Growing concerns in the US business community about the potentially adverse effects of tariffs could cause modest deterioration in US manufacturing activity and capital spending by YE 2018, according to Fitch Ratings.

The escalation of the US-China trade dispute and the notable absence of constructive negotiations point to a continuation of trade-related uncertainty for US businesses through the second half of the year.

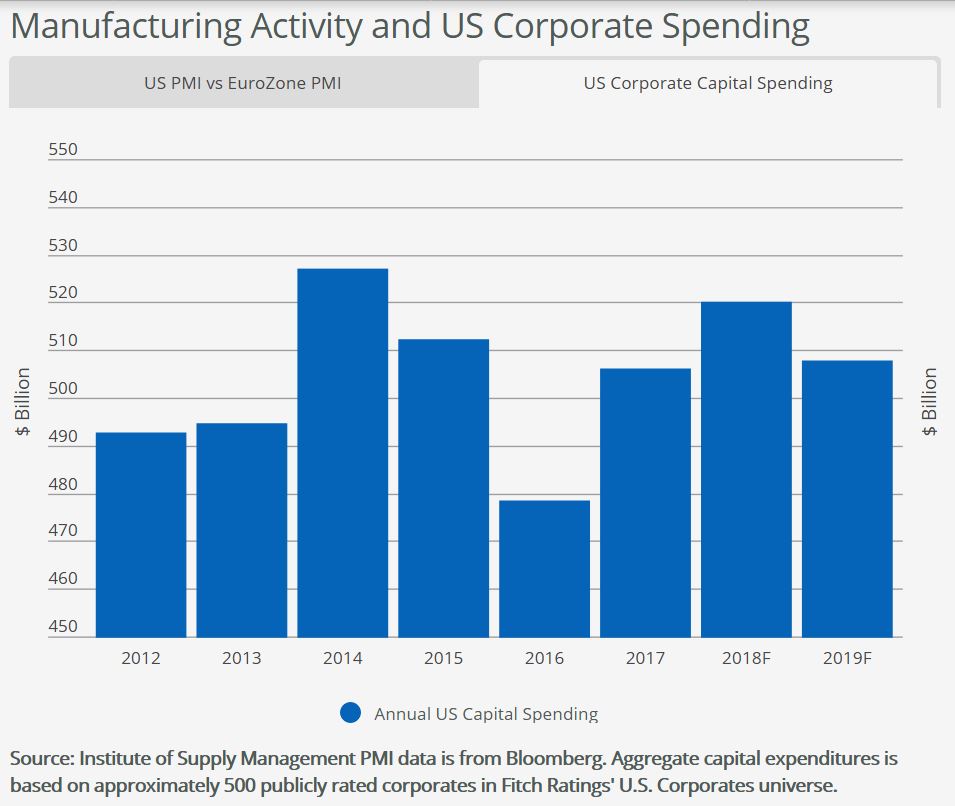

We expect approximately 3% growth in aggregate capital spending for Fitch’s universe of rated US corporates in 2018, following 6% growth in 2017, due in part to the cash benefits of tax reform. However, warnings that business strategies may be altered and capital projects delayed, along with potential pressure on exports, suggest capex trends could weaken. We currently expect aggregate capex to decline 0.8% in 2019. This may mark a potential inflection point in the current late-stage business cycle.

Several US companies, including Harley Davidson, Brown-Forman, and General Motors (GM), have spoken out on the potential adverse effects of escalating trade tensions. Harley-Davidson plans to move production of motorcycles for EU markets to its non-US plants to avoid retaliatory tariffs that would add an average of $2,200 to the cost of motorcycles exported to the region from the US. Brown-Forman cautioned that trade issues could negate benefits of a strong economy with the uncertainty making it difficult to accurately forecast earnings. GM indicated that potential US auto tariffs would raise prices of its vehicles, reduce its global competitiveness and lead to a loss of US jobs.

Comments by companies across various sectors, including electrical equipment, appliances and components, and food, beverage, and tobacco, were noted in the Federal Reserve’s June meeting minutes and the Institute for Supply Management’s (ISM) Purchasing Manager survey. This reflects broadening concern over the influence trade-related uncertainty is having on business sentiment and growth plans. Moreover, industry groups such as the US Chamber of Commerce and the Alliance of Automobile Manufacturers that support the business community are lodging complaints to the Trump Administration.

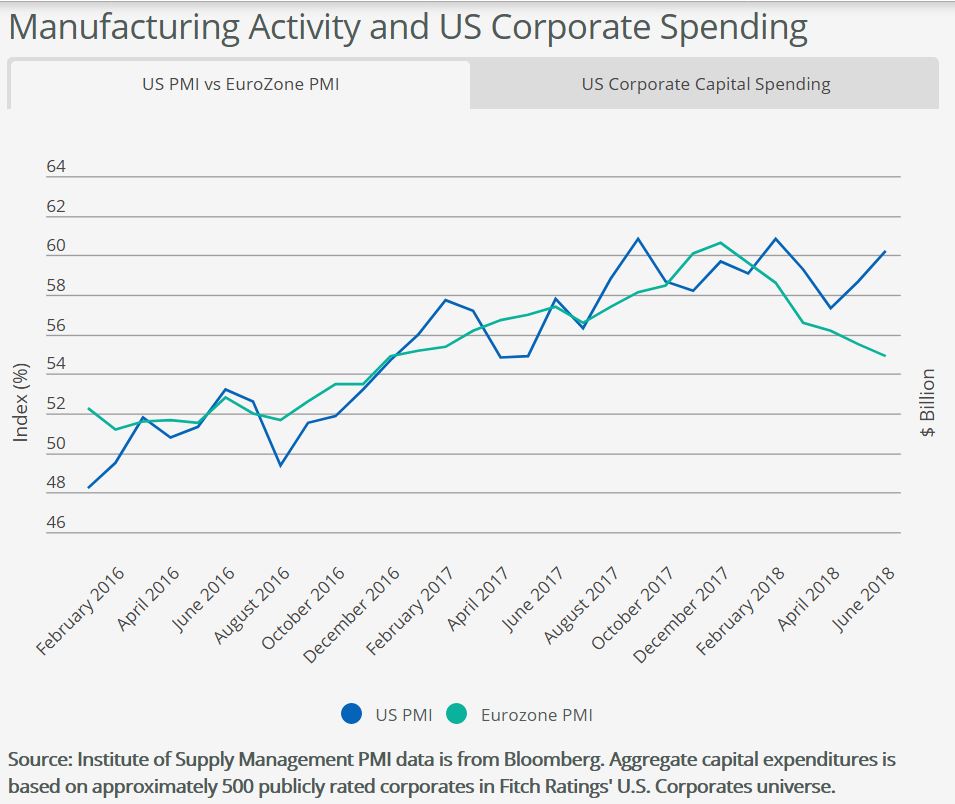

US leading economic indicators currently suggest overall business sentiment remains strong and manufacturing activity continues to expand due to a healthy growth outlook. The US Purchasing Manager’s Index (PMI) was near peak levels, rising to 60.2% in June from 58.7% in May. The index has only exhibited slight volatility in response to trade developments over the past year. The Philadelphia Fed’s survey of business intentions, a good bellwether of future capital spending plans, has recently declined slightly from very healthy levels, perhaps in response to protectionist threats.

Eurozone PMIs continue to signal expansion but have consistently declined since the beginning of 2018. Earlier in July, we noted increased trade tensions have raised the risk that additional tit-for-tat measures could have a greater impact on global economic growth than those seen so far. This would particularly be the case given the fact that investment and net exports are key components of GDP.

According to the ISM, expansion in new orders, production and employment drove the increase in the June US PMI reading. Inventories continue to struggle to maintain expansion levels, as a result of supplier deliveries slowing further. Labor constraints and supply chain disruptions continue to limit full production potential and price increases across all industry sectors remain on the rise. Additional rounds of tariffs could place further upward pressure on input costs, disrupt supply chains and weaken manufacturing activity in the near-term.