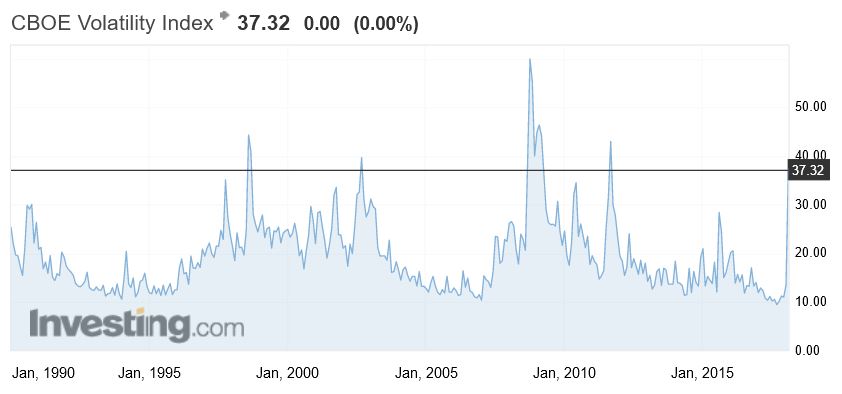

The volatility index (VIX) has roared back to life, having been asleep for months. This index gives an indication of market sentiment and is a popular measure of the stock market’s expectation of volatility implied by S&P 500 index options. This volatility is meant to be forward looking, is calculated from both calls and puts, and is a widely used measure of market risk, often referred to as the “investor fear gauge.”

On this basis, fear is stalking the halls, only 4 times since 1990 has the VIX index been higher.

On this basis, fear is stalking the halls, only 4 times since 1990 has the VIX index been higher.