Despite the property bulls (who seem to be a bit quiet just now) there are a series of logical reasons why prices will indeed fall from current levels.

First net migration into Australia will stop period. We have been seeing around 300,000 each year, which was one factor supporting demand in some areas.

Second, new property transactions will stall. No one will want to attend an open house, yet alone an auction in the current conditions. Sales transactions have risen more recently, but that just got turned off. How soon will it be before we see zero auctions reported on a Saturday?

Third, property investors, will continue to flee – they already saw rental returns dropping, now no capital growth. Demand from new investors was weak, it will die. They may have to subsidise renters who cannot pay rent due to job loss or income decline.

Fourth, existing mortgage holders will face cash flow issues as income stalls. We already have more than 1 million households in cash flow stress, another 200,000 or so are set to join them, in short order. Around one quarter of households have less than one months free cash available if incomes stall.

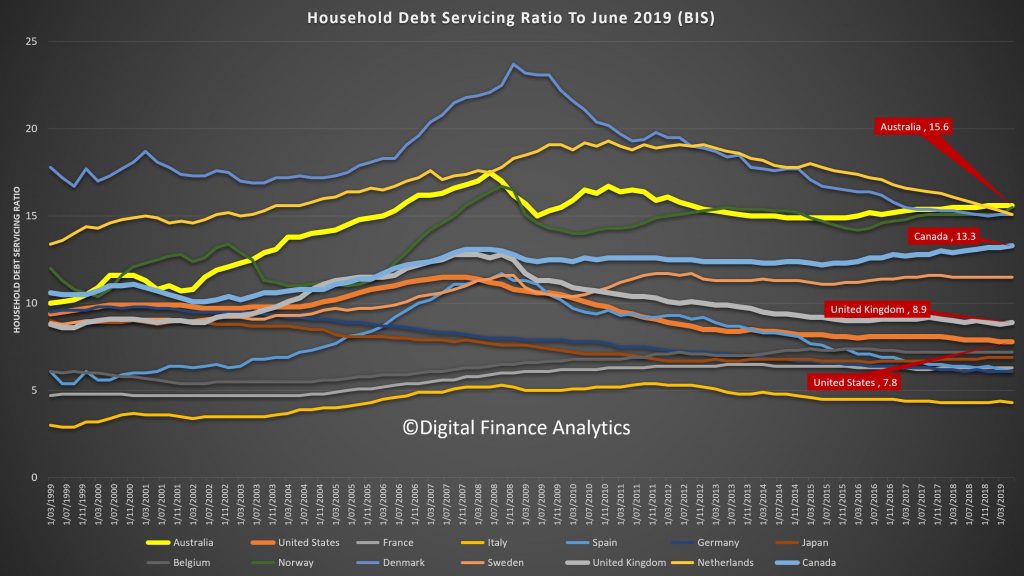

Fifth, banks will (are) cut back on mortgage lending. With margins already low, experience from Europe suggests it is unprofitable to lend. They will also lift risk underwriting standards. Meaning people if they want to borrow will get a lower available loan. Loan books will likely contain more defaults and higher risks – meaning more capital. Some may choose to shrink their balance sheets as liquidity stalls. Recently first time buyers were getting $420,000 mortgages no problems, with income ratios of 6, 7, 8 times or more. Debt servicing ratios are still high – and servicing is now an issue.

Income multiples often assumes double incomes. If one income stopped that would be a big problem.

Sixth, forced sales will eventually occur though nor immediately. I expect banks to support households in financial stress by loan and interest payment postponements, for a time. But eventually forced sales, at lower than current market values will follow. In addition, given the death rates among older people, more supply could well come on stream as estates are liquidated.

Seventh, States will take a hit from falling stamp duty as transactions slow. They will not be able to reverse this.

Eighth, Government will try various stimulation moves to try to prop up the market – but persuading people to buy now will be like selling seawater on the beach. They may well provide cash support direct to households for mortgage and rent payments – they probably should.

Ninth – the property wealth effect, which was a mirage, is dead. Finally. Until the next bubble starts, which it will, unless policy changes. I will have more to say about that ahead.

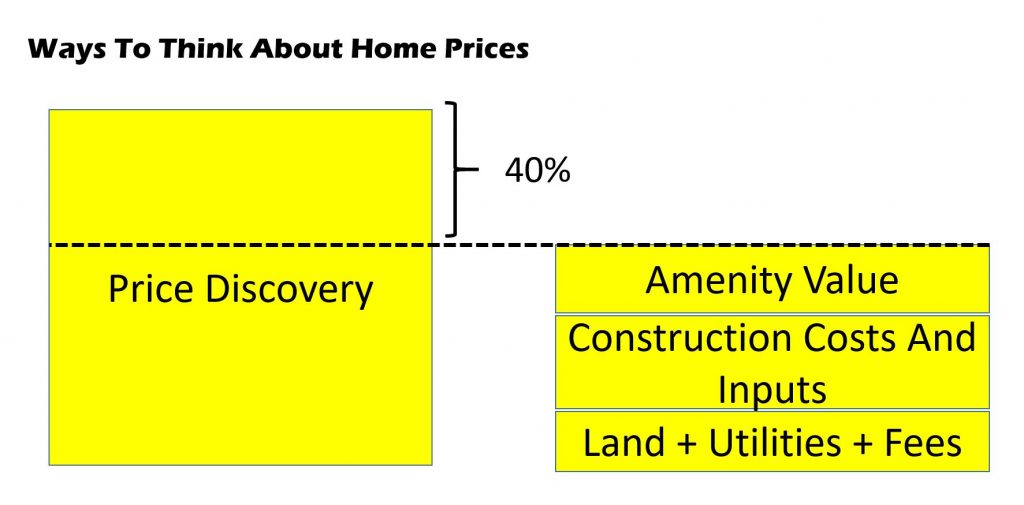

Finally, its worth thinking about this. On average, prices are 40% over their fundamental value. So they have a long way to fall.

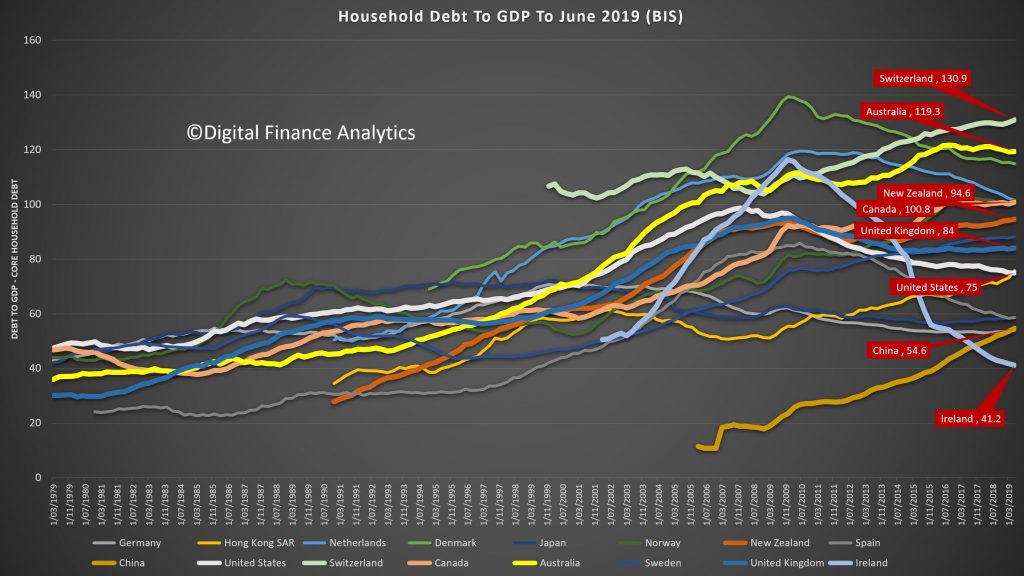

And debt to GDP ratios are, and will go further off the charts.