On 26 February, JPMorgan Chase & Co. at its Investor Day became the latest bank to caution that trading revenue would fall in first-quarter 2019, guiding to a year-over-year decline in core trading revenue in the mid-teen-percent range. JPMorgan has one of the world’s largest and most diverse trading operations and therefore may be more resilient than firms of smaller scale and scope, says Moodys.

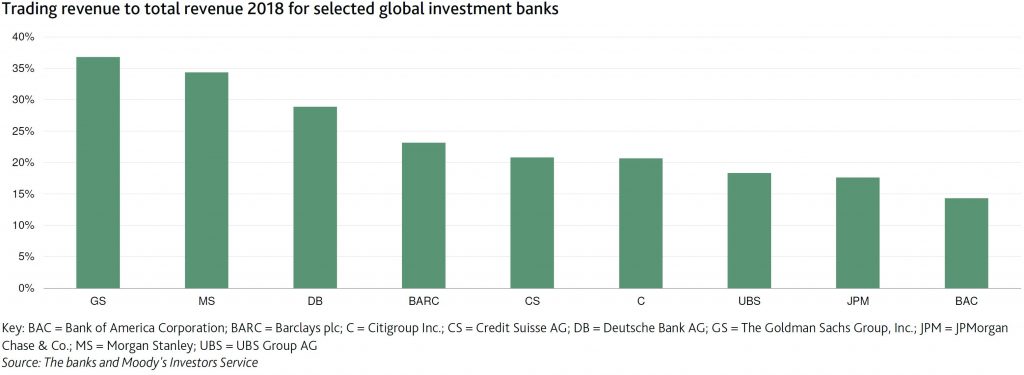

A double-digit decline in trading revenue in the typically busy first quarter would be credit negative for banks with extensive market making operations, including Bank of America, Barclays, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, Morgan Stanley and UBS.

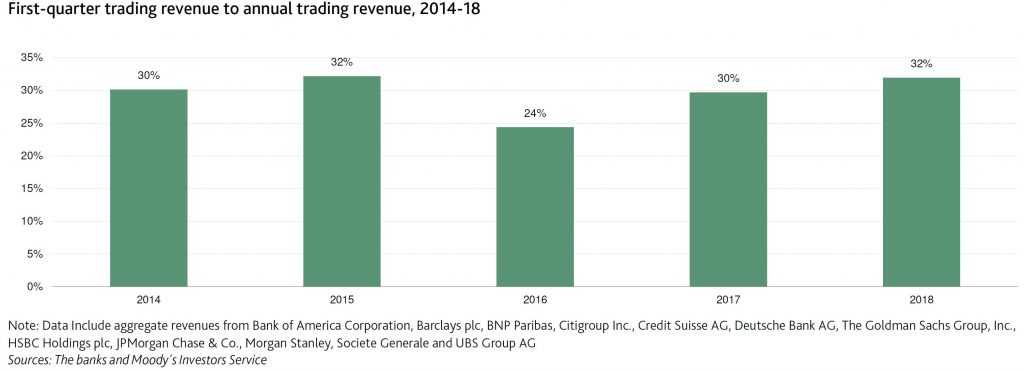

Economic fundamentals, technical market factors and sentiment are the primary drivers of capital markets volumes and volatility. Nevertheless, trading revenue also often displays seasonality. The first quarter is typically the strongest quarter of the year for marketmakers, driven by busy issuance calendars and strong interest by investment and portfolio managers to put money to work as a new performance period begins. By contrast, the third and fourth calendar quarters are often the weakest – owing to holiday day counts, buy-side and sell-side vacations and occasionally by reduced activity – as protecting annual performance increases in importance for

certain portfolio managers.

The vulnerability of individual banks to a shrinking trading wallet depends on the scale and diversification of their trading businesses and the diversification of their business mix. Diversification of a trading business can have asset class, product, customer and geographic dimensions. Firms with diversified trading operations will trade equities, fixed income, currencies and commodities (FICC) – making markets in cash and derivative products while offering financing and securities lending capabilities. Firms with the greatest client and geographic diversification deal with corporates, real money and leveraged investors, governments and other financial institutions in major market centers around the globe. Managing such expansive trading operations is definitely a challenge, but

such a platform provides two distinct advantages: scale and the opportunity to monetize a greater share of customer flows.

Soft first-quarter trading revenue would follow a challenging fourth-quarter 2018 trading environment for the industry. Managements of trading operations are always trying to answer the vexing question of which declines are cyclical and which are structural. The question has become ever more pressing with FICC revenue down roughly 20% across the industry since 2014. The most durable firms tend to combine scale, diversification and expense flexibility to navigate cycles and preserve real optionality toward global capital markets that deepen and widen over time. Firms with less resilient business models may face tougher reengineering choices if the

industry wallet remains depressed in 2019.

Perhaps one reason among many, why Goldman’s stocks have fallen more than 25% over the past year? 37% of revenue was from trading operations in 2018!