more volatile. This is explained by the changing demand profile as overseas investors and local investment property purchasers retreat. As we discussed recently, this is thanks to tighter lending standards making mortgages more difficult to come by, lower capital growth making investment property less attractive, and stronger controls on overseas investors, both in terms of moving capital to purchase, and local regulations and tighter supervision.

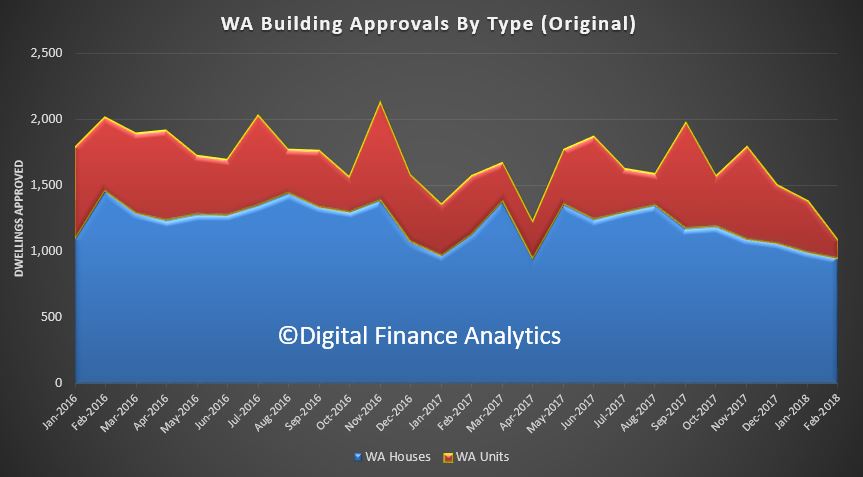

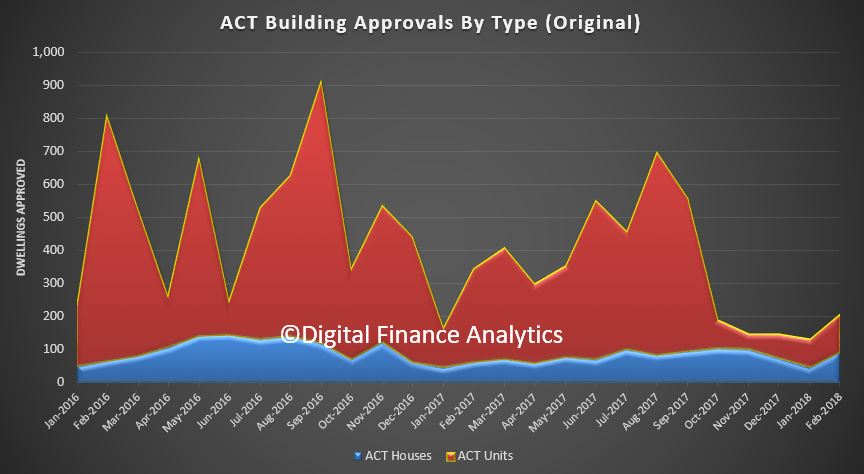

We can then look across the individual states, as there are significant variations. Among the states and territories, the biggest trend decrease in dwelling approvals in February was the Australian Capital Territory down 18.7 per cent,

We can then look across the individual states, as there are significant variations. Among the states and territories, the biggest trend decrease in dwelling approvals in February was the Australian Capital Territory down 18.7 per cent,

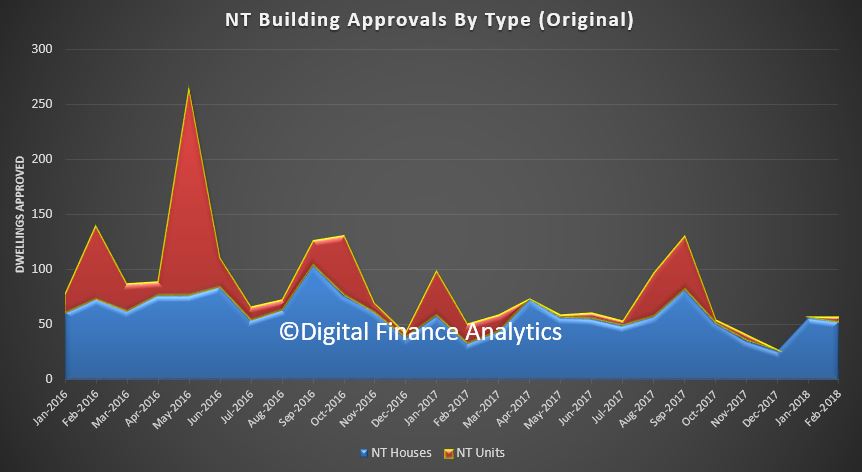

followed by the Northern Territory (down 7.2 per cent),

followed by the Northern Territory (down 7.2 per cent),

Western Australia (down 4.4 per cent),

Western Australia (down 4.4 per cent),

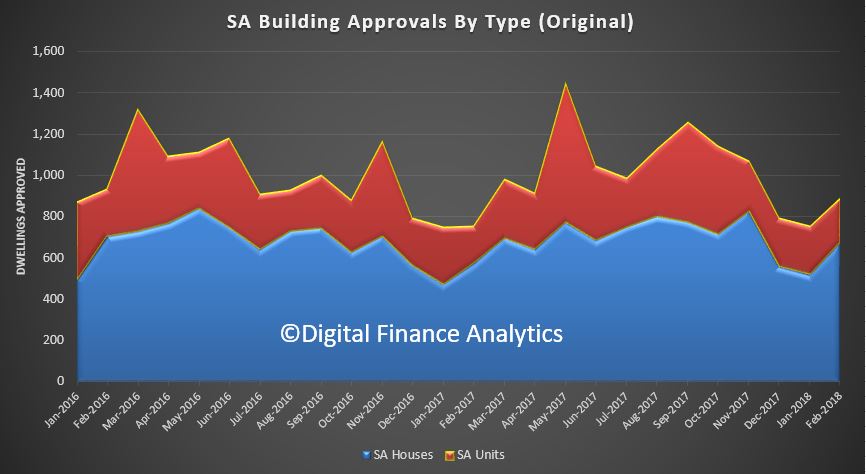

and South Australia (down 1.2 per cent).

and South Australia (down 1.2 per cent).

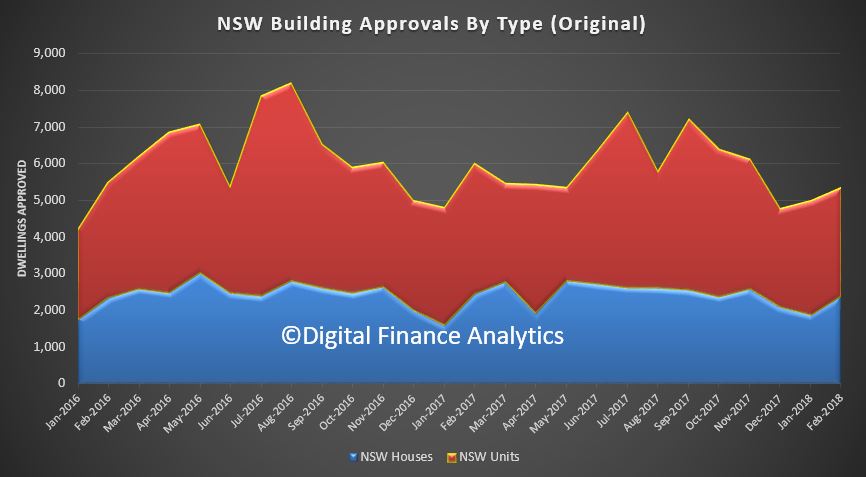

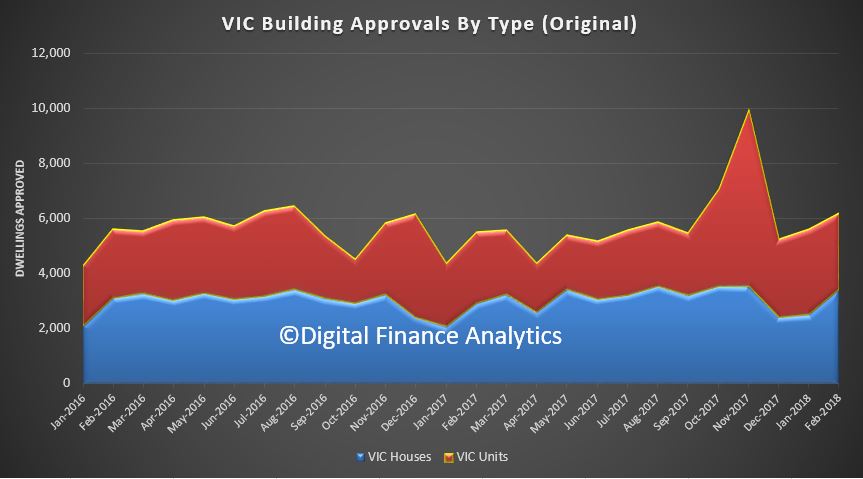

There were small increases in trend terms in New South Wales (1.0 per cent),

There were small increases in trend terms in New South Wales (1.0 per cent),

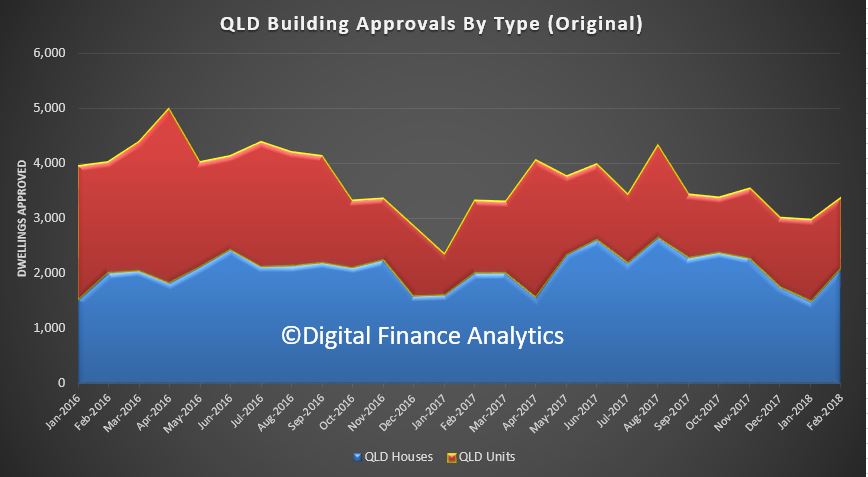

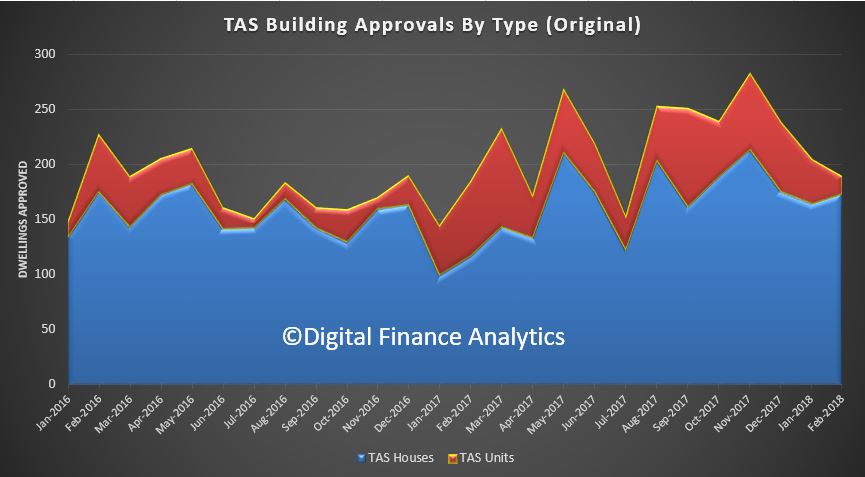

Approvals for private sector houses rose 0.2 per cent in trend terms in February. Private sector house approvals rose in Victoria (1.1 per cent) and New South Wales (0.8 per cent), but fell in Queensland (1.1 per cent), South Australia (1.1 per cent) and Western Australia (0.5 per cent).

Approvals for private sector houses rose 0.2 per cent in trend terms in February. Private sector house approvals rose in Victoria (1.1 per cent) and New South Wales (0.8 per cent), but fell in Queensland (1.1 per cent), South Australia (1.1 per cent) and Western Australia (0.5 per cent).

The value of total building approved fell 1.1 per cent in February, in trend terms, and has fallen for five months. The value of residential building fell 0.1 per cent while non-residential building fell 2.9 per cent.