Since the Government released the report of the Independent Panel’s Review of the Small Amount Credit Contract Laws in April 2016, three million additional loans have been written, worth an estimated $1.85 billion and taken by some 1.6 million households.

In that time, around one fifth of borrowers or around 332,000 households, were new payday borrowers.

We also know that over a 5-year period around 15% of payday borrowers will get into a debt spiral which leads to events such as bankruptcy. On that basis, an additional 249,000 households have been allowed to enter a debt path which leads to this unfortunate end. A larger number fall into other family or relationship issues when borrowing from this source.

Digital Finance Analytics was asked by the Consumer Action Law Centre to complete custom modelling using data contained in our rolling 52,000 per annum household surveys, focussing in on the question of the quantum and impact of delays in the proposed legislation relating to the sector.

Digital Finance Analytics was asked by the Consumer Action Law Centre to complete custom modelling using data contained in our rolling 52,000 per annum household surveys, focussing in on the question of the quantum and impact of delays in the proposed legislation relating to the sector.

Specifically, we estimated the incremental damage done to households in terms of the value of loans taken since the final review was published on 19th April 2016, as well as some observations as to the characteristics of borrowers over this period.

The data presented is this paper is somewhat indicative, in that we made a number of reasonable assumptions to support our findings.

- The survey remains as statistically robust sample (aligns with the most recent ABS census data).

- We have extrapolated 2018 figures on the current run rates per month.

- We have not tried to overlay the potential before and after impacts, had the proposed changes been made to payday sector, but we have considered the mix and impact of loans taken during this time.

- We use the term “payday loans” to refer to those loans made within the SACC (Small Amount Credit Contract) legislation, so this excludes medium term loans and other personal credit facilities.

The Current Size of the Payday Market

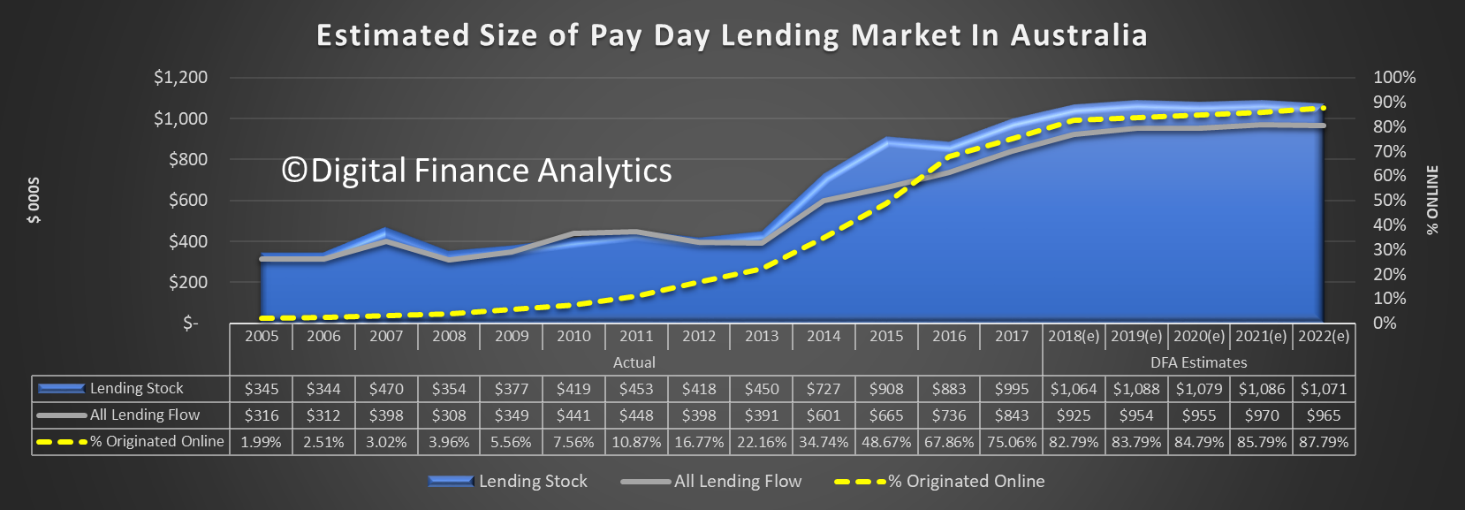

We continue to see some growth in the payday sector overall.

In 2016, the total loans written (loan flows) were in the order of $736 million and based on projections for the full year 2018, this will rise to $925 million. However, because payday lending is by nature short term, the incremental value of $189 million is not the full measure of loans written in the period. We will estimate this later in the paper.

Of note is the significant increase in online origination, with 83% of loans now accessed via a web site on a mobile device or another computing device.

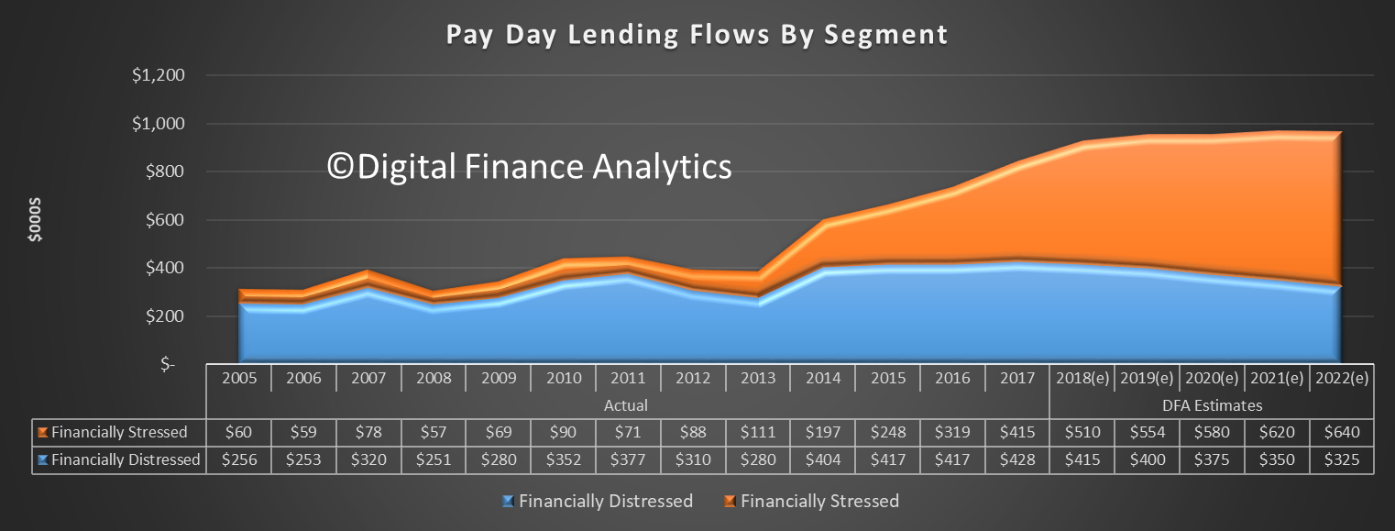

The other important factor is to note the switch in types of customers being attracted by these services. As a result of tighter controls on loans to Centrelink recipients, and the rise in online services, the mix between those we classify as financially distressed (those with immediate financial needs and no alternative) and financially stressed (those with financial needs, with alternatives, but who reach for payday loans as a simple, quick and confidential alternative) has increased, and is facilitated by greater online access.

Since 2016, the total loan flows have risen by $191 million for financially stressed, but the value of loans to distressed households has remained static. But again the net value of loans does not tell the full story.

Since 2016, the total loan flows have risen by $191 million for financially stressed, but the value of loans to distressed households has remained static. But again the net value of loans does not tell the full story.

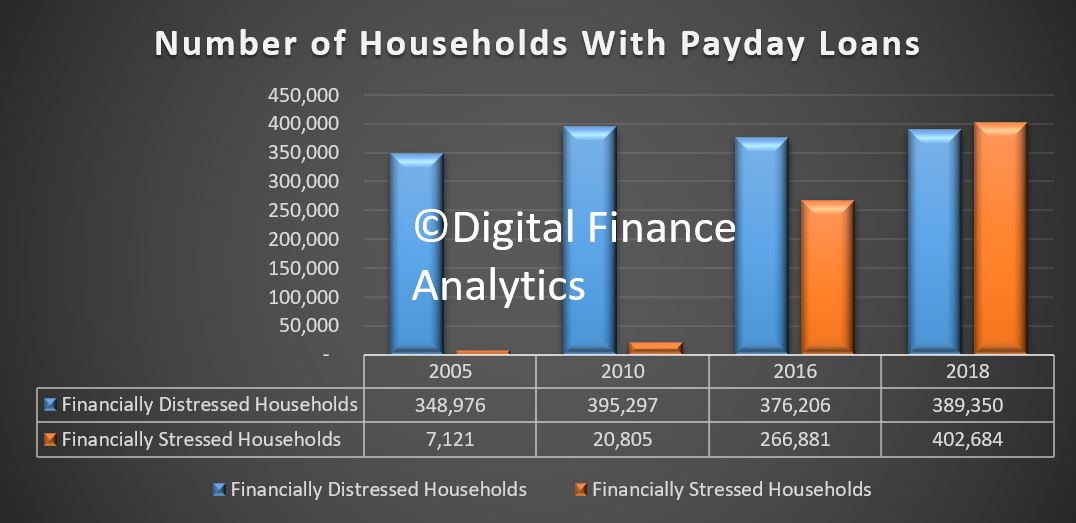

The Number of Households with Payday Loans

Value apart, the other perspective is the number of households taking payday loans. Since 2016, the number has risen by 149,000 households. Of that 13,000 are classified as distressed households and 136,000 are stressed households.

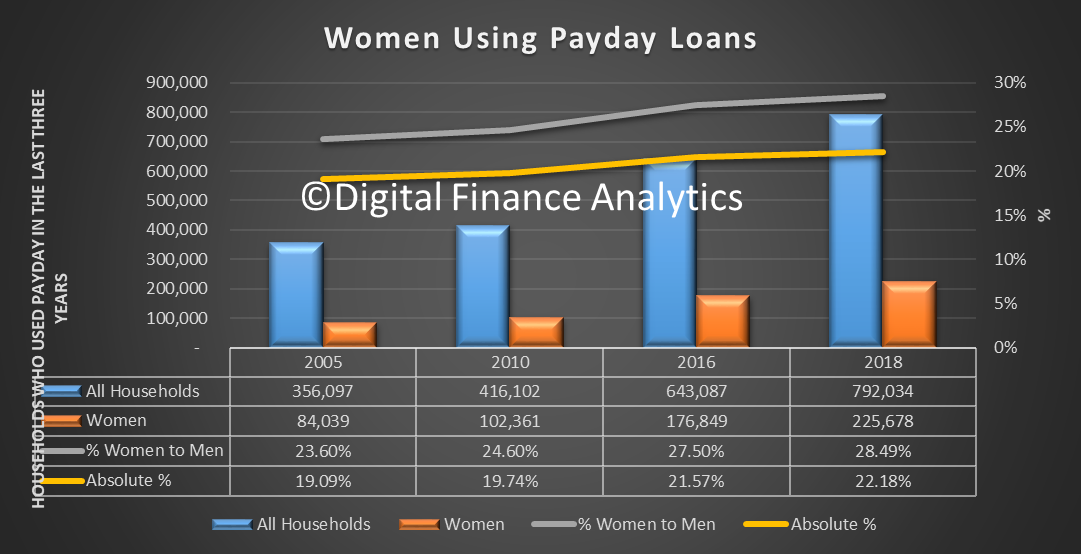

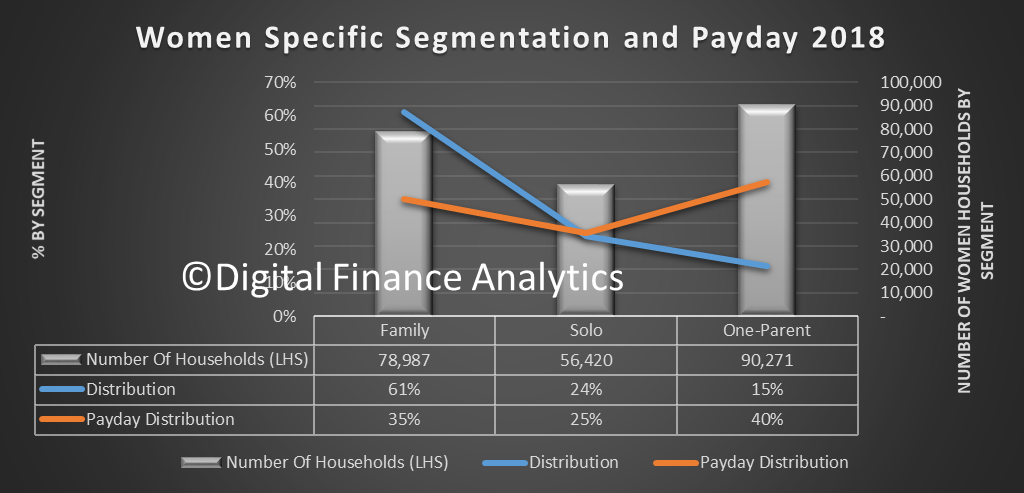

This once again reflects the refocussing of the industry of those in financial pain rather than distress. Within these numbers we note a continued rise in the number of women accessing payday loans. The number of women using payday loans has risen from 177,000 in 2016 to 226,000 in 2018. This represents a rise to 22.18% of all borrowers.

This once again reflects the refocussing of the industry of those in financial pain rather than distress. Within these numbers we note a continued rise in the number of women accessing payday loans. The number of women using payday loans has risen from 177,000 in 2016 to 226,000 in 2018. This represents a rise to 22.18% of all borrowers.

Within the women segment we see a large number of one-parent women accessing payday loans, representing 40% of women.

Within the women segment we see a large number of one-parent women accessing payday loans, representing 40% of women.

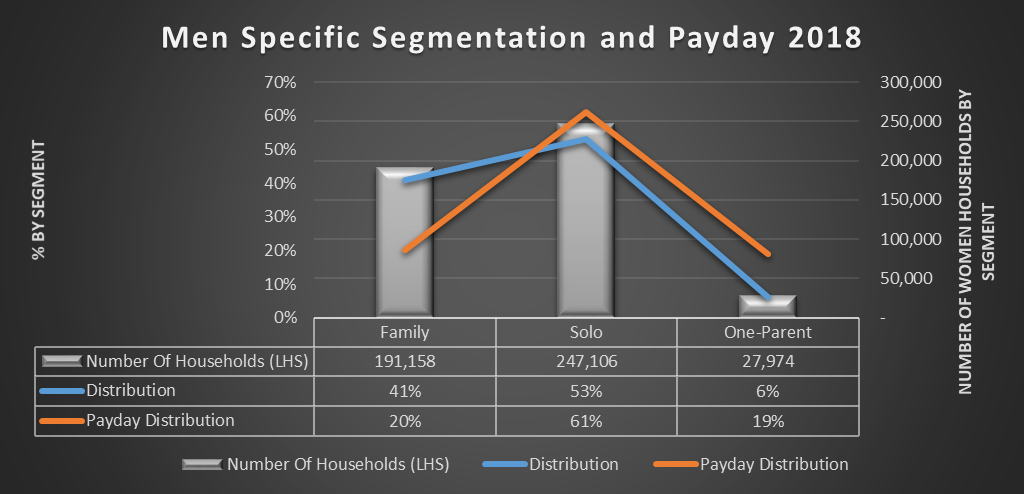

This is in stark contrast to males where just 6% are one-parent families.

This is in stark contrast to males where just 6% are one-parent families.

How Many Loans, and What Value Has Been Written Since 2016?

How Many Loans, and What Value Has Been Written Since 2016?

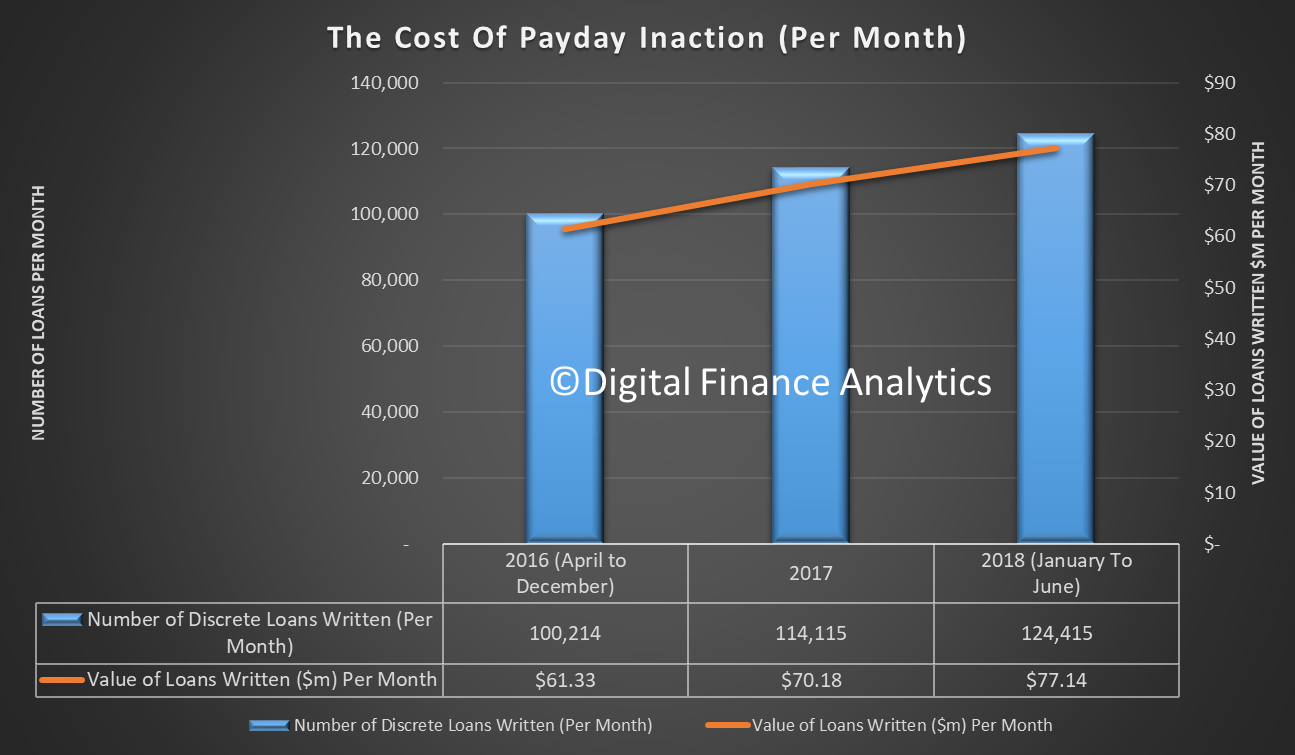

The final part of our analysis we examined the run rate of loans written by volume and value to assess the impact of the Government inaction since April 2016.

Since April 2016 and June 2018, just over 3 million discrete payday loans have been written, worth in total around $1.85 billion by around 1.6 million households. These loans would have generated something in the order of $250 million in net profit to the lenders.

Since April 2016 and June 2018, just over 3 million discrete payday loans have been written, worth in total around $1.85 billion by around 1.6 million households. These loans would have generated something in the order of $250 million in net profit to the lenders.

In that time, around one fifth of borrowers will be new borrowers, or around 332,000 households. We also know that over a 5-year period around 15% of payday borrowers get into a debt spiral which leads to events such as bankruptcy. On that basis, an additional 249,000 households have been allowed to enter a debt path which leads to this unfortunate end. A larger number fall into other family or relationship issues.