Westpac just released a revised economic outlook.

Growth through 2020 is now estimated at 1.5% with minus 1% in the first half ( minus 0.7% and minus 0.3% respectively in the March and June quarters) and 2.5% in the second half. This is recession territory.

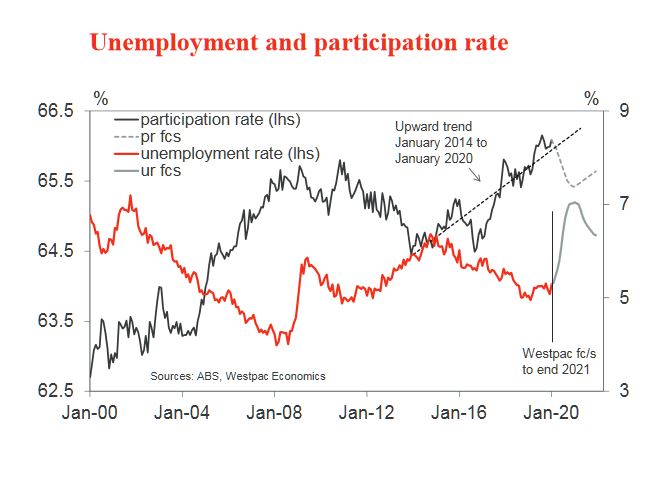

Just last week they had set the forecast peak in the unemployment rate at around 5.8%- 6%, up from the current level of 5.3%.

But now the unemployment rate is now forecast to reach 7% by October 2020 (up from the previous estimate of 5.8%-6.0%) due to the larger negative shocks to the labour intensive sectors such as recreation; tourism; education; renovations and additions; and dwelling construction. This lift in the unemployment rate is despite reducing the participation rate from 66.1% to 65.4% as a discouraged worker effect – that is, as workers respond to a deteriorating labour market the participation rate is likely to decline.

They add: please note that these forecasts are not based on Australia following a European style full lock down. Not surprisingly, the forecasts are subject to downward revision in the event of such an occurrence.

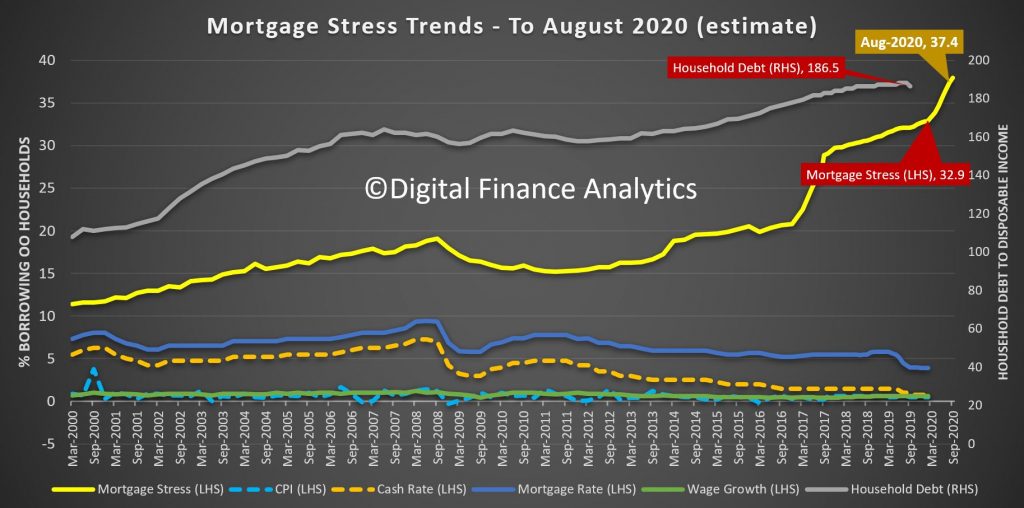

This is consistent with our modelling – mortgage stress will rise in the months ahead as unemployment rises.

Now the question becomes, to what extent with the banks forego mortgage repayments, and not foreclose, and to what extent will the Government supports households directly? The mortgage debt mountain could bite deep and early.

Its also worth noting that we are already seeing a rise in financial stress among those renting – here the protections currently are very limited, and will need to be increased.

Our own modelling is based on the assumption the crisis will run for at least 6 months. Overnight a UK report suggested 18 months is more likely, given the lead time to a vaccine.