The latest release of the Digital Finance Analytics Household Survey to end March 2018, helps to explain why we think home prices are set to fall further. We discussed four housing and property scenarios in a recent video blog.

But drawing on our 52,000 sample, from across Australia, today we will walk through the top-level survey findings, before later drilling into the segment specific data in later posts. You can read about our household segmentation models here. This analysis of course then feeds into our Property Imperative Report, which we publish twice each year as a summary of our research and analysis. The last edition – volume 9 – from 2017 is still available on request.

Read the transcript. or watch the video.

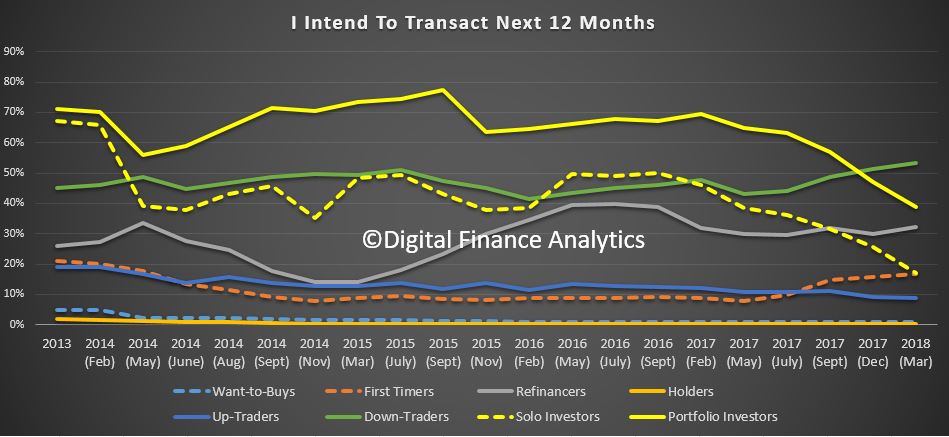

The first chart, which looks across our property segments, shows that both portfolio property investors (who hold multiple properties) and solo investors (who hold one, or perhaps two) intentions to transact are tanking, down 8% since December 2017. As we will see later, this is because credit is less available, capital growth has stalled, and in fact only the tax breaks remain as an incentive! This decline started in 2015, but is accelerating. Remember that 35% of mortgages are for investment purposes, so as this demand dissipates, the floor on prices starts to shatter.

Whilst there are offsetting rises from down traders (who are seeking to release capital before prices fall further) and first time buyers (who are being “bribed” by first owner grants) there is a significant net fall in demand. This pattern is seen across the country, but is most prevalent in our two biggest markets of Sydney and Melbourne.

Refinancing is up a little, thanks to the attractive discounts being offered by many lenders, and as we will see the prime driver is to reduce monthly repayments, as currently household finances are under pressure. We release the latest mortgage stress analysis in a few days.

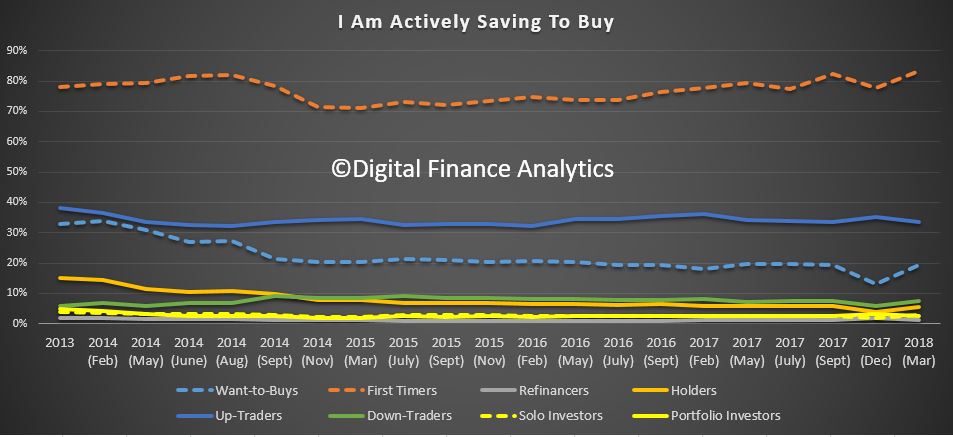

First time buyers and those wanting to buy, are saving a little more in an attempt to access the market, and those planning to trade up are also still putting some funds aside, otherwise, there is little evidence of concerted attempts to save cash for property transactions.

First time buyers and those wanting to buy, are saving a little more in an attempt to access the market, and those planning to trade up are also still putting some funds aside, otherwise, there is little evidence of concerted attempts to save cash for property transactions.

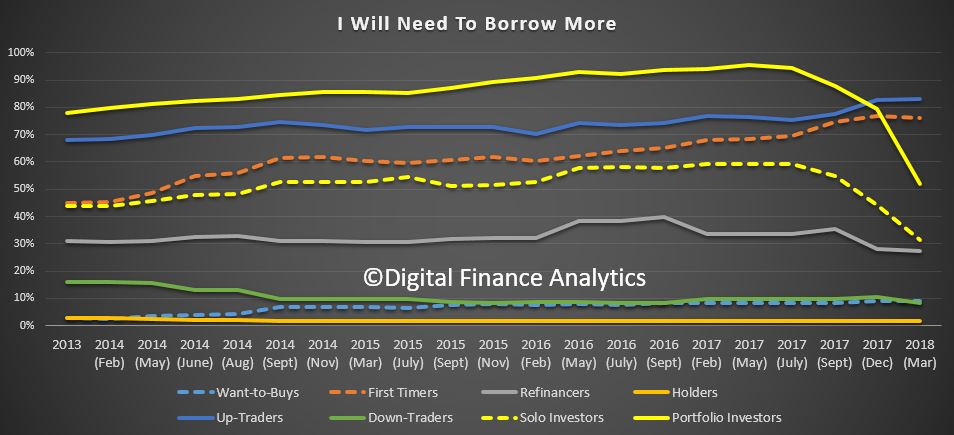

Turning for demand for credit, we see is crashing, especially in the investment segments. There was a 12% fall in the solo property investor group and an amazing 27% fall in the portfolio investor segment. One of the clearest messages from the survey is how much lending standards just got tighter, with an average 20% drop in “borrowing power” compared with a few months ago. As a result many first time buyers and investors simply cannot get credit, because they cannot meet the tighter requirements. The outfall from the Royal Commission will simply exacerbate the situation. There is a strong link between home prices and credit supply, so this will put further downward pressure on property values.

Turning for demand for credit, we see is crashing, especially in the investment segments. There was a 12% fall in the solo property investor group and an amazing 27% fall in the portfolio investor segment. One of the clearest messages from the survey is how much lending standards just got tighter, with an average 20% drop in “borrowing power” compared with a few months ago. As a result many first time buyers and investors simply cannot get credit, because they cannot meet the tighter requirements. The outfall from the Royal Commission will simply exacerbate the situation. There is a strong link between home prices and credit supply, so this will put further downward pressure on property values.

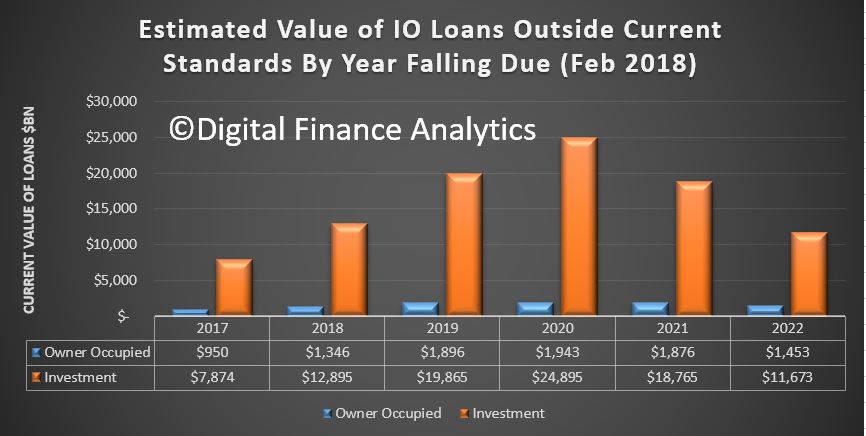

Refinancing households are tending not now to seek to release additional capital from their properties, as part of a refinance deal. We also note a rise in those being forced to refinance from interest only loans to principal and interest loans, and our latest modelling still is tracking an estimated $100 billion problem.

Refinancing households are tending not now to seek to release additional capital from their properties, as part of a refinance deal. We also note a rise in those being forced to refinance from interest only loans to principal and interest loans, and our latest modelling still is tracking an estimated $100 billion problem.

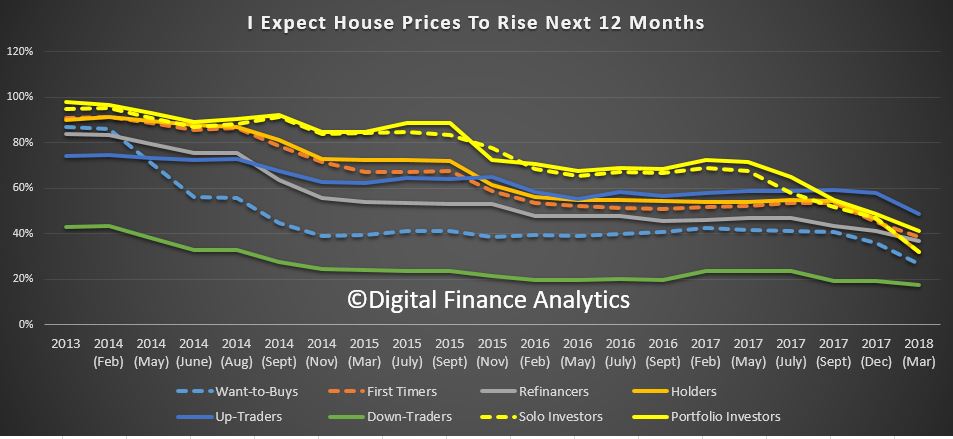

We find that ever fewer households are expecting home prices to rise, this registered across the board – but the trajectory down is strongest among investors. No segment is more bullish on prices compared with last year. This falling trend is strongest in Sydney, but Melbourne appears to be following about 6 months later. Households in Perth and Hobart are more bullish, but only slightly, and this was not enough to prevent the general decline. Remember WA has seen prices slide in recent years.

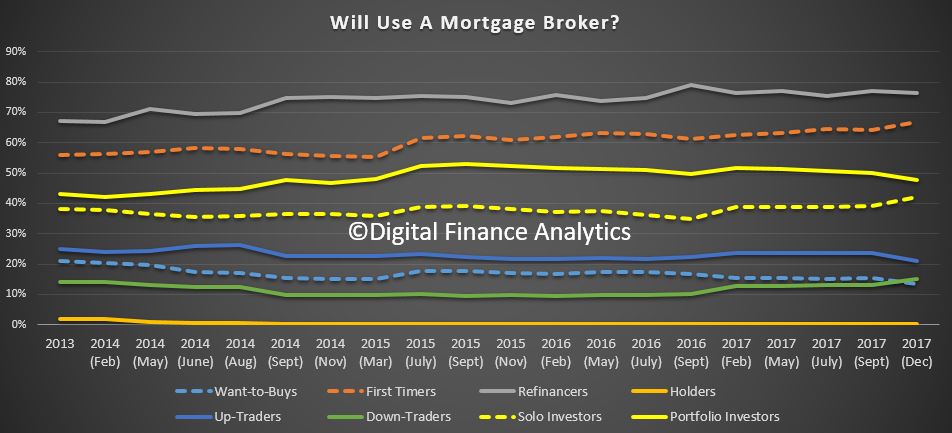

Households use of mortgage brokers appears pretty consistent (even if the volume of transactions is falling). Those seeking to refinance are most likely to approach a broker, followed by first time buyers.

Households use of mortgage brokers appears pretty consistent (even if the volume of transactions is falling). Those seeking to refinance are most likely to approach a broker, followed by first time buyers.

Next time we will look in more detail at the underlying drivers by segments. But current home prices appear to have no visible means of support – they are going to fall further.

Next time we will look in more detail at the underlying drivers by segments. But current home prices appear to have no visible means of support – they are going to fall further.